The MEV Edition (part III)

The Scourge; Inclusion Lists; MEV Burn; and the Health of the MEV-Boost Ecosystem

Dear Bankless Nation 🏴,

In this edition of the DeFi Download we dig into MEV. Particularly some of the in-protocol solutions to MEV and how that will affect ETH token holders and transactions. A lot has changed since our last edition on MEV, and we’re going to give you the down low on what’s going on.

As always, we finish off the new Project Releases and Twitter chirps as a final dessert. Thank you for reading.

This is definitely a more technical edition, so please let us know if you like this new style in the comments.

We also have a temp check survey regarding a paid subscription. Our bi-weekly articles will continue to be free, but paid subscribers would get an additional 8 articles a month. This content would include more timely current events, token analysis, and the impact of web3 on the broader tech ecosystem. Please let us know if this interests you. Thank you for reading!

Contributors: BanklessDAO Writers Guild (Jake and Stake, Austin Foss)

This is the official newsletter of BanklessDAO. To unsubscribe, edit your settings.

The MEV Edition (part III)

Inclusion Lists

Author: Jake and Stake

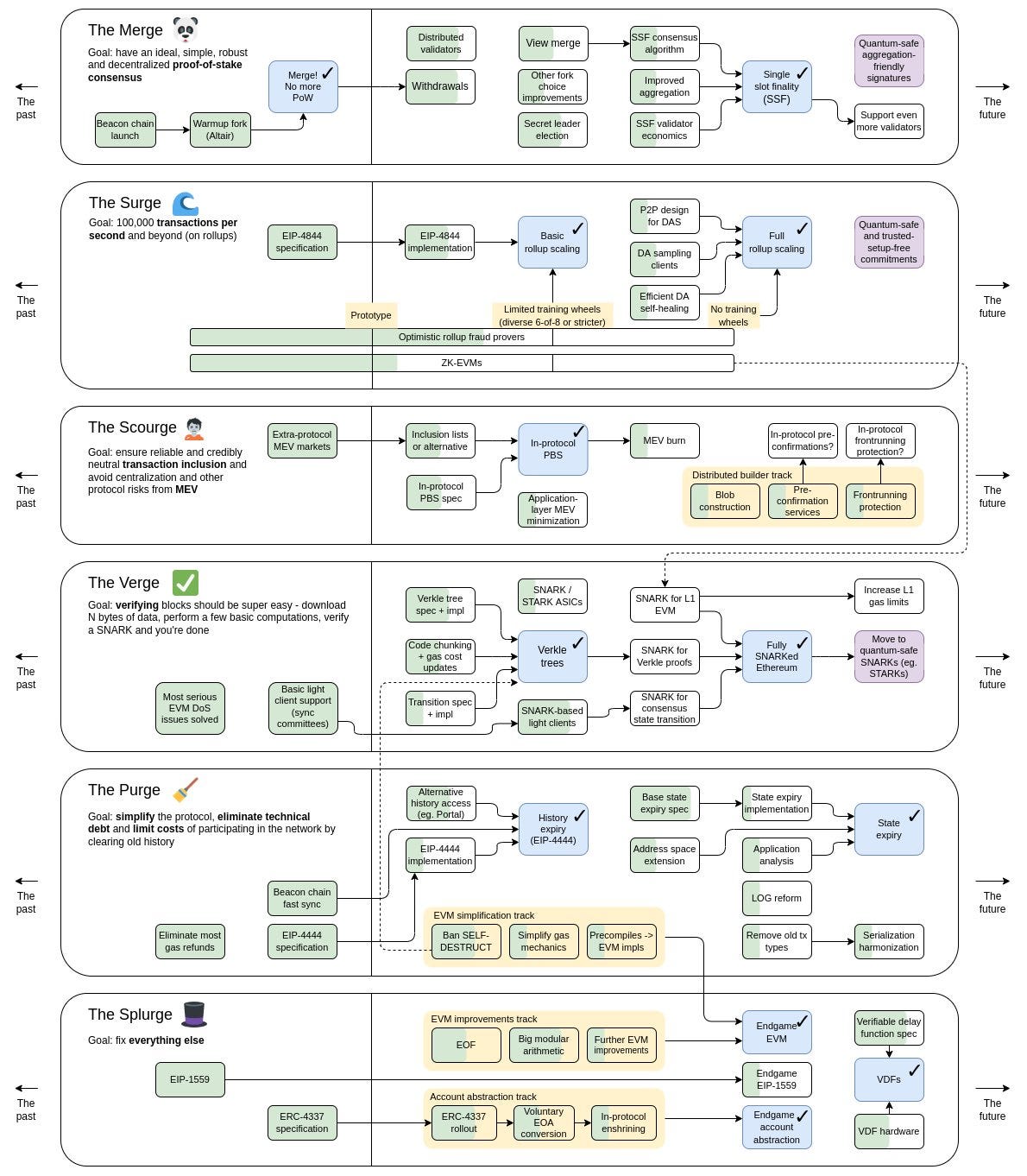

The Scourge is Ethereum’s plan to ensure reliable and credibly neutral transaction inclusion. Essentially, solve MEV issues, censorship problems, and centralization risks throughout the stack.

The goal is to reduce the power of MEV collectors (block builders and searchers) to censor transactions and limit the responsibilities of block proposers to ensure low barriers to become a validator—decentralize validators.

Before we get into the meat of the topic, it’s important to understand Ethereum’s gas market. If you already have a good grasp, feel free to skip the following section.

A Primer on Gas

Block space is sold based on a specified gas target and a price for each unit of gas known as the base fee. Each transaction uses a certain amount of gas N and users pay for each unit of gas at a specified price.

For a transaction to be included into a block it must have a gas fee greater than or equal to the base fee.

A block is full when the gas limit has been reached (2x the target). As a refresher:

Each block has a target size of 15 million gas, but the size of blocks will increase or decrease in accordance with network demand, up until the block limit of 30 million gas (2x the target block size). - The Ethereum Foundation

When the block size is larger than the target, the base fee for the next block will go up to reduce demand. If the block size is less, the base fee will be reduced to inspire demand.

The following is an example scenario portraying increasing gas prices.

For an in-depth look at the Ethereum gas market, check out our previous edition on EIP-1559 and visit ethereum.org.

Partial Block Auctions

Block size limits the number of transactions that can be included in a block. Given this constraint, we can only include valid transactions that fall under this limit.

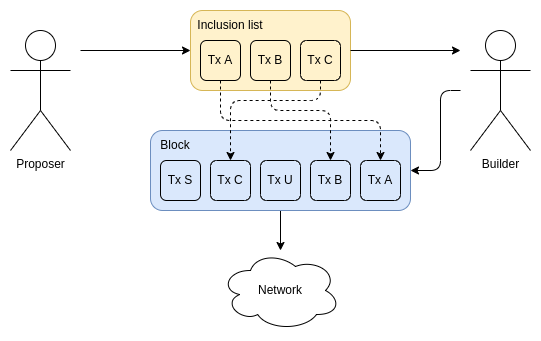

Partial block auctions allow builders to construct most of the block, but if the block cannot be completely filled, the block proposer will require them to include certain transactions.

There are three scenarios as a result of this change:

The block is not full and the transactions are included → The block builder gets more fees. In this case, the block builder is not sacrificing anything. The more fees, the more profits as far as they are concerned. No Censorship, Tampering, etc.

The block is full → The feature is disabled. The builder gets the max fee and is not required to add transactions from the proposer. Thus, transactions may be censored as long as the blocks are full, but because the base price rises exponentially (2.02x every 6 blocks), the likelihood of sequential full blocks is unlikely. For example, by the 30th full block (or 6 minutes of full blocks) the price of gas would be 2705.6 gwei. No Censorship, Tampering, etc.

The block is not full and the transactions are not included → The block builder is censoring transactions. The block builder is excluded from the auction.

But there are still some drawbacks.

If the builder identifies transactions in the inclusion list that they do not want to build on, they can refuse to build blocks for that proposer. However, proposers want the maximum fees possible and block builders can create blocks with the most fees. To incentivize builders to create blocks for them, proposers could have empty inclusion lists to ensure receiving a valuable block.

Still, this can be partially offset by encouraging block proposers to have a fallback block building mechanism, but this could encourage proposers and builders to vertically integrate.

Another drawback is that the proposer would have to identify fee paying transactions. This would require access to the mempool and the EVM state. Hence, no stateless clients, a long standing Ethereum upgrade to increase client decentralization through the reduction of hardware requirements.

Note that the builder can still capture MEV through sandwich attacks, so there’s no protection for that.

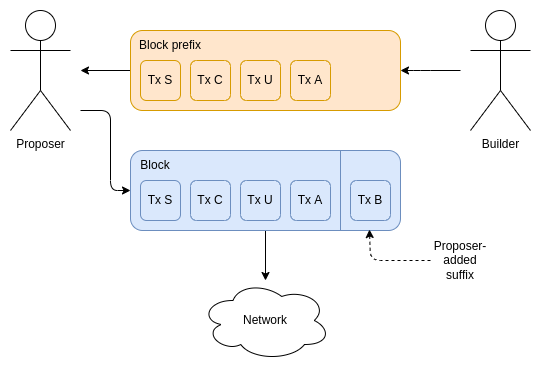

Proposer Suffixes

One solution to builders withholding blocks is to have the proposer add inclusion-list transactions to the end of submitted blocks. While this avoids one problem, there are similar drawbacks to inclusion lists:

Proposers avoid censorship, but builders can refuse to build blocks for the proposer the next time that they are scheduled to propose a block.

The proposer must compute the whole state root—no stateless clients unless the work of holding state is outsourced to another entity.

Proposers get some MEV, which may encourage them to join staking pools leading to increased centralization.

The builder can still engage in some abuses, as before.

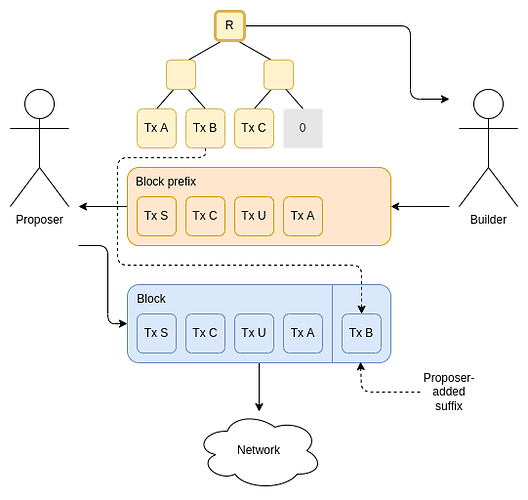

Fix to Proposer Suffixes: Pre-commitment

In the final iteration of inclusion lists, the proposer pre-commits a set of transactions that they want to include using a Merkle tree or KZG commitment. The builder then creates their block, which may or may not include committed transactions. If there’s enough space, the proposer adds the suffix of committed transactions not included by the block builder.

As a result, the proposer still receives the blocks created by builders and can simply append the inclusion list transactions to the end of the block given enough space. This way, the builder does not know the contents of the proposer’s inclusion list.

Inclusion List Conclusion

In reducing the censorship power of block builders and the responsibilities of block proposers, several tasks will remain unallocated:

The task of computing the post-state root

The task of computing and publishing the witness

The task of making a ZK-SNARK attesting to the block’s correctness

Vitalik has proposed creating a third actor to perform these tasks with such an actor having no ability to choose block contents. This is a cutting edge of Ethereum, so be on the lookout for future updates.

MEV Burn

Author: Jake and Stake

MEV Burn is a proposal by Domothy. Here’s the problem: MEV can lead to centralization of block proposers, increasing censorship risk and concentration of network stake. The protocol’s goal is to reward network participants in proportion to their stake in the network.

Further, the proposal aims to reduce incentives for centralizing. As it stands, more block proposals means more MEV, so each validator is incentivized to increase the number of blocks they propose. If we can, reduce MEV-based income so in-protocol emissions are the primary reward. This will make the incentives for validating smoother, more predictable, and easier to reason about.

Core idea: Let block proposers compete with each other to propose a block.

The design of MEV Burn involves sampling a random set of validators during each slot and each validator in the sample competes for the right to propose a new block. The validator that can burn the most ETH that gets to propose the new block.

This is the equivalent of MEV-smoothing (averaging MEV rewards across all validators), but for all ETH holders, not just validators. Everyone gets the benefits of MEV.

This also means MEV will always be transmuted into ETH, even if the arbitrage opportunity doesn’t involve ETH. MEV must be paid for in ETH, and the value of that ETH is redistributed to all holders via reduced supply (burn).

While the implementation details are still being worked on, the proposal includes increasing block time by 4 seconds (from 12 to 16 seconds) to allow proposers time to submit their bids. Each proposer only gets one bid, so it’s in their best interest to bid as close to the MEV total as possible.

During the process, each eligible proposer must precompute a block and submit its block hash in order to be accepted as valid. One side effect is the prevention of block proposers from affecting the liveness of the chain by submitting bids too late, because many eligible proposers reduces the probability of a late block.

Collusion

Eligible proposers can collude together to make a 0 gwei bid and share the MEV profits amongst themselves. However, it only takes one defector to nullify this threat. If the defector bids 1 gwei, they will earn all of the profits, if there are two defectors they’re each incentivized to bid as close to the MEV total as possible.

If a single entity does control all of the validators for a single slot, they may collude. However, if the pool of eligible proposers is not uniform, the entity cannot know whether there exists another eligible validator.

This would also solve some concerns with inclusion lists. Remember that censoring block builders could refuse to build blocks for non-censoring proposers? In this design, block builders wouldn’t know who the next validator is, and would thus not be able to coordinate a targeted withholding. The winning proposer could add transactions to their inclusion and keep Ethereum credibly neutral. Note that eligible proposers must be secret. If not, this could lead to collusion.

In fact, proposers are even more incentivized to include inclusion list transactions in order to maximize the probability of winning the bid.

Potential Drawbacks

Validators must commit to calculating and accepting MEV. If they do not, they will not be able to propose blocks, resulting in something of a soft-fork. Additionally, this incentivizes proposers to become more specialized entities and to become “better validators”, increasing the barriers to entry and thus centralization risks PBS tries to mitigate.

Entities with more validators will be able to undercut competitors to capture smaller rewards or otherwise run many validators on the same hardware. There may be colocation, both pieces of software running in the same datacenter or on the same server, between block builders and block proposers.

As the design exists today, proposers can submit their blocks any time within the 4 second auction. If the proposer waits to submit their proposal, they can add more MEV opportunities and collect a larger reward or have a greater probability of winning the auction. As a result, block proposers want to create blocks as late as they can without being so late that they’re ineligible to submit their block. The block proposer can improve their latency by colocating closer to MEV relays/builders and other nodes (forms of centralization).

The block reward will be included in the profitability calculation, resulting in it being burned. This has the effect of reducing Ethereum’s security budget as proposers overbid to earn a smaller reward.

Denial of Service (DoS) attacks. Eligible proposers are revealed when they broadcast their bid. So, a losing bidder could DoS attack the winning bidder before they reveal their block in order to collect the rewards as the fallback. The counterargument is that the cost of operating a DoS attack will outweigh the profitability of proposing the block, because most of the earnings are burned.

Again, this is the cutting edge of Ethereum and research is still ongoing. We’ll see more updates to come.

MEV-Boost Ecosystem Health

Author: Austin Foss

In a previous issue of The DeFi Download from November last year, MEV Part II, we mapped out the MEV ecosystem at the time and the challenges it was facing; fears of censorship and inevitable centralization. Back then, the merge was only two months prior and the MEV ecosystem was very young and relatively speaking it still is, approaching just six months old.

Now we're going to revisit the topic to see how the landscape has changed.

Healthy MEV?

In the past MEV has been looked at as an existential risk and centralizing force against the network. As the merge approached and PoS transformed Ethereum, attitudes around MEV shifted towards acceptance and eventually settled on viewing it as ultimately beneficial for the network.

"Realizing the full value of the network."

"Beneficial transactions (arbitrage, liquidations and privacy)"

"Network Security"

If MEV can be good for the network what makes a healthy MEV ecosystem? An unhealthy one would amplify the negative risks of MEV:

"Exploitation of users."

"Elevated gas prices."

"Blockchain security."

Relayer Builder Symbiosis

As a quick refresher, Flashbots, "a research and development organization", is the team behind developing the MEV-Boost Relayer software. Their model uses two roles, builders and proposers/relayers. An Ethereum validator running the MEV-Boost relay software is the proposer, and builders submit blocks to them. Relayers are temporary until proposer builder separation (PBS) is enshrined in the protocol.

Inevitable Centralization?

In his blog post titled "End Game", from December 2021, Vitalik made a case for why block builder market will likely lead to "a high chance that block production will end up centralized..." but goes on to say that we can use "protocol-level techniques... to "regulate" this market, ensuring that the winners cannot abuse their power."

According to Vitalik's most recent roadmap, as part of "The Scourge", a spec for PBS will come about around the time proto-danksharding (EIP-4844) is implemented, with PBS being implemented sometime afterwards.

Given this approximate timeline, the current model for the MEV ecosystem will be around for at least another year. Initially, the Flashbots MEV model was showing signs of trending towards centralization, their relay reaching a peak market share of about 80% of all MEV-Boost transactions following the merge. Just one month later reports were showing that this had declined to 51%.

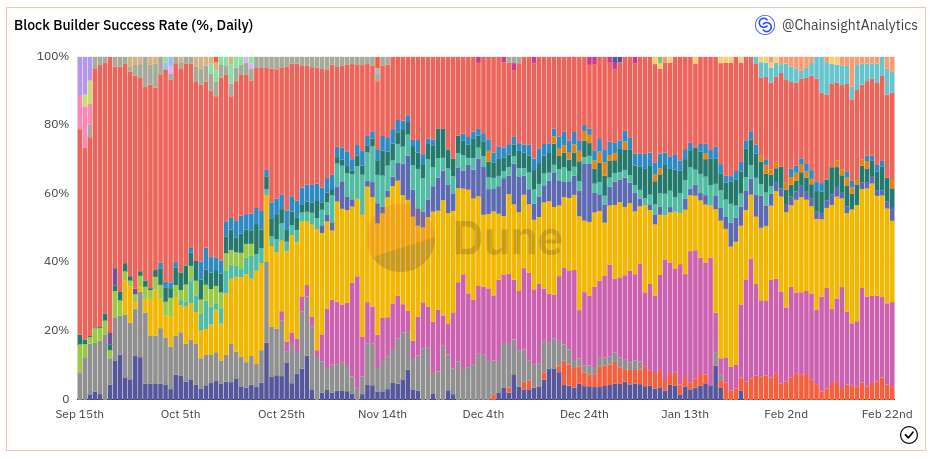

Using a new tool called Relay Scan developed by Flashbots team member Chris Hagar we can see up to date, real-time, data on the state of the MEV-Boost Ecosystem. At the time of writing, Flashbots' relay is down to just under 40% of the MEV-Boost market, with second place going to Bloxroute having a combined market share of ~24%, followed by Ultrasound.money at 20%. That's ~84% of all MEV-Boost volume going through 3 relays. Also at the time of writing, the MEV-Boost overall inclusion rate is ~80%, so with 40% of MEV-Boost market Flashbots facilitates, that's 32% of all Ethereum mainnet transactions.

When it comes to the builders, Flashbots open sourced this piece of software a little after their relay software in November 2022, Relay Scan shows four of these operators above 10% and further 6 above 1%.

Censorship Resistance

Around the time of the merge, discussion on the topic of censorship was on everyone's mind. Not only were the MEV dynamics shifting along with the move to PoS, but the US Office of Foreign Assets Control (OFAC) and recently sanctioned the TornadoCash project leading to the legacy MEV model, using MEV-Geth, and the closed source Flashbots relay censoring TornadoCash related addresses.

Built by Australian "Blockchain development agency", LABRYS, MEV Watch is a tool for monitoring how OFAC compliant Ethereum's validators are. At the time of writing, since the merge, 45% of blocks were OFAC compliant.

MEV End Game

Although Vitalik predicts that block builders will inevitably centralize, but right now the ecosystem is trending towards more decentralization for the time being. It is important to note that his argument for why builders would centralize has a lot to do with cross-domain (cross-rollup) MEV and the wider implications of Ethereum's scaling plans on the MEV market, so his prediction may still prove accurate.

Even if this were to happen it wouldn't be the end of the world. A centralized block builder market, according to Vitalik, would still result in "block validation [being] trustless and highly decentralized, and censorship [would still be] prevented." This would still fit the definition of a healthy MEV ecosystem according to the six points mentioned at the beginning, it just wouldn’t fit an idealistic vision of Ethereum where absolutely everything is decentralized.

MEV's final form and enshrined PBS are yet to come and nothing is set in stone just yet.

Action Steps

📖 Read The MEV Edition (part I) | DeFi Download

📖 Read The MEV Edition (part II) | DeFi Download

⛏️ Dig into Burning MEV through proposer auctions | Domothy

🎧 Listen Flashbots Saves Crypto with Stephane Gosselin | Bankless Shows

Project Releases 🎉

Hand-picked project updates to understand the current state of the DeFi ecosystem

MakerDAO releases 2022 annual report

MakerDAO numbers are down big as a result of slowed activity: Net Operating Earnings (-79.1%)

Revenues down 40% and protocol operating earnings down 40%, the Maker protocol still managed to generate a positive surplus

RWAs as a proportion of total revenues at Maker reached all time highs by the end of the year, with ca. 600m DAI or >10% of protocol assets backed by real-world vaults

The report can be found on IPFS

Arbitrum announces Stylus to launch this year

Arbitrum will allow developers to create smart contracts in different programming languages like Rust, C++, and Haskell.

Arbitrum states that dApps written in Stylus are an order of magnitude faster than Solidity

Stylus is expected to go live in 2023

Element releases AMM Hyperdrive

Hyperdrive offers fixed rates as part of a variable/fixed market with no preset expiration dates, no fragmented liquidity between terms, and no LP rollovers.

Integrations with MakerDAO and Spark Protocol.

Users can take out a fixed rate loan via Hyperdrive or they can long or short the fixed rate this pool offers.

InfinityPools

LP positions on concentrated liquidity pools can be lent to traders who submit a fraction of the borrowed funds as collateral.

Traders pay an ongoing “funding rate” to liquidity providers in exchange for borrowing their LP tokens.

0 liquidation risk and unlimited leverage on any asset

Mean Finance releases Meta Aggregator

A DEX aggregator aggregator

22 chains and 9 DEX aggregators

Offers transaction simulation to show predictable prices and to prevent failed transactions

Combined swap and sends in one transaction

Synthetix V3 launch

Live on Ethereum Mainnet and Optimism but does not have any markets attached to it yet

Create derivatives collateralized by ERC-20 tokens.

Liquidity providers in the V2 system will be able to drop their position into the V3 system with a single transaction and continue to collateralize the existing spot synths and perpetual futures markets.

Shopify has added Sign-in with Ethereum

Tokengated pages let merchants offer eligible token holders exclusive access to products and discounts.

Define the token contract you’d like to base the gate on and set your own requirements for access and discounts

Your gate requirements can be for any chain or any level of granularity, such as specific traits or IDs. Your app is responsible for evaluating whether customers meet the requirements of any gate that it configures.

Token Terminal introduces Financial Statements for DAOs

Real-time financial statements

Trading volume, Transaction volume, Active loans, Assets staked, AUM, and Capital deployed

Identify fees paid to liquidity or service providers, fees captured by the DAO, token incentives (user acquisition cost), and earnings

Chirping Birds

🔥 and 🧊 tweets from across the DeFi ecosystem

🛠 BANK Utility (BanklessDAO token)

With over 5,000 holders, BANK is one of the most widely held social tokens in crypto. So it bears asking, where are the best places to put our BANK to use? The five protocols below will allow you to deposit BANK in a liquidity pool and earn rewards. To get going, just click on the name, connect to the app, filter by BANK, and start earning passive income.

⚖️ Balancer

Balancer has two 80/20 liquidity pools, meaning that you are required to deposit 80% BANK and 20% ETH in the pool. There is one pool on Ethereum and another on Polygon. Once you’ve provided liquidity, you’ll receive LP tokens. Keep an eye out for opportunities to stake these LP tokens. There is nearly 500,000 USD in the two Balancer liquidity pools.

🍣 SushiSwap

SushiSwap has a 50/50 BANK/ETH pool. As with Balancer, you will receive LP tokens, and while you can’t stake them on SushiSwap’s Onsen Farm yet, you may be able to in the future. Liquidity providers earn a .25% fee on all trades proportional to their pool share. The SushiSwap pool has a little over 100,000 USD in liquidity.

⏛ Rari Fuse Pool- Deprecated Soon

This will be deprecated soon. The Rari Fuse Pool allows you to borrow against your BANK or earn huge APY by providing assets like DAI to the pool. At present, all borrowing is paused for this pool. There is over 450,000 USD deposited in the Pool

🦄 Uniswap

The Uniswap V3 liquidity pool is 50/50 BANK/ETH, and provides a price oracle for the Rari Fuse Pool. By depositing in the Uniswap pool, you can earn fees and help enable borrowing on Rari. This pool currently has over 500,000 USD in liquidity.

🪐 Arrakis

You can also provide liquidity to the Arrakis Uniswap V3 pool. The ratio is about 2/1 BANK/ETH. This pool is new, and only has a bit more than $6,000 in liquidity. In the future, you may be able to stake your BANK/ETH LP tokens within the protocol to earn additional rewards.

Get Plugged In

🧳 Job Opportunities

Get a job in crypto! Do you like solving hard problems, care about building more efficient markets for everybody, and want to work at the frontier of decentralized finance? Rook is looking for full time contributors, with salaries ranging from $169,000-$722,000. There are positions ranging from engineering, recruiting, product marketing, copywriting, and design. Sound interesting? Sign up for our referral program and go full-time DAO.

DeFi Research Lead (Fully remote)

DeFi Bot Wrangler (Fully remote)

Blockchain Economist (Fully remote)

Head of Research (Fully remote)