Dolce&Gabbana, Sorare, and the Value of Art on Unreliable Blockchains | Decentralized Arts

Dear Bankless Fam,

“How do you think I'm going to get along

Without you when you're gone

You took me for everything that I had

And kicked me out on my own”

So begins the second verse to one of Queen’s most iconic tunes, Another One Bites the Dust. Freddie Mercury seems to be saying goodbye to a recent love interest, suggesting that, with regard to his love life, another one bites the dust. It seems web2 can begin using this tune in this regard for itself. Week after week, we have been reporting on more IRL and web2 brands setting up shop in the metaverse. We’ve seen an entire football club go crypto native, and massive brands create space for themselves in the world of NFTs.

And it isn’t stopping any time soon. Pedro gives us the scoop on one of the most iconic luxury fashion brands, Dolce&Gabbana, turning to web3 for digital x physical collectibles and wearables.

Kaf takes this trend in a different route. Remember baseball cards? Sorare brings trading cards to the blockchain with their trading platform dedicated to sports enthusiasts.

And all this effort wouldn’t be worth the paper it’s printed on, or rather, the screens it’s displayed across, if the underlying technology wasn’t viable to support it. nonsense discusses the value of art as NFTs and how this may be affected by blockchains that struggle with reliability in the op-ed “Is Good Art Worth Minting on a Bad Blockchain?”

Finally, The Rug comes through to provide the hottest headline you need to add to your wallet, Perchy gives us another glimpse of life in Chippi’s Corner, and DustyEye group makes one final chronojump to bring us a summary of the life and times of Android N°44.

Welcome to Decentralized Arts.

Contributors: BanklessDAO Writers Guild (Grendel, Kouros, Kaf, nonsensetwice, Frank America)

This is the official NFT newsletter of BanklessDAO. If you were a Premium Member of the Bankless Newsletter as of May 1st, 2021, you have been subscribed to this newsletter at launch. To unsubscribe, edit your settings here.

Curated NFT News

SEC Investigating Yuga Labs

The U.S. Securities and Exchange Commission (SEC) is studying whether Yuga Labs–creator of Bored Ape Yacht Club and owner of CryptoPunks, among other popular franchises–have violated federal law and if some NFTs are considered to be more stock-like.

This doesn’t mean that the probe will lead to charges or that there have been accusations of wrongdoing. In response to the SEC probe, Yuga Labs has said it would help the government agency with any inquiries. Yuga has stated, “It’s well-known that policymakers and regulators have sought to learn more about the novel world of web3. We hope to partner with the rest of the industry and regulators to define and shape the burgeoning ecosystem. As a leader in the space, Yuga is committed to fully cooperating with any inquiries along the way.”

Konami’s Hiring Spree Ahead of NFT Marketplace

The Japanese gaming giant is looking to hire staff for their NFT and Metaverse projects.

On Oct. 13, the company announced that it was recruiting a “wide range of talent” for "system construction and service development,” relating to future metaverse and web3 platforms.

Konami stated that it has been conducting research and development to incorporate the latest technology into its games and content, adding it also plans to launch an NFT trading platform where players can trade their in-game digital items.

The roles range from technical ones such as system engineer or programmer to designer, legal, or finance.

The Rug Weekly NFT

New Message From Wallet.Support@gmail.com

Brought to you by The Rug

Well we all need tech support from time to time, and who better to trust than wallet.support@gmail.com? I mean, just look at that handle. Don’t forget to get seed phrase assistance if you are new to crypto.

“Well, I need words because technical support requires to see how much crypto you have, test transfer, etc. I also give feedback on good seed phrases for security. I’m sure you want to be secure like smart people?”

Collect this tech trouble-shooter as an NFT on optimism.

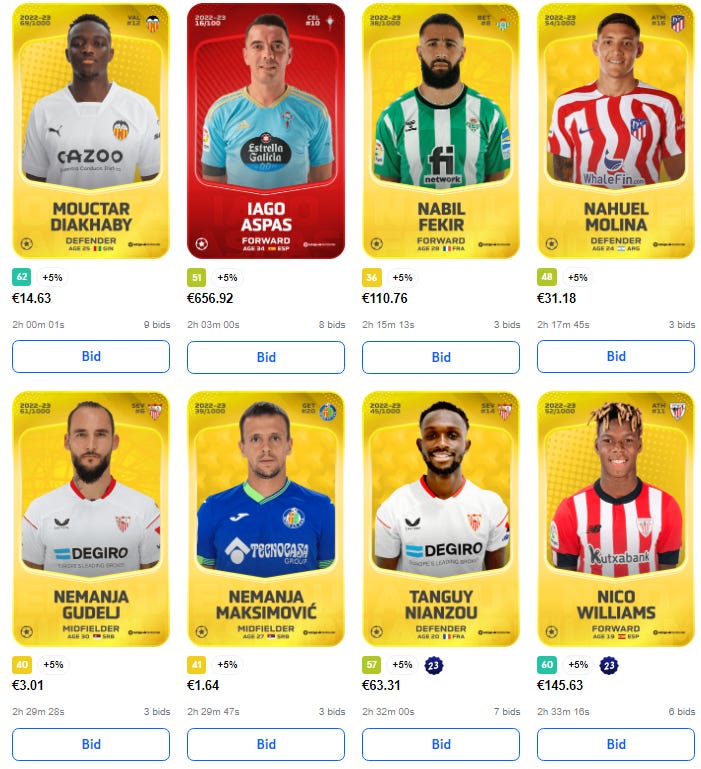

Sorare: Trading Cards 3.0

How to earn money trading NFTs while following your favorite sport

By Kaf

Who hasn't traded cards as a kid?

I remember during recess at school, there was great commotion to get that one card that nobody else had. What was at stake?

Respect.

Years later, I discovered the first football manager simulator. I spent hours perfecting my team's tactics to win the championship.

Then came the internet.

With the advent of the internet came the ability to compete against people from all over the world. Sports video games exploded.

The Internet also helped democratize sports betting. Today anyone of legal age can open an account and bet on their favorite sport.

Now imagine being able to do all of the above on the same platform. Collect cards, create your team from scratch, compete against people from all over the world, and earn money.

This platform is Sorare.

What is Sorare?

Sorare is a Blockchain-based fantasy sports game where you can buy, exchange and play with digital cards. Each card is an official digital collectible certificate for a club or league.

In Sorare you can collect digital cards, build lineups, and compete.

Sorare and its NFT trading card system works using Ethereum-based blockchain technology and is backed by video game company Ubisoft.

They began associating themselves with football clubs until reaching agreements with Real Madrid and F.C Barcelona. In March of this year they signed an agreement with the MLB. Their recent big announcement is their association with the NBA.

How to make money on Sorare

Earning in Sorare is easy, though the best way to earn money in Sorare is to be a good manager and lead your team to the top.

You’ll start by creating an account. This will take approximately 30 seconds.

Next, choose your sport. What do you prefer, football, baseball, or basketball?

When you sign up, you will be offered a random pack of common cards. These common cards are not actual in-game collectibles, they simply allow for a free game experience.

These cards make up your team. Your team's score is based on the actual performance of your players that weekend. The results come out every Monday. Depending on the players' score, you get rewards of higher or lower value. The rewards are usually unique cards and ETH for the division winners. The more power (i.e. scarcity and higher levels) your cards have, the more competitive the division will be.

The best advice is to remain up-to-date on your players to create a winning line-up.

Choose your manager strategy

There are three strategies to choose from:

Collectors. All trading cards are official NFTs from each club or league. Collectors focus on acquiring these NFTs. I have the first Sorare digital sticker of Cristiano Ronaldo. Its sentimental value will increase considering that he is going to retire soon.

Traders. The goal is simple: buy cheap and resell at a higher price. During the season the price of the players will vary depending on their performance. The best strategy is to sign them before they score goals. The most expensive NFT in Sorare sold for $600,000, due largely to Haland beating CR7.

Players. If you are a lover of competition then you will work to have the best players in your lineup. Is your goal to see your team at the top of the charts? If so, research hard and choose wisely.

Choose your strategy based on your talents and interests.

Final thoughts

NFTs are changing the nature of gaming and collectibles by providing new features like digital ownership and scarcity. Experts already place NFTs as one of the 10 trends to follow in the future.

Over the years, the way we enjoy sports has changed. Social networks and television networks have provided fans with 24 hours of sports entertainment. New generations seek more dynamic experiences.

The evolution of the internet is web3. Sorare recognized this early on and now stands as the leader in the NFT trading cards sector. With their recent collaboration with the NBA they reached 3 of the most watched sports in the world. Mass adoption is a only matter of time.

Dolce&Gabbana

Bringing Luxury Fashion to The Metaverse

By Pedro

One year ago, one of the most iconic luxury fashion brands in the world joined web3 : Dolce&Gabbana (D&G). Just as they played a big part in revolutionizing the IRL fashion industry, they intend to be one of the key players to revolutionize fashion in web3.

In partnership with UNXD, D&G will build its own fashion NFT universe on the Polygon network.

What is UNXD

UNXD is a curated marketplace for digital luxury, and are D&G’s partners for everything web3. The D&G brand is known for its luxury fashion innovations rather than any technological innovations. Shashi Menon, UNXD founder, knew this when he approached the brand with the NFT launch idea. It wasn’t long after that Dolce launched its first NFT project: Collezione Genesi, or their “genesis collection.”

Collezione Genesi

During the last week of September 2021, D&G launched Collezione Genesi, a 9-piece physical/digital collection made by world-renowned designers. Pieces in the collection were auctioned off, with winning names including Pranksy, Seedphrase, Boston Protocol, and Red DAO. Altogether, this collection was able to raise $6M, a record for fashion NFTs. In addition to being able to show off their 1/1 luxury wearable items, holders of Collezione Genesi NFTs will also get access to exclusive D&G experiences, including invitations to future Alta Moda events.

DGFamily Glass Box Set

After a successful initial NFT drop, D&G launched their DGFamily NFT glass box set, a 5,000 piece collection that will grant holders exclusive access to the D&G NFT universe, including exclusive physical drops. According to their description on OpenSea, “DGFamily members receive exclusive digital, physical, and experiential privileges as Dolce&Gabbana pushes the boundaries of luxury and culture in the metaverse. DGFamily boxes are based on the classic Italian Carretto style, and crafted in three increasingly rarer tiers.”

These tiers are:

Black: Grants holders access to the first tier of the DGFamily. Access to digital/physical apparel + metaverse fashion events + swag pack

Gold: Receive everything from the Black tier, “and more”, including rarer drops, invites to IRL events + an exclusive swag pack with kicks

Platinum: Rarest tier, granting holder access to everything mentioned above. They get access to the rarest drops and the most special IRL experiences.

Today, there are still about 1.3K glass boxes that have yet to be revealed.

Realtà Parallela IRL Drop

On July 30th, 2022, all DGFamily box holders were airdropped a piece from their Realta Parallela collection–a 100% made in Italy collection consisting of t-shirts, hoodies, and sneakers–all personally designed by Domenico Dolce & Stefano Gabbana themselves.

The claim window began on October 1st and will extend through October 18th, 2022, after which holders will be unable to claim the IRL drop. After a holder claims their items, the original NFT visual is converted to the item they selected, set against a new background. This NFT will then be made available as a digital wearable in the future.

Chippi Corner

By Perchy

By Nonsense.

Header art by Debra: @debrabdesign on Twitter. You can find her work on Formfunction, with a new series soon to be released on Foundation.

In the realm of physical, tangible art, collectors will go to great lengths to have their pieces certified as original. Paintings by classical or popular artists are highly sought after and valued accordingly. If a collector is unable to verify the authenticity of a piece, they’ll be unable to sell, insure, or donate the piece. Or if they do sell it, it will sell for far less than its intrinsic value, if it is authentic. NFTs solve this by creating mechanisms for provenance, verification, and ownership at the time of minting. This is, however, contingent on the underlying blockchain to remain in operation for these mechanisms to be of any value. This raises the question, is good art minted on a bad blockchain still worth collecting?

Anyone can save a JPEG to their device and view the JPEG. However, that JPEG does not, in and of itself, provide the owner with access to any of the utility that underlies the NFT over which the JPEG was created. Occasionally, minting an NFT provides the wallet that minted it access to communities, features, products, and events that would otherwise be inaccessible to the general public. Blockchain technology allows for digital ownership recognition in ways that other forms of technology never will.

Copy the image. Who gives a shit? I own the data that exists on the blockchain underlying the NFT. It’s the data that gives me access.

Considering the ownership aspect, there’s a reason hi-brow art auction houses like Sotheby’s and Christie’s have adopted this technology and operate their own separate metaverses: blockchain technology now offers a viable way to track legitimate ownership in the digital realm.

In traditional art spaces, when you purchase a piece of work from an artist, you’re taking home a tangible good. This may take the form of a sculpture, painting on canvas, or any other physical medium in which that artist creates. Prints of said works can be purchased, but these are obviously not the original work, and pale in comparison of value.

NFTs are to original works of tangible art as “right-click save” is to prints. Smart contracts by which an NFT is produced can be verified. Ownership can be verified. Counterfeits can be verified as counterfeit.

Ultimately, the viability of this verification is dependent on the blockchain on which an NFT is minted. If the blockchain is unavailable in any way to verify the data of the NFT in a user’s wallet, that NFT is naught more than an overpriced JPEG. Literally.

Take, for example, the recent Solana blockchain outage, a not-infrequent phenomenon:

I am no blockchain maxi; I am open to investing in projects and purchasing art on any viable blockchain. But in this case, viable is the working term.

According to Forbes, echoing a statement made by Vitalik when discussing blockchain viability, “when building a blockchain developers have to decide which 2 or 3 critical issues they’ll solve for: Decentralization, Security or Scalability”:

“Ethereum prioritized decentralization and security at the expense of scalability ... this resulted in massive ‘congestion’ and high gas fees particularly when NFTs boomed in popularity… Solana sacrificed decentralization in order to prioritize security and scalability.” - McMillian

That sacrifice has cost Solana unmitigated operation. According to the Motley Fool, Solana has crashed 12 times in 2022 alone. Spread out, this is akin to one outage per month. While this may be considered practically dependable, is it reasonably acceptable? The market has decided it is not: outages have driven sell pressure of Solana’s native token, SOL, causing it to lose more than 78% of the value of its most recent all time high. While many tokens dropped in value during this recent bear market, SOL has been dropping in value as of 6 November 2021, according to CoinDesk, long before the start of the bear.

When it comes to tokens of this sort, exiting your position is a simple matter of swapping or selling. This only becomes problematic when liquidity is low.

NFTs, however, are a different kind of monster.

If you want to offload an NFT, you need a buyer lined up ready to take on the risks and responsibilities of owning that NFT. If users are exiting a blockchain on which an NFT is hosted, this may prove to be incredibly difficult.

While art is art no matter where it’s being made available, the medium matters when it comes to verifiable provenance and ownership. And when we consider NFTs as a medium, the viability of the underlying technology matters. One of the primary factors driving NFT adoption is the idea of digital ownership. Many make jokes about “right-click save,” however this does nothing in terms of modifying the ownership of an NFT and all that entails. This bears examining in greater detail:

Metadata, artwork, and collectibles may change, but ultimately, the NFT itself represents the hash on a blockchain and ties that hash to the user that has created, minted, or purchased it. Holding an NFT, then, implies ownership of whatever that hash enables within the context of the blockchain ecosystem in which it is minted.

How does this apply to Solana?

You can’t verify ownership when a network is down.

An example: you purchase an NFT on Solana. You want to join the artist’s community and gain access to the “Member Only” categories. You plug your wallet address into the resident crypto bot, and you’re unable to be verified. The bot can’t check your data because Solana is down. It’s fine, you think. Solana will come back up.

What if the stakes are higher, or your transaction is time sensitive? Maybe you’re bidding on a piece of art or your favorite artist just launched their public mint. Or maybe you’re trying to buy tickets to your favorite football club’s game. Or maybe you want access to a variety of private sporting events. Or maybe you want to ape into the latest footwear drop. None of this works if the blockchain on which the NFTs were minted is not operational.

After a dozen crashes in a year, how many more times will it crash before the bulk of the community finally calls it, sells, and bounces?

As Bankless has written, “Arbitrary pauses of a blockchain, be it from technical bugs (Solana) or manual pauses (BNB Chain) compromises the raison d'être of the Web3 experiment.” This web3 experiment may have started with the goal to democratize finance, but has since expanded to include a host of other features. With DAOs, we’re revolutionizing the way we work. With NFTs, we’re revolutionizing the role and experience of art and utility in the digital realm. None of this is possible if the underlying technology is unreliable.

At this rate, it’s more likely that Solana fails entirely than it turns around. It’s a low-faith consideration, but their performance this year so far has done little to inspire faith at any level. If Solana fails, that NFT you bought will be useless.

The case can be made that in purchasing an NFT, you are supporting the artist’s work, which is admirable. However, if the recognition of ownership is not a key factor in purchasing an NFT, it would make more sense to simply fund the artist’s work directly by becoming a patron, rather than purchasing a product that may not be viable in the long run.

Now, this isn’t to say that other blockchains won’t be viable in the long term. The fact that other blockchains are operating with far greater consistency than Solana provides greater faith in the underlying communities building these blockchains.

For most blockchain development communities, decentralization is not being sacrificed for either security or scalability, leading them to continue to operate regardless if an entire platform crashes. If Amazon Web Services or Infura goes down, heavy data-centric apps may struggle, but many of these other blockchains will continue to operate, thanks to the continued operations of independent validators.

Now, is good art worth minting on a bad blockchain? Ultimately, the answer lies with you. This is but one facet of the argument, and given the value afforded to the function of NFTs as digital ownership technology, I argue it is unwise to purchase NFTs on any blockchain that struggles to remain reliable.

Meme

A small joke contributed by The Rug.

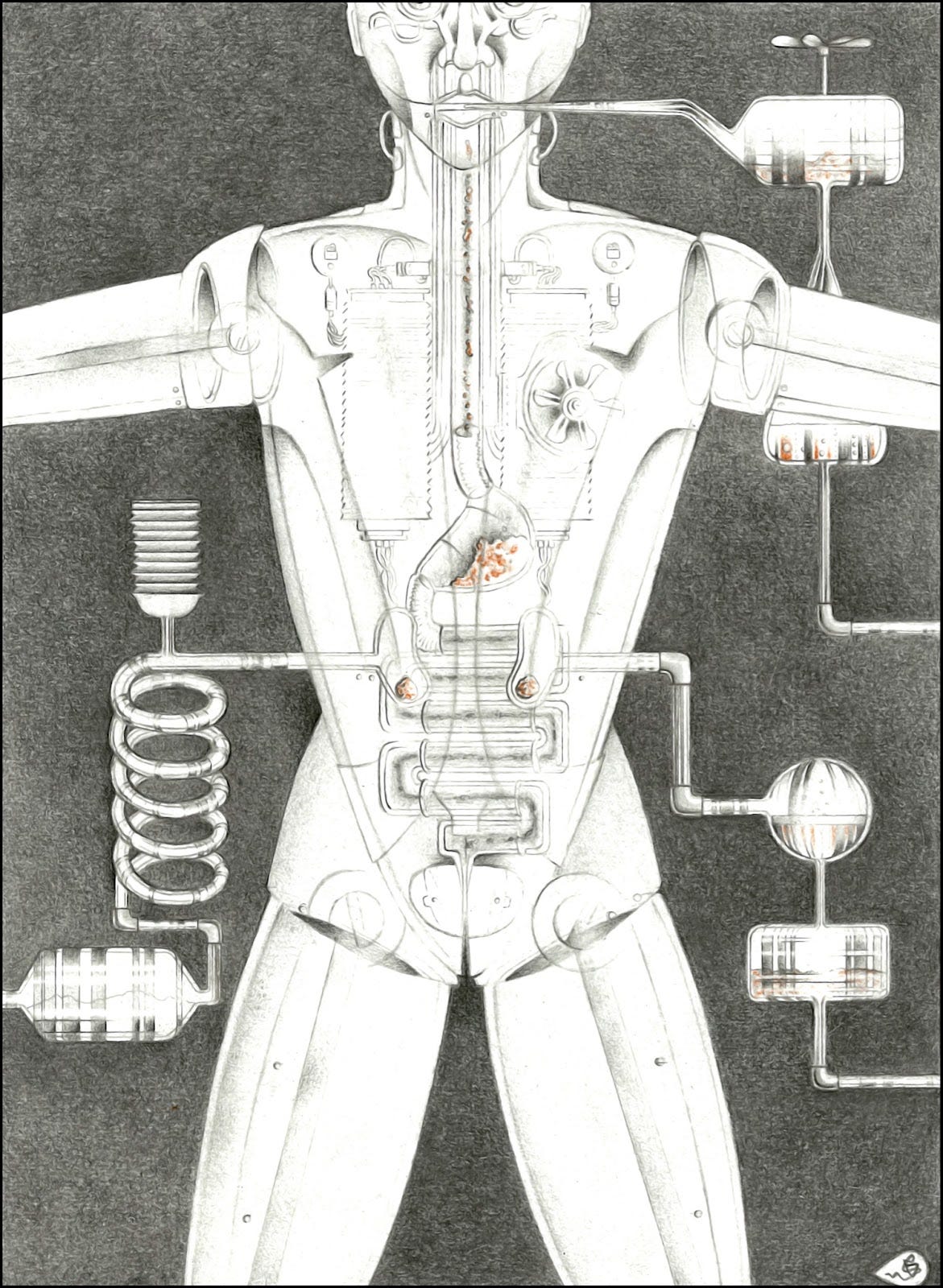

BITS OF N°44

IN THE MIDDLE, 2344|2374

By DustyEye, illustrations by Selena Garau Maher

After getting to know N °44 864.962 through the finds of Future Bazar, the DustyEye group is pleased to offer a quick overview dedicated to the life of the first emotionally advanced android

It runs in the year March 2344, when in May the android was hit by an intense attack of the Collodi Drive, the pathology that afflicts many machinic intelligences, leading them to desire to be "a real child". In the case of N°44 the episode of Collodi Drive is revealed with a self-sabotage and the production of 14 kidney stones. All expelled between contractions, spasms and suffering.

Among the many alternatives that N°44 could have considered to feel more Human, or if we want less Artificial, experiencing Pain was a singular choice. It should also be noted that the research did not even end with the renal colic of 2344. The trial continued in 2352 when partly to replicate the crucifixion of Christ, partly to emulate the hanging of Odin on the Tree of Life, the android N°44 screwed himself to a shrub for seven days tasting the suffering as an exploration of the Sacred sphere

The week of meditation gave rise to the idea for a twenty-year plan in N°44: when he came down from the shrub he printed an approximate cosmic route and in the four decades of success he visited four hubs of rotation of the universe. He started from the Arctic pole, then came the turn of the Sun and the center of the Milky Way, until he reached an ambitious center of the Whole..

…TO BE CONTINUED

______________________

WEB: www.DustyEye.comIG: @DustyEye_DETWITTER: @Dusty_Eye

Decentralized Arts is written and produced by a small team of contributors who are passionate about art, both visual and written, and its growing place in crypto and NFTs. With each edition, we aim to bring you not only the most current and relevant news in the NFT space, but also explorations in what it means for our culture and societies for this market to continue to grow and expand. When everyone is an owner of art, we all gain a deeper appreciation for it.

With great appreciation for you, we thank you for reading and subscribing to Decentralized Arts.

Cordially,

Grendel, Kouros, Kaf, nonsensetwice, and Frank America

🕺