Bitcoin Runes and the Layer 2 Surge | Layer 2 Review

Quick Reads and Hot Links Covering the People and Projects Who Are Scaling Ethereum

Dear Frens,

Welcome back to the L2 Review.

Recent analysis has it that Base remains the key draw for fresh investments. This week, Base received over 6,500 ETH in net deposits, outpacing Arbitrum and Optimism by a significant margin. This suggests that investors prefer Base for deploying their capital, possibly because of its established infrastructure or its assumed dependability, despite the growing interest in Layer 2 scaling solutions overall.

Arbitrum, on its end, is making a mark in history as the first L2 to surpass the $150 billion total transaction volume on DEX with a TVL of $2.64 billion, solidifying its position as the largest layer 2 by TVL. With this, many projects are integrating Arbitrum to benefit from its scalability and lower fees.

In this issue’s editorial, we explore a not-so-familiar topic captured in this newsletter, the Bitcoin Layer 2. What is brewing? What is the cause of the latest surge? What are some of its shortcomings? All these and more. It felt good putting this together, but we’d love to know what you think about it. If you are interested in these kinds of posts, kindly let us know in the poll after the article.

Truly, one thing is certain, layer 2 solutions continue to transform the landscape of decentralized applications. Stay tuned and keep your eyes peeled for the latest updates, as the evolution of blockchain technology continues to unfold.

Contributors: Ritaakubue, anointingthompson1, jengajojo, Tonytad, Boluwatife, Kornekt, WinVerse

This is an official newsletter of BanklessDAO. Please subscribe and share to help us grow our audience as we fulfill our mission to build user-friendly crypto onramps.

🗞️ Ecosystem Updates

♾️ Ethernity Introduces the Ethernity Chain, an ETH Layer 2 with enhanced AI-driven security

💰 Arbitrum surpasses $150 billion in total transaction volume on Uniswap

🔥 Hot News

ZKM Unveils Revolutionary Bitcoin Layer 2 Network After $5M Funding Success

ZKM has announced plans to launch a groundbreaking Bitcoin Layer 2 network following a successful $5M Pre-funding round.

The funding round, led by OKX Ventures and supported by prominent investors like Polygon Ventures, Crypto.com, Amber Group, and others, paves the way for ZKM to introduce the first implementation of its zkVM-based Entangled Rollup interoperability network.

At the heart of this Layer 2 solution lies a unique security framework that introduces a native BTC Multisig script control and decentralized transaction execution verified by BTC scripts. Notably, it employs an 'Optimistic Challenge Process' to secure off-chain computations, ensuring robust security and transparency.

Backed by the Entangled infrastructure, including a general-purpose zkVM and decentralized sequencers, ZKM's Layer 2 network not only guarantees native security but also provides sustainable yield without requiring asset locking. This is a game-changer for Bitcoin investors.

To showcase its commitment to the Bitcoin community, ZKM will sponsor and participate in the upcoming Bitcoin Asia conference in Hong Kong from May 9-10, one of the world's biggest Bitcoin events. Additionally, ZKM will co-host the Bitcoin Dragonland Fest on May 8, providing attendees with an opportunity to learn more about the Layer 2 network and sustainable yield generation from BTC assets without staking, secured by ZKM's state-of-the-art zkVM.

If you are interested in learning more, check out the tweet below.

🏛 Governance

💬 Proposals in Discussion

Arbitrum

Bitcoin Runes and the Layer 2 Surge

Author: Kornekt

In the ever-evolving landscape of blockchain technology, innovation continues to push the boundaries of what's possible. Runes is the latest protocol making waves on the Bitcoin ecosystem. Spearheaded by Casey Rodarmor, the mind behind Ordinals, Bitcoin Runes promises to revolutionize the concept of fungible tokens within the Bitcoin ecosystem.

At its core, Bitcoin Runes leverages Bitcoin’s native UTXO transaction model to create and manage fungible cryptocurrencies seamlessly. Token issuance, transfer, and storage are performed efficiently, with minimal impact on the underlying Bitcoin blockchain. By assigning messages to UTXOs via OP_RETURN, Runes ensures secure and transparent transactions without the need for off-chain data storage.

The launch of the Runes protocol coincided with Bitcoin's fourth halving, marking a significant milestone in the evolution of the Bitcoin ecosystem. This synchronized launch triggered a frenzy of activity, with users flooding into the Bitcoin blockchain to mint Rune tokens. Few days after launch, Runes accounted for about 68% of all Bitcoin transactions. As a result, Bitcoin transaction fees surged due to stiffer competition for blockspace. All these highlight the need for further scaling of the Bitcoin network.

Why Bitcoin Needs L2 Solutions

Despite its unmatched security and decentralization, Bitcoin grapples with inherent shortcomings that necessitate the existence of layer 2 solutions on the network.

First and foremost, Bitcoin's scalability has long been a subject of debate and concern. The network's limited throughput, capped at a mere six to eight transactions per second, pales in comparison to the transaction speeds offered by traditional payment systems and even some of its blockchain counterparts. This bottleneck often results in congested blocks and soaring transaction fees during periods of high demand, deterring users from engaging with the network for everyday transactions.

Moreover, Bitcoin's base layer lacks the flexibility to support complex smart contracts and decentralized applications (dApps). Unlike platforms like Ethereum, which embrace Turing-complete scripting languages, Bitcoin's scripting capabilities are limited. This constraint stifles innovation and hampers the development of novel use cases beyond simple value transfer.

Bitcoin layer 2 networks hope to scale the network by introducing innovative solutions that resolve these challenges. Let's delve into some popular layer 2 solutions on the Bitcoin network and explore how they function.

Lightning Network (LN)

The Lightning Network is arguably one of the most well-known layer 2 solutions for Bitcoin. It operates as a network of payment channels built on the Bitcoin blockchain. Users can open payment channels with each other, conduct off-chain transactions, and settle them on the Bitcoin blockchain when necessary. This enables instant micropayments with reduced transaction fees. LN leverages smart contracts and multi-signature wallets to ensure security and trustlessness in transactions.

Liquid Network

Liquid is a sidechain built by Blockstream, offering fast and confidential transactions for Bitcoin and other digital assets. It operates as a federated sidechain, meaning it relies on a group of trusted entities to validate transactions. Liquid supports the issuance of tokenized assets, such as stablecoins and security tokens, while providing fast settlement times of fewer than two minutes. Confidential Transactions and Confidential Assets features enhance privacy by obscuring transaction amounts and asset types.

While Lightning Network and Liquid Network are among the most prominent layer 2 solutions on Bitcoin, several other projects are also exploring off-chain scaling solutions. Projects like RSK, Rootstock, and Stacks (formerly Blockstack) are experimenting with different approaches to enhance Bitcoin's scalability.

Bitcoin L2 vs. Ethereum L2

Underlying Blockchain

Bitcoin L2 solutions operate on the Bitcoin blockchain, renowned for its security, decentralization, and robustness.

Ethereum L2 solutions, on the other hand, leverage the Ethereum blockchain, known for its smart contract capabilities and vibrant decentralized finance (DeFi) ecosystem.

Use Cases and Applications

Bitcoin L2 solutions primarily facilitate fast and low-cost payments, microtransactions, and asset tokenization within the Bitcoin ecosystem.

Ethereum L2 solutions cater to a broader range of applications, including decentralized exchanges (DEXs), non-fungible tokens (NFTs), DeFi protocols, and gaming platforms, leveraging Ethereum's programmability and smart contract capabilities.

Community and Adoption

Bitcoin L2 solutions benefit from a robust and longstanding community of Bitcoin enthusiasts, developers, and businesses, contributing to their adoption and development.

Ethereum L2 solutions thrive within Ethereum's vibrant ecosystem, buoyed by a diverse community of developers, DeFi projects, and decentralized applications (dApps).

Bitcoin Layer 2 Shortcomings

User Experience and Accessibility: Although L2 solutions aim to provide faster and cheaper transactions compared to on-chain transactions, the user experience can still be cumbersome for non-technical users. Setting up payment channels, managing channel liquidity, and understanding routing mechanisms can deter mainstream adoption and limit accessibility to L2 networks.

Interoperability and Network Fragmentation: The lack of interoperability between different Bitcoin L2 solutions and other blockchain networks hampers seamless asset transfers and cross-platform interactions. This fragmentation of the network ecosystem can lead to inefficiencies and siloed liquidity pools, hindering the growth of Bitcoin's broader DeFi ecosystem.

Security and Trust Model: While L2 solutions inherit the security properties of the underlying Bitcoin blockchain, they introduce additional layers of complexity and potential attack vectors. Issues such as channel breaches, routing attacks, and protocol vulnerabilities pose security risks that must be addressed through rigorous testing, audits, and continuous development efforts.

Conclusion

Relentless innovation and collaborative efforts within the cryptocurrency community continue to push the boundaries of what is possible on the Bitcoin network. With ongoing developments in layer 2 technology, coupled with a growing ecosystem of applications and services, the future of Bitcoin's layer 2 ecosystem looks promising.

📈 Data

Total Value Locked on L2s closes in on $40 billion!

Top Ten Projects by Total Value Locked:

🔭 Project Watch

Arbitrum

Top Projects by TVL

Optimism

Top Projects by TVL

zkSync

Top Projects by TVL

zkEVM

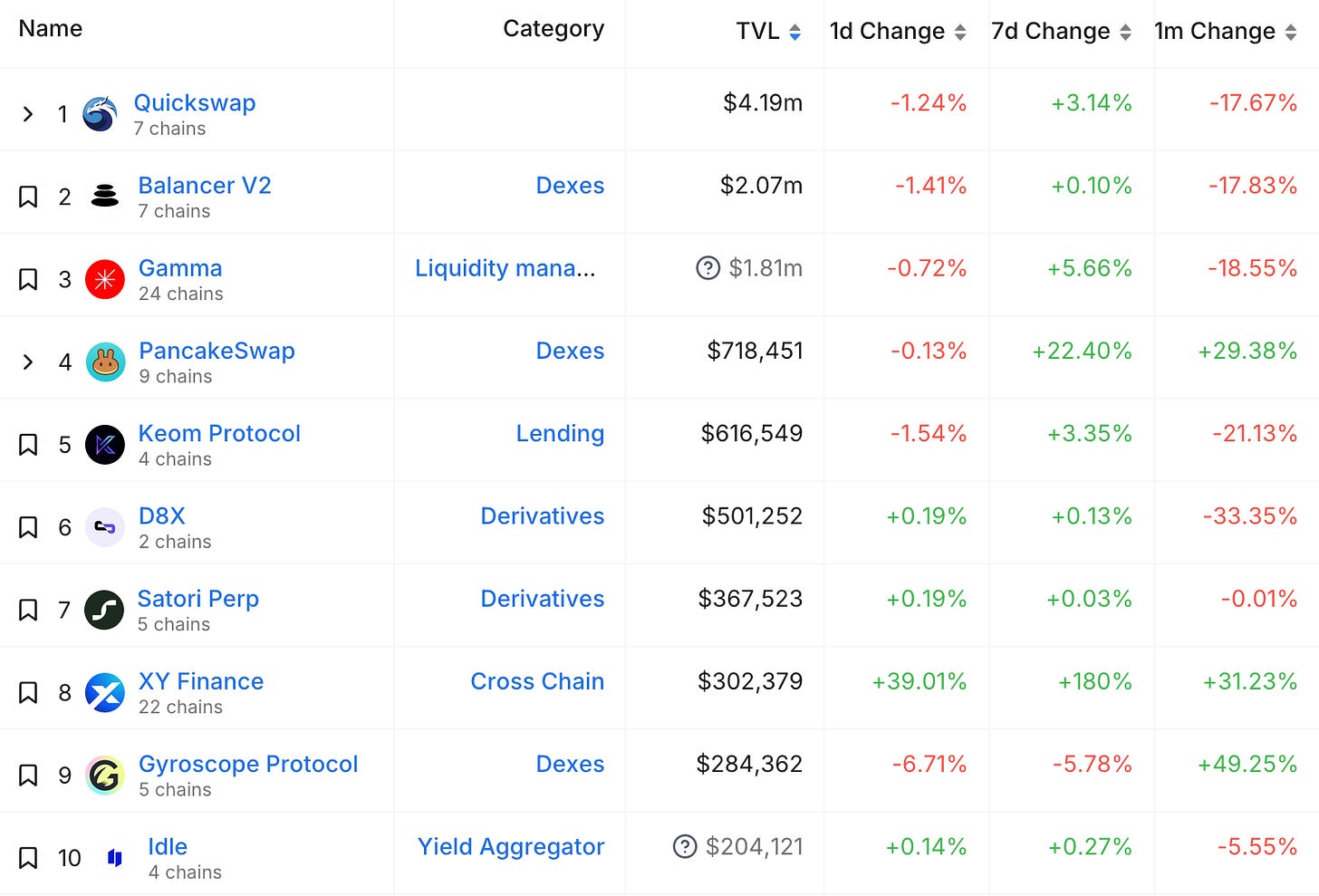

Top Projects by TVL