The Merge (Part III) | DeFi Download

After the Merge: token withdrawals; The Surge, The Verge, The Purge, and the Splurge; Proto-Danksharding. How Ethereum will scale, handle MEV, and survive the future.

Dear Bankless Nation 🏴,

Two weeks after the Merge, it finally feels like we can take a breath and plan for the future. As we discussed in the last issue, the Ethereum’s transition from proof-of-work to proof-of-stake is a step towards solving the Scalability Trilemma, creating a blockchain that is secure, scalable, and decentralized.

Ethereum has always been decentralized and secure. In fact, post Merge, Ethereum is about 30 times more decentralized that Bitcoin. But the one place where Ethereum has always struggled is scalability. During the bull run, the network was slow and expensive, sometimes costing 100 USD equivalent for a simple transaction.

This usability failure is why so much of the focus this past year has been on Layer 2s and side chains. But with Ethereum now primed to execute on its roadmap, scaling is back in the limelight, but this time, we’re scaling at the protocol level.

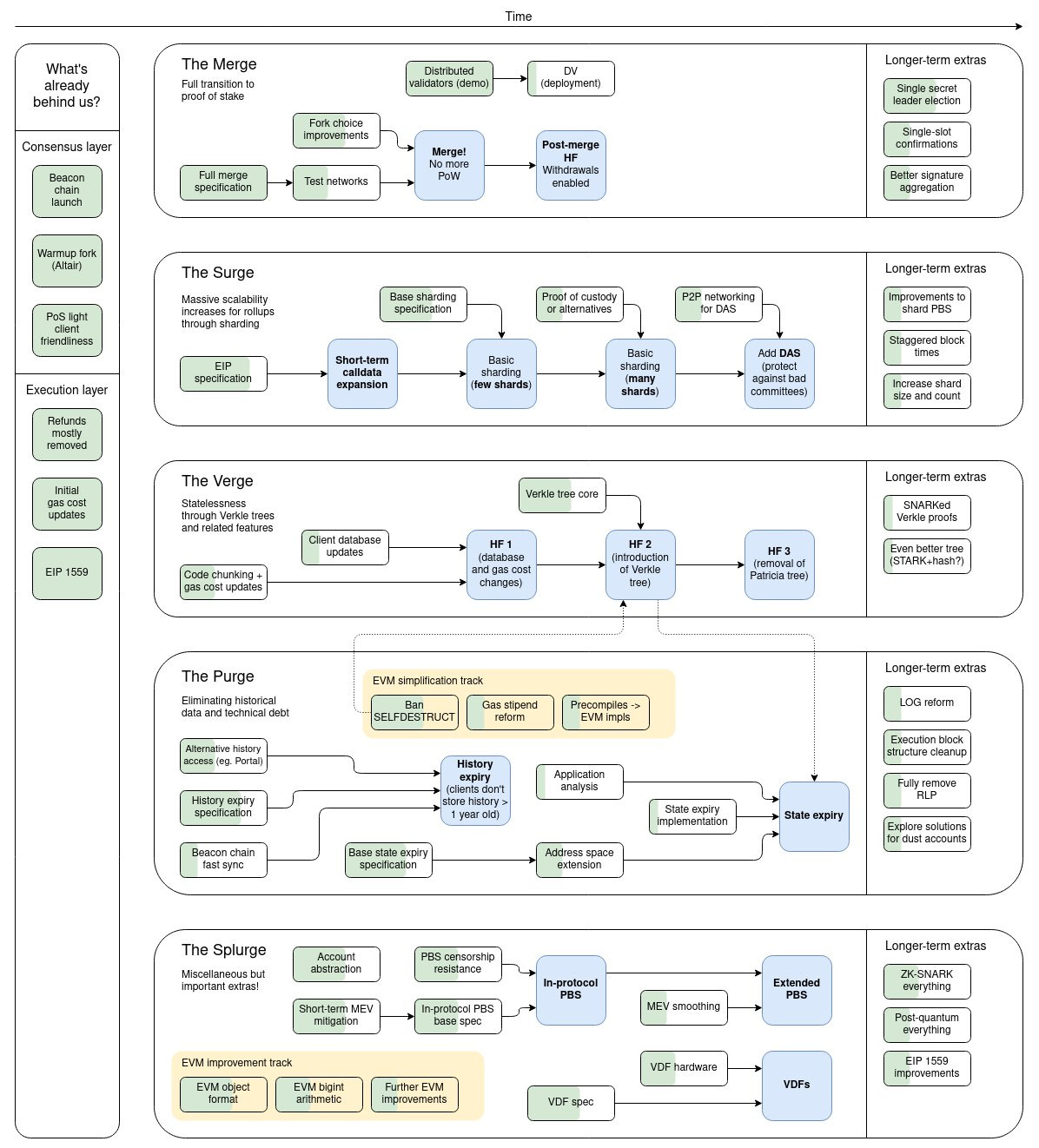

The Ethereum Roadmap is full of funny names: the Surge, the Verge, the Purge, and the Splurge. The ‘U-rges’, as we lovingly call them, are the next evolutionary phases of Ethereum. The Surge focuses on secure scaling; the Verge on making it easier to run nodes; the Purge on cleaning out historical data; and the Splurge, as the name implies, is a final package of important upgrades.

In this issue of the DeFi Download, we go in-depth on the U-rges and proto-danksharding. We’ll also discuss ‘wen ETH withdrawal’, the importance self custody, the mechanics of social slashing, and conclude with a roundup of tweets, DeFi news, and ETH staking tactics.

This is our final issue on the Merge, and we’ll be moving on to Maximum Extractable Value next. If you think the Merge and Ethereum’s roadmap is complex, just wait until we get to MEV. See you soon friends!!

Contributors: BanklessDAO Writers Guild (Austin Foss, Chameleon, Hiro Kennelly, siddhearta, Teeleroo, theconfusedcoin, Jake and Stake)

This is the official newsletter of BanklessDAO. To unsubscribe, edit your settings.

🙏 Thanks to our Sponsor

The DeFi Download Guide to the Merge (Part III)

In this edition, we take a look into the future. What’s coming next, now that we have the Merge complete? We begin with some of the immediate future: validator token withdrawals, and touch on the Shanghai upgrade. Afterwards, we reemphasize the importance of self-custody and peer into the roadmap. The next set of upgrades will happen in parallel: The Surge, The Verge, The Purge, and the Splurge. Finally, we end with some possible futures, including Ethereum’s defense against an attack from OFAC and Proto-Danksharding. Part III of the DeFi Download Guide to the Merge peers into what the future of Ethereum will hold.

Token Withdrawals

Author: Jake and Stake

With The Merge complete, soon validators will have the ability to withdraw tokens from the network. Withdrawals have the potential to impact the Ethereum ecosystem in terms of price action and security.

Why? Let’s get into it.

EIP-4895

Token withdrawals are planned for inclusion in Ethereum’s next big upgrade: Shanghai. Eventually, stakers will want the ability to withdraw their ETH for a variety of reasons. Some will want to take profits and others want to create more validators. An Ethereum Improvement Proposal (EIP) was created to help do just that.

EIP-4895: Beacon Chain Push Withdrawals as Operations has been updated to support validator withdrawals from the Beacon State (consensus layer). This introduces a new system-level operation to the Ethereum Virtual Machine (EVM), increasing the balances of validators that withdraw ETH from the Beacon chain.

A previous proposal (EIP-4788) was designed for the same purpose, but EIP-4895 would allow gasless withdrawals for validators. The beacon chain will send information to the EVM in order to increase the balances of the respective recipients. This means validators can initiate withdrawals from the beacon chain and include them directly into blocks, distinct from regular transactions.

These operations will not need general EVM computation, so there’s not much computational overhead or data needed to make updates. Still, there’s no precedent for consensus-layer to execution-layer transfers, so it’s critical that this works securely.

Withdrawals will be rate limited to ensure security is stable, and this also has an effect on price volatility. If users were able to withdraw all at once, the increased sell pressure could be large. This will function like the queue for stakers to enter the validator and earn rewards. As a result of the limited withdrawals, the price impact will be muted.

There are two types of withdrawals that will be available for validators:

Partial withdraws

Full withdrawals

Partial Withdrawals

Validators have an effective balance of 32 ETH, so having extra ETH does not increase rewards or penalties based. The extra ETH is unproductive, so with partial withdrawals, validators can collect their rewards and 1) sell it or 2) spin up a new validator.

I expect, large staking providers are interested in withdrawals for 2 reasons:

Restaking their rewards to get a larger share of the network

If OFAC encourages them to censor transactions, they can exit their stake without harming their customers.

These providers (Coinbase, Kraken, Binance) might lean toward the first option and will not put these tokens on the market. They have no need for the liquidity that unlocks provide, but will instead want to spin up more validators. However, these exchanges together make up 50%-60% of the validator set, so given the absolute number, this still poses a small risk for ETH price.

As mentioned before, there will be rate limiting for withdrawals with the Consensus Specifications allowing a maximum of 256 partial withdrawals from the validator set per epoch.

Data Always estimates that:

“[T]he number of validators at withdrawal unlocks [will] likely being in the range of 700,000 to 900,000 (modeled later in the full withdrawals section) and [with] each day comprising 225 epochs, all active validators should have the opportunity to withdraw their excess balance at least every 12 to 16 days.”

This might put a strain on the market, but it’ll be short-term. Again, from Data Always:

This suggests that the Ethereum market could face average sell pressure of:

(34-32) × (225) × (256) = 115,200 ETH / day for up to 16 days.

Some of this will be sold and some of it will be rotated into new validators. If:

65% of validators are held by liquid staking solutions, and they intend to sell 10% on the open market

And solo stakers holding the other 35% sell 50% of their stake

We get the following equation:

(34-32) × (225) × (256) × [(0.65 × 0.10) + (0.35 × 0.50)] = 28,000 ETH / day

This could lead to a sell pressure of 28,000 ETH/day. This has a few assumptions built in, but the estimate is probably directionally correct. While certainly not insignificant, to put this into perspective, Messari estimates that there has been an average of $2.40B in “real ETH trading volume” per day over the last 3 months. At an average price of $1,320.61, that’s ~1,800,000 ETH traded every day.

The market should be able to handle this kind of sell-pressure, excluding some kind of market event. Putting this 28,000 number into perspective, the previous rewards under proof-of-work led to approximately 14,000 ETH / day, or about 100,000 ETH / week going into the ecosystem.

Full Withdrawals

Full withdrawals entail a complete exit from the validator set. This means the entire 32 ETH and rewards are pulled. While the number of validators that can leave are also rate limited, easing sell pressure.

This pressure can be largely offset by comparing the number of validators that want to enter the pool and the set of validators that want to exit the queue. The net effect of full withdrawals can be calculated by finding the difference between the two:

(# of Validators in entrance queue - # of Validators in exit queue) = Buy/Sell pressure

The length of the entrance queue can also play a factor. If the queue is long, existing validators will have to consider the opportunity cost of exiting the validator set, namely earning rewards and having to wait to re-enter.

There’s a lot more to unpack here, so I highly recommend reading Data Always’ article to get a full picture of the impact withdrawals will have on price.

Conclusion

The effect of validator withdrawals on ETH price has many different factors to take into consideration:

Number of exits

Rate limiting for exits (churn limit)

Length of the activation queue (# of stakers wanting to validate)

Full withdrawals vs partial withdrawals

The reaching implications of withdrawals have to do with the number of validators securing the network. In general, if there are fewer validators, it’s easier to manipulate the chain, so token withdrawals will impact Ethereum’s security posture. But like sell pressure, I see this as a very non-impactful implication.

In general, I see this as a “buy the rumor, sell the news event” with the result being slight downward price pressure (not financial advice). Still, many in the Ethereum community are looking forward to the unlock.

The Importance of Self-Custody

Author: theconfusedcoin

In modern finance, it’s commonplace for a third parties (banks, exchanges, etc.) to have custody over our assets. Custody is defined as an entity or person who has the legal right to manage and look after another person or entity's money, investments, or finances. This may seem ordinary on the surface, but it comes with significant risk. We have heard numerous stories about people unable to withdraw their own money from banks because the bank had no liquidity or was in financial distress. In TradFi, the only option for self-custody, and ownership of your own assets, is in the form cash or illiquid real estate. However, with the money printer going berserk over the decades, cash is not the safe-have asset it used to be.

Crypto changes this. It re-introduces the concept of self-custody. Self-custody means having total control over your own assets without having to involve a third party. The applications that enable self-custody are called non-custodial wallets. Some examples include MetaMask, Phantom, Trust Wallet and Ledger. In a world where bank runs, exchange bankruptcies, and malicious hacks happen often, it is paramount to ensure that your assets are safe and in your possession. Apart from giving you peace of mind, self-custody has a number of benefits.

1. Ownership

In order to make crypto more accessible to the general public, a number of centralized exchanges and applications were born modeled on the principles of TradFi. Exchanges like Coinbase, Kucoin, and Kraken retain custody of your assets even though they show up in your account after you purchase them. Like Voyager, if any of these exchanges go belly up, you might end up losing everything. However, if the same tokens were transferred to a non-custodial wallet like MetaMask, you would sleep soundly knowing that you own all your assets.

2. Control of your assets

You are entirely responsible for your assets, and no third party can place restrictions or limits on your transactions. No permissions are required and you are free to buy or sell any number of digital assets. In order to withdraw your own tokens from exchanges, most of them require you to complete a KYC form. With self-custody, no such documents are needed and you are free to use your assets as you please.

3. Unlimited transactions

There are no limits on the amount and number of transactions you can make in a non-custodial wallet. Often centralized exchanges put limits on the amount you can withdraw and on who you can transfer your tokens to. These restrictions are not applicable when your digital assets are stored in a non-custodial wallet.

4. Security

When a third party is handling your assets, there’s always a risk of mishandling. This could be in the form of hacks or them misusing the assets they have been entrusted with. We have seen enough examples of this happening in the last few months (Celsius, Voyager, Banks in Lebanon etc.)

With self-custody, security is in the hands of the owner. The owner of the private key is the only one that has access to the wallet and its funds. However, non-custodial wallets have also been subject to hacks but this is largely due to the user interacting with decentralized applications that are unsafe and easily exploited.

In order to prevent this from happening, depending on your use case, there are majorly two types of non-custodial wallets:

Hot wallets

These wallets are typically the browser extensions or mobile applications that users are familiar with. They allow you to store your digital assets and interact with all the various decentralized applications with ease. Hot wallets are simple to use as they are always connected to the web and transactions can be made easily without having to physically connect any device to your phone or laptop.

However, because they are always connected to the web and interact with many applications, they are susceptible to hacks. Storing large amounts of crypto in a hot wallet is risky.

Cold wallets

Cold wallets are the most secure form of storing digital assets. Most cold wallets are attached to hardware, usually a medium to small USB stick that serve as a form of two-factor authentication. Only the person who physically has possession of the wallet and knows the pin can access the funds. Since they are not connected to the web, they are much harder to hack. This makes them one of the safest modes of self-custody. Some examples are Ledger, Trezor and KeepKey.

5. Accessing Decentralized Applications

The concept of self-custody introduces us to non-custodial wallets that are essential to access decentralized applications. Through these applications we can stake tokens for extra yield, exchange tokens on DEXs, trade NFTs and play Web 3 games. Although this is an indirect benefit of self-custody, it is an important one!

Moving your assets from centralized exchanges to a non-custodial wallet might seem daunting and scary at first. However the benefits of doing this far outweigh the initial discomfort. You can’t stay on the cutting edge if you’re not on the frontier!

Crypto is built on the idea of financial freedom and self-custody is an important step towards achieving that. We have been at the mercy of custodians for too long and it’s time we take control of what’s rightfully ours.

Ethereum’s “U-rges”

The Surge

Author: Jake and Stake

[…] the Ethereum ecosystem is likely to be all-in on rollups (plus some plasma and channels) as a scaling strategy for the near and mid-term future. - Vitalik (A rollup-centric ethereum roadmap)

Rollups

Rollups: Computation and storage goes off chain, but data stays on chain. Full EVM compatibility. Already, optimistic rollups like Arbitrum and Optimism reduce fees by ~3-8x and ZK rollups will have even greater data compression, reducing fees by ~40-100x.

Scalability will increase through rollups and sharding. Rollups will be much cheaper and faster with just L1 alone. This is part of the Rollup-Centric Roadmap.

Eventually, L1 Ethereum will be a data layer where data can be added at 2MB/second. This guarantees that the data is publicly available, but does not interpret the data. If you use rollups as the execution layer, the base layer can focus on data availability and consensus (security).

The Surge

Ethereum will no longer handle state and will instead delegate that responsibility to rollups. This will prove to be much safer for Ethereum than sharding execution (as in the original design for “eth2”). Asynchronous data availability sampling using ZK proofs is much safer than sharded EVM computation.

The goal is to order block times of different shards, so there’s always a block proposed within a few hundred milliseconds of the previous block. Ethereum will still focus on updating data sequentially, but rollups have the ability to operate across multiple shards, reducing latency.

Short-term CALLDATA expansion: Add more data space when calling functions to make rollups cheaper. The cost of rollup transactions is a function of the data they post to Ethereum mainnet. (X transactions)/(Y gas fees) = (Z cost of rollup transaction).

EIP-4488 (https://github.com/ethereum/EIPs/pull/4488) reduces the cost of CALLDATA from 16 to 3 gas per byte and adds a cap to the CALLDATA in each block.

EIP-4490 (https://github.com/ethereum/EIPs/pull/4490) reduces the cost of CALLDATA from 16 to 6 gas per byte.

This data would be stored in the transaction receipt which includes: a hash of the transaction, block number, amount of gas used, and address of contract, etc. This information is stored on-chain, so this update can increase the memory needed for Ethereum’s history in the long run. From the EIP:

The burst data capacity of the chain does not increase as a result of this proposal (in fact, it slightly decreases). However, the average data capacity will increase. This means that the storage requirements of history-storing will go up. A worst-case scenario would be a theoretical long-run maximum of ~1,262,861 bytes per 12 sec slot, or ~3.0 TB per year. We recommend EIP-4444 or some similar history expiry proposal be implemented either at the same time or soon after this EIP to mitigate this risk.

Basic Sharding I (few shards): Start adding sharding to increase data availability. Nodes will have to download all transaction data of all shards. This is the period where rollups begin to rearchitect themselves around this new paradigm.

Basic Sharding II (many shards): The “training wheels” come off and we substantially increase the number of shards. Not all nodes are required to download everything, and instead rely on committees, data availability sampling, etc.

Add Data Availability Sampling: Clients can verify all of the data is published by randomly checking random pieces without having to download everything. This increases the security of these scalability upgrades.

All users have to do is move their activity from L1 to L2 and watch as transactions become cheaper. None of these updates improve latency. The time for transactions to be confirmed will continue to be ~12 seconds or maybe even 16 seconds.

However, bandwidth (TPS) will improve substantially:

Ethereum Mainnet today: 15-40 TPS (

https://ethtps.info/

)

Rollups: 1,500-4,000 TPS

Rollups + Sharding: 100,000 TPS

This increase in transaction bandwidth means the chain will be able to handle more user interactions, reducing the competition for blockspace and lowering fees.

TL;DR: Ethereum will be cheaper because there will be higher transaction bandwidth.

The Verge

Author: Siddhearta

Designing for Decentralization

The goal of the Ethereum Roadmap is to increase the scalability of the Ethereum network without sacrificing decentralization. While some parts of the roadmap like the Surge focus on scalability without sacrificing security, the Verge focuses on allowing more people and more nodes to participate in validating the blockchain.

The Verge implements two technical upgrades:

Optimizing data storage by introducing Verkle trees

Extending decentralization through stateless clients

As Ethereum scales, it is particularly important to democratize access to the broadest number of network validators. The introduction of Verkle trees reduces the amount of data validators need to verify blocks, and stateless clients make it easier for validators to participate in the network.

Designing for decentralization is designing for a secure, scalable network.

Introducing Verkle Trees

The Ethereum state is a database of all accounts, smart contracts, balances, code, everything that is stored by the Ethereum blockchain. This massive database is currently just under 1TB in size and is accessed by all the contracts, users, and applications built on top of Ethereum.

The Ethereum state currently uses Merkle-Patricia trees to effectively and securely encrypt the blockchain data. Merkle trees use large proofs (from 10MB up to 400MB) to efficiently verify the integrity of data while reducing the validator’s memory requirements.

A [Merkle tree or] hash tree allows efficient and secure verification of the contents of a large data structure. A hash tree is a generalization of a hash list and a hash chain.

Hash trees can be used to verify any kind of data stored, handled and transferred in and between computers. They can help ensure that data blocks received from other peers in a peer-to-peer network are received undamaged and unaltered, and even to check that the other peers do not lie and send fake blocks. –Wikipedia

The Verge introduces Verkle trees as an alternative to store the Ethereum state. Verkle trees use a similar tree-like structure to the Merkle-Patricia tree, but they make use of shorter proofs which are faster and easier to verify.

“The key property that Verkle trees provide, however, is that they are much more efficient in proof size. If a tree contains a billion pieces of data, making a proof in a traditional binary Merkle tree would require about 1 kilobyte, but in a Verkle tree the proof would be less than 150 bytes - a reduction sufficient to make stateless clients finally viable in practice.” –Vitalik Buterin

The result of introducing Verkle trees is that validators can be much lighter, making way for stateless clients.

Extending Decentralization with Stateless Clients

In order to participate in the Ethereum network as a validator today, you need to verify the entire Ethereum state by either downloading the entire state or downloading and verifying block(n-1). In order to keep verifying, you need to have a local database which requires a large hard drive and the capacity to keep growing.

With the introduction of Verkle proofs, instead of needing the entire database to verify the next block, you only need the pieces of the state that are read and written to in a particular block, along with a proof that proves that data is correct. Using Verkle proofs, you can verify a block without needing any other information regarding the Ethereum state.

Due to the size of the Verkle proofs (less than 150 bytes) it is easier to run a node on the Ethereum blockchain, and instead of validators needing to be Ethereum state clients, we can have stateless clients who are able to step in at any time to verify a block.

The introduction of Verkle trees and stateless clients is a significant upgrade for the decentralization of Ethereum. After the Verge, anybody will be able to spin up a fresh node and start verifying blocks without having to download and verify the entire Ethereum state.

Validators can be lightweight and distributed. It will be easier to set up a node, faster to verify, and less expensive since it won’t require heavy databases to store the state.

The Verge makes it possible for everyone to participate in the network. By upgrading for decentralization, the Ethereum network can continue to grow and scale.

The Purge

Author: Jake and Stake

The purge is all about eliminating unused parts of the Ethereum protocol.

History Expiry

Nodes have to download all historical blocks (hundreds of GBs), and post-sharding the data will be even more (terabytes). If we can remove the amount of data that the chain must save, we can improve sync speed and hardware requirements to run a node.

The Purge means not requiring all nodes to store all historical blocks, just store blocks that are at most 1 year old. EIP-4444 is the most popular solution right now. Historical blocks and receipts need a ton of memory to store (current estimates are over 500 GBs). As time passes, the blockchain will continue to grow and post-sharding data will be even more—measured in TBs.

But even at these levels, users must have 1TB space to validate the chain. To perform a “Full Sync”, users have to acquire and compute all Ethereum transactions in order to validate the current state. However, this historical data is not needed to validate new blocks once the client is synced to the head of the chain.

EIP-4444 will prune this history, to allow clients to sync without high hardware requirements and using less bandwidth from the network. Clients should not serve headers, block bodies, or receipts older than 1 year and have the freedom to prune older data locally.

Clients will use a “Weak Subjectivity Checkpoint” to get recent views of the chain. Treating these checkpoints as canonical. These “weak subjectivity checkpoints” are blocks that can be assumed to be true, same as the genesis block. In fact these blocks are more trusted than finalized/justified blocks because “finalized blocks” can conflict depending on the consensus failure. If you’re curious about weak subjectivity and proof-of-stake check out this blog post by Vitalik.

These solutions are still being explored, so we’ll know more about the roadmap as different methods are investigated.

Full History

Many applications will not need this entire history, but some applications will want to hold this data. For example, in order to sync the state of the rollup, you have to go through the entire history of the rollup one block at a time.

Luckily, history is easy to verify using Merkle proofs, requiring only a 1/N trust model. As long as a single honest actor can prove the history of a blockchain, the history will be secure. Archive nodes are expected to hold the entire blockchain history.

However, some entities have to store the entire history. Some centralized actors like etherscan, etherchain, and beaconscan will require all this data so they can serve this information when users query for it. There are also decentralized solutions like The Graph and the Ethereum Foundation’s Portal Network project working on a decentralized solution, where each node stores a small percentage of the entire history with the aggregation of nodes creating the entire history.

The Ethereum protocol will not require all nodes to store all of the history, but there will be centralized and decentralized solutions for users that want the history. Ethereum clients that are interested in getting the full history must find new places to retrieve that information. This does pose something of a centralization risk, but the risk is mitigated—in part—by the 1/N security model and its ease of maintenance.

State Expiry

Here it’s important to denote state from history. History contains the entire history of transactions, but state shows what the world looks like at each block. You can construct the state from the history, but once you’re at the head of the chain, you only need the current state to calculate the result of transactions.

Still, some parts of Ethereum’s state have remained untouched for years. These are projects the people forgot about, lost the keys to, or kept as long-term asset holdings. In any case, these objects are not required for low latency and uptime. They will be touched rarely, so we don’t need every single node to hold this data.

With state expiry, objects (in the state) that have not been touched in the last year will go into a separate data store: The Expire Tree. If someone wants to bring it back to the other nodes, users can “revive” the data to make all consensus nodes hold it, otherwise it will be kept here.

In this new architecture, instead of having a single state tree, the protocol will store a state tree for “one period”, likely a year. In this design, clients must store the two most recent trees, but all previous trees are optional and transactions that use old state (not modified in the two most recent periods) are required to provide a witness—proof—to verify the state.

There will be a state tree per state period (think: 1 state period ~= 1 year), and when a new state period begins, an empty state tree is initialized for that period and any state updates go into that tree.

Below is an example of what a state tree might look like:

EVM Software

There are some features that can be removed from the node software. These features can make it difficult to make a new implementation of the protocol or otherwise cause unintended consequences when adding new features. In both cases, if the feature is not needed, it introduces long-term complexity costs.

This part of The Purge is about simplifying the protocol and removing complexity from the code to make creating a node, running a node, or otherwise debugging easier.

A few features that might be deprecated in the future:

The 2300 gas stipend: Contracts calling the functions of other contracts get 2300 gas to perform a limited amount of actions in order to issue a log when the contract receives funds. This feature is independent of gas repricing events, so there are no assurances about the computations it can support.

Gas visibility: The GAS and CALL opcodes were introduced to allow users to make untrusted calls to contracts. GAS tells you how much gas you have left in your transaction and CALL allows you to specify how much gas you want to use for a “child” function call. In most cases, untrusted calls can be replaced with trusted ones, so this is not needed. It also makes it difficult to do gas repricing if rates change.

The SELFDESTRUCT opcode: This was originally intended to allow users to prune the state of the blockchain by voluntarily removing data from the state. With the implementation of state expiry, SELFDESTRUCT is no longer needed. In addition, the opcode is something of a security threat because it alters an unbounded number of state objects within a single block, removing an entire storage tree. It’s also the only opcode which can cause contract code to change.

There are a variety of design choices that may be removed/changed as a result of the purge, including EVM pre-compiles, simplifying logs, removing RLP, and solutions that make it cheaper/easier for dust accounts to send transfer tokens. In general, these pieces should make it easier to use Ethereum and more predictable when building on it.

The Splurge

Author: Jake and Stake

The Splurge is something of a catch-all for a lot of miscellaneous upgrades that are important but don’t fit into any single category.

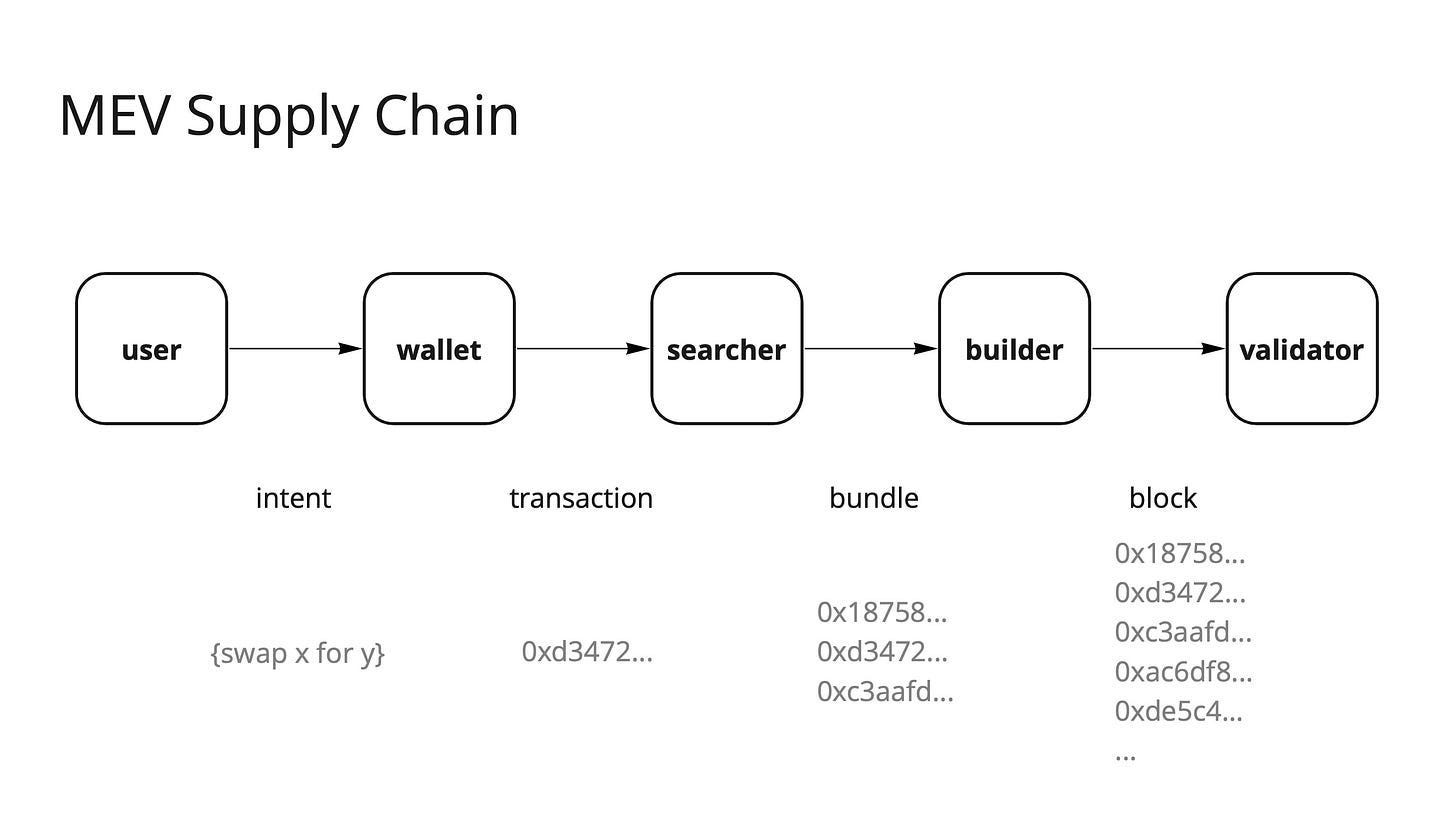

Proposer Builder Separation

Now that The Merge is complete, the validators will be submitting transactions and get the special privileges associated with that. Namely, collecting MEV. Proposer Builder separation aims to separate the entities that propose blocks to be added to the blockchain (proposers) and the the people that put transactions into these blocks (builders).

Before MEV-Boost and MEV-Geth, block producers (miners and validators) would create blocks themselves, optimizing for fees and, if they wanted, capturing MEV through arbitrage. The better value-extractors would earn more than others, meaning the best MEV extractors become the most profitable block producers and can allow them to leverage that advantage to get a larger market share. This has a centralizing effect on validators. Eventually, the validators worse at MEV extraction will be outcompeted by the better ones.

Proposer builder separation (PBS): The entity that creates a block and the person that proposes the block do not have to be the same person. Ethereum will be modularizing the role of the block producer into

The Block Proposer - Ethereum Validator

The Block Builder - Network of transaction orderers that create a maximum value block from the transactions submitted by searchers. This entity then buys block space from the Block Proposer in order to have their block included.

The builder optimizes for the maximum amount of fees, where validators simply charge the builder for block space. If the block builder extracts the MEV themselves, MEV searchers will exit the auction and combine resources with validators to outcompete other searchers and validators.

In order to increase the decentralization of the network, Ethereum is going to separate out the task of building blocks and extracting MEV. The goal of a secure and censorship-resistant chain is to allow as many people as possible to validate transactions. This has two important side effects:

Block builders compete on price to get access to block space, avoiding the market dynamics of colocation seen in the traditional finance space (see Flashboys and HFT).

Validators, the fundamental building block of consensus remains highly decentralized among anyone with sufficient stake and internet connection.

The goal of PBS is to increase competition at different layers of the “MEV supply chain” and encourage individual stakers to benefit from MEV. This shifts centralization to the ”Builder” layer, but it’s better to have centralization at that level than at the validator level. Chains without an MEV solution face problems like deep reorgs, spam, and concentrated block production.

Enshrined PBS

With MEV-Boost, “Relayers” receive blocks from block builders and submit them to validators for inclusion. But once Ethereum introduces PBS at the protocol level (enshrines PBS), the need for relayers goes away.

Although with most centralization risks comes censorship risks, relayers don’t have an incentive to censor transactions because they leave money on the table if they censor transactions.

On the other hand, relayers can be coerced into transaction censorship by governments. Ideally, there is enough diversity of relayers such that relayers not in that nation state can pick up those transactions. In turn, these relayers would be more profitable than the censoring ones.

In any case, PBS can introduce crLists as a safeguard. In this scheme, Block proposers create a list of transactions called the crList that have the correct information (nonce, balance, and fees). Block producers that can to include one or more of these transactions but don't will be punished for their censoring. This could mean leaking, slashing, or removal from the validator set.

Account Abstraction

Right now, there are two types of accounts on the Ethereum network: Contract accounts and Externally Owned Accounts (EOAs). The first is the address of a smart contract and the second is a typical wallet. The goal of account abstraction is to reduce these two kinds of accounts to one and treat them the same.

Today, transactions can only be initiated by EOAs and not smart contracts, meaning users have to manage the gas in at least two accounts (their EOA and the contract). The Ethereum protocol assumes everyone has an EOA, but once account abstraction is implemented, smart contract wallets (like multi-sig and social recovery wallets) will become easier for people to use as their primary accounts.

Account abstraction will make smart contracts more like first class citizens, making multisig wallets, social recovery wallets, and upgradability easier.

ERC-4337 is an approach to account abstraction that creates a second transaction layer with user-operation objects that talk directly to smart contracts. This introduces a “UserOperation mempool” that sits between users and the block bundlers and requires zero modifications to the consensus-layer.

From the EIP:

“Users send UserOperation objects to a dedicated user operation mempool. A specialized class of actors called bundlers (either miners running special-purpose code, or users that can relay transactions to miners eg. through a bundle marketplace such as Flashbots) listen in on the user operation mempool, and create bundle transactions. A bundle transaction packages up multiple UserOperation objects into a single handleOps call to a pre-published global entry point contract.”

The wrapper transaction can create a new wallet (EOA) for each UserOperation, verify the operation’s signature and if the operation is valid, pay the transaction fee. After this is complete, the handleOps call performs the operation based on the user’s input (calldata) and refunds any unused gas fees to the wallet.

Users may also be able to pay for transaction fees with ERC20 tokens, allowing developers to pay for their users’ fees. A “paymaster” can hold enough ETH to pay for the user’s transactions and can accept a different ERC20 token from the user in exchange.

Proto-Danksharding for Normal People

The longer I spend writing about and otherwise inhabiting the cryptoverse, the more interested I am in the architecture behind blockchains, and the infrastructure we use to access these distributed ledgers. I’m not really technical in the developer sense, but I’ve always been interested in the Ethereum Improvement Proposals process, which governs how upgrades make their way from idea to adoption on the Ethereum network. For example, EIP-3675 precipitated the Merge, and before that, EIP-1559 kickstarted the ETH burning mechanism.

The most recent EIP to catch my eye is EIP-4844, adorably titled Shared Blob Transactions. If that isn’t a great title, its nickname is even better - proto-danksharding. Before we get into danksharding, it’s important to highlight an underreported benefit of the Merge. While all the attention was on the 99.95% energy reduction, the transition to the proof-of-stake consensus mechanism also set the stage for the remaining half of the Ethereum Roadmap. The Ethereum Roadmap is long and complex, but in terms of EIP-4844, all we have to know is that the Ethereum network is now scalable.

How Does the Ethereum Network Scale?

As Ethereum users know, the network needs to scale, and the proliferation of rollup and side chain scaling solutions are testament to that fact. But with proof-of-stake, Ethereum doesn’t need to only rely on Optimism, Arbitrum, and Polygon to scale; now the stage is set for scaling at the network level. And this Ethereum network scaling solution is called danksharding. No, danksharding is not a cheeky reference to really great sharding, but it is a reference to Dankrad Feist, the Ethereum researcher who initially proposed this scaling architecture.

As you probably know, a ‘shard’ is a sharply edged piece of ceramic, metal, glass, or rock. In terms of blockchain architecture, sharding is the idea that the network data can be split up into pieces, shards. Each shard would contain its own set of independent blockchain data, including token balances and smart contracts.

In practice, sharding helps to solve two problems: centralization and scaling. Right now, the Ethereum blockchain contains about 1TB of data, which makes it expensive to buy the storage capacity required to run a node. The more expensive it is to run a node, the less likely it is to be decentralized (and FYI, you can run a node without validating the network). Relatedly, the Ethereum blockchain requires that each transaction be processed by every node, which makes network-based scaling nearly impossible - as scaling is achieved when each node does less work. Sharding addresses both of these concerns by breaking up the blockchain data into independent parts, enabling (1) lower storage requirements and (2) nodes to process independent sets of blockchain data.

What Is Danksharding?

Danksharding is one type of sharding architecture. While previous sharding frameworks sought to create more space for transactions, danksharding is a rollup-centric solution that creates more space for data-hungry rollups by using ‘blobs’ to store data. These data blobs are large, but are relatively cheap to transact with because the blob data is stored on the consensus layer rather than the computation-heavy execution layer. With data blobs, the execution layer needs to know what the commitments of the blob data are, not the details of that data.

While Danksharding is super complex, for the purposes of this article, you just need to keep in mind the main innovation behind it, which is the merged fee market. The merged fee market, despite its name, actually breaks out the job of building blocks and proposes that they be included on chain.

The big change is that only the block builder needs to process all the data, while network validators verify the blocks through data availability sampling, allowing nodes to verify large amounts of data by ‘sampling’ some of it. Because nodes only need to sample some of the data to know it’s valid, the Ethereum network will be able to process way more data than it could before, providing a faster, cheaper network that is primed for both network-based scaling and rollup optimization.

All that sounds both confusing and amazing, and it is, but getting the Ethereum network to the point where it’s ready for sharding is going to take years. And this is where EIP-4844 comes in, as this proposal introduces proto-danksharding.

What Is Proto-Danksharding

Proto-danksharding is the next step on the path to danksharding. EIP-4844 introduces a new transaction format that essentially adds space for the data ‘blob’ to accompany ordinary transactions. Full danksharing will add 16 MB of space to each block for rollup data; Proto-danksharding, however, will only add about 1MB of space. But even this small measure will make a big impact, as transacting on rollup-based scaling solutions will immediately be less expensive. Right now, blocks can carry between 50-100 kb of data, so the 1 MB of data availability targeted for rollups will reduce rollup transaction costs, as gas fees will not need to be paid to access this data.

In addition to introducing a new transaction format, EIP-4844 will also include the verification rules, logic, and gas fee adjustments to prepare for full-on danksharding. Notably, this proposal also includes a provision that historical network blob data will be deleted after 30 days, long enough for people and protocols who need the historical data to retrieve and store it.

It’s also important to note that while the proto-danksharding upgrade will introduce major changes to the Ethereum network, each node will still need to process all data. Nonetheless, proto-danksharding is a huge upgrade that will make transacting on rollups cheaper, while also preparing the Ethereum network for the rest of its roadmap.

Bring On the Dank

Blockchain architecture is complex—and the Ethereum Roadmap even more so. If you take anything away from this article, just know proto-danksharding will make transacting on rollup scaling solutions cheaper in the short term, while providing the infrastructure needed to ensure that Ethereum is scalable, secure, and decentralized. While danksharding may still be a ways off, even just a 1/16 of the eventual blob size is enough to really expand our minds to see the possibilities of what interacting with a fully scaled Ethereum may look like.

Ethereum’s PoS Social Slashing by UASF

Social slashing came into the spotlight a little less than a month before the merge when the US Treasury Department’s OFAC branch placed sanctions on several dozen smart contract addresses associated with the Tornado Cash project in mid-August. Implications of what these sanctions could mean and the uncertainty around the legal specifics quickly highlighted a potential weakness in the PoS model.

Ethereum dapps like Aave, Uniswap, and Balancer quickly began implementing an API from TRM Labs that banned many addresses for the dapp’s front-end. Very inconvenient, but on its own, censorship at the application layer doesn’t stop a user from interacting directly with a contract’s code via other means like command line tools. Unfortunately OFAC’s sanctions prompted the largest Ethereum mining pool, Ethermine, to start censoring Tornado Cash transactions at the protocol layer by not including such transactions in any of their blocks.

In May, 2021, the Bitcoin mining pool Marathon attempted to act as an OFAC-compliant miner by using DMG Blockchain Solutions’ software, analogous to the aforementioned TRM API. After just one month that decision was reverted due to community push back. Although economics could also have influenced their decision since it had been noted that compared to other mining peers Marathon’s blocks had fewer transactions resulting in lost revenue.

Nation state level censorship, while a known risk for a long time, could no longer be considered existential.

Social Slashing

With Ethereum imminently making the move to PoS and the majority of validators being managed by a handful of staking pools, like Lido, and centralized services, like Coinbase, the threat this kind of censorship posed to Ethereum’s neutrality was brought to the forefront of public discussion. Enter social slashing as the proposed solution.

Slashing already exists as a key component in the PoS model by holding the validators accountable for proposing and attesting to valid blocks on time. If they fail at their one job they are penalized by having their staked ETH slashed. It’s this form of slashing that is part of the protocol; occurring programmatically. Social slashing is not executed as part of the protocol’s code and instead has to be enforced by social consensus, through the use of a user activated soft fork (UASF).

Social slashing is the process of triggering a UASF to enact the already existing slashing system built into Ethereum’s PoS model.

Bitcoin has had its own UASF in 2017 when trying to implement the SegWit scaling upgrade, BIP 148. Instead of a UASF being used to penalize a miner who’s not signaling support for SegWit by ‘slashing’ their existing balance in some way, this UASF was used as a threat by node operators to not include blocks produced by those miners.

Vitalik talks about this in a blog post from November, 2020, where he compares how PoW and PoS can recover from 51% attacks utilizing UASFs. Between the two a UASF in PoS has the benefit of penalizing only the attacker by slashing their staked ETH, while a UASF in PoW negatively impacts all miner’s running ASIC hardware, malicious or not. Specifically regarding a 51% censorship attack from a coalition of validators he describes how a UASF is mostly automated and already part of the protocol’s rules, the one piece that’s not written in code is coordinating the node operators to select a block to fork from.

UASF Subjectivity

It’s this point of potential subjectivity that some criticism is targeted towards. One author writing for Coin Desk characterizes this as “Ethereum’s reaction to nation-state sanctions would be to impose sanctions of its own.” As we’ve already pointed out, Bitcoin has done this by threatening sanctions for miners who didn’t implement SegWit. SegWit’s successful implementation by the community’s threat of a UASF was so significant that August 1st has been dubbed Bitcoin’s independence day; celebrating “Bitcoin’s first major community stress test.”

At the end of making his own case for social slashing, crypto blogger Eric Wall includes some other questions around the subjectivity of deciding to trigger a UASF.

What is an attack?

What’s acceptable and what’s not?

Where does it say a validator has to ignore OFAC?

What if the community decides to censor transactions?

He points out that censorship resistance “emerged organically” as a valued principle of Bitcoin, and one Ethereum has inherited. It’s not a value written in Bitcoin’s code or its whitepaper anymore than in Ethereum’s; censorship resistance is an intrinsic property of each blockchain that’s expected by much of the community.

Is There Another Way?

A couple months after Bitcoin’s Independence Day in October, 2017, Ethereum’s future PoS system was published, Casper the Friendly Finality Gadget, authored by both Vitalik and Virgil Griffith. In the conclusion it was already predicted how useful a UASF would be against attacks, 51% or others, by giving users of the network a way to combat such malicious actions.They do leave the door open to other possibilities, stating that future improvements could “reduce the need for user-activated soft forks.”

Maybe at some future date technologies like zero-knowledge cryptography could make censorship at the protocol layer impossible or impractical; or maybe that’s just a pipe dream. Perhaps getting to a point where every aspect of the protocol’s security could be programmatically determined is too idealistic.For now we rely on layer-0, the social layer, the users, to have the final say on certain aspects of the blockchain.

Actions steps

📖 Read Sharding | The Ethereum Foundation

⛏️ Dig into Proof of Stake FAQ | Vitalik

🎧 Listen Endgame | Vitalik & BanklessHQ

🎧 Listen What’s Next? Vitalik Buterin | Vitalik & BanklessHQ

🙏 Sponsor: Oasis.app - Borrow Dai & Earn

Project Releases 🎉

Hand-picked articles to understand the current state of the DeFi ecosystem

$crvUSD is Live

The largest source of stablecoin liquidity in DeFi has released a stablecoin

Binance.us launches Ethereum Staking

Starting annual percentage yield (APY) rate of 6%

Minimum deposit of just 0.001 ETH

Notional Leveraged Vaults

Users can increase their yield through leverage

When Notional’s borrow rate is lower than the rate earned through the strategy, users profit.

Users borrow more than their initial deposit, and the borrowed funds are sent to pre-configured yield strategies

Infura to Launch a Decentralized Infrastructure Network

Infura wants to create a community of infrastructure providers

A decentralized infrastructure network that ensures users across the world can seamlessly access the information and services they need without outages and downtime due to no single point of failure.

If you have an interest in decentralizing blockchain API access, a willingness to actively participate and provide feedback, and experience running blockchain infrastructure, join Infura’s initiative

OpenSea Launches on Arbitrum

You can now buy, sell, and mint NFTs via OpenSea on the Arbitrum network

Nasdaq Announces Crypto Custody Service

Also launching crypto-focused division: Nasdaq Digital Assets

Liquid Collective Launches

Several staking service providers (@alluvialfinance, @CoinbaseCloud, @Figment_io, @Kiln_finance, @krakenfx, @staked_us) are joining forces to create a new liquid staking standard.

Produce a uniform liquid staking token across major centralized exchanges.

Chirping Birds 🐤

🔥 and 🧊 tweets from across the DeFi ecosystem

🛠 BANK Utility (BanklessDAO token)

With over 5,000 holders, BANK is one of the most widely held social tokens in crypto. So it bears asking, where are the best places to put our BANK to use? The five protocols below will allow you to deposit BANK in a liquidity pool and earn rewards. To get going, just click on the name, connect to the app, filter by BANK, and start earning passive income.

⚖️ Balancer

Balancer has two 80/20 liquidity pools, meaning that you are required to deposit 80% BANK and 20% ETH in the pool. There is one pool on Ethereum and another on Polygon. Once you’ve provided liquidity, you’ll receive LP tokens. Keep an eye out for opportunities to stake these LP tokens. There is nearly 500,000 USD in the two Balancer liquidity pools.

🍣 SushiSwap

SushiSwap has a 50/50 BANK/ETH pool. As with Balancer, you will receive LP tokens, and while you can’t stake them on SushiSwap’s Onsen Farm yet, you may be able to in the future. Liquidity providers earn a .25% fee on all trades proportional to their pool share. The SushiSwap pool has a little over 100,000 USD in liquidity.

⏛ Rari Fuse Pool- Deprecated Soon

This will be deprecated soon. The Rari Fuse Pool allows you to borrow against your BANK or earn huge APY by providing assets like DAI to the pool. At present, all borrowing is paused for this pool. There is over 450,000 USD deposited in the Pool

🦄 Uniswap

The Uniswap V3 liquidity pool is 50/50 BANK/ETH, and provides a price oracle for the Rari Fuse Pool. By depositing in the Uniswap pool, you can earn fees and help enable borrowing on Rari. This pool currently has over 500,000 USD in liquidity.

🪐 Arrakis

You can also provide liquidity to the Arrakis Uniswap V3 pool. The ratio is about 2/1 BANK/ETH. This pool is new, and only has a bit more than $6,000 in liquidity. In the future, you may be able to stake your BANK/ETH LP tokens within the protocol to earn additional rewards.

The Merge Tactics

Beginner Tactics

How to Stake ETH

Author: William Peaster

Liquid Staking Tokens

Author: Ben Giove

ETH Staking Tactics

Author: Hiro Kennelly

There are a number of ways to gain exposure to the Merge and the opportunities afforded by the shift to a proof-of-stake consensus mechanism, but perhaps the most satisfying is to earn yield by staking ETH. After all, you’re not just earning interest on your digital assets, you are also helping to secure the Ethereum network.

Stakers who run nodes are also known as validators, because they propose and validate new blocks, which enables them to earn yield on their ETH. This yield primarily comes from block rewards and tips/bribes paid to validators to order transactions in a certain way. The current staking yield is about 5%, but many estimate that staking yield may average 10% long term.

And here’s the great thing: you don’t have to be a validator to participate in ETH staking or to earn staking rewards. With the Merge complete, now is a great time to get in the ETH staking game.

There are four main ways to stake ETH:

Centralized exchanges

ETH derivatives / liquid staking tokens

Running a partial node through Rocket Pool

Running a full node

The list above ranks these yield-generating methods from basic to complex, and we’ll run through each option so you’ll have a sense of which tactics you want to employ to start earning yield on your ETH.Important note! If you lock your ETH into a staking contract, you will not be able to directly withdraw it before the Shanghai upgrade, which is expected to occur six months after the Merge.

Tactic #1: Stake ETH on Centralized Exchanges

The simplest way to earn yield on your ETH is to stake it with a centralized exchange. These exchanges stake your ETH for you, passing on some of the yield generated through validation. Most major centralized exchanges offer similar ETH staking programs, but as an example, to stake on Coinbase, you follow these steps:

Hold ETH on Coinbase

Click on ETH

Find the ‘Stake now’ button

Read disclaimers

Choose the amount to stake

Complete transaction.

By way of platform comparison, Coinbase is currently offering 3.25% while Binance is offering 6%.

With staked ETH, you’d normally have to wait until the Shanghai upgrade to withdraw it. But since Coinbase introduced cbETH, its own ETH staking derivative (that we’ll cover below), you can swap your staked ETH for cbETH and then for ETH. cbETH is slightly depegged, so you’ll lose some ETH in the process, but if you’re really motivated to regain control over your ETH, this can be a great way to do it.

While staking through a CEX increases protocol centralization because you’re contributing to large staking pools run by these centralized platforms, it is a good option if you aren’t comfortable holding your own keys, or are just getting started in crypto. Many people are clearly taking advantage of centralized staking, as Coinbase, Kraken, and Binance control a combined 30% of staked ETH.

Tactic #2: Hold ETH Derivatives

As more deeply discussed elsewhere in this newsletter, liquid staking tokens are derivatives of ether that depositors receive for staking ETH, and they are called ‘liquid’ because you can enter and exit positions as easily as swapping tokens.

There are a number of staking pools, but we’ll briefly take a look at three liquid staking tokens: Coinbase’s cbETH, Lido’s stETH, and Rocket Pool’s rETH. As we’ll see below, each staking derivative shares a number of common characteristics, but the most common distinction is whether a liquid staking token is rebasing or non-rebasing, referring to whether the rewards come in the form of price appreciation or additional tokens respectively.

cbETH

Coinbase recently introduced cbETH, its liquid staking token. You can buy cbETH on DEXs or you can wrap your staked ETH on Coinbase. cbETH is a non-rebasing token, so it gets positive tax treatment, but the downside is that Coinbase is highly permissioned and centralized, and the cbETH contract has deny-list functionality similar to USDC. While your cbETH earns around 3.25% yield, Coinbase takes a whopping 25% of all staking rewards earned.

Lido

Lido is the OG staking pool, having launched alongside the Beacon chain at the end of 2020. Currently, about 30% of all staked ETH is locked in the Lido protocol. Those who stake on Lido receive stETH in return. Lido provides a centralized staking solution, similar to Coinbase, so depending on your decentralization priorities, Lido may or may not be a good choice.

Unlike cbETH (and rETH below), it’s rebasing, meaning that the price of the stETH should remain pegged to ETH, and additional rewards are paid in stETH. This can create tax consequences, so be sure to know how rebasing tokens are treated in your jurisdiction. stETH currently earns a yield of about 3.8%, but Lido takes 10% of all staking rewards – the lowest of the protocols we are reviewing.

Rocket Pool

Although much smaller than its rivals above, having around 2% of the staking market, Rocket Pool’s rETH is a great option for a liquid staking token, as it combines the non-rebasing characteristics of cbETH with a more crypto-native solution like Lido. But unlike Lido or Coinbase, staking ETH with Rocket Pool is an act of decentralization, as Rocket Pool stakers contribute their ETH to nodes run by individuals, not a centralized set of validators. As we’ll learn below, Rocket Pool provides the smart contract infrastructure for partial node running, and rETH provides ETH to help these partial nodes become full nodes. Rocket Pool is totally trustless and permissionless, which is fantastic, but it does have a couple of downsides. The major downside is that the protocol is still new, so it’s not as battle-hardened as Lido. And while Rocket Pools pays a yield of about 3.6%, it charges a variable fee on non-node operating rewards depending on supply and demand dynamics of node operators and ETH deposited (it ranges between 5-20%).

Tactic #3: Rocket Pool Node

If you want to get a bit deeper into ETH staking but aren’t ready to run a full solo node, Rocket Pool is the protocol for you. Rocket Pool allows users to set up a node with 16 ETH (plus 1.6 ETH equivalent of Rocket Pool’s native token RPL for insurance), with the remaining 16 ETH required to run a full node coming from ETH stakers (rETH holders).

Running a node with Rocket Pool is in line with the ethos of Ethereum, meaning it is totally permissionless and trustless. Rocket Pool nodes are also controlled by individuals, so running a Rocket Pool node helps to further decentralize Ethereum.

To run a node on Rocket Pool, you’ll need hardware similar to running a regular solo node. Yet because of the incentive structure of Rocket Pool, it’s possible for Rocket Pool node operators to earn greater yield than running a solo validator. This higher yield is possible because node operators get 5-20% of the rewards earned by rETH holders in their pools, in addition to regular staking rewards like native yield, MEV, tips, and commission.

Notably, however, each node comes with what Rocket Pool terms an RPL sidecar. RPL is the native-governance token for Rocket Pool, and the tokenomics put a bit of juice into the node operator model, by both providing insurance for rETH holders (RPL can be liquidated to make them whole if necessary) and giving RPL holders rewards in the form of RPL inflation. While rewards for running a Rocket Pool node are currently just shy of 5%, RPL rewards are paid out at greater than 12%.

So just to break it down, there are three ways to earn by running a Rocket Pool node:

Earn standard Beacon chain rewards on the ETH you are staking.

Earn a commission of 5-20% on the pooled staked ETH used to get your node to 32 ETH.

Earn RPL rewards for providing the required collateral/insurance necessary to run a node.

While running a partial node through Rocket Pool isn’t for everyone, for those who are interested in becoming a validator but don’t have 32 ETH, this protocol is a great option to get into the validator game in a decentralized ‘rewarding’ manner.

Final note, Rocket Pool plans to lower the threshold required to run a partial node. Stay tuned!

Tactic #4: Solo Staking

Our final tactic is the Holy Grail of Ethereum staking, running a solo node. To run a solo node, you’ll need to deposit 32 ETH into a staking contract. A full Ethereum node consists of both the consensus layer and the execution layer clients, and these clients make up the software required to verify, attest to, and propose blocks. When you are solo staking, you are responsible for your hardware and uptime. In return for this investment and diligence, solo stakers are rewarded in newly created ETH.

Solo staking is the ultimate goal for many, as it allows stakers full control over their ETH, their staking setup, and ultimately their security. This is all very important, but perhaps the most important aspect of solo staking is that you are contributing to the decentralization and distribution of Ethereum nodes, helping to make the blockchain more secure and resilient.

There are risks associated with running a node. The main risk is that you may be hit with penalties if your node is offline for long periods of time. Your ETH stake can also get slashed for improper validator setup or from bugs in the client software, but these are unusual events. There is a lot of information available about solo staking from the Ethereum Foundation, so I recommend you check out their staking materials if you are serious about wanting to run a full node. While solo staking isn’t for everyone, it’s the best way to help keep Ethereum secure and decentralized.

A quick note: There are also Staking-as-a-Service providers. If you have 32 ETH but don’t want to deal at all with any of the technical complexities or requirements of running your own node, this may be of interest to you. These services run a validator for you, and charge you a small fee in return. Companies that run Staking as a Service platforms include BloxStaking and Kiln. These providers are new, so proceed with caution.

Wrap It Up Like a Token

Where and how you stake your ETH should be something to which you give more than a passing thought. If you choose to stake on a centralized exchange like Coinbase or a centralized protocol like Lido, you’ll be contributing to the centralization of the Ethereum network, while staking with Rocket Pool, running a partial node, or going full-on solo staking helps to keep the network robust and decentralized. The truth is, Lido, Coinbase, Kraken, and Binance control 60% of the proof-of-stake network, so doing a bit more to ensure decentralization is a very worthwhile mission.

But to some people, not having to worry about custody, tax considerations, or access to liquidity is more important than helping to create a more resilient network. Your staking options are as varied as the possibilities on Ethereum — so try out a tactic and join those of us who are staking their claim to the future of the internet.

Get Plugged In

Event Highlights

DevCon Bogota—Bogota, Columbia—hosted by the Ethereum Foundation that’s geared toward developers, researchers, and movers within the Ethereum ecosystem. Devcon aims to deliver a holistic learning experience through panels and workshops. This conference is for builders of all kinds: developers, designers, researchers, client implementers, test engineers, infrastructure operators, community organizers, social economists, artists, and more. Oct 11-14 📌 Agora Bogotá Convention Center

ETH San Francisco—San Francisco California—Hailed as the West Coast’s premier Ethereum event of 2022, ETH San Francisco unites blockchain and crypto enthusiasts, as well as developers, industry experts, and tech companies. Discover more Ethereum events around the world here and check out the ETHGlobal site to get more updates about this and other upcoming events. November 3-5, 2022, San Francisco, USA.

🧳 Job Opportunities

Get a job in crypto! Do you like solving hard problems, care about building more efficient markets for everybody, and want to work at the frontier of decentralized finance? Rook is looking for full time contributors, with salaries ranging from $169,000-$722,000. There are positions ranging from engineering, recruiting, product marketing, copywriting, and design. Sound interesting? Sign up for our referral program and go full-time DAO.

Sr. Copywriter (❌ technical)

2D Graphic Designer

Quantitative Analyst

🙏Thanks to our Sponsor

Oasis.app

Oasis.app was born as the frontend to access Maker Protocol and create DAI. It allows you to borrow DAI, exchange your tokens internally and multiply the exposure to your collateral (among the 30 available cryptoassets). Oasis.app is now the most trusted entry point to the Maker Protocol. The long term mission is to allow users to simply and easily deploy their capital into DeFi and manage it in one trusted place.

👉 Get started with the Oasis.app

👉 Follow them on Twitter

👉 Join their Discord