The Merge (Part I) | DeFi Download

Your Trusted Source for 101s, Project Announcements, and Tokenomics Tutorials.

Dear Bankless Nation 🏴,

The Merge is here! The Merge is here!

In less than a few weeks, this call will be heard throughout the cryptoverse, but nowhere will it echo and resonate as loudly as in the Ethereum Ecosystem. After all, the Merge is all about the Ethereum network, and its long-awaited transition from its Proof-of-Work consensus mechanism to Proof-of-Stake. Based on current estimates, the Merge is expected to happen on September 13, 2022.

The Merge refers to the joining of the Proof-of-Stake (PoS) Beacon Chain with the Proof-of-Work (PoW) mainnet chain. To understand the Merge, it helps to imagine two blockchains running parallel to each other. In one lane, you have the PoW chain, the same chain Ethereum users have been interacting with since genesis. The Beacon Chain runs alongside this PoW chain, and once the Merge happens, the PoS chain takes over the mainnet consensus and the Ethereum network transitions to PoS. That’s a huge oversimplification, of course, but if all goes smoothly no one should really even notice a difference.

Will it go smoothly? Although there have been a few test net hiccups, all signs point to a successful Merge. The PoS Beacon Chain launched on December 1, 2020, and since that time Ethereum developers have been testing and hunting for bugs. Over the past many months, simulations of the Merge have run on Ethereum’s various test nets, and were largely met with success.

When the Merge happens, PoW will no longer serve as the consensus mechanism for Ethereum, and the PoS chain becomes the means of block production. The benefits to the Merge cannot be overstated: a 99.95% reduction in energy use, the possibility of sharding, which permit further network capacity and scaling, and a huge reduction in the issuance of new ETH.

The Merge is complex, so we’re devoting our next three issues to it. This first issue is going to get you up to speed on the terms and definitions you need to know, offer a history of PoS, compare PoW and PoS, review the changes to ETH tokenomics, and conclude by offering some speculation on what may occur during the Merge. The later issues will explore the Merge and its implications in greater detail, so be sure to keep an eye out for the next issue in two weeks.

While we don’t know for sure what the Merge may bring, you can be sure the DeFi Download will be here to cover it. Thanks for joining us for the Greatest Show in Crypto!

Contributors: BanklessDAO Writers Guild (Ap0ll0517, Elemental, helloashpreet, Hiro Kennelly, oxdog, siddhearta, Teeleroo, Jake and Stake)

This is the official newsletter of BanklessDAO. To unsubscribe, edit your settings.

🙏 Thanks to our Sponsor

The DeFi Download Guide to the Merge (Part I)

First we begin with a little history on Ethereum including some misconceptions on the Merge, and the Byzantine Generals Problem. Afterwards, we break down some basic terms and concepts to help you become a literate observer of The Merge. Part I of the DeFi Download Guide to the Merge will set your foundation for blockchains.

A Splash of History

Author: Jake and Stake

History of the Merge

Proof-of-Stake (PoS) was formally introduced by Sunny King and Scott Nadal in a paper in 2012, but early ideations have been discussed on Bitcoin Forums since 2011. QuantumMechanic presented the idea as a way to lower transaction fees and speed up transaction settlement times. Since then, several blockchains have implemented PoS as a consensus mechanism, demonstrating the robustness of the protocol, but none with the same economic value as Ethereum.

For Ethereum, the consensus algorithm was always subject to change. At the time of Ethereum’s release, PoS was still very early in its development and had unaddressed challenges like the “Nothing at Stake” problem. Today, Ethereum solves this through slashing and correlation penalties. More on these later.

Before Ethereum’s launch in 2015, Vitalik released an Ethereum Foundation post on July 22, 2014 that contained the following:

“We may choose later on to adopt alternative consensus strategies, such as hybrid proof of stake, so future patches may reduce the issuance rate lower.”

The seeds for PoS were planted before the genesis block.

The DAO Hard Fork

In 2016, a project called “The DAO” (aka Decentralized Autonomous Organization) raised 150 million USD in Ether to act as a decentralized investment firm. Control of the funds was governed by the smart contract and investors, but after its launch it was hacked.

60 million USD worth of ETH was stolen, which forced the community to make a difficult choice: do we accept that the funds were stolen and continue on or do we reclaim the stolen funds by rolling back the history of the chain to a point before the hack occurred? The community chose the latter.

Two chains, Ethereum Classic (ETC) and Ethereum (ETH), were the result. The former is the chain that includes the hacked funds and the latter is the Ethereum we know today. One inadvertent positive side effect of the hack is that it allowed the more dogmatic members to offboard to ETC and left Ethereum as the more progressive community. The new composition of the Ethereum community is open to a change in consensus mechanisms, where the community composing Ethereum Classic has no plans to perform a similar migration.

The early community split contributed to the culture we see in the Ethereum ecosystem today: one of flexibility, innovation, and equity. Certainly, Ethereum is less rigid than Ethereum Classic — even as Ethereum Classic experiences more frequent reorg attacks than Ethereum.

The Beacon Chain

The Beacon Chain marks the beginning of Ethereum's transition to PoS. The Beacon Chain was launched in December 2020 and coordinates the PoS validation mechanism. The Beacon Chain has been coming to consensus on new validators, but upon the Merge the Beacon Chain will also validate executed transactions, taking over from the PoW chain.

The goal of the Merge is to make the transition from Proof-of-Work to Proof-of-Stake, all without halting block production. A halt in block production would be very disruptive for DeFi, so the entire change is made from one PoW block (x) to the next PoS block (x + 1).

On PoW Ethereum, node operators run both the execution layer (EVM) and the consensus layer (PoW). If the Merge goes well, the transition to PoS will not affect users. Users don’t have to update software or move their assets.

Things to Know About The Merge

Forked from BanklessHQ:

Users will be unable to withdraw their staked ETH immediately after the Merge, so there will not be any additional ETH on the market until a withdrawal update is created. It’s estimated that the withdrawal update will be pushed to the protocol six months after the Merge, at which time ETH will be unlocked.

The Merge will not lower gas fees. This is a change to the consensus algorithm, not to the gas fee market.

The Merge will not directly improve transaction throughput.

Ether issuance will drop from the current 4.3% to 0.43%. The Merge has been termed Ethereum’s “Triple Halving” event by Squish Chaos because this is equivalent of going from 1 → (½) ** 3 = 12.5%.

Users can run their own execution client node and submit transactions. This is separate from validating, so no need to stake Ether!

The Byzantine Generals Problem, 51% Attacks, and Proof-of-Work

Author: Jake and Stake

The Byzantine Generals Problem

The Byzantine Generals problem is a problem distributed computing that asks the question: “How do we make decisions?”. In a centralized system the answer is obvious. Someone is the decision maker and that person is the source of truth. However, in a decentralized system, there are multiple independent actors and the answer becomes more complex.

Suppose a number of Byzantine Generals are preparing to attack a city. Each General’s army has their own resources and supply lines, however, the number of troops needed to successfully take the city is greater than each individual army. Each General casts a vote to attack or to retreat and they will act together based on the majority vote (>50%).

If some Generals attack and the others do not, the city will defeat the attackers. In order to survive, they must attack together or retreat together.

The problem is often complicated by the presence of treacherous generals (bad actors). They may vote for a suboptimal decision or even communicate different answers to other generals.

For example, suppose there are nine generals and the vote is split with four to attack and four to retreat while the bad actor has the deciding vote, the bad actor may send a vote of attack to one General and a vote of retreat to another General. This forks the decision, causing some generals to attack and some to retreat, thus sabotaging the campaign.

There is a related problem in cryptocurrencies: the “Double-Spending” problem.

First, some background. Blockchains have two important characteristics:

Decentralization

Append-only

Decentralized means anyone can write to the blockchain database and verify the validity of data.

Append-only means actors can only ever add to the blockchain. Once a record has been added to the blockchain, the data in that block cannot be deleted or modified. The state may be updated by an additional block, but the data added to the chain in the original block cannot be modified in-place.

Blockchain transactions can be tracked and verified to be legitimate, and users cannot change their balance from 1 to 100, without first receiving funds from somewhere else in the blockchain. These characteristics combine to create a source of truth that anyone can access and write to.

Let’s use the Bitcoin protocol as an example. Typically, transactions will occur like this…

Suppose Alice has 1 Bitcoin and decides to pay Bob 1 Bitcoin for a very product card. When Alice sends the funds to Bob, the transaction is recorded by a node (computing unit) on the blockchain network.

The node verifies the transaction against the previous transactions in the previous blocks, asking “Does this account have enough funds for this transaction?”. If the account has enough funds, the transaction succeeds. If not, the transaction is thrown out.

The node will then add the transaction to the block it is working on adding. When the node solves the Proof-of-Work the node adds a block to the blockchain and collects a Bitcoin reward given by the network. Each node races to add blocks to the blockchain to collect the reward, and verifies transactions in the process.

In our example, the node will verify the transaction is legitimate by checking Alice’s balance and will apply the funds to Bob’s account after the node solves for the Proof-of-Work requirement.

Back to the Double-Spending problem...

Now let’s say Alice promises to pay both Bob and Charlotte 1 Bitcoin each (for their rare Pokémon cards of course). Although she does not have enough funds to pay both Bob and Charlotte, she can create two transactions on different nodes:

1 Bitcoin paid to Bob

1 Bitcoin paid to Charlotte

In both cases, the transactions seem legitimate. One node thinks Alice has 1 Bitcoin to pay to Bob. Another node thinks Alice has 1 Bitcoin to pay to Charlotte.

If both blocks get added to the chain then Alice has spent double the funds she started with.

On the blockchain, it pays to be first. Only one block can be added to the chain at a time and each block is linked to the previous block.

Blocks are added in a “first-come-first-serve” fashion and each block has a timestamp to show where it is in line. This allows for a clear order of when transactions occur, so Alice cannot pay Bob and Charlotte the same coin. (This solves the trivial Double-Spending problem).

But things get more interesting when there’s a tie (the non-trivial Double-Spending problem): What happens if Alice somehow adds each transaction to two different blocks with the exact same timestamp?

At this point, there is a fork, and the network must collectively decide which way to go.

If a Node receives both blocks, it will do two things. 1) Work on the block that arrived first and 2) keep the other block in memory in case that branch’s chain is longer thus becoming the source of truth.

Let’s break this down with an example. Suppose Node1 receives Bob’s transaction and begins working on a block B and Node2 receives Charlotte’s transaction and adds that to the block C. Assuming both blocks satisfy the Proof-of-Work requirement with the same timestamp, they will tie, broadcast their respective blocks to the network, and continue to work on their respective chains.

To summarize, Blockchains defend against the double-spend problem by using timestamps to determine the order of transactions. When two nodes add a block simultaneously the result is a tie and the other nodes will work on the block they received first, saving the block they received second.

The tie is broken when one chain becomes longer than the other. If a node has been working on the shorter chain, it will discard its work and begin working on the new chain. If the second set of blocks also tie, the process continues until one chain is longer than the other.

These two chains are analogous to the two decisions offered to the Byzantine Generals. The nodes must act in unison in order to maintain the integrity of the blockchain, just as the generals must act in unison in order to campaign successfully. The result of the action is determined by majority rule. In other words, a decision is made with >50% consensus.

51% Attacks

This system works when the majority of nodes are honest players. If the majority of nodes are bad actors, they could use their power to take back the payments they have already made.

For example, an attacker with the majority of computing power can work on one block (with payments they have already made) and switch to another block. The attacker can build a competing chain faster than the other nodes in the network because the attacker controls the majority of computing power.

If the bad actor does this, it de-legitimizes the value of the network. No one would want to put their money into a system that could take their funds away from them at will.

To combat this, blockchains offer rewards for successfully adding blocks to the chain. At this point, the attacker can choose to collect the reward and add to their own wealth or take back payments and devalue their own wealth.

“[The attacker] ought to find it more profitable to play by the rules, such rules that favour him with more new coins than everyone else combined, than to undermine the system and the validity of his own wealth.” -Satoshi Nakamoto (Bitcoin: A Peer-to-Peer Electronic Cash System)

101’s and Basic Terms

Author: Ap0ll0517 & Jake and Stake

Proof-of-Stake

Proof-of-Stake (PoS) is a consensus mechanism that allows a peer-to-peer (decentralized) network to asynchronously determine a shared state. The shared state includes the order and results of transactions. In other words: How do we determine the state of the world when multiple people say different things happened?

In Proof-of-Work (PoW), Miners demonstrate their commitment to the network through energy expenditure. They burn electricity to run hashing algorithms to generate a golden nonce. Commonly analogized to solving “computational puzzles” or “math problems”.

In this example, strings are used as input, but in PoW systems the input is a block’s header.

In Proof-of-Stake, the commitment of capital is not demonstrated through proxy of hash power, but instead through the in-protocol asset itself. In Ethereum’s case: Ether. This forgoes the need for specialized hardware and high energy expenditure, even improving upon security.

The ability to make a block is very powerful. Cryptoeconomic consensus algorithms allow us to fairly choose a block producer without a centralized 3rd party.

Randomness

Computers are inherently deterministic; given a function and an input, the same output will always be returned.

PoW gets around this by using the hashing algorithm as a source of randomness to make block production—and its rewards—equitable. But PoS doesn’t use hashing to determine the next block producer. It chooses the next block producer algorithmically. In order to make this process fair and more secure, we need another source of randomness.

PoS uses mechanisms to collect randomness from participants. Ethereum’s beacon chain maintains a RANDAO variable that is updated at each block proposal. The protocol uses digital signatures from validators to update the RANDAO variable; these signatures serve as a source of randomness and are unfakeable.

Above is a diagram demonstrating RANDAO updates. The signature over the epoch number is the RANDAO reveal that the proposer includes in its block. This is hashed then mixed into the existing RANDAO with an xor operation.

Slots

Time in Ethereum is divided into slots which are about 12 seconds each. During each slot a validator proposes a block which is subsequently broadcasted to the rest of the network. Then, a committee of validators is randomly chosen to vote on the validity of the block (submit an attestation).

Epoch

An epoch refers to 32 slots or approximately 6 minutes and 24 seconds. The first block in every epoch is a “checkpoint” where validators vote to finalize two blocks. The earlier of the two blocks is considered “justified” whereas the latter is considered “finalized”. In the next epoch, a new block will be “justified” and the previously justified block is upgraded to “finalized”.

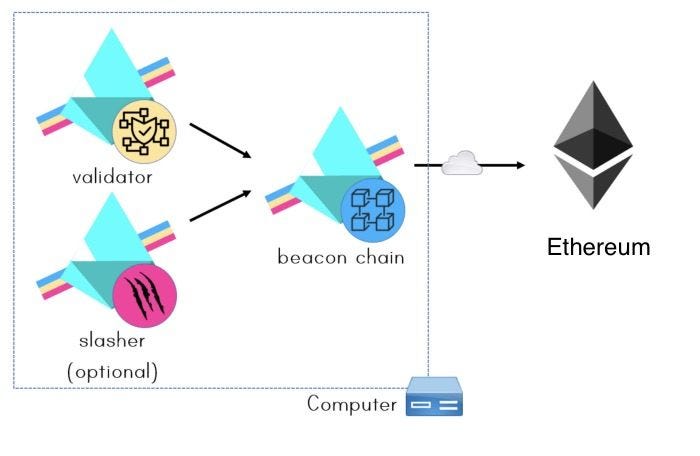

Validator

Validators are paramount to the security and integrity of the Beacon Chain because they validate transaction data. Validators are connected to each other in a peer-to-peer network and pass messages to each other. The primary messages they communicate to each other are blocks which are voted on by other validators.

Validators are responsible for processing transaction computations, producing blocks (i.e. collections) of transactions, and storing the results on the blockchain. Validators hold the state of the EVM and make updates to it. Without validators, consensus would not be possible.

To participate as a validator, you must deposit 32 ETH into a staking contract and run client software on your computer. It is recommended that you have a dedicated device strictly for running this software. You must also maintain a constant internet connection to fulfill the requirements as a validator. As long as you perform your duties well and in a timely fashion, you will be rewarded in additional ETH. If you fail to execute your responsibilities, you will lose ETH.

Beacon Chain

The Beacon Chain is the engine that powers the new PoS mechanism by coordinating the validators. This is done by randomly selecting validators to propose blocks of data from their designated shard(s). Today, the Beacon Chain does not store any blockchain data, only a list of validators and the attestations those validators make.

It is currently separate from the Ethereum blockchain we know and use today. The Beacon chain is only coming to consensus on active validators and account balances. It does not process transactions or handle smart contract computations. However, upon The Merge, the new PoS consensus mechanism will replace the current consensus algorithm, Proof-of-Work (PoW).

It will be responsible for nominating block proposers, collecting attestations, distributing block rewards, and slashing ETH from malicious actors. Later, the Beacon Chain will be used to coordinate additional scaling upgrades like sharding.

Proposer

In each slot, the Beacon Chain chooses a random validator to be a block proposer and a random set of validators (called a committee) to vote on the block’s validity. At the first block of each epoch—called a checkpoint—the proposer is also responsible for proposing their view of the chain to the rest of the network for finality.

Slashing

Validators who behave honestly and perform their duties in a timely fashion will receive ETH rewards added to their staked ETH balance. Validators who are offline for some time or who don’t attest to the current state of the blockchain can lose some of their staked ETH balance. This incurred inactivity penalties, not to be confused with “Slashing”. Typically, these penalties are small and very negligible.

However, certain infractions signal malicious intent. These actions include:

Proposing multiple blocks for the same slot

Attesting to multiple blocks for the same slot

Contradicting previous checkpoints

All of these actions are considered “slashable” offenses and carry greater penalties. Slashing includes destroying a validator’s staked Ether and removing that validator from the network. This exit process takes ~36 days after the initial slashing, and the validator will continue to incur penalties until they exit.

If your validator was slashed, you cannot enter the validator set with the same keys and stake. Your validator is permanently kicked from the validator set and this is irreversible, which means you must generate new keys and stake to validate again.

Clients with the validator slasher feature enabled are able to detect and propagate slashing events. In the post-Merge design, only one honest slasher must be live to ensure network integrity.

Finality

Blocks that have achieved finality cannot be reverted. The finality of blocks are voted upon by validators during checkpoints (the first block of every epoch) with a super-majority vote of two-thirds (66%) required for the checkpoints to be upgraded. The most recent checkpoint upgrades to a “justified” block; with the previous “justified” block now upgrading to a “finalized” block.

Finalized blocks are considered canonical consensus history. In other words, these are blocks that the blockchain is sure of.

To revert a finalized block, an attacker would need at least one-third of all staked Ether. It takes a two-thirds (66%) majority to finalize a block, so an attacker with one-third (33%) of the vote could prevent finalization, causing many problems.

However, there is a safety mechanism preventing this type of attack from being a successful one. When the chain has failed to finalize for more than four epochs, an inactivity leak activates. This slowly drains the staked ETH from any validator voting against the majority. Eventually, the attacker's stake would be reduced and a two-thirds majority can achieve consensus once again and finalize blocks.

Node

According to ethereum.org, a node is “any instance of Ethereum client software that is connected to other computers also running Ethereum software, forming a network.” Anyone can run a node, even those without ETH!

You don’t need to stake ETH or be a validator to run a node. It’s recommended that you run your own node, with or without ETH.

There are two kinds of clients that you can run, one for the execution layer and the other for the consensus layer. The execution client listens for new transactions, processes them, and broadcasts them to the rest of the network. These clients are responsible for storing the state of the EVM.

Execution Clients:

Akula

Besu

Erigon

Geth

Nethermind

The consensus clients communicate with each other and achieve consensus on the state of the EVM. These nodes implement the Proof-of-Stake algorithm and validate data from the execution client.

Consensus Clients:

Lighthouse

Lodestar

Nimbus

Prysm

Teku

There are also different categories of nodes based on their data consumption:

Full Nodes: These nodes store “full” blockchain data which is periodically pruned. These nodes validate blocks and verify the state of the blockchain. This node comes with all the bells and whistles, serving the network and providing data upon request.

Light Node: These nodes only download block headers (hashes, block producer, etc.). Light nodes allow users to participate in the network without the hardware or high bandwidth requirements. These nodes do not participate in consensus nor earn block rewards, but they can access the Ethereum blockchain just like full-nodes. As of today, light execution nodes have limited functionality and there are no light consensus clients released.

Archive node: These nodes store all blockchain data and require terabytes of data storage. This is less useful for everyday users, but is great for block explorers, wallet vendors, and chain analytics.

Running your own nodes allows you to earn rewards, verify all blockchain data yourself—without relying on a 3rd party, use Ethereum more securely and privately, low latency, and you can also provide services that depend on data from the Ethereum blockchain.

“Running a node allows you to directly, trustlessly and privately use Ethereum while supporting the network by keeping it more robust and decentralized.”

Having more nodes in the network is essential for safety and security. Having more nodes in the network increases the resiliency of the network, improves decentralization, promotes network diversity, and allows for social recovery in case of an attack.

Attestations

An attestation is a validator’s vote on the current state of the blockchain and its data therein. Every epoch, each validator must vote on two aspects of the blockchain. They must attest to the most recent justified block and the first block of the current epoch. If they create, sign, and broadcast attestations with every epoch, they can earn ETH rewards. If they fail to attest, they can lose ETH rewards.

Attestations happen in the following steps:

Generation: Each validator generates an attestation.

Propagation: This attestation is broadcasted to other nodes in the subnet.

Aggregation: Validators are randomly chosen to collect the attestations of validators in its subnet.

Propagation: Aggregators broadcast their information to the network.

Inclusion: The next block proposer collects these aggregate attestations and includes them in their to-be-proposed block.

Poof-of-Work vs Proof-of-Stake

Author: Elemental

Three Major Advantages of the Proof-of-Stake Upgrade

The Merge will transition the Ethereum blockchain from using a Proof-of-Work (PoW) consensus mechanism to using Proof-of-Stake (PoS). With PoW, validators (AKA miners) race to be the first to solve a cryptographic puzzle and win the right to add their block to the chain. Block rewards in the form of newly minted ETH go to miners who produce each new block. This competition encourages miners to operate specialized computers and consume a lot of electricity to try to solve the problem first.

In PoS, validators deposit a stake of 32 ETH to operate a node that can propose blocks for inclusion on the blockchain. Instead of a race, an algorithmic function randomly chooses the node that will propose the next block and earn its fees. If through negligence or malicious intent, a validator proposes a block with invalid or fraudulent transactions, some or all of their staked ETH can be slashed (removed from their staked balance and burned.)

Here are three of the most significant improvements that will result from Ethereum’s upgrade to Proof-of-Stake.

99.9% Lower Energy Use

A major criticism of Proof-of-Work blockchains is the enormous amount of electricity they consume to secure the network. It’s a fair point that PoW mining rigs use egregious amounts of electricity in their race to be the first to solve the cryptographic math problems. The amount of energy needed to secure the network scales with the value of the network.

With PoS, validators are able run nodes on standard computers, and the power they use to propose and confirm blocks is similar to or less than other typical computing tasks. Post-merge, the Ethereum blockchain is expected to use approximately 99.95% less electricity!

Lower Costs to Participate

As mentioned above, PoS validation doesn’t require specialized, high-performance computers. Node operators can use standard consumer-grade PCs, laptops, and even low-power Raspberry Pi devices. Also, there’s that 99.95% reduction in electricity bills to run them.

Plus, while the minimum stake required to operate a validation node that can propose blocks is a hefty 32 ETH, it’s worth noting that the staked ETH is deposited, not spent. As long as a validator doesn't do anything that causes their stake to be slashed, they will be able to withdraw the full amount in the future. In addition, pooled ETH-staking protocols enable a validator to essentially rent the 32 ETH from individuals. Not only does this lower the capital costs required to set up a node, but it allows many more people to earn yield for securing the network. By comparison, PoW miners need to purchase, maintain, and replace specialized mining rigs and pay for electricity to run them at top speed.

Side note: Did you know that you don’t actually need to stake any ETH to run a node? Staking 32 ETH is required to run a node that proposes new blocks to be included on blockchain–and to earn fees for doing so. However, all that’s required to run a node that helps secure the blockchain by verifying that proposed blocks are valid is a consumer-grade computer, 1-2 TB of storage, and an internet connection. The Ethereum Foundation encourages everyone to run a node and has a comprehensive how-to guide to get you started.

Improved Security Model

Under PoW, for a malicious actor to push through fraudulent transactions or create a fork of the chain, they would need to control more than 50% of the total hash power produced by all miners. It would require a mind-boggling investment in computing power to accomplish, but due to the concentration of hash power among the largest mining operators, if several of them cooperated on an action they could surpass the 50% threshold and succeed with little or no financial repercussions.

These mining pools could perform reorg attacks without the rest of the network knowing who is behind it. With PoS, we can identify the perpetrator with precision. Because validators must register their accounts with the protocol, we can immediately trace and punish misbehavior.

For example, if an entity is found to be proposing two conflicting blocks for the same slot, the protocol can identify the account and the accounts that attested to the block, slash their tokens, and remove them from the validator set. In PoW, there’s no in-protocol mechanism to punish these kinds of attacks.

Proof-of-Stake is also useful for socially coordinated defenses. In the case where the attack can’t be identified in-protocol, because Proof-of-Work relies on specialized hardware to efficiently submit blocks, the only way to stop a 51% attack is to 1) hope that the attacker is sufficiently incentivized to act honestly or 2) fork the protocol to a new hashing algorithm. But for case 2, if the PoW chain is valuable enough, there are few hardware options available to maintain decentralization, and in changing the algorithm, honest miners are also affected by the cost of buying new hardware.

In PoS, the community can more precisely target the bad actors in the hard-fork, leaving honest validators unharmed and even benefiting. When the bad actors’ stake is burned, the rest of the honest validators have a greater share of the entire ETH market cap.

Tokenomics of The Merge

Author: oxdog

Every four years, Bitcoin cuts its rewards for mining a block in half. This event is called “the halving”, which plays an essential role in the crypto ecosystem and brings significant price changes. With the Merge, Ethereum will also reduce its rewards for mining a block on the network. But instead of halving, Ethereum is reducing the block rewards by 90%! This substantial reduction equals three Bitcoin halvings; hence it is often referred to as “the triple halving

The strong reduction of issuance leads to three main questions. What impact does it have on the network’s security? How does it affect staked ETH? How will EIP-1559 affect the PoS ETH Supply?

Network Security

How incentives link to network security

In terms of censorship resistance and protection against attacks, the security of a blockchain network heavily depends on the number and variety of block producers. To incentivize more people to operate as miners (PoW) or validators (PoS), proper rewards must be in place.

These incentives come from block rewards when mining a new block. The higher the compensation for building blocks, the greater the attraction. More folks joining leads to further staked ETH in the network and a higher degree of decentralization. Because an attacker or malicious party needs at least 51% of capital power (in the form of staked ETH) to harm the Ethereum PoS network, it becomes more difficult to attack as a wider variety of validators operated by different people stake more ETH.

Reducing block rewards by 90% draws the question if it will lead to less participation in the network, and therefore less network security.

Do fewer rewards mean weaker security?

For Proof-of-Work systems, miners compete against each other by solving a complex mathematical puzzle to mine the next block. Taking part in this race requires beefy hardware and a lot of electricity. The greater your arsenal's hash power, the greater the likelihood of scoring the next block. Due to this arms race, the operating costs for running a miner are immense. Therefore, miners need larger rewards to make their efforts pay off.

Instead of relying on mining rigs grinding away electricity, Proof-of-Stake uses the capital power of staked ETH to protect the network. To participate as a validator in the PoS block creation, you must stake at least 32 ETH, which can be destroyed (slashed) by the network if you act maliciously. Staking ETH is, in essence, a promise that you act in good faith. The decision of who produces the next block is made randomly, but if you have more stakes, you are more likely to be selected to create the next block.

With this different mechanism, validators consume 99% less energy because they do not need to run heavy hardware nor consume large amounts of electricity by brute forcing a complex mathematical puzzle. With fewer physical requirements, validators need smaller rewards to be profitable.

Less issuance does not lead to less security. In fact, after the merge, Ethereum will increase from 11k miners in the network to over 300k validators. That’s 30x!

Staked ETH

As mentioned, validators need to provide a stake to be allowed to participate in the block creation. This stake is in the form of ETH and can be slashed if they behave maliciously. With services like Rocketpool and Lido, anyone can stake their ETH and gain staking rewards of around 4% APR.

To ensure that not all stake is withdrawn after the merge, ETH remains locked for an estimated 6-12 months until the network is fully upgraded. This keeps staked ETH and block rewards out of the market, decreasing supply and driving Ethereum’s price. Once the funds are released, stakers need to wait in a queue to be able to unstake and claim their rewards.

Issuance reduction in tandem with EIP-1559

Another compelling aspect is the symbiosis of the PoS issuance reduction and EIP-1559. When issuing ETH as block rewards - be it in PoW or PoS - the total supply slowly increases, which means Ethereum is gradually inflating. With a 90% cut in issuance and EIP-1559, Ethereum will eventually become a deflationary asset.

How is this possible, and what is EIP-1559?

What is EIP-1559

EIP-1559 is an Ethereum Improvement Proposal implemented on the 5th of August 2021. This EIP changed the economics behind Ethereum gas fees by separating the transaction cost into a base fee + priority fee and adding another vital mechanism.

Every transaction in the Ethereum network needs to pay a gas fee. Since EIP-1559, every transaction must spend a minimum base fee determined by the network. This base fee gradually adapts to the network's activity. To ensure your transaction is confirmed faster, you can top up your gas with a priority fee, which acts as a bribe for validators to prioritize your transaction.

The unique part and vital mechanism of EIP-1559 is that every transaction burns its base fee. More transactions on the network mean more base fees paid and more ETH burned. Since implementation a year ago, more than 2,600,000 have been burnt. You can view the most recent stats at ultrasound.money.

How EIP-1559 can make ETH deflationary

The block producer receives ETH as a reward for every block added to the chain. By constantly mining blocks, more ETH is emitted, which grows the total supply. EIP-1559 counteracts this inflation by burning ETH with every transaction. On the one hand, you have ETH entering the market through issuance. On the other, you have ETH leaving the market by burning it.

As we discovered, EIP-1559 burns a larger amount of ETH when the network is busier. Because PoS issuance only equals a tenth of PoW issuance, fewer transactions need to happen to burn more ETH than there is issued.

Whether Ethereum is inflationary or deflationary depends on network activity. With the current bear market activity, Ethereum is still slightly inflationary. In the next paragraph, you will find a figure on current inflation rates. Notice that even though there is low activity on Ethereum right now, there is not a lot more transaction volume needed to burn enough ETH to make Ethereum deflationary.

Inflation rate compared

Unsurprisingly, the Fiat Category is inflating the most at 12.88% with USD at 9.22%. Following is Ethereum PoW with 4.21% before the merge. In the graphic, you can see the significant impact changing Ethereum’s consensus mechanism to Proof-of-Stake has on the inflation rate. With an issuance reduction to a tenth of PoW, the yearly increase in total ETH supply is close to zero. Depending on the network activity, it can even become negative, thanks to EIP-1559.

An Ethereum Proof-of-Work Fork

Will There Be a PoW Fork Initiated By Ethereum Miners?

Why Is It possible?

Once the Merge is complete, the GPUs used to mine Ethereum will be useless. Stakers will begin validating the network, and all the GPUs will either hit the market, be used to mine some other chain like Ethereum Classic, or be used to continue the PoW chain continuing a different block history than the PoS chain.

Will It happen?

I think the odds of miners initiating a forked PoW Ethereum chain are high. Why not create it? Everyone that had tokens on the PoW chain will still have the same tokens. But a lot of the fundamental building blocks of Ethereum’s economy will be worthless.

Will Circle and Tether double their collateral and support stablecoins on both PoS and PoW Ethereum?

What happens to staked ETH derivatives like rETH and stETH? I imagine they’ll be worthless. Given these serve as collateral on Aave and Maker, liquidations will be abundant and the second-order even more chaotic.

But even if PoW Ethereum survives all that, I don’t think a PoW fork chain will be valuable. For one thing, who will continue to maintain the PoW contracts? Will DeFi and NFT teams continue to build on the PoW chain in addition to the PoS chain?

Building a product is already hard enough, having to maintain two projects — with one on deprecated software — does not seem like a high-value proposition. If a PoW chain does gain traction, it won’t be valuable for long.

This leads into the broader point: All of the brain power in Web3 is going to follow the PoS chain. This includes DeFi teams, MEV researchers, and all varieties of operators in crypto. It all starts with the Ethereum Foundation. The world will follow the most economically valuable chain, and the most economically valuable chain is going to be the chain with the most innovation and talent.

Who would want to build on the PoW chain?

One thing the PoW chain does have going for it is the lack of options for miners. They could continue to support a PoW Ethereum chain with an extremely foggy future or mine for Ethereum Classic. Still, the profit margins will be extremely low! For every $1 earned mining, costs are marginally less.

And if Ethereum is where the developers, users, and projects are, wouldn’t miners be better off selling their hardware, buying ETH, and staking it? It’s far more likely that they will hype up a PoW chain, get uninformed retail to buy and pump it, and then sell everything: stablecoins, DeFi tokens, PoW ETH tokens, and finally their hardware, before converting all of that to PoS ETH.

Still, an Ethereum PoW chain could serve as a back-up plan in case anything goes wrong during the Merge. If something does go wrong, projects and teams can continue to develop on the PoW chain, which has already proven to be robust and decentralized.

In my humble opinion, most users should not give too much thought to a PoW chain, but there will certainly be opportunity that arrives as a result of the Merge. If you must play that game, know your timeframe first and take caution, but maybe the best option is to take the advice from Alice in Wonderland’s White Rabbit:

“Don’t just do something, stand there!”

Actions steps

📖 Read The Merge | The Ethereum Foundation

⛏️ Dig into Gasper | Vitalik

🎧 Listen The Ethereum Merge | Finematics

🎧 Listen THE ETHEREUM MERGE! Everything You Need to Know | BanklessHQ

🙏 Sponsor: Oasis.app - Borrow Dai & Earn

Project Releases 🎉

Hand-picked articles to understand the current state of the DeFi ecosystem

Galleon Portfolios — Narrative Based Indices

One-click exposure to popular trading & investing narratives such as the Ethereum merge event or the Synthetix project ecosystem on Optimism

Managed index saving the investor the burden of rebalancing transaction fees every cycle

Coinbase will add support for Coinbase Wrapped Staked ETH (cbETH)

Coinbase Wrapped Staked ETH (cbETH) is a utility token that represents ETH2, which is ETH staked through Coinbase

Friktion Partnership with Fireblocks

Connects Fireblocks’ 1300+ institutional clients to Friktion Volts directly with the safety and convenience of the leading digital asset and crypto technology platform

First key milestone for Friktion Institutional, a new division focused on scaling their DeFi product offering to Treasuries, DAOs, and Asset managers

Doxdit Fair Launch

Doxdit (XDIT) is a DeFi-based crypto project verification platform

Project verification is the name of the mechanism that examines the smart contract, other software code, and the project team contained in a crypto project

Huntingdon Valley Bank and Maker pioneer the first commercial loan

It’s the first commercial loan participation between a U.S. Regulated Financial Institution and a decentralized digital currency

Maker is connecting to the legacy economy through the largest real-world asset vault to date and its first relationship with a US-based bank

This integration involves a 100 million DAI participation facility to support the growth of Huntingdon Valley Bank’s existing and new businesses

Compound III is live

Compound III is a streamlined version of the protocol, with an emphasis on security, capital efficiency, and user experience

The first Compound III market allows users to borrow USDC using ETH, WBTC, LINK, UNI, and COMP as collateral

Phi has launched on Polygon Mumbai Testnet

Phi is the Web3 world created directly from ENS domains & wallet activities, enabling the easy visualization of on-chain identities

Unique objects can be claimed based on users’ on-chain activities

Fixed Borrowing Now Live on Voltz Protocol

Traders can convert variable borrowing positions on Aave and Compound into fixed borrowing positions

The initial pools cover Aave USDC, Aave ETH and Compound USDT borrowing positions - providing opportunity to lock in fixed stablecoin borrowing or fixed ETH borrowing costs in the build up to The Merge

Chirping Birds 🐤

🔥 and 🧊 tweets from across the DeFi ecosystem

🛠 BANK Utility (BanklessDAO token)

With over 5,000 holders, BANK is one of the most widely held social tokens in crypto. So it bears asking, where are the best places to put our BANK to use? The five protocols below will allow you to deposit BANK in a liquidity pool and earn rewards. To get going, just click on the name, connect to the app, filter by BANK, and start earning passive income.

⚖️ Balancer

Balancer has two 80/20 liquidity pools, meaning that you are required to deposit 80% BANK and 20% ETH in the pool. There is one pool on Ethereum and another on Polygon. Once you’ve provided liquidity, you’ll receive LP tokens. Keep an eye out for opportunities to stake these LP tokens. There is nearly 500,000 USD in the two Balancer liquidity pools.

🍣 SushiSwap

SushiSwap has a 50/50 BANK/ETH pool. As with Balancer, you will receive LP tokens, and while you can’t stake them on SushiSwap’s Onsen Farm yet, you may be able to in the future. Liquidity providers earn a .25% fee on all trades proportional to their pool share. The SushiSwap pool has a little over 100,000 USD in liquidity.

⏛ Rari Fuse Pool

The Rari Fuse Pool allows you to borrow against your BANK or earn huge APY by providing assets like DAI to the pool. At present, all borrowing is paused for this pool. There is over 450,000 USD deposited in the Pool

🦄 Uniswap

The Uniswap V3 liquidity pool is 50/50 BANK/ETH, and provides a price oracle for the Rari Fuse Pool. By depositing in the Uniswap pool, you can earn fees and help enable borrowing on Rari. This pool currently has over 500,000 USD in liquidity.

🪐 Arrakis

You can also provide liquidity to the Arrakis Uniswap V3 pool. The ratio is about 2/1 BANK/ETH. This pool is new, and only has a bit more than $6,000 in liquidity. In the future, you may be able to stake your BANK/ETH LP tokens within the protocol to earn additional rewards.

The Merge Tactics

Beginner Tactics

How to Stake ETH

Author: William Peaster

Liquid Staking Tokens

Author: Ben Giove

Get Plugged In

Event Highlights

DevCon Bogota—Bogota, Columbia—hosted by the Ethereum Foundation that’s geared toward developers, researchers, and movers within the Ethereum ecosystem. Devcon aims to deliver a holistic learning experience through panels and workshops. This conference is for builders of all kinds: developers, designers, researchers, client implementers, test engineers, infrastructure operators, community organizers, social economists, artists, and more. Oct 11-14 📌 Agora Bogotá Convention Center

ETH San Francisco—San Francisco California—Hailed as the West Coast’s premier Ethereum event of 2022, ETH San Francisco unites blockchain and crypto enthusiasts, as well as developers, industry experts, and tech companies. Discover more Ethereum events around the world here and check out the ETHGlobal site to get more updates about this and other upcoming events. November 3-5, 2022, San Francisco, USA.

🧳 Job Opportunities

Get a job in crypto! Do you like solving hard problems, care about building more efficient markets for everybody, and want to work at the frontier of decentralized finance? Rook is looking for full time contributors, with salaries ranging from $169,000-$722,000. There are positions ranging from engineering, recruiting, product marketing, copywriting, and design. Sound interesting? Sign up for our referral program and go full-time DAO.

Sr. Copywriter (❌ technical)

2D Graphic Designer

Quantitative Analyst

🙏Thanks to our Sponsor

Oasis.app

Oasis.app was born as the frontend to access Maker Protocol and create DAI. It allows you to borrow DAI, exchange your tokens internally and multiply the exposure to your collateral (among the 30 available cryptoassets). Oasis.app is now the most trusted entry point to the Maker Protocol. The long term mission is to allow users to simply and easily deploy their capital into DeFi and manage it in one trusted place.

👉 Get started with the Oasis.app

👉 Follow them on Twitter

👉 Join their Discord