State of the DAOs #3 | Overview of the DAO Ecosystem

You're reading State of the DAOs, the high-signal low-noise newsletter for understanding DAOs.

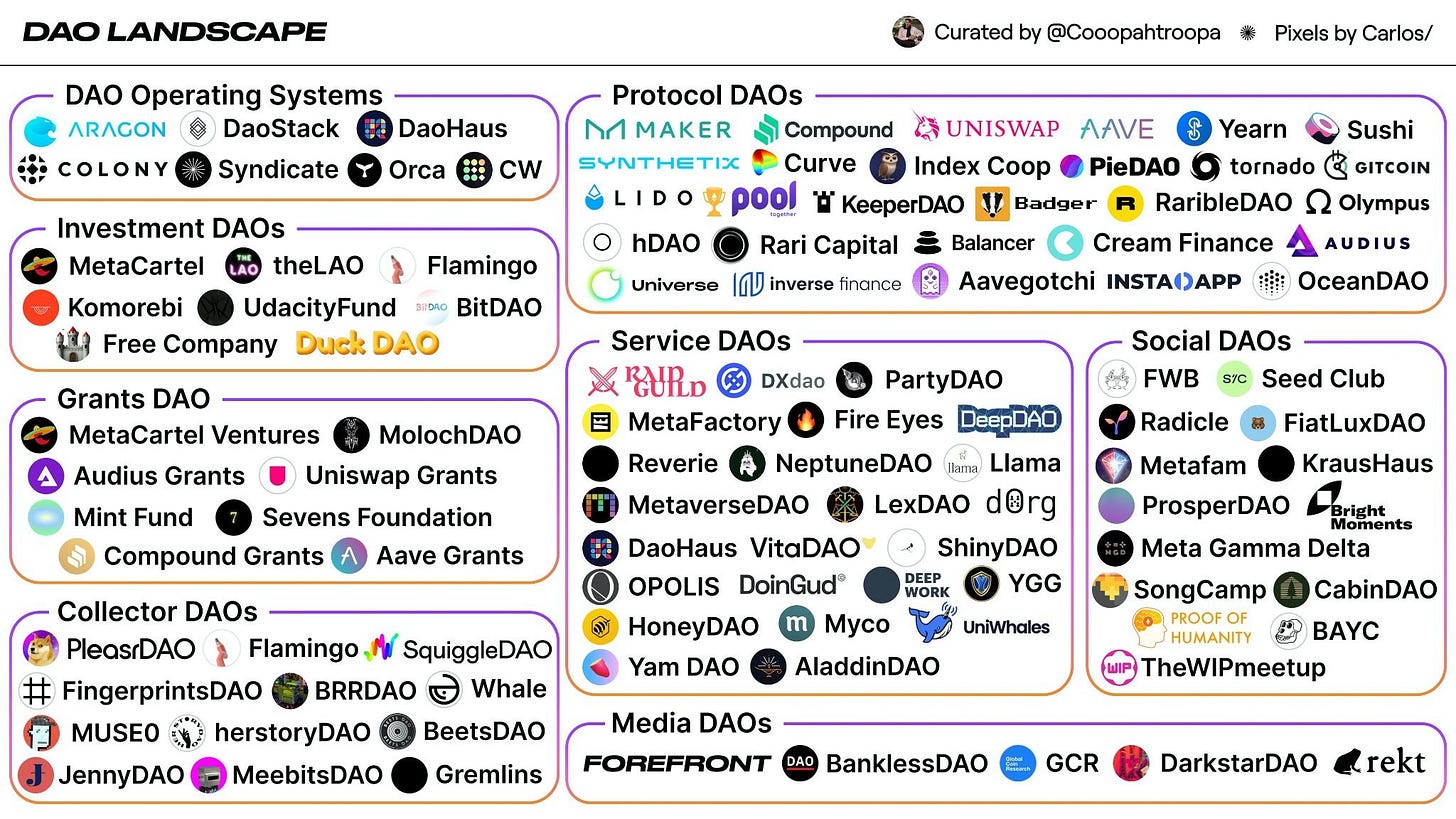

This past year we have witnessed a Cambrian explosion in the DAO landscape, with many different types of DAOs coming into existence. This week we provide a general overview of the DAO landscape and begin to explore how various DAOs interact with each other within that ecosystem. We identify some of the major categories that DAOs tend to fall within, as well as the core components or tools that enable DAOs to function effectively.

Next, we share the TL;DR on the best ecosystem takes and thought pieces published in the past few weeks, making it easy for you to cut through the noise and stay up to date on the world of DAOs.

Authors: BanklessDAO Writers Guild (purrplecat.eth, Adi G, Alvo von A, hirokennelly.eth, Jake and Stake, scottyk, siddhearta)

This is the official newsletter of the BanklessDAO. You are subscribed to this newsletter because you were a Premium Member of the Bankless Newsletter as of May 1, 2021. To unsubscribe, edit your settings here.

DAO Ecosystem Overview

Introduction

As value continues to accrue throughout Web3, it is often argued that algocratic systems (managed by algorithms and smart contracts) will slowly replace traditional modes of governance that are enforced through laws and social hierarchies.

Although the transition towards these trustless platforms is far from perfect, we are starting to see these once discordant and convoluted concepts clarified and implemented with the accelerated growth of DAOs over the past year. With this in mind, not all of these subsets like guilds or community DAOs are the same in purpose or function.

DAO Categories

As DAOs become more layered in their complexity, it’s important to understand the core mechanics and how to tell the difference with various categories. To start, we can outline the more common types of DAOs in the Web3 landscape.

Project focused

Like traditional companies, Project DAOs focus on creating products and services (usually complemented by tokenomics and other community incentives). Although there are no generic tokenomic models, the revenue of Project DAOs is often received by a treasury governed by stakeholders (token holders). In some instances, these DAOs can also hold governance tokens from other protocols, allowing them to have a more powerful influence over decisions across an interrelated and cohesive ecosystem.

Some examples of Project DAOs include Index Coop - a collective aimed at creating and maintaining the most formative crypto indices on the market. The coop makes crypto ETPs (exchange-traded products) that give users broad exposure to different sectors or themes across the industry, including the Bankless BED Index.

Protocol-centric

Protocols like Yearn Finance, Aave, Compound, and Uniswap are often defined through a governance structure that sends tokens out to their communities so that users can vote on network decisions such as upgrades to smart contracts.

Due to the innate complexity of these decisions and the deep level of technical experience needed to understand or implement them, some of the more knowledgeable people across various protocols may emerge as thought leaders in their respective fields of governance.

Investor focused

DAOs for investors often require participants to input capital to their organization in exchange for voting shares. These voting shares (like governance tokens) then help determine what the DO (decentralized organization) should invest in as a collective.

Members of the DO typically combine their expertise and knowledge to build a portfolio of investments that are aligned with their overarching objectives. Stacker Ventures is an example of a decentralized investor organization.

Creator & Curator

While there are many variations, a creator or curator DAO typically has members combine expertise, brand awareness, and capital to curate projects or share in the growth of a collective portfolio. One clear example is the highly accredited and rapidly growing PleasrDAO that purchased and later fractionalized a rare 1/1 DOGE NFT.

Community driven

Communities can also create DAO tokens related to a shared mission or interests. Examples include tokens that provide access to a social platform like a discord server or telegram group. Members of community organizations can also benefit through a range of closed-network incentives and collaborations.

Guilds

The structure of guilds differs from the more general nature of community DAOs in that they focus on pooling talent to offer high-quality services to clients. Freelancers and sole contractors often benefit from leveraging established marketing channels related to a guild as it helps increase their ability to work broadly across the ecosystem.

Mechanics & Dynamics

Given the myriad of ways that a DAO can onboard new participants and structure its internal workings, the following examples are some of the more common methods and resources implemented today:

Token membership

Token-based memberships are usually permissionless (openly accessible) to anyone and everyone - depending on the token used. Although some are created in the form of governance tokens that can be traded openly on decentralized exchanges, others have to be earned through providing services like liquidity or other work-related offers. Regardless of how they are granted or purchased, holding the token is often enough to allow members to vote on proposals and access additional aspects or locked components of the DAO.

Share-based

Share-based DAOs, on the other hand, are more regulated but still open to the public. In a share-based DAO, prospective members can submit proposals to join, usually outlining a specific service or skillset to receive tokens in exchange for the work on offer. As with the dynamics of governance tokens, shares can also provide members with direct voting rights and proportional ownership, giving people the freedom to exit with their treasury share at any time. These share-based DAOs are usually used for closer-knit human-centric organizations like charities, worker collectives, and investment clubs with a general focus on governing protocols and tokens.

Prevalent issues in the DAO Ecosystem

Incentives for DAO Members

Due to the challenges surrounding L1 complexity and scalability, several market solutions such as Snapshot have emerged to help developers build side chains to optimize governance methods. Other tools such as Tally can help improve the voting process for members within a DAO.

With that in mind, these alternative resources do not leave DAOs entirely void of deeper problems. For instance, DAOs typically suffer from a disproportionate amount of centralization and a lack of practical financial incentives, making it difficult for members to proactively contribute, especially over the long-term.

Inefficiencies of DAO Projects & Organizations

DAO management solutions such as Aragon, Boardroom, and Alchemy (DAOstack) help simplify the process for companies or organizations to create new or related DAOs. However, there are still prevalent shortcomings in the overall process, like high costs and a limited amount of DAO friendly resources or tools for developers to work with Layer 1 and Layer 2 networks. Specific to DAOs, some examples of gaps for both users and projects & organizations include:

High fees and costs surrounding governance activities like DAO setup, voting, and delegation.

A lack of effective management and practical incentives for new members.

In light of broader challenges like the blockchain trilemma, DAOs also have problems balancing their ability to govern at scale without compromising decentralization.

DAOs also face a number of regulatory grey areas with governance tokens that may be deemed as securities.

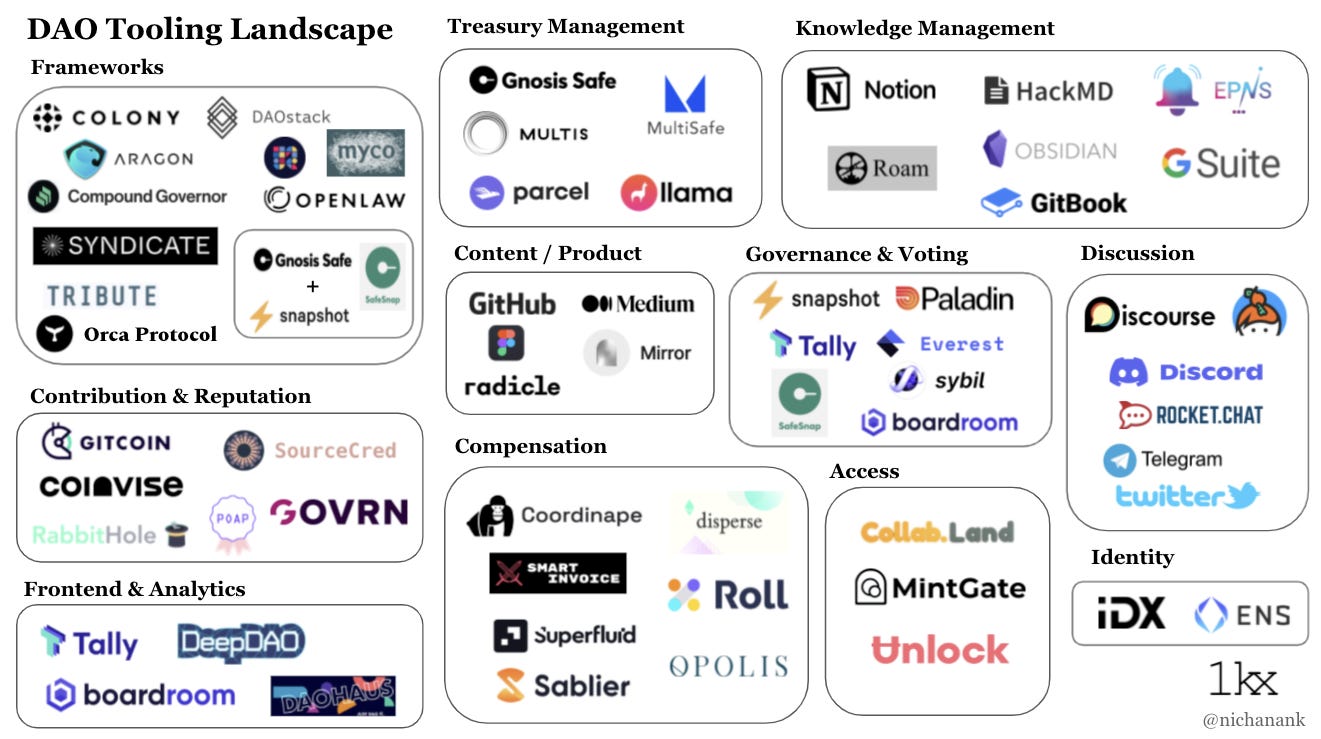

Core Components of DAOs

Several core tools help DAO ecosystems function and grow despite the gaps mentioned above. These include governance frameworks, treasury management, controllers, aggregators, and organizing the talent and skills of contributors.

Governance Frameworks

Regardless of the context, all organizations need a clear governance framework to function effectively. In traditional companies, the framework used typically defines the role of the governing body and the role of members. The same overall structures also apply to DAOs and DOs. But instead of being enforced by social hierarchies that could be corrupted and mismanaged, governance frameworks are implemented by smart contracts on a related network and blockchain.

In essence, the underlying code of the smart contract dictates the parameters by which authority is shared and the determines the rules of the DAO. This process is executed on the network, and the participants or members cast votes to reach a consensus on decisions.

Controllers

Controllers help people interact with a specific governance framework by providing a user interface. Aragon was one of the first teams dedicated to DAO infrastructure that offers a suite of applications to create, manage, and govern DAOs at scale.

Controllers are usually built by the same team creating the framework and offer data and APIs to help developers pull and index information, which allows for more diverse features to be created throughout the organization.

Treasury

Treasury and matters related to capital allocation are some of the more common decisions that DAO members make. The funds of a DAO are usually secured in a multi-sig wallet like Gnosis Safe which requires a specific (minimum) amount of members to approve before a transaction can be made. Something worth noting is the growing number of teams building treasury contracts and tools for members to interact with locked capital and the management of portfolio assets.

Contributors & workers

As with any company or group, the talent and skills of its members are an essential component that influences future growth and direction. Collective skills and talent of members also shape the overall value of DAOs and DOs - both internally and externally. Members can build tools to help measure labour and cohesively work together in a multidisciplinary environment to help expand the resources, product, knowledge, and services of the DAO in its entirety.

Although there are still issues within each DAO or DO like the reputation of its contributors, it'd be fair to state that workers helping further expand the internal and public value of the DAO can be likened to the engine room of a ship or train, helping propel its passengers forward.

Some examples of contributing roles for DAOs and DOs include; community managers, recruiters and promoters, writers, artists, engineers, developers, and treasurers.

Aggregators

DAO aggregators such as Tally (in the context of voting) are commonly seen as the glue that connects various frameworks and tools. This is because these solutions centre around simplifying the nuance and complexity of a DAOs infrastructure and help provide a more user-friendly experience for members when interacting and contributing to the community.

Aggregators also hold highly valuable positions to help index and provide global statistics, along with data to study the relationships or patterns emerging between different DAOs.

Conclusion

Ultimately, the ecosystem of DAOs is created and maintained through a unique synergy of smart contracts and people that help regulate on-chain and off-chain parameters.

While the algorithms and contracts define the rules, members of a DAO or DO are still required to regularly vote on proposals and upgrades to ensure that their organization continues to deliver on its overarching purpose and vision.

In essence, and while slightly abstract, the ecosystem of DAOs could be analogous to the perennial systems that help our bodies function as a cohesive unit. This is because while each organ has a unique and complex role, it cannot exist independently. What's more, they all work together to help maintain the consciousness of the body that houses them.

Within the context of DAO and DOs, such a comparison could be related to the Ethereum network and its unique amalgamation of sub-communities or dApps. The only difference between what helps our physical bodies function and the digital ecosystem of DAOs is that one will live on indefinitely through its network for posterity to maintain, while the other will invariably wither and fade with the snows of yesteryear. Remembered only through the legacy it helped create.

Actions steps

📖 Read The Ultimate DAO Report

⛏️ Dig into DAOs: Absorbing the Internet

🎧 Listen DAO Panel | Kain Warwick, CoopahTroopah, Tracheopteryx

🙏 Sponsored by Yearn Finance

DAOs at a Glance

Hand-picked articles to understand the current state of the DAO ecosystem

Incentive Design & Tooling for DAOs

Author: Ben Perez

DAO tooling is really hot right now, and there are many tools available. This article does a deep dive into the tools available for incentive design within the DAO ecosystem. Before jumping to use any tool, the DAO should identify the most pertinent values or circumstances of the DAO, understand the relationship to the contributor to be incentivized and identify the nature of work to be rewarded. Defining answers to these questions will help a DAO pinpoint the type of tools that will be helpful. Here is an overview of some of the core DAO tools:

POAPs & NFTS - These tools allow access and gating, as well as a way to build reputation at a low cost. The limitations of these tools are that they are non-financial and work only in specific use cases. Proof of Attendance Protocol (POAP) creates NFTs that signify your participation or attendance in activities. Key Examples: POAP.xyz, Rabbithole.gg, Mirror.xyz

Tipping & Tips: These tools allow real-time recognition and are suitable for spontaneous value creation. The limitations of these tools are that they are very centralized and do not scale well. Tipping requires no reputation knowledge of the individuals, allowing anyone in a DAO to contribute and get tipped. Key Examples: Tip.cc, Collab.land, Coinvise.

Algorithmic Network Analysis: These decentralized tools enable participatory actions and recognition workflows such that the algorithm makes calculations around how much value has been created and accrued. The challenges with these tools are that they require development experience. Key Examples: Sourcecred.

Coordinape: Coordinape is a decentralized, pro-social recognition tool that moves recognition from leaders to teams. It works by allocating tokens to each participant, who awards them to their peers during 'epochs'. In the end, an individual's proportion of tokens is converted into their proportion of financial rewards allocated from the treasury. The limitation of this tool is that there is uncertainty of the rewards for contributors.

Bounties: Bounties are good tools for discrete or one-off tasks, which can easily be defined. Bounties work well when the success criteria are well known. The limitation of these tools is that they bring additional overhead and are not suitable for work that is hard to define. Key Examples: Gitcoin, Layer3.

Grants: Grants are becoming a staple of the industry for large-scale, complex, or highly specialized needs. They are a way to attract new participants into a DAO. The challenges with Grants are that they are not great for small tasks and require a heavy operational lift. Key Examples: Gitcoin.

Streams: Streams are likely to become the salaries of Web3 because they have many of the same unique properties but provide a more digitally native and logical solution. Streams reward ongoing commitment and can deliver payment block-by-block. The limitation of the stream is that they might operate like salaries, rewarding contributors without the direct and visible link to value creation. Key Examples: Superfluid, Sablier.

KPI Options: KPI options allow the ability to incentivize results and output in binary and non-binary ways, potentially scaling rewards proportionately to impact. An example is to incentivize via an option valued more as the impact generated by the work increases—these tools reward over-achievement. The limitation of these tools is that results need to be defined and be publicly verifiable. Key Examples: UMA.

Building and Running a DAO: Why Governance Matters

Author: Tarun Chitra

The first well-known early DAO was "THE DAO," which was a collective investment vehicle where contributors supplied ETH to The DAO in exchange for DAO tokens that represented the ETH supplied along with token holder voting rights. Although the project was rugged and the ETH was drained from the treasury, this early experiment in collective governance set the foundation for modern DAOs. Fearing another loss of funds, THE DAO's failure ensured that the next wave of DAOs brought better programming standards and incentivization models into DAO governance. These incentivization models first emerged on DeFi protocols and included innovations we are familiar with today:

Yield farming. With yield farming, users earn rewards for lending, borrowing, staking, and providing pooled liquidity or other forms of asset liquidity. These rewards are typically in the form of the protocol's native-governance token.

Retroactive airdrops. Retroactive airdrops occur when current and former users of a protocol are rewarded with a protocol's new native-governance token, thereby creating a decentralized governance framework.

Different types of DAOs use govenance differently:

Cultural collector DAOs fractionalize ownership of NFTs and buy and sell certain assets, much like museums, and use on-chain governance procedures to execute these collective decisions to efficiently and transparently coordinate decision-making.

Gaming DAOs use play-to-earn models to reward those who play the game with a share of the gaming revenue.

The governance areas common to all DAOs are collective asset ownership and management, risk management for assets, and asset curation. And DAOs work best when the governance burden can be reduced faster than the natural increase in coordination costs. To maximize DAO efficiency, DAOs should:

use governance tools that are qualitative and visual to help the community manage risk.

create subgroups or guilds for more effective operations and governance.

hire people who can work at the DAO full-time.

Regardless of the DAO's mission, governance frameworks serve as the foundation of DAOlife. Governance should be front and center during DAO formation - not an afterthought to piecemeal together once DAO operations are under way.

How to retain high-value contributors to your DAO?

Author: Eliot Couvat

This article presents strategies to retain high-value contributors within a DAO. Currently, in crypto there are more jobs available than good candidates. It is pretty challenging to attract and retain high-quality talent. DAO’s, unlike traditional organizations, enable fluid collaboration and provide flexibility of work. This fluid nature comes with the risk that most active contributors get frustrated by the level of engagement of less active ones. This article explores how culture, tools, and ownership might be the perfect recipe for high retention in a DAO.

Three key elements that a DAO can learn from studies conducted in the traditional organizations around contributor’s needs are:

Culture - create a strong culture and share long term vision and values with contributors

Tools to succeed - provide contributors the tools they need

Autonomy / Ownership - Give enough flexibility and ownership to contributors over the projects

In addition to the above managerial practices, DAO can put some structural models in place to help retain contributors.

The reward/ push model - This model aims to push advantages and rewards to contributors to convince them to stay and contribute. This model is deployed by many organizations such as Nouns DAO, Forefront, etc. As ownership is the cornerstone of web3, the reward model aligns incentives well.

The membership/ pull model - This model incentivizes the community members to become contributors and put in some work to make the DAO grow. Membership focuses on the community’s longevity and health. Friends with Benefits is a prominent community that has chosen this model.

There are new innovative models such as grants for long-term members, paying higher than standard market rates that are being explored.

DAO Tool Observatory

Author: The DAOist

DAOs have arrived, matured, and are here not only to stay, but to thrive. The alignment of mission and incentives serves as the catalyzing force for DAO growth. And while it's possible to build a DAO from scratch (shout-out BanklessDAO), a new crop of DAO launchers and tools are making it easier to both build and run a DAO at efficiency and scale.

DAO launchers, like the suite of tools from Aragon, aim to streamline DAO deployment by:

Making deployment of blockchain-native organizations easy and intuitive.

Allowing communities without advanced development skills or those that lack DAO experience and expertise to build quickly.

Providing solutions from governance frameworks to treasury management and analytics.

DAO tools can be thought of as DAO legos and permit communities to pick and choose what tools are right for their DAO, and often include:

Information management tools such as Discourse and Notion.

Voting platforms such as Coordinape and Snapshot.

Treasury management tools such as Gnosis Safe and Parcel.

Participation tools such as POAP.

Discord and its related bots such as seshbot (polling), DEGEN (soon to be released all-in-one Discord management), and Collab.Land (contributor tipping).

With these launchers and tools available today, it's possible for any community to become a DAO, and that should make all of us in the cyrptoverse bullish on DAOs' long-term potential to change the landscape of human coordination.

DAOs: Communities of the Future

Author: Lisa Xu

While users will ultimately carve unique paths through Web3, DAOs are communities that enable exploration in teams. Lisa Xu posits that a mixture of loneliness, an evolving perspective on work & the rise of crypto was catalyzed by the pandemic lockdowns to spark the emergence of this new organizational structure.

Building off Web2’s successes, decentralized groups have grown rapidly in the past year. However, they can borrow best practices from their predecessors with respect to onboarding, cohort-based learning, member management and content production/delivery. Further, because each community has unique needs that change over time, bespoke & dynamic infrastructure solutions are required. On the other hand, some areas of relative promise include:

Monetization: Web2 creators rely on brand deals & ads for 80% of their revenue. However, Web3 can better leverage NFT drops, subscription fees, token investments and more.

Membership: Coin balances provide DAO supporters voting rights, access to gated content/events and irrefutable evidence of commitment.

Scalability: Active contributors are enabled to make decisions and their impact towards progressing the group’s initiatives keeps them highly engaged, even as the broader community scales.

Incentives: Tokenomics entice members to add tangible value through their efforts.

Data: Web2 community records often live in centralized repositories, but with Web3, digital identity is tied to a user’s wallet. This (along with an open-source philosophy) should enable DAO leaders to have much greater visibility across their communities.

Let's Buy the US Constitution (📜,📜)

Author: Packy McCormick

Packy McCormick outlines his experience joining a new DAO whose ambition is to purchase the only remaining privately-owned copy of the US constitution. The group is intent on raising about $20M USD to secure the winning bid for the historic document at a Sotheby’s auction this Thursday at 6:30pm ET; only seven days after their formation. This endeavor is garnering quite the buzz and has involved substantial coordination:

Packy calls the devs a “Liquid Super Team” who would be nearly impossible to hire full-time since many are founders themselves.

Syndicate DAO stepped up to assist on legal formation.

Juicebox Protocol was selected to code the contract for fractional ownership while minimizing gas fees to increase adoption. They’re also managing refunds if the effort is unsuccessful or too much capital was raised.

FTX tweeted that it was ready to help facilitate the purchase.

Sotheby’s agreed to accept an ETH balance as proof of funds and would hold the asset for 30 days while display options were evaluated.

Groups like the Smithsonian and New York Public Library have been in discussions to present the artifact. The selected museum will agree to provide free viewing & maintain a placard so that people who visit can learn about Web3, the story behind the project, and have a chance to buy tokens in ConstitutionDAO.

The author believes “that this could be one of those moments that the world looks back on in a decade as a turning point in web3, a moment when the world woke up to the fact that it was about a whole lot more than speculation or Bitcoin.”

Ecosystem Takes

🔥 and 🧊 insights from across the DAO ecosystem

Launching a DAO Inside Your Brand

Author: Jump

🔑 Insights:

Web3 continues its unstoppable ascents and is grabbing more attention. We see brands dip their toes into NFT’s and social tokens, but they are not making bold moves.

This article provides a roadmap for a brand looking to launch its Brand DAO.

DAO’s require three things to be successful: seed capital, membership, and purpose for existence. Brands have money and cohorts of loyal customers. The drive will be the key differentiator. A few ideas to explore:

Brands can develop new IPs within the DAO. DAO members can help identify the best trends and generate new IPs. In return, the DAO can share the benefits with the contributors.

Brands can launch new product lines. Brands can work with the community to launch and sell products, sharing the process with members accordingly.

Brands can collaborate with DAO members to launch event series. DAO members have skin in the game and will be heavily invested in creating hype around the event and making it successful

Brands need to consider the best process for onboarding community members carefully. Brands need to onboard contributors who will have a meaningful contribution to the DAO and not free riders, who will immediately flip tokens for profit.

Brands need to carefully evaluate the legal and compliance risk to avoid future litigation.

Community management, where the community members have a financial stake in the outcome, will require different internal processes than existing methods.

What is DAO-to-DAO?

Author: Eliot Couvat

🔑 Insights: While intra-DAO tooling is getting its wings, there is an opportunity for crypto-native inter-DAO tooling that Coinvise also aims to fill. DAO to DAO (D2D) platforms will play an important role in the ecosystem by allowing DAOs to safely exchange goods and services with each other via on-chain, web3-native tools.

Generally, tools for collaboration and building trust must be integrated in all D2D platform tools.

Reduce bureaucracy and negotiation costs using permission-less interfaces like DAO-owned smart contracts. This will allow direct, on-chain interaction between DAOs.

Tools for open discussions will reduce information asymmetry and enable everyone to participate in DAO decision making.

Tools should be able to serve many types of DAOs, be interoperable with other tools, and enable DAOs to find new partnerships and strengthen existing ones.

Four problems D2D tools can solve are: information asymmetry, lack of trust, inter-DAO governance, and information overload.

Fiat DAOs: A bridge between DAO Treasuries and fiat debit cards

Author: Amanda Peyton

🔑 Insights:

DAOs need to pay for real-life (IRL) goods and services, such as software subscriptions, plane tickets, food, etc. These expenses need to be paid in fiat currency.

There are parallels between DAOs and groups that use Braid every day. Braid is a service that allows people to pool money and then spend it from the Braid account.

The Braid team wants to build a product where:

DAO sends USDC from its treasury to a DAO-managed USDC wallet at Braid

The USDC would be instantly off-ramped, converted to fiat via an exchange, and sent via wire/ACH into a shared money pool. The DAO would control who has access to the collection of funds and levels of controls.

The DAO could use the pool’s debit card to pay for expenses without any need for reimbursements. All transactions will have a record in a shared space.

Braid would need to ensure proper KYC(Know your customer) for every person who will access the pool of funds. KYC is a non-negotiable requirement that potentially conflicts with the open, decentralized, and pseudonymous nature of DAOs.

There are great tools available that solve this problem in business banking, but incorporating as a C-Corp or LLC forces unnecessary operational overhead.

This is not a new problem and has been for decades in non-web3 situations. The workaround has become common practice and entrenched: one person organizes and fronts the money and then asks to get repaid. Expenses get entered, tracked, and reimbursed.

First DeFi, Then NFTs, Now DAOs, the Next Big Chapter of Crypto Is Already Here

Author: Yasmine Karimi

🔑 Insights:

DAOs are a paradigm shift in human organization. Blockchain is the recordkeeper and this distances them from government bureaucracy.

These modern groups enable internet users to create value collectively in a trusted environment, while rewarding them for the output generated.

Stakeholder alignment should theoretically motivate each member to contribute their best, making the organization more productive.

Information security and regulatory risk pose unique challenges to DAOs and frequent decision-by-vote can slow progress.

The valuation drivers of decentralized and autonomous societies can be evaluated by studying its incentive mechanisms.

A DAO that regularly pushes through projects is generally representative of collective engagement. An ability to execute suggests potential for long term value appreciation.

Yield DAOs: Leveraging Web3 for Better Offline Living

Author: Nat Eliason

🔑 Insights: What if we could leverage DAOs, NFTs, and DeFi together to enable new business models? In this article, Nat goes through three thought experiments where the sale of NFTs can bootstrap the funds to provide products and services, the NFT holders (members) get access to these services at a discount, and the profits are reinvested into yield earning activities in the DeFi ecosystem. This is the idea behind a "Yield DAO."

Yield DAO: a DAO committed to enhancing the lives of its members by intelligently harnessing the financial tools at its disposal through DeFi.

DAOs can bootstrap funds through the sale of "membership" NFTs, use the funds to earn yield in DeFi protocols, and provide cheap services to members by negotiating bulk discounts on their behalf.

Members get discounted (or free) access to services (subsidized by the DAO treasury's earned yield) and/or a share of future profits.

The DAO can continue to earn funds through NFT resales, DeFi yields, and the provision of products/services to non-members. These profits are continually reinvested into the yield earning treasury.

Example businesses include responsibly sourced meat, coffee, and education.

Get Plugged In

🗺 Live DAO Directory

This is a free, long term, data-stewarded directory for DAOs. It's built with diverse community cooperation and participation, which aims to enable greater understanding of the emerging DAO ecosystem, allow for more interDAO communications and awareness, and increase visibility and accessibility of joining a DAO.

State of the DAOs - Newbie Friendly Events

Event Highlights

BanklessDAO - Permissionless Conference - Tickets are on sale for one of the biggest DeFi conferences! Over 5,000 people will be attending in total and every two weeks 250 more tickets unlock. Once 250 tickets are purchased, registration closes and you’ll have to wait until the next release. Speaking of the next release, your next chance is on October 1st and prices are currently at $316. Speakers include our very own Ryan Sean Adams and David Hoffman, as well as many others. Join us on Tuesday - Thursday, May 17 - 19, 2022 in sunny Palm Beach, Florida for the event.

🧳 Job Opportunities

Research Analyst: Smart Contract Platforms & Web3 at Bitwise

Community Manager at Dexible (❌technical!)

Community Manager at Aragon (❌technical!)

DAO Spotlight: ENS

For many in the DAO ecosystem, the ENS airdrop was a very welcomed surprise on Nov 9th. Ethereum Name Service, aka ENS, has become critical infrastructure for the Web 3 community. Acting as the ecosystem's primary naming service, the ENS airdrop was a method of mass governance distribution to its users.

Price predictions and speculation have ran rampant as many traders are looking to turn a quick profit. But Brantly Millegan (founder) & Nick Johnson (dir of ops) were quick to point out that this airdrop isn't about "rewarding" the community. This airdrop, and the subsequently required voting delegation, has effectively decentralized this core Ethereum infrastructure back to the community in the form of a DAO. Reminding us; with great power, comes great responsibility.

What do you need to know?

Claim: Check the website to see if you're eligible for an airdrop.

Review: Read through and review the proposed (now ratified) constitution

Delegate: Choose your delegate carefully! This is the governing body for the core naming protocol for the entire Web 3 ecosystem and votes are token weighted.

🙏Thanks to our sponsor

Yearn Finance

Yearn Finance is an emergent and evolving experiment in decentralized collaboration. It has no papers of incorporation, no headquarters, nor even a list of names and locations for its contributors. Yearn is a team of generous, big hearts. We care deeply for each other, DeFi, and the world. That means Yearn will not merely be a world-changing DeFi protocol, but a blueprint for the next stage of human coordination.

👉 Learn more about the Yearn DAO and how you can contribute by visiting our notion.

👉 Chat with Yearn contributors in our Discord.

👉 For more in-depth information about yearn finance see our documentation.