Specialized Stables | DeFi Download

Terra's Stable Coin Collapse, RAI, A Stable Fractional Reserve, Threshold USD, Remoooving Funds from CoW Swap’s Settlement Contract

Dear Bankless Nation 🏴,

In a bear market it can be hard to find an asset that isn’t going down, not to mention just holding steady. For many DeFi users stable coins offer a refuge from the down trends and potentially earn some passive yield until markets stabilize. In a previous issue of the DeFi Download we took a broad overview of the stablecoin topic, and many users are already familiar with coins like USDC, USDT, and DAI; but what about the alternatives?

We start this issue of the DeFi Download exploring the collapse of Terra and it’s algorithmic stable coin as a cautionary tale that this is all still very much experimental technology. On paper many of these ideas may seem like the next project to send you to the moon, but in reality the unexpected is always possible. We then take a look at RAI, the spiritual successor to single-collateral DAI, but for some reason never caught on the way other alternative stable coins did. Next up is FRAX and it’s unique approach to stablecoins, almost contrarian in its defiance of the stigma of being a fractional reserve asset. Last up is a yet to be released BTC backed stable coin made possible by the tBTC bridge paired with a fork of Liquity’s lending protocol.

Our Security Scare feature of this issue we take a look at how more than $150,000 USD in protocol fees was remoooooved from Cow Swap. There’s a lesson here for the average user and how you yourself may be vulnerable.

This is the DeFi Download ⚡️

Contributors: BanklessDAO Writers Guild (0xzh, Jake and Stake, Chickenramencrypto, Austin Foss)

This is the official newsletter of BanklessDAO. To unsubscribe, edit your settings.

Specialized Stables

Terra’s Stablecoin Collapse

By: Chickenramencrypto

The fall of Terra was the catalyst for one of the largest collapses in all of DeFi history. Billions of dollars were lost within the span of a couple days, both small and large investors felt the shock originating from Terra’s collapse, the repercussions of which may be felt for years to come. Of those impacted were some of the large cryptocurrency investing firms, such as Three Arrows Capital which had approximately 50% of its total capital inside the Terra ecosystem. Even those who hadn’t put their money inside of the Terra ecosystem felt the shock wave as after Terra crashed, many other crypto currencies began crashing as well. With such a monumental amount of money being simply lost overnight, many people questioned whether or not this happened due to a hacker, or the creators of Terra outright rug pulling on everyone and leaving, however that couldn’t be further from the truth. What was once supposed to be one of the most secure blockchain projects to invest your money with, turned out to be a blockchain-protocol that was built to crash from day one.

How Terra Worked

For a brief introduction, Terra was a Cosmos based blockchain which used both an algorithmic stable coin called $UST and their native token called $LUNA in order to both regulate the price and to always make sure that $UST was always pegged at one US dollar. How this system worked was that when someone wanted to buy UST they would have to burn LUNA in order to receive their UST. Once that LUNA is burned, the supply is reduced and the price goes up. From the other side, if you want to acquire LUNA, you would need to burn UST in order to receive your LUNA; with UST’s supply decreasing the price increases. The idea being that both UST and LUNA be in constant equilibrium to maintain the peg. UST was deemed to be a reliable stable coin and thought to be on par with other stable coins.

Unlike another other algorithmic stable coin, FRAX, which had half of its store of value being controlled algorithmically and the other half being collateralized by actual assets such as USDC, Terra had no collateralization behind it; for many that didn’t really matter. Many users had so much in Terra’s system that many people, rich or poor, would keep their assets invested, and even other DeFi protocols in theCosmos ecosystem were relying on UST as their form of a stable coin. The trust for Terra to succeed was high,however, as time went on it would turn out that not all was as well as it seemed.

How the Crash Happened

For many people, the crash was completely unexpected and catastrophic for Terra’s users, as within the span of a couple days both LUNA and UST had lost all of their value overnight leaving many in ruins as the dust settled. The cause was from UST being de-pegged to such a degree that in order for the algorithm to keep things pegged luna was printed so much to the point where LUNA’s supply was so incredibly inflated that its price shot down by 99.9%, rendering LUNA effectively worthless and with UST soon to follow. Within the span of 48 hours billions of dollars was thrown into the wind and one of the largest blockchain protocols by volume vanished with no recovery in sight.

After an investigation from Nansen, they found the culprit(s) behind this depegging to be a group of addresses who caused it. By making large deposits of UST into a Curve pool the peg was destabilized. This forced the price of LUNA to inflate in an attempt to maintain the peg. Many believed if Terra had had a collateralized component to it, the crash wouldn't have been as drastic as it was, backed by actual assets, instead of it relying on just using an algorithm to keep UST at the peg. Without having that cushion, Terra lost all of its value within such a short amount of time that most people who were either asleep while this was happening or were away from their keyboard just for a moment had no idea that they lost everything.

Directly After the Crash

Moments after Terra entirely collapsed many people had no idea it had even happened. No one would have expected billions of dollars to just be gone overnight. Whether people found out from twitter, a news site, or by just routinely looking at their crypto wallet balances, many people had lost everything. As a result of this crash many different centralized exchanges have outright removed the ability to trade both UST and LUNA.

However to ensure that Terra doesn’t completely collapse, an emergency plan was enacted in order to keep Terra’s value by forking the old Terra and making a new version of it, respectively called LUNC for the old and LUNA for the new. The key features that distinguish the two were that LUNA would now be the newest version of LUNA while the original LUNC was left abandoned in favor of developing the new and more favorable second version. Anyone who was still holding the original LUNA and UST after the collapse were given the newer forked version for both on Terra 2.0 with the idea being that they were going to continue on as normal, and Terra Classic would continue without the fork.

Conclusion

The collapse of Terra was one of the most catastrophic things to happen for DeFi in a while, and even today, the ripples of that event are still felt all within DeFi, such as how cosmos took a significant hit to its ecosystem, and CeFi in regards to how much three arrows capital has become bankrupted by the crash. From large institutions to retail investors, like the closure of 3AC, to many people being unable to ever get their life’s savings back, the collapse of UST and LUNA impacted the whole DeFi ecosystem. UST’s de-peg taught a lesson about having a protocol that solely relies on an algorithm to keep its value without being backed by any other asset. Because in the end stable coins are still an experimental technology and regardless if it is controlled by an algorithm or not, we should treat it as such.

RAI

By: Jake and Stake

RAI was created by Reflexer Finance which was founded by Ameen Soleimani and Stefan Ionescu. They forked the Maker codebase with the goal of creating a more decentralized stablecoin through the use of smart contracts to control monetary policy. Vitalik has called it “The pure ideal type of a collateralized automated stablecoin.” Reflexer calls it the “Money God 🗿” thesis.

Comparing RAI to DAI

Like Maker’s DAI, RAI can be minted by depositing collateral into vaults and creating debt positions. However, unlike multi-collateral DAI, RAI is only backed by ETH.

Users are bucketed into two categories

RAI generators: Users that mint RAI by depositing ETH into SAFEs

RAI holders: Users that hold RAI and use it in the larger DeFi ecosystem

DAI is backed in large part by the value of USDC, a centralized stablecoin provider—and also by other centralized collateral. USDC is run by Circle, a US based company that has to comply with US regulations, financial audits, etc.

This means that the US has an outsized influence on USDC, and subsequently DAI albeit to a lesser extent.

Mechanism

RAI is not pegged to the value of USD; at the time of writing, it is worth $2.77 USD, and the stability fee is fixed. RAI isn’t pegged to any fiat value, but instead pegged to the ratio of collateral to market cap.

The goal of the protocol is to control the market price of RAI in such a way that the value is maintained in the face of volatility. In other words, maintain some equilibrium without over correcting and overshooting the target rate too much. The protocol can devalue or revalue RAI in order to maintain its purchasing power.

The exchange rate for RAI/USD fluctuates each day, but is managed by buying and selling RAI to stabilize its value, not a peg. The protocol does this by adjusting the redemption rate of RAI. Let’s get into some vocab to understand how the system responds to volatility.

Redemption Price: The price chosen by the protocol that the protocol wants RAI to trade at on the secondary market. This is used for the collateralization ratio, the price at which borrowers mint RAI, and the amount of ETH that backs each RAI. Enforced by global settlement. This is the “Reference” in the diagram above.

Market Price: the price that RAI is traded at on secondary markets like Uniswap. This is the “Measured Output" coming from the sensor.

Redemption Rate: The rate at which RAI can be redeemed and debt issued. This affects the redemption price.

Global Settlement: Akin to Maker’s Global Settlement. Consists of shutting down the protocol and allowing both SAFE and RAI users to redeem collateral from the system. Settlement uses the redemption (and not the market) price to calculate how much collateral can be redeemed by each user.

The smart contract will react to some sensor (Market Price) and use a mechanism (Redemption Rate) to influence the sensor to converge on a chosen equilibrium (redemption price).

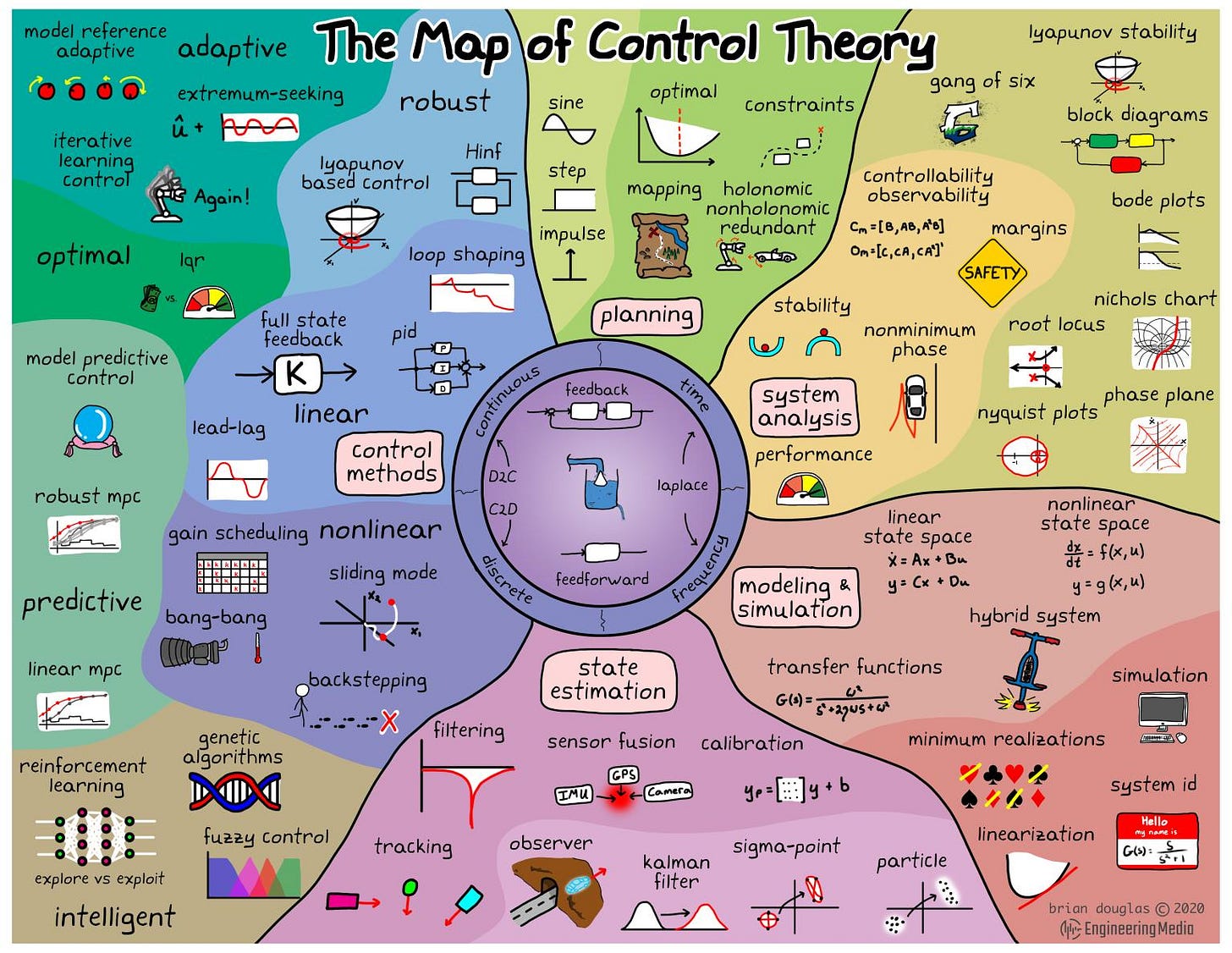

The core idea is the use of “Control Theory”.

Control Theory in Monetary Policy

When collateral increases or decreases in price, the value of RAI will move in a similar direction. The protocol does this by changing the RAI “Redemption Rate”, forcing the redemptions of RAI when the market price is above the Redemption Price and vice versa.

If RAI is priced too highly, the cost of minting new RAI will be reduced, increasing supply and reducing price. The reverse is true when the cost of RAI is too low: the system incentivizes RAI holders to buy collateral and reduce supply.

RAI price goes up:

Redemption rate goes negative

Redemption price starts to drop

RAI holders sell to avoid negative interest rates

RAI price returns to new equilibrium

RAI price goes down:

Redemption rate goes positive

Redemption price starts to increase

RAI borrowers buy RAI to repay their loans

RAI price returns to new equilibrium

The price of RAI is largely determined by demand for ETH leverage, and the protocol can adjust redemption price accordingly.

In the short-term, RAI should be relatively stable in the face of volatility, but in the long-term it should track the demand for ETH leverage (thus ETH price).

The Introduction of Staked ETH

Note that RAI can only be backed by vanilla ETH. Liquid staking derivatives (LSDs) cannot be used as collateral. However, because LSDs accrue value as a result of staking rewards, the cost of using ETH as RAI collateral is higher. Put simply, why should I deposit my ETH and borrow RAI when I can also earn a yield on my ETH and borrow against it somewhere else?

The market has certainly taken note.

On the other hand, LSDs are not without risk. They’re exposed to centralization risks and slashing events. RAI, by nature of being maximally decentralized, is safe from long-tail risks that come with other assets.

The RAI community is staunchly in favor of maximum decentralization. They believe that the best form of monetary governance is “ungovernance”. That the only thing that should govern RAI is immutable code: the “Money God”.

A Stable Fractional Reserve

By: Austin Foss

Among the different kinds of stable coins that have been created in the last several years FRAX is the most unique, "the world's first fractional algorithmic stablecoin..."

That alone could set off some alarms for many people and searching for the term online can send someone down any number of a multitude of rabbit holes about why it's a bad idea. One of the common reasons for concern about fractional reserve banking is opaqueness in traditional finance, just how much is being lent against how much is deposited?

"Blockchains fix this!", or so the saying goes. Such concerns about the protocol taking on too much risk, and depositors wondering if a financial institution/protocol has enough assets to cover all deposits (causing a run on the bank), disappear when you can audit everything on the blockchain.

So can a fractional reserve asset work in a blockchain context?

Stability Mechanism

For over two years now, after launching to Ethereum's main-net in December 2020, the FRAX token has held its peg within a 2% range, with increasing stability as time goes on. So far so good.

A purely algorithmic stable coin, without any other non-native asset to back the protocol, has yet to stand the test of time. As we saw with the failure of Terra a little over a year after FRAX's launch, the price of the collateral token, LUNA, was manipulated in such a way that it triggered a cascading failure, pure algorithmic stable coins might not ever be a reliable stable coin.

Is a fractional reserve of assets, a reserve of assets not large enough to redeem every stablecoin issued against it, enough to provide a reliable stablecoin? This is the reason stablecoins like DAI, RAI, and LUSD, are all over collateralized. So how does FRAX do it?

A second token is required to mint FRAX fractionally, FRAX Shares (FXS). At a collateralization (collat.) ratio of 100% if we deposit $10 USD worth of collateral we could mint 10 FRAX. At a collateralization ratio of 90% we would need $9 of collateral and $1 worth of FXS to burn. Conversely, if we wanted to redeem $10 of FRAX and the protocol had a collateralization ratio of 90% we would get $9 of collateral back in addition to $1 of newly minted FXS.

When the price of FRAX is too close to the $1 USD peg, minting and redeeming FRAX is disabled. Only when FRAX falls out of the appropriate range (greater than $1.0033 and less than $0.9933) can either be performed. How close FRAX is to the $1 USD peg is determined using a Chainlink oracle.

FRAXv2

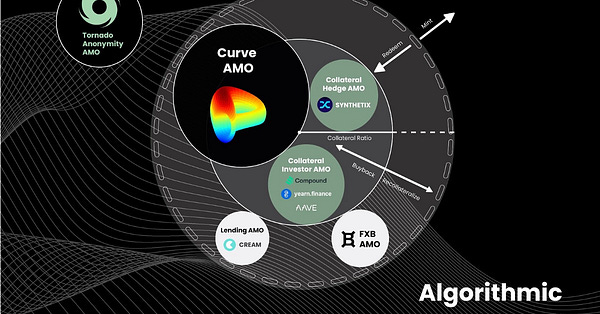

An algorithmic market operations controller (AMO) a DeFi primitive that acts as "A framework for composable, autonomous central banking legos". These can best be explained through examples.

Collateral Investor

When the FRX protocol's collateralization ratio is too high the AMO can reinvest it with Aave or Yearn earning fees for the protocol. When the collateralization ratio falls too low, this collateral is withdrawn and returned to the protocol for FRAX redemptions.

Frax Lending

When minting FRAX is disabled because the price is too high, the Frax Lending AMO allows us to borrow FRAX at interest through usual lending protocols like Compound. Simply put, it allows us to borrow FRAX in the same way we would DAI, over collateralized and with interest that gets paid back to the Frax protocol.

FXS1559

Both of the above AMOs produce revenue for the protocol but what is it used for? FXS1559 "is an in-protocol rule for every AMO to formally channel excess value above the current target collateral ratio to FXS holders." Originally, this was done by buying back FXS with the revenue and immediately burning it.

This was changed in a governance vote and now the bought back FXS is sent "to the veFXS yield contract."

FPI

Using another Chainlink oracle to read a report of "the CPI-U unadjusted 12 month inflation rate reported by the US Federal Government ''the Frax protocol has created the Frax Price Index (FPI).

Some of the top Consumer Price Index (CPI) items:

Food

Energy

Electricity

Apparel

Shelter

Medical Care

Unlike FRAX, FPI is intended to operate at a 100% collateralization. ratio. In order to keep up with inflation and maintain the FPI to CPI peg, an AMO must continually add collateral at the same CPI rate. If the collateralization. ratio falls below 100% because the AMO yield cannot keep up FPIS is sold for FRAX, lowering the price of FPI to correct the collateralization ratio.

FRAX's Future

Now into its third year of life, Frax has proven to be a tremendously innovative protocol and team, creating a product entirely unique in the DeFi ecosystem, and they continue to innovate further.

Frax has also developed their own frxETH and sfrxETH tokens, further expanding the growing liquid staking derivative token pool of tokens. Ethereum and DeFi are looking forward to whatever the Frax team comes up with next.

Threshold USD

By: Austin Foss

In a previous issue of the DeFi Download on Bridges, we discussed the tBTC project. A permissionless and decentralized solution, developed by the Threshold DAO, for bridging BTC to Ethereum. Version two of tBTC launched in a semi-permissioned, intermediate stage, on Ethereum's main-net at the end of January, with a total tBTC minted nearing 300 at the time of writing.

Having a soon-to-be fully permissionless Bitcoin-Ethereum bridge is a great thing to have, but why would someone cross it, what's on the other side and worth the risk; tBTC is on Ethereum? Now what?

TIP-005

A Curve pool currently exists for the new tBTCv2, paired with WBTC and sBTC. This is adequate on its own, allowing BTC holders to move their wealth into the rest of DeFi without ever touching a centralized exchange (CEX), but to go through all that effort only to sell their tBTC defies the strong hodl nature of Bitcoin culture. Version one of tBTC never was integrated with some of the classic DeFi protocols like Aave or Maker, and historical data shows most of its activity in DeFi was through Curve.

Threshold improvement proposal (TIP) 005 was posted to the community’s forums in November of 2021.

"In order for tBTC to become an attractive wrapper for BTC it needs use-cases. Integration with existing platforms are important, but so is looking for alternative ways to expand the tBTC ecosystem on its own."

Plans to implement a Threshold USD (thUSD) stable coin drew inspiration from the Liquity lending protocol which differs from Maker’s model in several ways. When taking a loan in Liquity's stable coin, LUSD, the borrower only pays a fee up front and can keep their collateral deposited indefinitely without paying interest; not even fixed interest—zero interest.

A second major difference is the way liquidations are handled where instead of the collateral being auctioned off, liquidated Liquity troves pay out a fixed amount to the liquidator and the rest of the collateral is "absorbed" by Liquity’s stability pool; a pool of LUSD rewarded with LQTY tokens in exchange for absorbing the defaulted debt.

Liquity-Like

Even though it was modeled after the Liquity protocol, thUSD’s design has a key difference (aside from using tBTC instead of ETH as collateral). Instead of being paid in a third token, like LQTY, the pool is paid back directly in thUSD. This results in the pool being able to run indefinitely, accumulating more thUSD rewards instead of slowly being replaced with the reward token until there is no thUSD left, as happens with the LUSD in the Liquity’s pool.

PCV and the IPL

Protocol controlled value (PCV) is an increasingly common practice within DeFi. Popularized by protocols like Olympus, PCV is an alternative to practices like liquidity mining that "dilutes a project’s supply and attracts mercenary capital...", offering instead a more sustainable method to bootstrap a protocol as opposed to trying to find an alternative once liquidity mining rewards dry up. How PCV is managed is different for each protocol, but for thUSD it takes the form of ownership over the stability pool.

In order to provide the initial stability pool without incentivizing user deposits through liquidity mining rewards, the idea for the protocol to be issued a thUSD loan for no collateral has been suggested; dubbed an initial protocol loan (IPL). Without funds in the pool to absorb liquidations “...the system redistributes the debt and collateral from liquidated Troves to all other existing Troves.” Over time the loan would be paid back from the stability pool rewards.

Single Collateral Limitations

For thUSD, rounding up to a total bridged supply of 300 tBTC minted at an approximate USD value of $23,000 each ($6,900,000 market cap of tBTC), and the same collateralization (collat.) ration as Liquity at 110%, this means the maximum amount that could be borrowed if all existing tBTC at the time of writing was deposited we would have 6,272,727 thUSD. For the sake of safety, and a moderately conservative 150% collat. ration, we get 4,600,000 thUSD. However, at the time of writing more than two thirds of the existing 300 minted tBTC is in the Curve pool.

If 10% of BTC's total maximum supply is used, 2.1 million BTC, at the same $23,000 USD price ($48.3 billion US), and a 150% collat. ratio, we get 32.2 billion potential thUSD. If Bitcoin returned to its all time high, nearly triple the current price, we get to 96.6 billion thUSD.

Extrapolating these numbers puts it into perspective how a single collateralized stable coin compares against other kinds of stable coins. Maker's DAI peaked at 10 billion in total supply, USDT at 40 billion, and USDC at 48 billion. To get to the same peak market caps as the top two stable coins thUSD would require 15% of BTC's supply at the 150% collat. ratio and $23,000 USD price, 3.15 million BTC bridged to tBTC and used to mint thUSD. FRAX peaked at $2.9 billion USD, currently sitting at $1 billion, and Terra's UST peaked at $1.2 billion USD. For this reason when asked how thUSD would address this limitation a developer responded:

"It has been decided that thUSD will use multiple types of collateral, starting with ETH and tBTC. This can be expanded in the future, but our vision is a decentralized stablecoin and we're going to have to be careful not to go down the same path as Maker of taking in more and more centralized assets. As you've stated, BTC alone allows for massive growth, but if it turns out that the growth gets capped due to not taking on centralized coins, it might be a tradeoff worth making. More important than growth is the ability to safely borrow against BTC or ETH. High demand for thUSD could drive the price up, and there is a soft-ceiling at $1.10. Liquity Protocol has struggled somewhat with growth due to being limited to ETH, but our options are greater with the addition of tBTC and potentially other assets in the future. "

A Digital Gold Backed Digital Currency

Bitcoin's narrative as digital gold has managed to stick with it for its whole life so far. Debate over Ethereum and Bitcoin's monetary policies may never be settled but there is something to be said for Bitcoin’s simplicity. Having a digital gold backed digital currency is another narrative that sounds nice, just rolls off the tongue, but we'll have to wait and see how such a model plays out in the wild.

When asked “Since thUSD allows Bitcoin holders to utilize Ethereum's DeFi ecosystem without selling their tBTC, and without needing to wait for other lending protocols to integrate tBTC, what do you think thUSD's value proposition would be once those integrations start happening with protocols like Maker?” One of thUSD’s developers responded:

"thUSD liquidation is at 110% versus 150% at maker. That makes thUSD safer to borrow with the same collateral - or potentially more capital efficient. thUSD has little to no governance whereas Maker is pestered with governance and compromises to decentralization such as exposure to real life assets and other centralized types of risk, including upgradeable contracts. thUSD is much more decentralized and focused on self-custody, decentralization and autonomy. Once a pool is deployed it cannot be upgraded, only deprecated. The lack of upgrade ability makes it much safer and decentralized for borrowers."

Action Steps

📖 Read Stablecoins | Ethereum.org

⛏️ Dig into The Bridge Edition | The Oracle Edition

🎧 Listen FRAX on Bankless HQ

Project Releases 🎉

Hand-picked project updates to understand the current state of the DeFi ecosystem

Proposal to release Uniswap V3 on Binance passes temp check

This is the first step in the governance process

The following phases include a Consensus Check and a Governance Proposal

Robinhood Releases Wallet

Robinhood users can access the Polygon and Ethereum networks

Self-custody wallet app on iOS

View and store NFTs and swap without network fees

Access will be granted to waitlisted users on a rolling basis

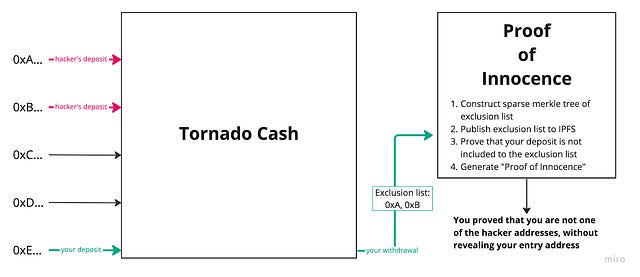

Tornado Cash Proof of Innocence

Allows users to prove (with a ZK proof) that their withdrawals from Tornado Cash are not from a list of specified deposits, selected by the user themselves.

To create this proof, the user provides the blacklisted commitments and constructs a Sparse Merkle Tree of this blacklist.

https://medium.com/@chainway_xyz/introducing-proof-of-innocence-built-on-tornado-cash-7336d185cda6

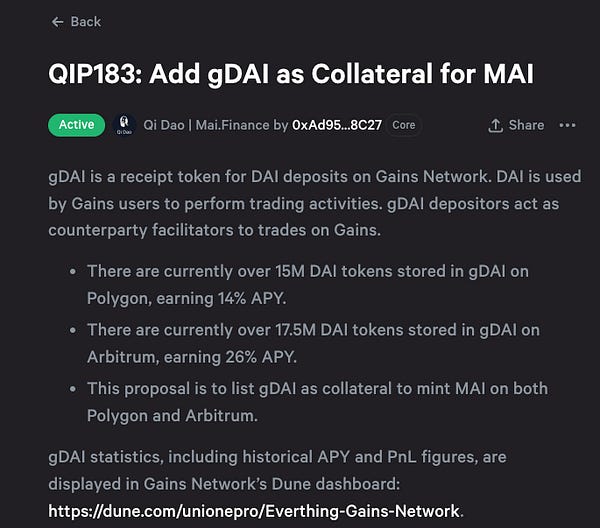

Index Coop’s DIversified Staked ETH Index

The Diversified Stakes ETH Index (dsETH)

Composed of rETH (Rocket Pool), stETH (Lido), and sETH2 (Stake Wise)

Reduce exposure to the specific risks of one protocol

Constituents are equally weighted before adding a NodeOperator Factor, which benefits staking protocols with more active node operators. You can find the token inclusion criteria in the tweet below.

Lido V2 Launch Announcement

Decentralizes Lido Node operation, allowing anyone to become a node operator.

Allow stETH holders to withdraw directly from the Beacon Chain

Next steps include a DAO-wide vote, deployment to Goerli, deploying contracts to mainnet, and a final vote before the hardfork.

Chirping Birds

🔥 and 🧊 tweets from across the DeFi ecosystem

Security Scares: Remoooving Funds from CoW Swap’s Settlement Contract

By: D0wnlore

CoW Swap is a trading protocol with mechanisms to mitigate against common frustrations like MEV. Specifically CoW Swap is an interface for the CoW protocol, both under the stewardship of CoW DAO. CoW protocol works vai “ batch auctions”, where third parties known as “solvers” compete to find the optimal settlement path for trades within those batch auctions.

Specific to the recent hack, solvers have privileged access to the funds stored in CoW's settlement contract – a week’s worth of collected protocol fees – as a buffer that can be drawn from to find more optimal settlement paths.

The Hack

Since these third-party solver contracts have access to funds in the settlement contract, they can be used as a proxy to steal those funds from the CoW protocol. To mitigate the impact of this vulnerability should it be exploited, CoW DAO has done the following:

Kept only a week’s worth of protocol fees in the contract, limiting financial exposure should the contract be attacked

Established a bonding pool mechanism that solvers must deposit into to join the solver competition, which will be slashed and used to repay CoW DAO should a malicious event happen that occurred due to that solver’s access

Unfortunately a new solver was added to the allowlist of solvers, and deployed a contract that had an arbitrary code execution vulnerability. This was fixed in a subsequent deployment of a new contract from the solver. However, approvals made for the original, vulnerable contract were not revoked. The old contract’s remaining privileged access was exploited a few days later, on February 7th, to drain about $167,000 USD in protocol fees from the settlement contract.

More details about the specifics of the hack can be found in various write-ups from CoW DAO:

There is a proposal to slash the bonded funds of the solver that deployed the vulnerable contract. This would refund CoW DAO the protocol fees that were lost through the hack. This is a much happier ending than most hacks that have occurred in DeFi.

Takeaway

If you use a protocol often, or run large value transactions through it, you should read enough of the technical documentation or whitepaper to have a firm but high-level understanding of its overall design. If events like these occur with a protocol you use, but you have an adequate grasp of the overall design, then you will know what actions you should or shouldn’t take, given the parts of a protocol that were exploited.

On Token Approvals

Questions are still lingering as to whether it was prudent for CoW Swap users to have revoked their token approvals as news about the hack broke out. We now know the extent of the damage and that user funds would not have been impacted directly. But this wouldn’t have been clear to typical users when CoW Swap started trending in popular crypto news circles.

According to a co-founder at CoW Protocol, two thousand accounts had revoked token approvals for the protocol on that day. The tone of the thread paints this situation as users taking unnecessary actions due to news media being uninformed of how the protocol is designed but nonetheless warning protocol users that they should revoke their token approvals.

There’s no question that there are crypto news sites and security researchers that can make a mountain out of a molehill. This happens due to these sources not having the requisite knowledge to assess a security event accurately and timely, or just not wanting to let a good crisis go to waste.

But users that decided to revoke approvals as this news first broke out were making a prudent decision. Token approvals should always be scrutinized and revoked or limited when their usefulness has worn out. We are building this industry on what is to be trustless technology. This should extend to higher level abstractions such as the amount of trust we give to protocols to transfer our tokens on our behalf.

Takeaway

Don’t give protocols more approval for spending your tokens than necessary. Find your balance between convenience and protection as to whether you should let protocols have unlimited spending permissions or limited ones, then revoking those permissions when it’s no longer useful.

Stablecoin Tactics

Curve (CRV): How it Works

Author: Michael Egorov

🛠 BANK Utility (BanklessDAO token)

With over 5,000 holders, BANK is one of the most widely held social tokens in crypto. So it bears asking, where are the best places to put our BANK to use? The five protocols below will allow you to deposit BANK in a liquidity pool and earn rewards. To get going, just click on the name, connect to the app, filter by BANK, and start earning passive income.

⚖️ Balancer

Balancer has two 80/20 liquidity pools, meaning that you are required to deposit 80% BANK and 20% ETH in the pool. There is one pool on Ethereum and another on Polygon. Once you’ve provided liquidity, you’ll receive LP tokens. Keep an eye out for opportunities to stake these LP tokens. There is nearly 500,000 USD in the two Balancer liquidity pools.

🍣 SushiSwap

SushiSwap has a 50/50 BANK/ETH pool. As with Balancer, you will receive LP tokens, and while you can’t stake them on SushiSwap’s Onsen Farm yet, you may be able to in the future. Liquidity providers earn a .25% fee on all trades proportional to their pool share. The SushiSwap pool has a little over 100,000 USD in liquidity.

⏛ Rari Fuse Pool- Deprecated Soon

This will be deprecated soon. The Rari Fuse Pool allows you to borrow against your BANK or earn huge APY by providing assets like DAI to the pool. At present, all borrowing is paused for this pool. There is over 450,000 USD deposited in the Pool

🦄 Uniswap

The Uniswap V3 liquidity pool is 50/50 BANK/ETH, and provides a price oracle for the Rari Fuse Pool. By depositing in the Uniswap pool, you can earn fees and help enable borrowing on Rari. This pool currently has over 500,000 USD in liquidity.

🪐 Arrakis

You can also provide liquidity to the Arrakis Uniswap V3 pool. The ratio is about 2/1 BANK/ETH. This pool is new, and only has a bit more than $6,000 in liquidity. In the future, you may be able to stake your BANK/ETH LP tokens within the protocol to earn additional rewards.

Get Plugged In

🧳 Job Opportunities

Get a job in crypto! Do you like solving hard problems, care about building more efficient markets for everybody, and want to work at the frontier of decentralized finance? Rook is looking for full time contributors, with salaries ranging from $169,000-$722,000. There are positions ranging from engineering, recruiting, product marketing, copywriting, and design. Sound interesting? Sign up for our referral program and go full-time DAO.

DeFi Research Lead (Fully remote)

DeFi Bot Wrangler (Fully remote)

Blockchain Economist (Fully remote)

Head of Research (Fully remote)