Pooly Owners Are Fighting for DeFi

You're reading State of the DAOs, the high-signal low-noise newsletter for understanding DAOs.

gm gm and welcome to the State of the DAOs!

This week, EthHunter gives us the details on a class action lawsuit mounted against PoolTogether. PoolTogether is project that allows users to win pooled yield with their saved tokens, but in October 2021 Senator Elizabeth Warren’s staffer, Joseph Kent, deposited $10 into the protocol and promptly filed a class action lawsuit. Crypto is under attack by regulators under the guise of protection.

Soon the PoolTogether team created a set of NFTs called Pooly NFTs. While not a DAO in name, the Pooly community shows us how organizations can be formed in a decentralized and autonomous manner. The fight for fair DeFi regulation is under way in the form of collective action.

Next, we share an excerpt by Matthew Jackson from an impact DAO research and book project that highlights how new contributors can better understand the web3 landscape. In the excerpt, Saf outlines five counterintuitive truths about working in a DAO.

Finally, we share the TL;DR on the latest DAO ecosystem takes and thought pieces, making it easy for you to cut through the noise and stay up to date on the world of DAOs.

This is the current state of the DAOs.

Contributors: BanklessDAO Writers Guild (EthHunter, Matthew Jackson, Alvo von A, anointingthompson1, AustinFoss, suyash, Yofi A., Dippudo, hirokennelly.eth, siddhearta, Jake and Stake)

This is the official newsletter of BanklessDAO. To unsubscribe, edit your settings.

Pooly Owners Are Fighting for DeFi

Author: EthHunter

PoolTogether created Pooly to help in its fight for the future of DeFi. Credit: Dippudo

Launched on Ethereum mainnet over three years ago, PoolTogether is a prize-rewarding savings protocol, enabling users to win pooled yield, all while saving tokens in a vault.

The protocol works by users first depositing funds into a pool which is like a giant joint savings account. This lump sum of tokens, in this case USDC, generates yield through strategies utilized by the PoolTogether team on platforms such as Aave.

At a set time every day, the yield is redeemed and PoolTogether does a very cool and unique thing: they raffle off the yield to the pool depositors, allocating “raffle tickets’ based upon a depositor’s average deposit across a 24-hour period. This raffle gives depositors an opportunity to win the yield generated by not only their deposit, but also the deposits in the pool. The prize amounts (and therefore the total amount of money awarded) change dynamically based upon the number of deposits and withdrawals into or out of the pool.

One of the great features of PoolTogether is that you don't lose any of your principal by taking part in the pool. Sure, depositing your tokens into a yield-generating strategy of your own will return you yield, and in the DeFi space, sometimes that yield is quite good. With Pool Together, you can always maintain your principal investment, but you also gain access to the lossless lottery and have the chance to win an amount way greater than the yield your tokens would be generating on their own. Fun!

Unfortunately, this platform has recently come under attack, and this staple of the Ethereum Network needs your HELP!

What Happened?

Well, PoolTogether, Inc. and others are being sued in a class-action lawsuit alleging the protocol is in illegal lottery operation under New York law. Among those being sued is Leighton Cusack, one of the confounders of PoolTogether:

The lawsuit was filed by the former technology lead for anti-crypto crusader Senator Elizabeth Warren’s 2020 presidential campaign. The software engineer, named Joseph Kent, filed the suit in October of 2021 after he deposited the equivalent of 10 USD into the protocol. After that deposit, Kent immediately filed a class action lawsuit seeking a whopping 250 million USD, claiming he and others like him were injured by this ‘illegal lottery’.

Kent also stated that the source of his issues with the protocol were that he is against crypto in general, in large part for its perceived environmental cost, and would like to see it go away. Apparently PoolTogether to him is just a protocol with a convenient attack vector. But it really sucks to pick on the nice guys, and this seems like a direct attack on DeFi to temp check the strength of some of DeFi’s core doctrines, including permissionless smart contract interactions, DAO governance, and peer-to-peer exchanges of digital currency.

Why Is This Important?

This lawsuit could be instrumental in deciding if and when a party can be held liable for losses incurred from using DeFi protocols. The lawsuit was filed against not only PoolTogether, Inc. and its cofounder, but also its investors and Aave and Compound, where it earns yield.

The corporate parent has no control over the the PoolTogether protocol, which is a set of smart contracts that can only be modified by a majority of POOL token holders. If the lawsuit proceeds to trial, one of the major tenets of DeFi, that decentralized protocols are just computer code facilitating peer-to-peer transactions which can’t be held liable for any outcomes resulting from interacting with the smart contracts, will be put to the test. Code as law meets the law.

One unfortunate outcome of this frivolous-seeming lawsuit is that the PoolTogether team is now forced to pay exorbitant legal fees to fight this case. Because this case is important to not only the PoolTogether protocol, but DeFi in its entirety, as a ruling here could affect other protocols built in similar ways, we need to help. Fortunately, PoolTogether thought of a creative way for DeFi users and those concerned about the future of crypto to help fight for the tenets of DeFi: Cute NFTs.

How Did People Help?

One superpower of Web3 is the ability of people and projects to quickly and securely crowdsource funds. ConstitutionDAO and FreeRossDAO are examples of communities that rapidly came together to pool funds for a shared cause. This case is no different. In order to fund this fight for DeFi, PoolTogether created the Pooly NFT.

These lovely parrot NFT pfps are the graphical representation of your support for DeFi and its protocols. By minting one of these NFTs, it signifies that your wallet address and the owner behind it care for the ecosystem, which has already had positive consequences for Pooly owners – such as early access to the Lens protocol.

The Pooly funds a legal team to defend our native DeFi rights, and its holders may even receive some airdrops or additional benefits that will accrue to Pooly Holders from platforms and protocols that consider minting a Pooly an act worth rewarding.

Sure, this is gamifying a worthwhile cause, but, why the hell not if it works!

There are three different levels of Pooly that were available to mint.

Pooly Supporter is the entry-level donation and every one counts! The cost was 0.1 ETH and nearly 7K supporter-level NFTs were minted.

Pooly Lawyer is the second-support level and costs 1 ETH. Almost 300 of these NFTs were minted. RSA and David both minted at this level of support.

Pooly Judge is the highest level of support. This shows a great dedication to the cause and set the donor back a whopping 75 ETH! There was only one Pooly Judge minted:

The Pooly NFT initiative raised 1,042 ETH from 6,134 supporters!

This just goes to show that there is a community of people on the Ethereum network that care, and put their ETH where their causes are. Many thanks to those people for funding the fight!

Let’s Have a Pooly Party!

PoolTogether is one of the good guys, a team that built something that is fun and educational, allowing users to take part in DeFi, while still keeping your initial deposit SAFU. They are now on four chains (ETH, Polygon, Avalanche and Optimism) and drawing prizes each and every day. These are the kinds of things that people build with the limitless opportunities that distributed ledger technology and blockchains unlock. We need to protect this ecosystem from frivolous lawsuits that aim to discredit and disassemble the very space we are building in.

This also shines a light onto how tools that we create and use in web3 help facilitate these kinds of collective actions. Even if you haven't taken part in PoolTogether, the lawsuit affects you. Please spread the word – it could be your favorite protocol that gets sued next.

To keep up to date on this ongoing lawsuit, follow PoolTogether on Twitter or in their Discord.

Actions steps

📖 Read Wall Street Journal: Crypto-Savings Lawsuit Puts Principles of DeFi to the Test

⛏️ Dig into Review of Optimism retro funding round 1

🎧 Listen Bankless Shows | PoolTogether Co-Founder Leighton Cusack

Impact DAO Study

Impact DAOs Research + Book project is a decentralized, collaborative and open source project. The goal of the project is to publish a book on Impact DAOs that provides information, wisdom, and insights for new web3 entrants. The project covered ten DAOs in total, conducting three in-depth conversations per DAO. To learn more about the project visit the Gitcoin grant page. If you’d like to follow their work they’ll be regularly sharing their learnings and DAO builder interviews on Crypto Good. You can also follow the hashtag #impactdaostudy on Twitter.

Enter the Mind of a DAO Builder

Author: Matthew Jackson

Decentralized Autonomous Organizations (DAOs) are an emerging phenomenon, and the rules are still being written. Since most of us haven’t worked in a DAO, there are a lot of misconceptions about what they are and what they aren’t.

As part of our work on an upcoming book on Impact DAOs, we interviewed Saf, a DAO veteran and BanklessDAO alumni. He shared his experiences in a wide-ranging, fascinating Q&A session, which you can read here:

Below, by way of a teaser, is a summary of five counterintuitive truths about working in a DAO. Enjoy!

You Can Show Up As Yourself

Saf had no professional writing experience before he started as a contributor to BanklessDAO, and yet all he had to do was put himself forward. “Bankless has a Writers Guild, so I joined and just started writing articles for them.” Before he knew it, he was getting great feedback - and getting paid.

Part of the reason this is possible is the frictionless nature and culture of Web3 organizations, where zero bureaucracy (no entry or exit interviews, meetings for the sake of meetings) is the starting point, not an aspiration. “There’s not a lot of opportunities like that in Web2 - where you can just show up as yourself.”

Leader ≠ Boss

There is a misconception that DAOs are leaderless, with coordination occurring entirely spontaneously because…blockchain! Saf is clear on this point. “Not only is that not always true, it's also not always a good thing to have an organization that's completely flat.”

There is, however, a difference between a leader and a boss. “A leader is basically there to provide a sense of accountability. That is to say, they're kind of ‘nudging’ you towards executing and delivering results.” The result is that it does not feel like a corporate hierarchy, but more like a startup where everyone has a stake in success.

Proactivity is Non-Negotiable

Saf is unambiguous about the most important factor for succeeding - or even starting - in a DAO. “You need to be very outspoken and very proactive/self-directed if you want to go anywhere.” This kind of environment selects only the most dedicated and passionate people, which is an excellent ‘interview process’ in itself.

A common way of starting work at a DAO is to show up on the Discord server, announce that you have noticed something that needs doing, and that you are going to do it. Better yet, that you’ve already done it. “You start with small things…build trust with the community, and then people will start giving you more”.

Every DAO is Different

While there are some common principles, you can’t claim to ‘know how DAOs work’. Each DAO will have a different culture, technology stack, and way of approaching governance. Saf’s time at Bankless, Protein, DreamDAO, and Gitcoin has exposed him to multiple forms of token-based compensation (stablecoin, governance, virtual tacos), decision making (one NFT:one vote, delegated voting) and organizational structures (concentric, completely flat).

“Gitcoin has a much more complex governance process, because we're a mature DAO and have a lot more resources than, say, DreamDAO.” A single DAO will be a constantly evolving entity throughout its existence. At Gitcoin, Saf is currently working on a more advanced compensation framework to offer a greater sense of progression.

Everything Changes, All The Time

The benefits of DAOs - no bosses, freedom of entry/exit, and transparent decision-making - come at a trade-off against the calm stability of a centralized system. You can’t ‘learn the ropes’ in the same way you would in a slow-moving bureaucracy, and this can be a challenge. “I still don't think I'm amazing at it!” Saf admits. “I think everyone kind of struggles. Your attention is constantly pulled in all directions, just because there's so much to do.”

This means that it takes a certain level of tolerance for ambiguity and uncertainty, and the patience to bear with issues that would not arise in a top-down environment. For the entrepreneurially minded, though, that trade-off may seem like a bargain!

Conclusion

The investor Nassim Taleb said, “There is no intermediate state between ice and water but there is one between life and death: employment.”

The area of DAOs is a massive topic, and like so many other things in crypto, we’re only at the beginning of the story. As more of us embrace the DAO life and the web3 philosophy of responsibility over predictability, we look forward to seeing how not only investing, finance and gaming can be revolutionized, but also the concept of fulfilment, purpose, and the work-life continuum. Check out the full interview where Saf gives us a detailed look at working at multiple DAOs and how work gets done.

Matthew Jackson ( www.elyptik.net) is a Web3 writer & researcher with a background in traditional finance and a passion for disruption. He works with Web3 innovators to help convey the benefits of blockchain-based propositions to investors, regulators, and curious consumers.

DAOs at a Glance

Hand-picked articles to understand the current state of the DAO ecosystem

Learn How to Build for the Creator Economy

Author: Li jin

Li Jin (Co-Founder & General Partner of Variant Fund) constructed the Creator Economy course and taught 150 live participants in the Spring of 2021 and is offering this workshop for free. With 200 million people becoming creators in the last decade, businesses and technologies are looking to serve this new sector of the economy. This set of people have specific needs and mindsets that are crucial to understand if you want to create a business that enable them to succeed. This course is geared for founders, product leads, and investors to help them find a market, solve important problems, and determine the right business strategy.

Evolutionary Organizations

Author: Chase Chapman

Just like in software, premature optimization can lead DAOs astray. It can create false assumptions that make the solution inadequate for the problem to be solved. This is costly and expensive when software, processes, and organizations are built on top of it. Don’t optimize too early because DAOs, like software, follow Gall’s law:

“A complex system that works is invariably found to have evolved from a simple system that worked. A complex system designed from scratch never works and cannot be patched up to make it work. You have to start over with a working simple system.”

The best way to build a resilient organization is to build an evolutionary one, a system that accepts failure as an indicator for improvement and a potential result of action.

What We Can Learn from Decentralized Community Building

Author: Bethanymarz.eth

In many instances, successful decentralized communities started first with a mission, next building products and services, and lastly asking pragmatic questions. They start with possibility and then move towards strategy.

Web3 is great at evangelizing things. Users are your marketing team and they will sell the dream for you. One key motivation includes being first. People want to make history, so being early and trying things that seem weird appeal to the people that are most enthusiastic. They also want to join a community of their peers, bond with them, and build lasting relationships with like-minded members. They also want to make money. No one can work for free for long, and the potential upside is too great to ignore.

Don’t overlook your core team. DAOs must figure out who the high-impact contributors are and reward them. This means letting them make high-context decisions and letting the DAO make large sweeping changes.

Why the DAO must Resist “MBA thinking”

Author: Shawn Grubb

Corporations have centuries of experience maximizing shareholder value and they’re well-honed to do so. Some of their best practices might fit within the decentralized and autonomous organization, but the latter is a novel and alternative structure for organizing people. In the traditional arena of efficiency and profit-maximization, the DAO is at a disadvantage relative to the firm. However, rather than using old tools to fix new problems, the best solutions DAOs will encounter are likely to spawn from innovative thinking. The first iterations should be expected to stumble as they learn how to achieve their nuanced goals effectively. But fostering an ethos of collaboration vs. competition and a departure from zero-sum outcomes are worthy targets. Maybe one day you’ll be able to get an MBA with a focus on DAOs, but for now the best way to learn is by trying new things.

Ecosystem Takes

🔥 and 🧊 insights from across the DAO ecosystem

A DAO's Guide to Surviving the Bear Market

Authors: Jordan Stastny and Sam Bronstein

🔑 Insights:

Authored by Wall Street veterans who have moved from advising Web2 companies to a Web3 “crypto-native strategic and financial advisory firm” called Alastor and contribute to Llama, a “community that works with DAOs on protocol engineering, treasury allocation, and analytics.” They discuss where to focus DAO resources in a bear market and why this is crucial, making strategic planning in the short, medium, and long-term a top priority “If DAOs are to survive the winter…”

Thinking about finances, for many people, is often not done “until they have to”, unfortunately creating a mountain of potentially unaddressed problems that were easy to ignore in a bull market, but impossible to do so during the bear.

Committing resource towards “”value-focused” DAO financial and strategic practices...“ like treasury and expense accounting, operating key performance indicators(measurable milestones and metrics), short-term budgeting, long-term forecasting, and regularly reviewing all of the above consistently.

Some DAOs that represent excellent models for executing these practices include Yearn, Gitcoin, ENS, to name just a few, and Maker DAO who “is one of the few... with a fully funded Strategic Finance Unit”.

The Network State in One Essay | The Network State

Author: Balaji Srinivasan

🔑 Insights:

A network state is the next iteration of the nation state. Built upon shared values, an online community can become a new source of identity, untethered to your ethnicity or place of birth. These entities will be free of historical constraints.

There are 7 ways to start a new state(country). Conventional: Get elected and change the laws; political revolution; wars to change state borders. Unconventional: Create a micronation; seasteading; colonizing other planets in space. Preferred method: Create a Network State—cloud first, land last.

Network states can construct archipelagos, not of islands, but of apartments, houses, and cul-de-sacs. Communities can congregate on the internet cultivating an online “Reverse Diaspora”, avoiding political roadblocks and physical innovations. This could utilize a wide array of existing technologies—including cryptocurrencies and VR—only using physical locations as “embassies” or for IRL meet ups.

At what point do network states become real countries?

A new state with a population of 1-10M would actually be comparable to most existing states. That’s because of the 193 UN-recognized sovereign states, 20% have a population of less than 1M and 55% have a population of less than 10M. This includes many countries typically thought of as legitimate, such as Luxembourg (615k), Cyprus (1.2M), Estonia (1.3M), New Zealand (4.7M), Ireland (4.8M), and Singapore (5.8M). These “user counts” are surprisingly small by tech standards!

MakerDAO: The War Between Decentralization and Efficiency

Author: Kerman Kohli

🔑 Insights:

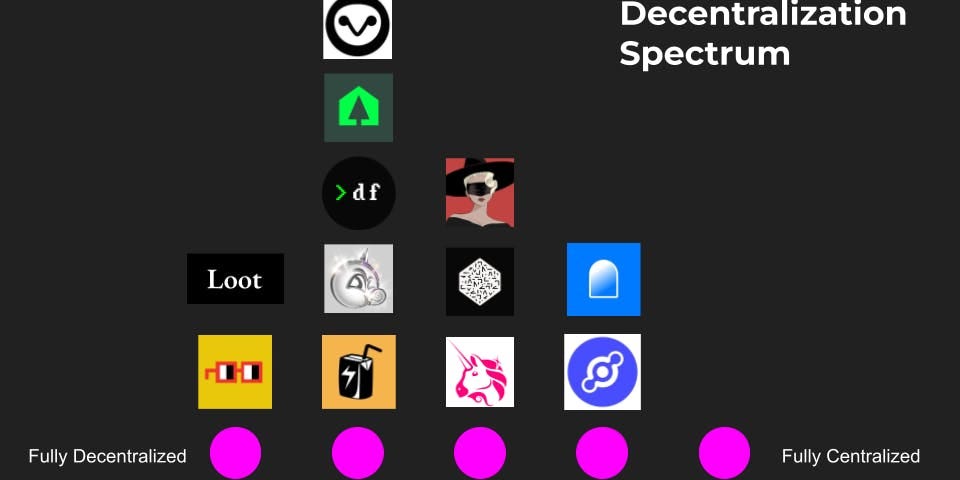

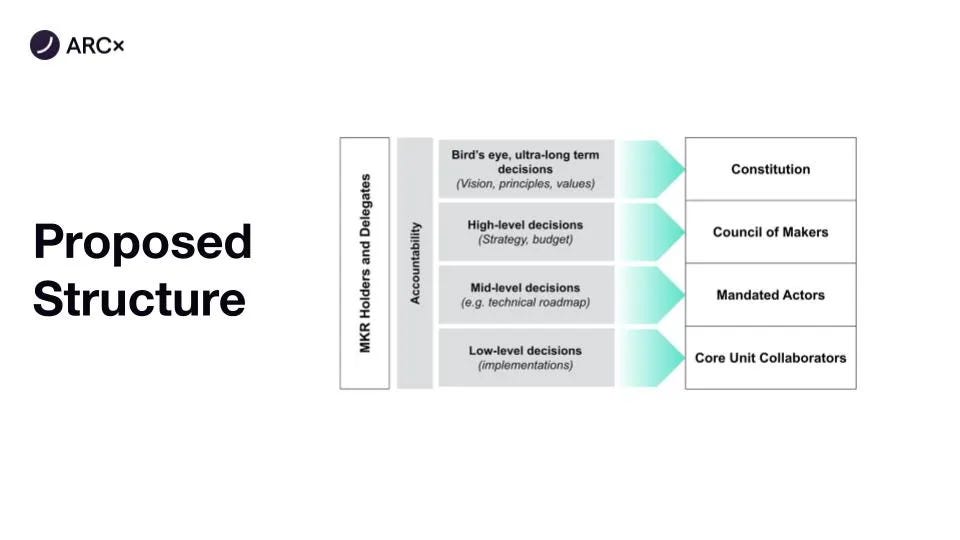

Decentralization is a key feature of DAOs, but does it stand in the way of operating a protocol successfully? Recent frictions at MakerDAO have highlighted important trade-offs between speed of action and distributed decision-making.

An important consideration for DAOs is to balance how their protocol or project runs versus how it scales. Lacking agility to execute on core decisions can be harmful to stakeholders, but organizations with too much concentration of power start to resemble traditional businesses.

One alternative is to empower some elected members to act on behalf of the DAO within a smaller, predetermined scope, and over a specified period. Longer-term and high-level strategic choices would still be brought to all token holders for a vote.

Performance measurement is tricky. DAI has grown exponentially, while the MKR token has languished, so has Maker been successful?

DAO Spotlight: MetaCartel

The MetaCartel Foundation is a non-profit organization that is responsible for the MetaCartel Ventures (MCV) fund, which is a decentralized autonomous organization (DAO) that funds projects and teams that are building decentralized applications (DApps) in web3. The MetaCartel DAO issues significant grants to teams and individuals working on user-focused projects within the Ethereum infrastructure.

The community started its work from a telegram account where they coordinated meta transactions between projects. MetaCartel emerged as a strong cluster that nurtured experimentation revolving around use-cases for the ETH application layer.

The core of the MetaCartel ecosystem lies in the idea of building a robust community that supports blockchain technology. As part of its growth plan, MetaCartel collaborated with multiple top-tier firms like Opera, Gnosis, Aave, etc. Amongst these entities, some are already active within the DApp sector, while others are looking forward to an opportunity to enter the field.

Another vital unit of its kingdom is the MetaCartel Ventures - this segment helps entrepreneurs, developers, engineers, and others to collect capital for their projects. The DAO has played a significant role in multiple endeavors through pre-seed, Series A, or OTC rounds. MetaCartel Ventures also provides logistics support and other aids to help DApp developers achieve their targets.

Through its grants fund, the platform offers financial aid to potent projects. DApp projects can earn funding support and operational guidance via this facet during their nascent stage of blockchain development.

Check out their website, follow them on Twitter, or apply for a grant!

Get Plugged In

Event Highlights

ETHCC 5 —Paris, France— The Ethereum Community Conference (EthCC) is the largest annual European Ethereum event focused on technology and community. Three intense days of conferences, networking, and learning. Covering many different subjects at different levels education through conferences and workshops. The Maison de la Mutualité will be accessible from 9 AM to 7 PM July 19-21, 2022.

DeFi Security Summit —Stanford, California— is the inaugural DeFi security event to address pressing DeFi vulnerabilities and mitigation strategies. The summit includes discussions and talks about DeFi vulnerabilities, cross-chain security, and audits. Confirmed speakers include Aave Head of Smart Contracts, Emilion Frangella, Nexus Mutual Founder Hugh Karp, and Optimism Security Engineer John Mardlin. August 27-28, 2022, Paul & Mildred Berg Hall, Stanford University, Stanford, California, USA.

DevCon Bogota—Bogota, Columbia—hosted by the Ethereum Foundation that’s geared toward developers, researchers, and movers within the Ethereum ecosystem. Devcon aims to deliver a holistic learning experience through panels and workshops. This conference is for builders of all kinds: developers, designers, researchers, client implementers, test engineers, infrastructure operators, community organizers, social economists, artists, and more. Oct 11-14 📌 Agora Bogotá Convention Center

ETH San Francisco—San Francisco California—Hailed as the West Coast’s premier Ethereum event of 2022, ETH San Francisco unites blockchain and crypto enthusiasts, as well as developers, industry experts, and tech companies. Discover more Ethereum events around the world here and check out the ETHGlobal site to get more updates about this and other upcoming events. November 3-5, 2022, San Francisco, USA.

🧳 Job Opportunities

Get a job in crypto! Do you like solving hard problems, care about building more efficient markets for everybody, and want to work at the frontier of decentralized finance? Rook is looking for full time contributors, with salaries ranging from $169,000-$722,000. There are positions ranging from engineering, recruiting, product marketing, copywriting, and design. Sound interesting? Sign up for our referral program and go full-time DAO.

2D Graphic Designer

Quantitative Analyst

Please contact Siddhearta either in BanklessDAO’s Discord or on Twitter for more information.