Legal Entity Solutions for DAOs | Decentralized Law

BanklessDAO Legal Newsletter

Dear Crypto-Legal Observers,

DAOs are growing up. In fact, by crypto standards, they are nearing middle age. The DAO hack, one of the defining events in crypto history, was over five years ago. Since that time, decentralized autonomous organizations have proliferated.

There are DAOs that act as social clubs and investment vehicles. Many DAOs govern DeFi protocols and NFT projects. Some DAOs are formed for more niche purposes, like ConstitutionDAO or AssangeDAO. Although they share the same acronym, all DAOs are different. But there is one unifying thread that ties most DAOs together — they are operating without the benefits of a legal wrapper or other legal entity.

A legal wrapper or entity gives the DAO and its members certain legal protections and a jurisdiction to call home. There are various versions of these wrappers and entities, including a Delaware limited liability company, a Wyoming DAO LLC, and an offshore or onshore foundation.

While most DAOs still operate in the legal wilderness, many DAOs and their contributors are coming to believe that a legal entity is good for the DAO and its members. A legal entity provides a DAO with default statutory provisions, the ability to operate more easily in the off-chain world, and a jurisdiction in which it can pay taxes. Equally important, a legal entity protects DAO members from joint and several liability, which is common law in most U.S. jurisdictions where a DAO’s default legal status is as a general partnership.

According to DeepDAO, DAO treasuries currently hold over 12 billion USD and the number of wallets holding DAO governance tokens stands at 1.8 million. With numbers like this, it’s no surprise that many DAOs and their members are starting to think deeply about the protections afforded by a legal entity.

A new type of legal entity for DAOs is the Marshall Islands DAO. Earlier this year, the Republic of the Marshall Islands became the first country in the world to formally recognize DAOs as a distinct legal entity, in this case, as a DAO LLC. To more fully explore DAOs as legal entities, Decentralized Law had the opportunity to interview Adam Miller, the co-founder of MIDAO, an organization that helps DAOs incorporate in the Marshall Islands. Adam has a long history of working in and with DAOs, and his experience helps us to understand the current legal risks to DAOs and their members and how these risks can best be mitigated.

Also in this issue of Decentralized Law, we discuss preemptive litigation as a tool to seek regulatory clarity, review Kali as an option for DAO formation, analyze the Arizona regulatory sandbox, and summarize news and articles from around the cryptoverse.

Although this newsletter may help to familiarize readers with the legal implications arising out of blockchain technology, the contents of Decentralized Law are not legal advice. This newsletter is intended only as general information. Writers’ opinions are their own; therefore, nothing in this newsletter constitutes or should be considered legal advice. Contact a legal expert in your jurisdiction for legal advice.

Contributors: eaglelex, lion917, hirokennelly.eth, COYSrUS.eth, Trewkat, ComeBackKid, lawpanda, MDLawyer, G0xse, Tromso, B(3,A)Rhunter, Cosmic Clancy

This is the official legal newsletter of BanklessDAO. To unsubscribe, edit your settings.

🎙 Interview

Adam Miller on Legal Entities and the Future of DAOs

Please tell us something about your background and how you started to engage with crypto-legal issues.

My first experience with crypto was trying to convince all my friends and family to buy Bitcoin in 2012. Luckily a few of them obliged, and a couple held on to this day.

In 2021, with the explosion in capabilities on Ethereum and blockchains in general, I was drawn to DAOs, because they represent an opportunity to rethink how we organize people and resources, from the smallest high school chess clubs up to the largest national and international businesses and governments. So I started doing consulting to help people launch and operate DAOs.

Meanwhile, one of those friends from 2012, Mark Lurie, had developed the leading DEX for transactions under 10,000 USD called Clipper. As he looked to hand the DEX over to its customers through a DAO, he started looking for a legal entity and was shocked to find that there was no good solution.

Knowing I was working with DAOs, Mark called me up, and we started talking about legal entity issues for DAOs. We thought about how DAOs are like ships in the ocean: they are spread all over the world and don’t really have a home. We looked into it and learned that 20% of all shipping capacity is registered in the Marshall Islands. We partnered with a local resident, former chief secretary Bobby Muller, to kick off a conversation with the Marshallese government about DAOs. The government eventually passed new legislation to make the Marshall Islands the first sovereign nation to recognize the true nature of DAOs in allowing them to set up DAO LLCs.

We formed MIDAO Directory Services to help people create these DAO LLCs for their DAOs. MIDAO is the company for which I now run global operations.

What makes you so passionate about blockchain technology and digital assets?

I grew up during the first internet bubble of the 1990s and always looked up to my father, an early internet investor. As a teenager, I was always trying to start companies, but I was too young to do anything with a huge impact. Through the 2000s and 2010s, I felt like I had missed the opportunity of a lifetime, to be a part of the internet revolution. And then crypto came around, presenting an entirely new set of technology capabilities that will revolutionize the internet and turn it into something even more significant than what we can imagine in today’s internet. This time, I am not missing my opportunity to leave my mark on the world and help make a better future.

What current projects are you working on?

I run global operations for MIDAO, the company that helps DAOs all over the world form legal entities in the Marshall Islands. On the side, I advise my former project, a DAO consulting company, which recently became a DAO and was renamed DAO Ninjas. I am also a contributor at DAOPlanet, a DAO for people passionate about DAOs that recently hosted the biggest DAO event ever DAODenver, at ETHDenver.

What are the biggest challenges facing DAOs at the moment?

I’d break down the biggest challenges facing DAOs into three categories: technological, operational, and legal.

Technologically, we are just starting to have widely available software that helps people launch and operate DAOs effectively. Realistically, all this software is very early stage and generally pretty inflexible. I applaud all the entrepreneurs working on this technology. There are years of work and hundreds of millions of dollars that still need to be spent before the technology catches up to all our visions of what DAOs are capable of.

Operationally, we are just starting to learn how to run organizations in this new way. It’s like when television first came out, you didn’t have TV shows; you had radio shows… on TV: people sitting around, talking into the microphones, doing the same thing they used to do. With DAOs, we are trying to retrofit our old ways of thinking: basic democratic voting, hierarchical management structures, etc. It will take years of innovative thinking and experimentation before we get a solid grasp on how to run a DAO well, especially at scale.

Legally, until very recently, DAOs suffered from their inability to get two fundamental things that most organizations can easily get: limited liability and corporate personhood. Without limited liability, every member of a DAO can be held financially responsible for the actions of the DAO and its other members. If one member did something that violated securities law, or was fraudulent or negligent, the other members could be held personally liable! Without corporate personhood, a DAO cannot truly own any off-chain property. This includes both intangible properties such as its brand and intellectual property and tangible property such as fiat currency in bank accounts or physical real estate, and they can’t enter into contracts with other people or businesses.

Luckily, the legal problem has a cheap, easy, and fast solution. Jurisdictions like Wyoming and the Marshall Islands simply needed to update their laws so that DAOs could form legal business entities. In particular, in the Marshall Islands, DAOs can now quickly and easily form LLCs, solving their limited liability and corporate personhood challenges.

How does a Marshall Islands DAO solve this? Why the Marshall Islands?

The problem with legal entities, until these new laws were passed, was twofold. Firstly, you had to elect some kind of board, directors, or trustees to run the legal entity, thus introducing a layer of trust in humans that goes directly against the values and principles of a DAO. Secondly, you could not store part of your bylaws or operating agreement on the blockchain; it had to be written in English. Thus, you had to keep a written record of everyone who joins or leaves the organization to keep track of your membership. And you had to record the organization’s decisions on paper, like having minutes from a meeting. All of this paperwork made it impossible for a legal entity to operate truly on-chain.

Now, with the Marshall Islands DAO LLC, your smart contract can genuinely be the organization and keep track of its membership via ERC-20 token, NFT, or any other smart contract. If there is ever a legal dispute, there is no board of directors to ask for input or hold specially liable for the organization. A court would have to look at your governance smart contracts to see what the organization decided about any issue and who your members are. In a sense, DAOs no longer have to create a ‘legal wrapper’ that makes it like a legal entity; now your DAO is the legal entity, just like Microsoft Corporation is not some kind of ‘wrapper’ around Microsoft; it is Microsoft.

Where do you see the crypto space in two years?

DAOs will be everywhere in two years. So any person who is contemplating starting any kind of organization (business, association, non-profit, foundation, trust, etc.) will now have one other option to consider: starting a DAO. And any company that already exists will be asking itself, should we start a DAO for some particular purpose, such as engaging our customer base or giving more control of a product to users.

DAO technology will have taken an enormous leap forward, and to set up a DAO, you won’t have to be a crypto native or the most patient business person on Earth. The platforms will be much more flexible, configurable, and interoperable; you won’t need blockchain developers or experts to be able to create complex, nuanced on-chain governance and financial management structures. In addition, with the proliferation of Layer 2s and other scaling solutions and bridges and cross-chain capabilities, DAOs will be cheaper to run and have a broader range of control over their digital assets and activities.

And of course, DAOlicious puns and memes will be more prevalent than ever… let’s DAO it!

MIDAO: Twitter | Website | Discord

⚖ Developments

Challenges in Using Preemptive Litigation to Elicit Regulatory Clarity

Author: lawpanda

Over the past few years, there have been increasing calls for digital asset entities to go on the offensive to elicit guidance and clarity from U.S. regulatory bodies such as the Securities and Exchange Commission (SEC), Commodity Futures Trading Commission (CFTC), and Internal Revenue Service (IRS). Litigation can often be a valuable tool for obtaining clarity, or resisting perceived regulatory overreach by the government. This type of action is usually referred to as a ‘pre-enforcement challenge’ or ‘preemptive action.’ Generally, a party seeking to pursue a pre-enforcement challenge must demonstrate a ‘credible threat’ of enforcement. In other words, someone seeking pre-enforcement relief must show that: (i) they engage or plan to engage in conduct that arguably falls within the scope of a given law; and (ii) it is likely that the government will enforce that law against them. Once these prerequisites are established, the party can seek declaratory — or other — relief clarifying the law or regulation. However, in many cases, statutes and regulations procedurally limit potential challenges in a manner that can ultimately reduce precedential efficacy. For instance, challenges to certain SEC orders and rules need to follow specific procedures, and challenges to U.S. tax laws in certain venues do not allow for the issuance of declaratory relief.

Issues relating to Coinbase’s ‘Lend’ product and Terra’s suit against the SEC in response to subpoenas are two examples of calls for, or the actual filing of, affirmative pre-enforcement actions. A current and ongoing example of preemptive litigation designed to elicit regulatory clarity is the suit brought by Josh and Jessica Jarrett against the IRS. The suit — seemingly backed by the Proof of Stake Alliance — attempts to establish precedent regarding interpretation of the Internal Revenue Code as it relates to taxation of proof-of-stake (PoS) rewards. The Jarretts’ suit highlights some of the issues presented when attempting to utilize preemptive litigation as a mechanism to clarify regulatory uncertainty.

In 2019, the Jarrets requested a refund of amounts paid to the IRS on Tezos staking rewards issued in the native token. There is currently no direct guidance from the IRS on how PoS rewards are taxed. Existing guidance has addressed instances where a taxpayer receives tokens as part of a hard fork and from proof-of-work mining. In those instances, the IRS has determined that because cryptocurrency is ‘property’ for tax purposes, the tokens received are ordinary income at the time the taxpayer can dispose of them, i.e. at the time they are created and issued as block rewards. By contrast, the Jarretts have asserted that this type of PoS staking reward is not taxable until it is sold, exchanged, or otherwise disposed of by the taxpayer. In May 2021, when the IRS did not respond to their request in a timely manner, the Jarretts filed suit in the U.S. District Court for the Middle District of Tennessee. On February 3, 2022, the U.S. Department of Justice (DOJ) Tax Division informed the Jarretts and the court that a full refund had been approved and that it had directed the IRS to issue the refund. However, the Jarretts rejected the IRS’s offer because the IRS would not provide assurance that staking rewards constitute taxable income at the time of disposition. Instead, the Jarretts continue pursuing the suit in an effort to receive a definitive ruling they believe will be binding on the IRS.

The IRS’s offer to the Jarretts prompted widespread — and presumptively premature — claims that the IRS has capitulated on its position regarding staking rewards. Unfortunately, the fact that the IRS issued a refund to the Jarretts does not provide any inference of guidance that taxpayers can or should rely upon. Notwithstanding the Jarretts’ rejection of the IRS’ offer, the tax refund was purportedly delivered on February 14, 2022. On February 28, the DOJ filed a motion to dismiss the Jarretts’ attempt to obtain an official ruling from the court.

An important procedural issue raised by the the DOJ, and overlooked by the myriad of internet posts claiming victory for the Jarretts, is whether directing a refund renders the Jarretts’ case moot as there is no longer a live controversy for the court to settle. The DOJ also stressed the second, arguably determinative, point that prospective or declaratory relief is unavailable in a refund lawsuit in the district court. The lack of resolution of the Jarretts’ claims regarding the treatment of staking rewards is not likely to be a strong argument against mootness. The Jarretts have filed a timely opposition to the DOJ’s motion. It is also worth noting that Coin Center filed an amicus brief echoing the Jarretts’ arguments and reiterating the importance of and need for clarification. However, it is unlikely that the court will ultimately issue a ruling on the motion that is favorable to the Jarretts.

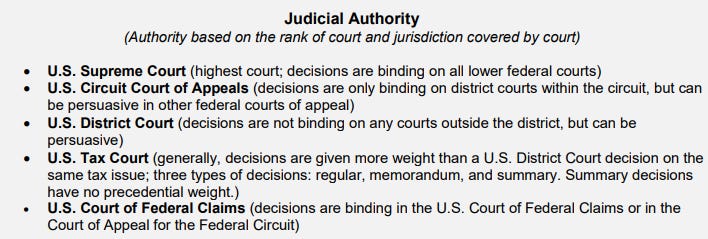

Notwithstanding any ultimate outcome, the best-case precedential value of the Jarretts’ lawsuit is likely to be nominal. For anyone not familiar with the inner workings of the IRS’s tax administration regime, there are multiple levels of formal and informal guidance affecting taxpayers as individuals or as a whole. Beyond that guidance, lawsuits to clarify ambiguities in the law can be heard in three primary trial court forums, the U.S. Tax Court, U.S. District Courts, or the U.S. Claims Court. The taxpayer has the right to choose the forum, subject to venue considerations. However, these three courts have different jurisdictional scope, procedural guidelines, and issue rulings with varying levels of precedential value. Ultimately, even if the court issues the type of order the Jarretts are seeking, the decision is not binding beyond that district. As noted on the table below, the Jarretts’ case would have to be appealed through multiple levels of appellate courts before it would have widespread precedential value.

Currently, PoS blockchains represent over half of the 1.68 trillion USD cryptocurrency market capitalization, and five of the top ten PoS blockchains have a stake rate greater than 50%. This is not including the valuation of Ethereum’s future transition to PoS. How the United States government treats PoS rewards is incredibly relevant to U.S. citizens and domiciled digital asset entities and requires clarity. While the offer of a refund to the Jarretts was lauded as an important and exciting moment for the crypto community, most commentators incorrectly attributed the IRS’s response as setting precedent. Unfortunately, because the IRS may have rendered the lawsuit moot by issuing a refund and because the venue precludes declaratory relief, even in the best case scenario for the Jarretts it is unlikely their lawsuit will generate regulatory clarity or have an impact on future IRS policy and guidance.

Individuals and digital asset entities subject to U.S. laws are subject to regulatory uncertainty that often limits involvement and innovation in the cryptocurrency space. Preemptive actions are an important and often necessary mechanism to resolve that uncertainty. However, parties considering litigation as a mechanism to elicit clarity should understand that litigating effectively against the U.S. government involves a variety of legal issues and procedural hurdles that are not generally present in litigation between private parties, and should plan accordingly if they intend to establish meaningful precedent.

One-Click DAO Creation With the New Kali Application

Author: COYSrUS.eth

Ready to set up your own DAO? The legal engineers at LexDAO have created a user-friendly application for creating new DAOs that anyone can use — even if you know nothing about coding, creating smart contracts, or running your own server or blockchain node. The application, called Kali, simplifies DAO creation and enables smart contracts that tokenize membership and execute and enforce funding, governance, voting, and other commitments. The contracts are optimized for gas efficiency and can be tailored. Kali also provides customizable legal forms maintained by LexDAO, with incorporation and full-service legal engineering support built into the user interface. A Kali DAO can be deployed on Ethereum, Arbitrum, Polygon, or a testnet.

The most innovative feature of Kali is its integration with a limited liability company wrapper called a Ricardian LLC. Ricardian is a smart contract with a Delaware LLC agreement function and related documents embedded in it. The master operating agreement allows for instant deployment of a new subDAO by minting an NFT. Ricardian LLC is a sort of ‘mothership’ entity that allows for the creation of multiple subDAOs under it, each with its own address, rights, and liabilities, that share Ricardian's limited liability protections. The mothership has no ownership stake in the subDAOs and handles the Delaware filing, taxes, and other formalities. This structure provides for limited liability without the need for separate LLC filings, greatly reducing the expense and complexity of establishing a new DAO.

Depending on the goals and needs of the founders in structuring their DAO, Kali allows for considerable customization. A DAO can be set up using different templates depending on its purpose — social club, investment club, or services company. Each template offers different baseline membership and voting protocols. Ownership tokens can be transferable or non-transferable. A DAO can launch with closed membership (like a Moloch) and be configured to allow for new members. Kali also offers flexibility on how tokens are minted and burned. A DAO can do a crowdsale, with a specific price in ETH or other token, a time limit, and limit purchases to a whitelist, and can allow members to burn tokens to claim their capital (like a Moloch rage-quit). Proposals can be set up to require either a simple or a supermajority, with or without a quorum requirement, for any of the 11 types of proposals (mint new tokens, burn tokens, call external contracts, set voting period, set quorum, set supermajority, set type of proposal, approve certain contracts, delete a pending proposal, or amend documents stored in the DAO).

Even with the expertise of the LexDAO team in creating the templates and legal documents, it's a good idea to hire your own counsel who is knowledgeable about smart contracts and blockchain-based organizations to make sure that everything is working the way you think it is and to help think through the legal ramifications of the DAO structure. Kali goes a long way to simplifying and streamlining DAO creation and is a tremendous addition to open-source DAO tooling.

🏛 Regulation

Arizona: The OG of U.S. Fintech Regulatory Sandboxes

Author: ComeBackKid

As part of our continuing series on regulatory sandboxes, this issue focuses on Arizona, which in 2018 became the first state in the U.S. to create a regulatory sandbox for fintech companies. The idea and rationale behind the initiative came from Arizona’s Attorney General Mark Brnovich, who made the case for stateside regulatory sandboxes in a 2017 op-ed in the American Banker with the premise that “fintech startups are burdened with a fractured and redundant regulatory system.” Moreover, he notes that “not only can it take several months to obtain regulatory approval to operate a fintech startup in just one state, but it can cost a startup thousands of dollars in fees, compliance costs and legal work. Launching a product nationwide is harder still. Entrepreneurs navigating our 50-state licensing regime commonly expect two years of frustration and expenses in the millions.” He concluded by stating that “states must look inward and recognize when our patchwork of state regulation stifles innovation and creativity.” Shortly thereafter, in 2018, Arizona adopted the regulatory sandbox legislation, making it the first U.S. state to do so. The law allows participants to develop, test, and deploy innovative products without licensure or authorization for up to two years, with an option for a one-year extension.

Arizona Sandbox Highlights

What Is the Application Process?

To apply, sandbox participants must fill out a form to provide information about their service or product to the Attorney General’s Office.

The application fee is 500 USD.

After approval, sandbox users will have 24 months to test their product or service.

A sandbox participant may request an extension of up to one year from the Attorney General’s Office.

Who Heads Arizona’s Sandbox?

The Office of the Attorney General is responsible for approving and providing entry of applicants into the sandbox.

The Civil Division of the office will administer the sandbox program.

The Arizona Consumer Fraud Act guides all products and services offered in the sandbox. All products must comply with all statutory limits and caps in Arizona law related to financial transactions.

What Are Eligibility Requirements?

The company must be under Arizona jurisdiction through incorporation, residency, or presence agreement.

It must operate and maintain records and date in a physical or virtual location that is accessible to the Attorney General.

Consumers must be Arizona residents.

The user base for a fintech product is capped at 10,000 customers. This may be increased to 17,500 if the company is financially solvent and has proper risk management protocols in place.

There is a cap on the maximum loan size.

The program ends on July 1, 2028.

Arizona’s Regulatory Sandbox at Work

One often-cited example is BrightFi (owned by parent company Verdigris Holdings, Inc.), which, according to its website, is a financial technology company with a mobile banking app that offers almost everything you’d get at a traditional bank at a lower cost with no hidden fees. The company’s goal is to expand financial services to traditionally underserved communities by making it profitable to serve these customers. Its success to date is in good part attributed to the streamlined process made available by Arizona’s regulatory sandbox. The company was founded in Ohio but moved to Arizona believing that the initiative would speed up its launch timeline. It graduated from the sandbox on July 17, 2020 and continues to serve its customers. Some other notable examples include companies focused on income-based loan repayments (Align Income Share Funding), refinancing car loans (With Clutch LLC), and helping banks integrate blockchain technology (Cryptoenter).

Resources

🙏 Sponsor: UMA - Making financial markets universally accessible. DAO Better.

🌐 News and Selected Articles

Goldman Sachs Makes ‘Milestone’ Crypto Trade With Galaxy Digital

Author: Ben Strack

🔑 Insights:

Goldman Sachs has added to the crypto products it trades, facilitating the first over-the-counter (OTC) crypto transaction with Galaxy Digital Holdings. The transaction was in the form of a bitcoin Non-Deliverable Option (NDO). An NDO is an option for which the underlying asset is not delivered but settlement on maturity is made in cash instead.

Goldman Sachs said at the time that the partnership with Galaxy Digital Holdings was the result of more clients looking to secure access to cryptoassets.

Max Minton, Head of Digital Assets for Goldman Sachs’ Asia-Pacific division, said in a statement on March 21, 2022, “We are pleased to have executed our first cash-settled cryptocurrency options trade with Galaxy. This is an important development in our digital assets’ capabilities and for the broader evolution of the asset class.”

Senators Lummis and Gillibrand Are Collaborating on a Regulatory Framework for Crypto

Author: Aislinn Keely

🔑 Insights:

New York Senator Kirsten Gillibrand and Wyoming Senator Cynthia Lummis are joining forces on a yet-to-be introduced bill that promises regulatory clarity for crypto. Specific details of the bill are yet to be disclosed, but the intention is that it will have a "broad-based regulatory framework for how this industry should potentially be regulated in the future" and “include a ‘standing body’ that will make judgment as the industry grows and parameters change.”

The bill will not make any changes to the existing definitions of securities used by the Securities and Exchange Commission (SEC). It will introduce "a new organization under the joint jurisdiction of the Commodity Futures Trading Commission and the SEC to oversee the digital asset market," among other provisions.

The provisions of the bill are still in flux as comments are being solicited from stakeholders. It will be introduced in the next several weeks and go through the usual processes of getting through Senate committees as well as hearings and proposed amendments.

Thailand Bans Crypto as Means of Payment

Author: Sam Reynolds

🔑 Insights:

On March 23, 2022, the Securities and Exchange Commission of Thailand banned the use of cryptoassets as a means of payment, citing money laundering concerns and the central bank's incapacity to intervene and assist with respect to the same. The commission further justified their decision by stating price volatility and high gas fees also make payment impractical.

The commission clarified that the ban is limited to digital assets being used as payment. However, investment and buying or selling of digital assets is permitted.

In January 2022, the government announced a comprehensive plan to regulate digital assets. Thai officials also declared in early March that cryptocurrency transactions on government-approved exchanges will be free from the 7% Value Added Tax until 2023.

Many real estate developers in Thailand turned to cryptoassets to spark the interest of a younger audience. They were using it as a means to attract foreign investment. However, the government disagreed with this sentiment and cited financial instability as an additional reason for banning payments in crypto.

U.K. Regulators Publish Cryptoasset Supervisory Framework

Author: Sam Woods, Deputy Governor and CEO, Bank of England Prudential Regulation Authority

🔑 Insights:

In a March 24, 2022 letter to CEOs, the Prudential Regulation Authority (PRA) highlights aspects of a prudential framework for measuring and managing crypto exposures, including expectations that U.K. regulated financial institutions maintain strong controls for market, capital, counterparty credit, and operational risks.

The letter was one in a series of publications issued by the Financial Policy Committee, the Bank of England, and the Financial Conduct Authority on the role cryptoassets and markets currently play in the U.K. and globally, a summary of responses to research on new forms of digital money, and guidance on risks such as financial crime and custody risks related to crypto activities.

The letter notes that “discussions are ongoing internationally on the prudential treatment of cryptoassets. It is likely that the long-term treatment will differ from that under the current framework. As the long-term framework is developed, the PRA will consult where this results in proposed changes to the regulatory framework.”

The PRA is also launching a survey of firms on their existing crypto exposures and plans for 2022, which are due back to the PRA by June 3, 2022.

Hong Kong Vows to Develop Its Virtual Asset Sector

Author: Christopher Hui, Secretary for Financial Services and the Treasury of Hong Kong SAR

🔑 Insights:

The Secretary for Financial Services and the Treasury recently published a blog, summarizing various measures taken by the Hong Kong government to develop its virtual asset (VA) sector.

Hong Kong is establishing a licensing regime for the VA service providers. Both securities-type VAs and non-securities VAs (such as Bitcoin) are subject to the licensing regime. Hong Kong’s regulatory philosophy is that “VA exchanges should be subject to the same requirements and obligations which currently apply to traditional FIs [financial institutions] in such areas as anti-money-laundering and counter-terrorist-financing as well as investor protection” to ensure consistency in regulation.

Hong Kong is contemplating the regulation of payment-related stablecoins. In particular, the regulators will look into risks such as whether there is a robust mechanism for supporting stablecoins’ value, or the impact on real economic activities in case of disruption of its payment function.

Hong Kong regulators are providing traditional financial institutions with guidelines on offering VA-related services to clients. For example, it is not necessary to impose the ‘professional investors only’ restriction on the distribution of certain VA-related derivative products as long as existing rules are observed and additional safeguards are in place.

🧰 DAO Legal Tools

Ryval Tokenizes Litigation Financing for the Masses

Author: MDLawyer

Financing for third-party litigation is a growing industry. The total amount committed to new financing deals in 2021 was 2.8 billion USD in the U.S. alone, representing an annual increase of 11%. Claimants intending to file a suit against a defendant with deep pockets may face prohibitive costs, thus creating an investment opportunity in sponsoring a party’s case. In addition, with the onset of the COVID-19 pandemic, the year-on-year increase proves that this 12.4 billion USD asset class is generally not subject to market forces and may be seen as an alternative form of investment.

However, these investments, which have seen significant profits over the years, are generally restricted to accredited investors, barring retail investors from betting on the outcome of lawsuits. Ryval aims to make this sector accessible to all and enable claimants to file suits that otherwise would not have been brought. The startup plans to achieve this by facilitating the purchase and exchange of cryptoassets representing an interest in the outcome of a particular case.

Leveraging a JOBS Act provision that allows for private early-stage companies to raise up to 5 million USD from Americans regardless of their wealth, Ryval will let investors acquire tokens, the value of which is directly tied to the result of a single case, and hold or trade them on secondary markets via the Avalanche blockchain. At the time of a settlement or verdict, whoever holds the token may cash in.

Investors in initial litigation offerings may stand to benefit from the liquidity Ryval intends to afford to a currently illiquid industry. The company is designing these litigation funding tokens in order for them to be traded on an ongoing basis, with prices being subject to the development of the case in real time. To assist newcomers in traversing such a complex sector, Ryval plans to give potential investors the essential facts of the case and the relevant procedural aspects, as well as other pertinent information including the past performance of certain types of lawsuits. Retail investors may not be a party to the lawsuit, but they can now get in on the action.