Layer 2 Summer Is Finally Here, Really! | Layer 2 Review

Quick Reads and Hot Links Covering the People and Projects Scaling Ethereum

Dear Frens,

Welcome to Layer 2 Summer (or Winter if you’re in the Southern Hemisphere)! Although we’ve been waiting for Layer 2 Summer for nearly two years, it’s safe to say that this time, it really is here.

It’s not the time for Layer 2s just because zkSync recently went live on Mainnet with its Era rollout, nor is it because Arbitrum dropped its much-awaited token. And no, it’s not because Coinbase is building Base on Optimism, promising to help onboard its 100 million users to DeFi. But with all the Layer 2 news, you certainly wouldn’t be mistaken for thinking so.

It’s Layer 2 Summer simply because people are finally using Layer 2s in droves. In fact, daily activity has been outpacing Mainnet all year, and it’s been by nearly a 3:1 margin for the last two months.

Suffice to say, it’s due time for us to launch a newsletter focused on the Layer 2 ecosystem. We’re going to cover governance, new projects, ecosystem updates, hot takes, and offer up a short editorial on a topic unique to Layer 2s. And with over 20 Ethereum scaling solutions and more set to launch this year, we’re going to have a lot to talk about.

For this issue, our editorial by HiroKennelly is a short(ish) explainer on Velodrome Finance. Velodrome is a revolutionary AMM that offers low-slippage trading and a way for projects to attract liquidity by combining the best elements of Curve Finance and OlympusDAO. In the future you may see articles on governance models, NFT projects, public goods funding, or how traditional businesses are using Layer 2s to connect to their customers.

If you have any hot tips or just want to let us know how we’re doing, please DM HiroKennelly on Twitter or Telegram. We’ll be shipping monthly to begin, but expect fortnightly issues in the near future. Thank you for being on this journey with us, and we’ll see you next month.

Contributors: KingIBK, Warrior, jengajojo, thinkDecade, tomahawk, Trewkat, HiroKennelly

This is an official newsletter of BanklessDAO. To unsubscribe, edit your settings.

✅ Action Items

🗳️ Vote: If you’re an Optimism Delegate, be sure to vote on current proposals.

🏃♀️ Catch up: After reading our article on Velodrome, check out the dApp.

🏛 Governance

⭐ Featured Proposals

Optimism introduces Collective Intents, a new way for its ecosystem to align on short-term goals. For Season 4, the Intents include:

Progress towards decentralization

Innovate on novel applications

Spread awareness of the Optimistic Vision

Increase governance accessibility

Optimism has proposed allocating 11 million OP tokens for Season 4 Intents.

In line with Collective Intents, Optimism’s Token House has introduced Token House Missions. The Missions help Optimism achieve its Intents, and must be completed within one season. Missions can be proposed by a group of contributors, called an Alliance, or these Alliances can apply to accept a Mission pre-defined by the Optimism Foundation.

🗳️ Active Votes

💬 Proposals in Discussion

Arbitrum:

Grants Funding Framework Discussion - How To Excel at Being a DAO

Optimism:

Protocol Delegation Program Renewal

Introducing Optimism Co-Granting

Polygon:

📈 Data

Total Value Locked on L2s is nearly $10 billion!

Top ten projects by Total Value Locked:

🔭 Project Watch

Arbitrum

New projects joining the Arbitrum ecosystem:

Projects with top daily transactions:

Optimism

Top NFT collections:

Top projects by TVL in the last seven days:

What projects users are flocking to?

Velodrome Finance Upcycles the DEX

The Curve Finance and OlympusDAO-Inspired AMM Is on Track to Finish First in the DeFi Race

Author: HiroKennelly

If you’ve ever watched indoor bike racing, you’ve seen velodromes: those beautiful race tracks with banked sides at the turns, made so that cyclists can focus on racing – speed, tactics, desire – rather than on steering. A velodrome is a race track designed and optimized for a single purpose: make cyclists the best racers they can be.

Velodrome Finance is doing the same thing for DeFi users and projects as a velodrome does for cyclists: providing an arena where crypto enthusiasts, traders, and builders can do their best work without worrying about things like high slippage, poor liquidity, and misaligned incentives. How does it do this? By combining two of the best elements of DeFi: Curve Finance’s voting escrow (ve) time-locked feature and the game theory incentivization engine created by OlympusDAO, also known as (3,3). Best of all, it’s built on Optimism, a rollup-powered Ethereum scaling solution that enables users to access DeFi for a fraction of what it costs on Ethereum Mainnet.

How Velodrome Works

At its core, Velodrome is an automated market maker, which means it was created to enable the swapping of digital assets. Uniswap may be the most famous of the AMMs, but there are many others. Anyone who has traded digital assets in pools without sufficient liquidity knows that slippage can eat into purchasing power, sometimes in amounts that leave one a bit shaken. Velodrome set out to solve the issue of how to incentivize liquidity in a way that is productive, sustainable, and aligned with the long-term success of Velodrome and its users, whether they be traders or other projects.

The concept behind Velodrome was first proposed and developed by DeFi legend Andre Cronje through the Solidly project. Solidly was a DEX built on the Fantom blockchain, and it made use of both the vote-escrow model pioneered by Curve Finance and the staking/rebasing/bonding model developed by OlympusDAO. Andre Cronje coined the mechanics ve(3,3).

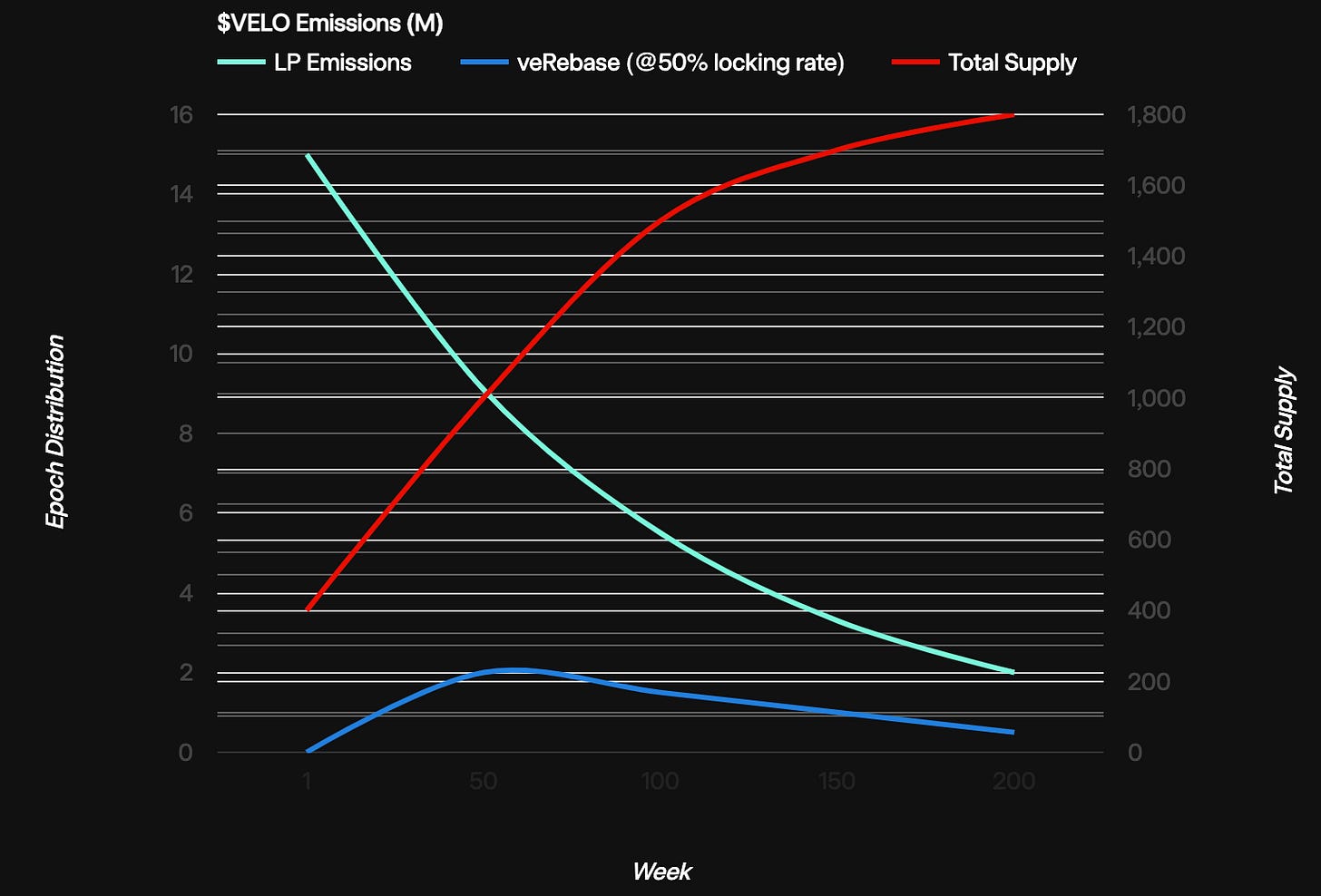

The Velodrome team previously launched veDAO to work within Solidly, but pivoted to Optimism after Solidly ran into problems. They took the most successful parts of the Solidly ve(3,3) model and improved on the parts that didn’t work well in practice; specifically they started tying rewards to emissions and prolonging emissions decay. You can read about the improvements on Solidly in Velodrome’s docs. These modifications to the model have proven successful. Less than one year after launch, Velodrome is far and away the most successful AMM on Optimism.

Velodrome makes use of a two-token model, VELO and veVELO, and its liquidity pools come in two types, those that are made up of like assets, such as pools that contain only dollar-denominated stablecoins, and those that contain more volatile asset pairs, such as wETH and a governance token, like OP. This method reduces the risk of experiencing negative slippage. However, Velodrome's tokenomics model is even more important than its pool division.

Protocol Emissions and Rewards

The tokenomics models derived from Curve Finance and OlympusDAO work together to incentivize the flow of assets to the most valuable liquidity pools. To do this, Velodrome rewards users in four ways: token emissions, protocol fees, bribes, and rebases.

In terms of token emissions, VELO is paid out to liquidity providers to offset impermanent loss and provide yield on deposits. This is now a standard practice across DeFi. What is not standard practice is that these rewards are determined by veVELO holders, meaning that during each epoch, VELO distribution to each pool is proportional to the number of votes that pool receives.

To receive veVELO, VELO holders must time-lock their tokens. Users who lock 100 VELO tokens for one year will receive 25 veVELO, while those who lock VELO for four years will receive 100 veVELO, a 1:1 ratio. To incentivize users to lock up their tokens, veVELO holders are entitled to protocol fees, voting rights, bribes, and rebases.

Protocol fees are basically trading fees, and these fees are streamed to veVELO holders in the pool’s native trading pairs, meaning that a USDC/OP pool will pay out USDC and OP to veVELO holders who voted for that pool to receive emissions.

Voting rights are valuable because it’s these holders who determine the liquidity pool emissions.

Bribes are rewards paid by a third party to incentivize a veVELO holder to direct emissions to a particular pool. Bribes are only paid out to those who voted to direct such emissions in proportion to their share of overall votes in a given pool.

Rebasing fees are additional veVELO tokens paid to long-term stakers to offset the dilution in their voting power that occurs with additional token emissions.

In practice, this design incentivizes veVELO holders to vote for pools which they think will entitle them to the highest protocol fees and bribes, and they are also betting that others will do the same. Assuming everyone is acting to maximize their self interest, more VELO tokens will be allocated to those liquidity pools, attracting more liquidity and thereby reducing slippage. With reduced slippage, more trades will occur that will generate more protocol fees. And we’re back to the beginning of the flywheel.

Finishing First

ve(3,3) is a proven mechanism that accomplishes for DeFi participants what a velodrome does for cyclists – it gives DeFi users and projects an arena to try out some of the best DeFi building blocks without losing focus on their core pursuit, whether that is earning fees or attracting liquidity. Directing VELO emissions to liquidity providers, designing a system than optimizes for low-slippage trades, giving vested community members 100% of trading fees and bribes plus additional voting power, and providing a platform that enables projects to attract liquidity through offering incentives seems to be the antidote for the problems facing many AMMs.

Creating products that align the interests of users, protocols, and the platform is one of the great challenges in crypto, but Velodrome reminds us that if you build a great track, the racers will come. And in this case, they will be well rewarded for not only putting in the training, but for showing up to every race.

🗞️ Ecosystem Updates

⛓️ Two Weeks Ago, On-chain Volume on Arbitrum Surpassed Ethereum

🆕 Ontology Foundation Incubates New Layer 2 Solution: Goshen Network

➿ Loopring (LRC): Scaling Decentralized Exchanges With zk-Rollups

⚡ Exploring Ethereum's Ecosystem of Layer 2 Blockchains

🧠 On-chain Analysis of Ethereum and Its Layer 2 Ecosystem: IntoTheBlock

⭕ Arbitrum Announced the Launch of Its Roundtable Series—Explore The Core!

🔒 StarkNet Aims to Enhance Scalability, Privacy and Security on Ethereum

📈 DeFi Driving zkSync Growth as 1inch Deploys on Ethereum Layer-2 Scaling Platform

🔮 Coin Bureau Predicts Ethereum (ETH) Layer-2s Will Play Dominating Role in Crypto Payments

🧰 Metis (METIS): A Multi-Faceted Layer-2 Solution

🔀 zkSync Era Crosses $200M In TVL While Polygon zkEVM Trails

🏁 Arbitrum vs. Optimism: What’s the Difference Between These Ethereum Rollups?

📶 Boba Network’s Advanced Ethereum Scaling Solution

🌌 Moving Beyond the Blockchain Trilemma: L1 vs. L2

I'm not convinced Velo bribes work for sticky liquidity. Agreed they're definitely better than direct payment a la food coins, but CRV become massive bc it had a marginally better model than the extant 2020 tokenomic distribution models for organizations.

then CVX comes along and gave veCRV holders liquidity again and everybody went crazy on it. Turns out ppl talk about the long-game with ve model but most don't actually want to wait for it (VC model).

veVELO is same tokenomic model but for a noncorrelated assets, bribes have shot up but have fees earned raised equivalently? Obv more bribes is better for those who can tolerate the risks and LP but spending more of your native token that will be inevitably dumped on the farside of LP incentives doesn't seem worth it for organizations.

all this is to say, I'm not convinced that increased incentives are good for the organization as opposed to looking for other ways to multiply liquidity spend.