It’s About Time (-Locked BANK) | BanklessDAO Weekly Rollup

Catch Up With What Happened This Week in BanklessDAO

Dear Bankless Nation 🏴,

It’s probably fair to assume that those of us who appreciate blockchain’s potential are quite open to change, but the process is not always easy. Keeping up to date can be a challenge, as can forming an educated opinion about new initiatives, but BanklessDAO needs your input if we are to truly decentralize the process of organizational decision making.

As the DAO approaches its two-year anniversary, many contributors to the DAO are concerned with mitigating value loss and stabilizing the BANK economy. In this week’s editorial, Tomahawk walks us through the concept of time-locked BANK, its importance, and potential utility.

In this week’s Community Call round table discussion, Icedcool talked about plans to introduce a new season pass associated with the tlBANK, and the advantages this would provide to the DAO. Listen to the Community Call recording on YouTube to hear Icedcool address some of the concerns raised by community members in relation to this planned change.

Remember to join the Education Department for some awesome training this coming week. There are also protocol demos, podcasts, newsletters, and articles to feed your brain and keep you excited about the future of web3.

So much is going on and the bDAO train is moving. Make like an Easter Bunny and hop on board; sit back, relax, and catch up with the Weekly Rollup.

Contributors: Tomahawk, Perchy, angelspeaks, anointingthompson1, Allyn Bryce, WinVerse, theconfusedcoin, Warrior, KingIBK, Jaux, siddhearta, Trewkat, HiroKennelly

This is an official newsletter of BanklessDAO. To unsubscribe, edit your settings.

✅ Action Items

🏛 Participate by commenting and voting on Season 8 funding proposals.

🤓 Learn about ZKX or Helix in upcoming demos in the Amphitheater.

🎉 Celebrate: help to plan the transition to Season 8 and bDAO’s 2nd birthday!

🏃♀️ Catch up: Review this week's Community Call notes or listen to the recording.

🏛 Governance

Proposals in Discussion

Delegating VITA Tokens to DAOstewards.eth

This proposal aims to build on top of the treasury swap BanklessDAO did with VITADAO last year by delegating VITA token voting rights to DAOstewards.eth and therefore improving BanklessDAO’s participation in VitaDAO’s governance.

Selection and Election of BanklessDAO Vault Multi-Signature Wallet Signers

There is a slight change to the proposed text in this bDIP to correct a factual error. The proposal has already met quorum but Icedcool has posted the updated text to allow time for comment until this Sunday, April 9.

Uniswap LP Pool Fees — Withdraw to Multisig

We need quorum on this proposal! BanklessDAO has now earned on its full range Uniswap liquidity position, equating to ~1.1 million BANK and ~9.76 ETH. This proposal is to collect these accrued fees and deposit them into the BanklessDAO Multisig. A no-brainer? Go and vote please!

It’s About Time (-Locked BANK)

Author: Tomahawk

Lock It Up

You are not sufficiently bullish on BanklessDAO.

I think that part has been established — no one really is, anon. But just how bullish are you?

Maybe, like me, you’ve been a ‘gung ho’ contributor and BANK holder for many months now, and see this DAO as a fueled rocket, sitting on the launchpad, waiting for ignition. If so, this next update in tokenomics is going to light your fire.

A new core-primitive function for the BANK token is being prepared, and it will bring a new dimension to BANK tokenomics: time-locking. Soon the most bullish among us will be able to flex ownership of an all-new, bDAO mega-bull status symbol.

Let’s talk about time-locked BANK (tlBANK)!

Why Time-Locked?

The BANK token has served us well for nearly two years, but let’s be honest. It could do a better job of aligning incentives and driving the mission.

Many DAO contributors are building their governance stake over time and contributing as a way to invest in the DAO’s future. Contributors are also using earned BANK to supplement their income; this is fine and typical. The DAO has always supported contributors who have economic needs, and we don’t shame those who sell the token to meet expenses. But we can see that the monetization of rewards isn't a sustainable model for our token, especially after a prolonged crypto bear market.

Fortunately the DAO reclaims many of these sold tokens by being a liquidity provider, but what we don’t reclaim is the token price. Put simply, we are not onboarding new Level 1 (L1) DAO members fast enough to compensate for contributor sell pressure.

Since a large portion of our treasury multisig is in BANK, real value is leaving the treasury with every market dump. How can we mitigate this value erosion and stabilize the BANK economy? The Tokenomics Department has spent several seasons reviewing this plight, and tlBANK is the first and perhaps simplest mechanism we are adding to address the issue.

What utility can be added in the future with the time-locked function? There are lots of potential use cases. Consider that:

We can provide additional benefits to tlBANK holders, to incentivize each contributor to grow their stake and invest in the future of the DAO.

We want to give DAO teams the tools to ensure strong value alignment is placed where it is needed.

tlBANK with variable lock terms could be used in place of BANK whenever a project or guild needs to incentivize long-term value alignment.

The locking mechanism adds price stability by freezing liquidity, stretching out sells and making them less frequent.

Tooling

The bDAO Treasury Department has chosen Hedgey Finance to facilitate the creation and redemption of tlBANK. Hedgey creates “financial infrastructure for DAO treasuries to help them diversify assets, alleviate contributor sell pressure, and prosper through DAO to DAO swaps.” In addition to token locking, they also provide web3 organizations with services for vesting and token swapping without the need of a trusted escrow.

A swath of heavy-hitting DAOs are already using the platform, such as Gitcoin, IndexCoop, Safe, and Shapeshift. Their endorsement and Hedgey’s track record of being a value-aligned, open source builder really inspires confidence, and shows that their protocol is aligned with the BanklessDAO ethos and mission. Hedgey Finance famously handled the SPORK token distribution at ETH Denver.

Add it all up, and that’s some serious Ethereum community street cred.

Protocol security is a strong suit. Hedgey has undergone five audits of their platform, with a sixth audit due any day now. While you can never be 100% confident an exploit or bug won’t be discovered, the more times their open source code is pored over, the less likely it is that we’ll see major issues with the protocol moving forward.

How Time-Locking Works

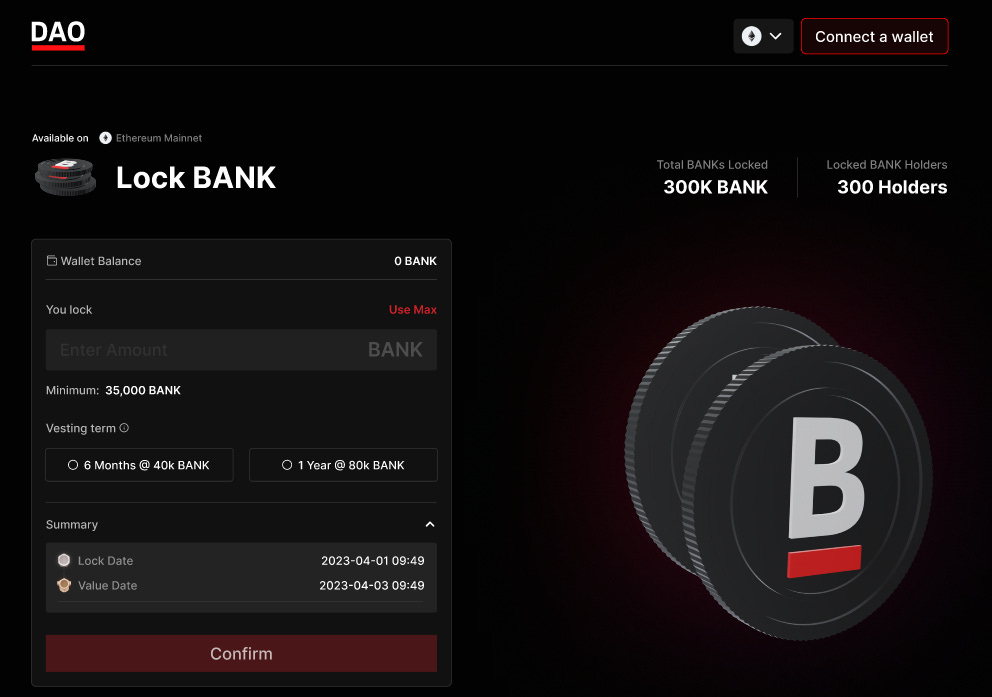

Hedgey’s toolset is basically a multi-function vesting smart contract. BANK holders wishing to lock their tokens will connect their wallet to the customized interface and then select their chosen amount of BANK and the length of time to be locked. BanklessDAO’s frontend design isn’t final, but it will probably look similar to the Figma image below.

After completing the transaction, the holder will receive a custom bDAO NFT to represent their locked stake of tlBANK, featuring artwork by none other than our own Perchy! The native lockup amounts for tlBANK are proposed at 40k for six months and 80k for one year. The options in our customized interface will be limited at first as we integrate Collab.Land functions to the tlBANK NFT, but we will be able to add more capabilities and make future adjustments upon review of how the mechanism is working for us in practice.

Applications of tlBANK in the Works

tlBANK is a critical element of our Tokenomics 1.0 initiative to build a more complete BANK economy and drive value alignment in a more sustainable way. As Icedcool put it in the Forum post:

We now have the opportunity to develop an economic ecosystem that better supports the token, has a larger range of utility that supports growth and better aligns contributors to the DAO.

We propose a modular multi-initiative approach that is mutually independent and supports the next evolution of our tokenomic ecosystem. This initiative will support the long term viability of the DAO… and grant additional utility to BANK.

Read more about the full Tokenomics 1.0 specification and join in the Forum discussion today!

Another core element of bDAO’s Tokenomics 1.0 is the Season Pass initiative, which builds upon the tlBANK primitive to confer an all-access pass to DAO utility for holders of the tlBANK NFT. The first utility (beyond the art) of the tlBANK NFT will be automatic L1 for those who mint.

The Tokenomics 1.0 implementation is deliberately slow and iterative to avoid abrupt transitions and to allow the needed time for planning, troubleshooting new mechanisms, and membership continuity. As such we shall propose maintaining the 35k BANK holding as the primary way to attain L1 membership to facilitate a smooth transition for current members who are not ready to lock.

Rather than replace L1, the forthcoming bDIP will instead propose implementation of a secondary route to L1 membership with equal rights and privileges to all wallets that mint tlBANK. This will allow DAO members the opportunity to choose whether:

they would like to simply hold the 35k BANK as normal, or

mint tlBANK and use their NFT instead for L1 access.

Keep an eye out for this important bDIP!

The Impact

I’m excited about tlBANK because it enables future use cases that will help us focus on longevity and sustainable operations, and once proven, this time-locking core primitive can be extended and generalized to drive long-term value alignment in any guild or project.

Locked-BANK NFTs incorporate art value and open up new trading opportunities for value-aligned BANK investors looking to acquire tlBANK at discounted prices. Projects can incentivize a sustainable, long-term approach to building by offering tlBANK as rewards.

So let’s lock the BANK and unlock our creativity. The possibilities for tlBANK are limited only by our imagination!

🗓 Set A Reminder

📈 ZKX Demo

ZKX is a trustless, borderless DAO which is bringing the CEX experience to Starknet. This is the first perpetual futures DEX on Starknet with self-custody and true community governance. Join this demo in the Amphitheater on Wednesday, April 12 at 18:30 UTC.

⛓️ Helix Demo

Helix is a protocol that rewards community members for answering developers’ questions. Helix is changing the way communities engage by enabling web3 protocols to utilize the expertise of their dedicated communities. With Helix, protocols can reward their knowledgeable members for answering support questions. Join this demo in the Amphitheater on Wednesday, April 12 at 19:15 UTC.

🏬 How to Collab.Land

Collab.Land is an automated community management tool that curates membership based on token ownership. RSVP to join the Education Department and learn about tipping and gating in Discord on Tuesday, April 11 at 14:00 UTC in the watercooler voice channel. Participate in showing appreciation to friends who work with you and have in some way, made an impact on you. To be onboarded to the Zep platform, you must hop in 15 minutes before the event starts.

Check the async learning resource here.

🔩 How to Sesh Bot

Sesh is a bot for organizing activities like events and setting up polls on Discord. If you would love to know how to register and get your events on the sesh, RSVP to join the Education Department on Wednesday, April 12 at 14:00 UTC in the watercooler voice channel. Hop in 15 mins before the event start to be onboarded to the Zep platform. Check the async learning resource here.

🧰 How to Discord

Learn how BanklessDAO uses Discord at this event on Thursday, April 13 at 14:00 UTC in the watercooler voice channel. RSVP and bring your questions about bots, threads, permissions, and navigation tips. Here are the slides and the lesson plan. You can always find Discord Help documentation in the How To Guides on the home page of the DAO Notion site. Remember to hop in 15 minutes before the event start to be onboarded to the Zep platform.

👀 In Case You Missed It

📺 Weekly Rollup Recap With Allyn Bryce

Allyn is keeping it four times as classy with this recap of last week’s Rollup, which focused on the proposal to implement a quadratic funding pilot for selected bDAO projects. Don’t forget to support the Rollup Recap proposal for Season 8!

You can find all the previous episodes on the BanklessDAO YouTube Channel.

💼 Understand On-Chain Proof of Work

Unable to understand what on-chain proof of work means ? Listen to this insightful Twitter Space recording with Work on Chain and bDAO contributors, Feems and Ornella, as they look to deconstruct working in web3.

Also check out the Work on Chain podcast where Feems chats with Richie Bonilla of Quests about working as a freelancer in web3.

📝 Season 8 Proposals

Season 8 proposals are due from all those seeking BANK disbursements. When submitting your proposal, please follow the specific templates outlined for Guilds, Departments and Projects. Remember to add a poll at the end of the proposal. Quorum required for each Forum post depends on the amount of BANK requested.

✍️ Bankless Publishing

🍔 Grab It While It’s Hot

🧑🏽🎨 d’Art Drops

These weekly art drops are a collaboration with up-and-coming NFT artists, for the Bankless community, presented by Decentralized Arts.

Title: Settled

Artist: Dark World Arts

Description: This is for the hodlers, the crypto natives and newcomers who recognize the long term value in their investments and are unwilling or reluctant to sell as a result. These individuals and communities are content to watch the tumultuous market roll violently between peaks and valleys, unfettered by drops and unmoved by rises, because they know they’re setting themselves up for success in the next bull run, and the next one, and the next one.

Cost: 0.02 ETH

Editions: 100