Dear Bankless Nation,

To paraphrase a well-known legal scholar, “code is law.” But those of us in the legal profession know that this often-misused phrase should not be construed literally. The law in its traditional sense impacts us all, from developers coding smart contracts to DAOs leveraging this code to change the future of social relations. But unlike code, people are not immutable, nor are they sublimated to the code:

Decentralized Law is the playground for this interaction between decentralized technology and legal scholarship. As our ecosystem grows, the legal uncertainty faced by its many players is well-documented. From crypto-traders and developers to DAOs and prominent protocols, we are all paying attention to the emerging legal frameworks seeking to undergird what we are building. Whether we like it or not, we must become conversant in the international language and actions of regulatory authorities.

As some say in our field, “we are still early,” and that is ever-so-true as we explore the interaction between the law and crypto-native technology. And while we are most often focused on, and fearful of, heavy-handed regulation, Decentralized Law is here to help us understand that not all regulation is bad, not all government intervention should be feared. Many national legislatures are adopting innovative approaches to crypto regulation, seeking to ensure that minimal harm is done to inevitable technological advancements. Others, more reluctant and ossified, choose the more conservative strategy of regulating under existing legal frameworks. And to be sure, the absence of clear guidance from regulatory and other governmental authorities rightly amounts to peril for our industry, as this lack of clarity induces players within our ecosystem to foster what some consider to be overly-cautious, limiting behavior.

Decentralized Law will be a crypto-legal observatory, a place where readers will find a selection of news, articles, analyses, interviews, and discussions covering legal developments impacting the crypto ecosystem. This newsletter is decentralized not only in its name: Decentralized Law will analyze legal developments in a global context, fostering varied perspectives from a variety of jurisdictions. True to its decentralized nature, everyone is free to contribute and to express his or her views on these developments - the newsletter is open to everyone willing and able to contribute.

Although this newsletter may help to familiarize readers with the legal implications arising out of blockchain technology, the contents of Decentralized Law are not legal advice. This newsletter is intended only as general information. Writers’ opinions are their own; therefore, nothing in this newsletter constitutes or should be considered legal advice. Contact a legal expert in your jurisdiction for legal advice.

Authors: BanklessDAO Legal Guild (eaglelex, hirokennelly.eth, jalaj719, drllau, taxpanda, Bauhaus, SchwarzeKatze, LarryFlorio, Delgadoge, GC)

This is the official legal newsletter of the BanklessDAO. You are subscribed to this newsletter because you were a Premium Member of the Bankless Newsletter as of May 1, 2021. To unsubscribe, edit your settings here.

👉 In this inaugural issue of Decentralized Law, we interview prominent crypto-lawyer Sarah Brennan, explore blockchain regulation, discuss China’s “crypto ban,” provide insights into the parallels between informal Chinese markets and DeFi, consider the basic tax implications of delighting in the cryptoverse, and highlight recent news and selected articles from around the crypto-legal ecosystem. Let’s get to it.

🎙 Interview

Crypto-Lawyering with Sarah Brennan

Please tell us something about your background and how you started to deal with crypto-legal issues?

I have been a corporate and securities attorney for over a decade, working in DC and Latin America and spending the majority of my career in NY. I really got into crypto in 2017, starting a practice group in late 2017. I have an international development background and technology has the ability to be a societal equalizer - but I was interested in crypto initially as a hyperinflation safe haven and in its remittance use cases. More generally, crypto presents the ability to study the intersection of law and economics, game theory, and optimizing incentive schemes among stakeholders. There are opportunities to do original work in governance design/mechanics and to dare to dream of having a role in shaping policy.

I recently joined the team at Delphi as the GC of Delphi Ventures, which I could not be more excited about. There is so much talent there and I am excited about what we can do in the space. Part of the work I will be doing at Delphi will be helping with policy and advocacy efforts and putting together formulations for best practices in the industry. I am also more broadly interested in helping with social good initiatives, building communities with aligned incentives, and promoting an open-source mindset. I enjoy working collaboratively, engaging with/debating others, and really enjoy the intellectual challenge and rigor of working in the space.

Do you think DeFi is the “Wild West,” as some argue?

As I am sure you know, I think this line is tired and disingenuous. It is used interchangeably with the line about how it is quite clear that existing law applies and projects should just comply. Well, which is it, right? To the extent existing law applies, there should be an effort to produce guidance around compliance. This is a new space, and do I think it could benefit from self-regulatory initiatives and the development of best practices? Sure, but there is already an appetite for that and projects are acting on their own volition to introduce transparency initiatives and improve governance.

I also think that since we have had to hear this "Wild West" line since at least 2014 and it evokes images of just the world’s most terrible movie, they should really try some other idioms out - might I suggest: a den of iniquity, a vice ring, a market for back alley dealings (s/o to Palley on that one).

In your opinion, what constitutes a sound regulatory approach to crypto? Are legal reforms absolutely needed?

A sound regulatory approach to crypto addresses the actual risks posed instead of trying to advance theories why the change in paradigm posed by DeFi should be “per se” illegal because they do not have licenses required of centralized businesses. This rhetoric is anti-competitive and protects incumbents more than it necessarily advances the legislative intent of these laws, which is to address the risks posed by the particular business. It is the definition of “arbitrary” to apply law to address risks that do not apply to the facts on the ground.

I think a lot of projects would be open to that (regulating risks posed) and have expressed an interest (and need) to educate regulators on DeFi - this is one of LeXpunK’s core goals on the policy front. Namely, we are focused on advocating for regulatory development that *makes sense based on the risk landscape* but because that will be a long time horizon for us to see meaningful progress, we are also working on (i) formulating solutions to suit our purposes out of existing law (trying on entity structures, like the coop model for instance), and (ii) developing crypto-native solutions (self-help and self-regulatory/best practices, opt in arbitration mechanisms, formulating “customary” practice). LeXpunK really shifted toward the builder defense priorities in response to this U.S. administration’s seemingly hostile stance towards the crypto space and the need to provide devs and others with a voice and an advocate.

I find the end goal of the recent rhetoric very confusing frankly (saying that the whole space exists solely to avoid complying with law, etc). It would make sense, just from a pure public relations perspective, for regulators and policy makers to tone down the hostile rhetoric. When projects reach out to you (because you are asking them to repeatedly), engage in a productive dialogue with them as opposed to referring them to enforcement, and generally [work] to develop trust and to attempt to mutually forge a path forward on policy/regulation that addresses legitimate concerns around risks and disclosure.

What would you suggest to DAO founders who are willing to seek legal advice?

First, let me premise this response [by saying] the use of the term “willing” is appropriate in that it is reflective of the fact that the crypto market would not exist without some risk appetite, as projects unwilling to accept uncertainty in the space don’t ultimately come to market. DAOs present a whole host of legal and regulatory risks and uncertainties. Some of these risks are because DAOs do not typically utilize legal entities to wrap around and shield liabilities of the business (or activities, if a social club) and therefore DAO participants do not have the benefit of the entity as a shield for personal liability. This means that there is a potential (and often spoken about) risk that a plaintiff could sue one or more contributors and hold them personally and joint and severally liable for the entirety of the losses or damages claimed as general partners of a de facto general partnership.

There are also risks based on a DAO's underlying business model, many are involved in decentralized finance (DeFi), which poses unique risks for participants as opposed to a DAO formed to invest in NFTs, for instance.

Finally, there are operational pain points. The DAO does not have legal standing to sign contracts or to enforce contract rights. The DAO is not able to pay taxes or officially employ contributors, which could lead to tax liabilities for contributors.

When looking at the risk landscape for a crypto project, there are two types of risk - risk that cannot be mitigated (i.e. risks from past acts and clearly this would also be business specific) and risk which can be mitigated and/or managed (i.e. ongoing operational risks). I think it is important to involve legal counsel to understand the broader risk landscape for the project, and then to analyze and present it with a relative weighting (how remote the risk is, penalties involved), and the risks that are capable of being mitigated should be presented along with actionable steps for risk management. It is important for lawyers in this space to be more creative and flexible than in traditional practice and to be solutions-oriented where possible. This means navigating evolving global regulation and regulator sentiment and making sound decisions going forward amidst the uncertainty.

Is a legal entity needed?

This might get a little too existential - but let’s back up to discuss what is a DAO? What are the defining characteristics? There are largely two camps of thought around how to approach DAOs - the Wyoming camp, which prioritizes automating governance and process through code. To others, you have essentially just formed an LLC with some processes that may (or may not) have added efficiencies. Membership is dictated by equity ownership in the DAO (with all of the drawbacks). Another way of thinking about DAOs is to focus on the decentralization aspect (sometimes called DOs) - to see decentralized organizations as cloud cooperatives, horizontal organizations, where a membership nexus is established by participation and there are fluid entries and exits. I see one as an evolution (and debatable how much of a step forward) and the other as more of a revolution. Nevertheless, there are significant drawbacks to the revolution model, as we discussed above in terms of personal liability concerns, but also tax uncertainties, jurisdictional questions, and operational pain points. A legal entity would be helpful to give more certainty on all these points. However, use of existing entity structures have significant drawbacks when used because they were not created to accomplish the goals that DAO participants are seeking to accomplish - as such, they all are like ill-fitting sweaters that people are trying on. Many of the models being worked on are trying to utilize entities that do not entail ownership stakes such as trusts, Cayman memberless foundations, coops, or leveraging unincorporated association laws but all of these are ongoing experimentations using the legal structures that exist today.

🏛 Regulation

Defining a Regulatory Approach for the Blockchain Ecosystem

Author: eaglelex

The law is a social construction that reacts to social changes. In doing so, the law is always in delay when it comes to assessing and regulating new phenomenons within society. Regulating a technology as disruptive as the blockchain is an enormous challenge, which involves different political concerns. On the one hand, the regulators want to prevent systemic risks and dangers for investors and consumers. On the other hand, they do not want to create obstacles to technological innovation and to the advent of a digital economy.

Legal systems and public authorities possessing administrative powers are following different paths. This creates arbitrage opportunities for market players, who choose the jurisdiction where to set their venues and start their activities depending on the legal treatment concerning cryptocurrencies, taxation, etc. Some big crypto exchanges have built complex networks of companies spread around the world, which take advantage of jurisdictions showing a friendly attitude towards crypto and/or crypto tax havens.

Actually, such a situation is not new. Legal systems compete to catch investments and wealth in building friendly onramps for companies dealing with new technologies. El Salvador’s adoption of Bitcoin as a legal tender is only the latest (and perhaps the most visible) testament of a wider movement of countries, which - sometimes also for economic and financial difficulties - see cryptocurrencies as an opportunity. The risk related to the described competition is a kind of race to the bottom, where national jurisdictions erase their settled legal requirements (concerning significant aspects such as, for instance, anti-money laundering) in order to attract businesses.

As said, this is not new. Nevertheless, the blockchain adds an additional layer of complexity. Its inherent innovation lies in the fact that it allows for the building of decentralized organizations (DAOs), which simply do not want to be inhibited by the rules of a given jurisdiction. Its inherent decentralized and open nature makes them unfit to settle in a nation state. Moreover, the type of activity and the use of cryptocurrencies do not pose the practical need of getting in contact with the off-chain world.

In this respect, the main regulatory challenges are:

assessing the legal status of tokens;

determining a regime for DAOs concerning liability and taxation.

The starting assumption of regulators of the Western world seems to be that it is appropriate to apply financial regulation to crypto assets. This stance was initially based on the need of financial capital to develop the technology. In other words, investments of capital were needed to kickstart blockchain innovations. The approach adopted by regulators brought to kind a common narrative which has created many uncertainties in determining the scope of application of already existing rules dealing with financial services. Smart contracts and cryptocurrencies give rise to a wide array of activities with different features, able to change over time due to the work of developers and contributors.

The main question from the standpoint of legislators or competent agencies seems: Do we need new rules to tackle the innovative nature of blockchain technology?

The United States approach on the issue is not entirely clear, but public declarations of the Securities and Exchange Commission’s chair Gary Gensler go in the direction of considering the existing rules on securities fully applicable to crypto assets. This has led to worries in the ecosystem and to some lack of understanding, notably for the Coinbase “Lend” product. Not everything is a security, but how can a business determine which rules to follow?

The European Union has developed a very cautious approach. The importance of distributed ledger technologies for financial services has been stressed in a Resolution of the European Parliament back in 2018. The European Institutions then started to develop a digital finance strategy culminating with the draft Regulation on Markets in Crypto-Assets (MiCA), which has been designed to provide a comprehensive regulatory framework for digital assets. MiCA clarifies when a token should not be considered a security. In addition, it provides for stringent rules on stablecoins and crypto-related activities such as exchanges.

Finally, one has to mention the friendly Swiss approach. Switzerland is commonly considered “the” crypto-friendly legal system. This is particularly due to the comprehensive and helpful approach of the Swiss Financial Market Supervisory Authority (FINMA), which hands out inclusive advice and short guidelines for the blockchain operators. In its “Guidelines for enquiries regarding the regulatory framework for initial coin offerings (ICOs)” FINMA has established three categories of tokens for the purpose of understanding whether to apply financial regulations.

As to the problem of shaping a reliable set of rules for DAOs, the efforts seem absolutely insufficient so far. Interesting experiments, such as the Wyoming bill, do not capture the decentralized nature of the organization and may generate additional problems. European law and Swiss law do not cover the issue and, for crypto-related activities, they require the presence of an entity with full legal personality. Actually, the only viable solution would be to create an international set of rules, able not to harm the digital nature of the organization. The COALA DAO Model law represents a good basis for an international convention because it respects the inherent features of the digital organization and provides solutions for matters of liability and taxation.

The complexity of the framework does not make things easy, but it is possible to identify some important factors that should influence law-making activity. Obviously, it is first necessary to deeply understand the peculiarities of blockchain technology. In addition, there is the need to collaborate with people who are involved in the industry in order to understand their expectations and respect their views. In conclusion, an international collaboration is essential, as permissionless blockchains do not consider nation-state borders.

⚖ Developments

China’s Crypto Ban: Final Nail in the Coffin?

Author: Jalaj

On 24 September 2021, People’s Bank of China (PBoC), China’s Central Bank, declared all crypto-related transactions unlawful, citing that such transactions breed illegal and criminal activities like gambling, fraud, money laundering, etc. This was, by far, the most extreme and aggressive step taken by the Chinese government to ban cryptocurrency and its mining. All sovereign governments, in order to assert their power, enjoy a monopoly over distribution and regulation of the flow and use of money in the economy; they do it through a series of intermediaries, such as banks and financial institutions. Chinese policymakers are concerned that cryptocurrencies will erode and weaken the government's authority over this financial system and compete with the official central bank reserve currency (DC/EP). For the same reasons that the Chinese authorities maintain a monopoly over information and speech through the Great Firewall, they also want to maintain a monopoly over the country’s financial system as blockchains and cryptocurrencies eliminate the need to manage or distribute money when peer-to-peer transfers can occur between two parties. Cryptocurrency fundamentally alters the role of all governments. Autocratic leaders are only as strong as their monopoly over finance, defense, and law and order. Hence, the Chinese authorities have made multiple attempts in the past to restrict cryptocurrencies.

While stories regarding China’s inspection and regulatory interests with respect to cryptocurrencies have appeared multiple times over the last eight years, none have resulted in an absolute prohibition of cryptocurrencies and related activities. Previously in 2013, the PBoC forbade financial institutions from handling Bitcoin transactions as it believed that Bitcoin was not a currency in ‘real terms.’ Reports emerged in 2017 that the PBoC was tightening regulatory pressure and pushing the country’s Bitcoin exchanges to come into full compliance with anti-money laundering rules. Additionally, China also banned Initial Coin Offerings (ICOs) in 2017 on the grounds that it facilitates illegal fundraising and financial frauds. Further, in 2018, China’s Central Bank, Banking Regulatory Commission, Central Cyberspace Affairs Commission, Ministry of Public Security, and State Administration for Market Regulation issued a warning about illegal fundraising via “blockchain” and “cryptocurrencies.” Recently, in May 2021, the National Internet Finance Association of China, the China Banking Association, and the Payment and Clearing Association of China announced that bank and payment institutions cannot conduct business related to cryptocurrencies, specifically banning a slew of activities including cryptocurrency registration, trading, clearing, and settlement.

By prohibiting financial institutions from participating in cryptocurrency transactions, China may have created market space for state-owned banks to establish their own blockchain ventures. Since early 2017, the PBoC and other state-owned commercial banks have been developing encrypted transaction systems which isolate blockchain technology from cryptocurrency's speculative financial applications. Thus, one could argue that by prohibiting cryptocurrency transactions, China is attempting to facilitate and aid the establishment of another, namely a state-sponsored, "centralized" digital currency - the Yuan. Denying cryptocurrency as a form of currency due to the lack of a legal tender, the PBoC later proposed that the state-initiated cryptocurrency could compensate for cryptocurrency’s lack of anchoring in values. The 2020 amendment to China’s Civil Code elevates the state-sponsored cryptocurrency to the status of property. Such state-backed digitized legal tender would allow the Central Bank and the Government to more carefully monitor the velocity of digital transactions, which is not achievable with cryptocurrencies. The constant restrictions with respect to cryptocurrencies reflect that the Chinese authorities fail to differentiate between utility and security coins.

Additionally, this move will impact the miners and cryptocurrency exchanges that are now forced to move out from China, which has been one of the world's major mining centers owing to its comparatively low electricity prices and inexpensive mining technology. Data from the University of Cambridge suggests that there has already been a substantial decline in China’s share of global Bitcoin energy use. In September 2019, China accounted for 75% of global Bitcoin energy use. By April 2021, that figure had dropped to 46%. Following the Chinese regulators' crackdown, the incentive to validate transactions (mining) has essentially increased all over the world and presents other Asian and Eastern European miners an opportunity to gain enormously from China's actions. Cryptocurrency exchanges are seeking an alternative to China as well, and so other countries could perhaps seize this opportunity to relax certain norms and assume a leadership role in the development of such exchanges. However, other countries, such as India, might take inspiration from the steps taken by the Chinese and impose similar hostile conditions.

In terms of valuations, despite several setbacks coming in from China, cryptocurrencies have historically been able to recover losses and make gains. While the news of this most recent ban in China resulted in a sharp fall in cryptocurrency prices, wiping out most of the gains made in 2021, many cryptocurrency speculators have seized the chance to 'buy the dip' amid widespread panic, confusion, and scepticism. As of October 2021, coins like Bitcoin and Ethereum are again trading near their respective peak values.

Consumerism … with Chinese Characteristics

Author: drllau

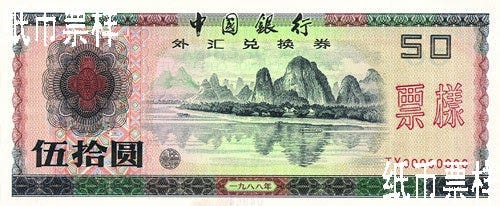

“Hey, Mister .... you got money?” This came not from an alluring lady of the night, but a nondescript guy half-hidden in an alley entrance. This was the early 1990s, and I was young and foolish, backpacking through China armed with an electronic translator and tatty Lonely Planet guidebook. The man wasn't flogging bootleg CDs (that was the alley two blocks down) but trying his entrepreneurial luck in bargaining for foreign exchange certificates (外汇兑换券 aka China “bucks”). As part of Deng Xiaoping’s Open Door policy, foreigners were permitted their own currency enclave, with imported luxury goods (Johnny Walker whisky, Marlboro cigarettes, etc.) at Friendship stores and a two-tiered pricing regime. Naturally, a black market sprung up with locals wanting scarce foreign luxury goods and visitors objecting to the surcharge or wanting to acquire hidden goodies outside approved stores.

Pre-crypto examples of “minting” and “burning” alternative currencies.

In hindsight, the massive export-drive created an economic situation with many parallels to today's DeFi chaos:

shunning of centralized regulators (TradFi) in favor of new risk capital;

regional issuance of unauthorized parallel currencies (stablecoins);

get rich-quick schemes like nightclubs (NFTs) instead of policy-directed infrastructure;

bogus currency futures agencies (rug-pull DEXs);

capital flight and round-trip tax-dodges (cf offshore financial centers).

If anything, this illustrates it doesn't matter whether East or West, the nature of human greed remains the same. It got to the point that there were three exchange rates: official (managed float), swap (excess quota) and black-market. Attempts to cap exchange rates were like the UK defending the pound except with currency couriers literally carrying suitcases of cash around the country. Capitulation came in the form of a 33% official devaluation, elimination of the dual FEC-RMB currency regime, and a unified rate based on the authorized interbank market.

The arrival of the Euro was greatly welcomed ... as was explained to me, the €500 note significantly reduced the number of bodyguards needed to carry cash across borders. At this point in time (early 2000s) bank information, communication and technology systems were still lagging. I couldn’t get the balance of my personal bank account in a different province, and this was one of the big four national banks. Shadow banks became the favored route for illicit wholesale transactions and, if you knew the right people, you could deposit in Guangzhou one day and access funds in Hong Kong the next. The economy was growing at double digits so foreigners wanted a slice of the FDI action, especially in the “controlled” industries such as media. Flashback to the 2017 ICO boom and you’d have a sense of what the hot-money business environment was like that decade.

The Global Financial Crisis turned the monetary stimulus taps from export mercantilism to domestic consumption growth. Behind the Great Firewall, eCommerce surged from $18 billion USD (2008) to $1,542 billion USD (2021). This is thanks to the mobile phone which allowed China to leapfrog the generation of fixed-lines (with Western legacy of faxed B2B purchase orders). Private firms had the motivation to streamline payment mechanisms with 80% of retail Business-to-Consumers done via smart apps. Uniquely Chinese traits are group-buying (where consumers flash-mob manufacturers to price-beat bulk purchases), mass customization with short product runs, social shopping (to tap networks for larger discounts), and live-streaming product endorsements by online celebrities. Basically digital Disneyland (entertainment) with QRcodes (quickBuy).

However, the fact that regulated banks were being bypassed by private actors didn’t escape notice. The introduction of the Digital Currency/Electronic Payment (DC/EP) will firmly bring mobile wallets back under central scrutiny. The modern retail system will be showcased at the 2022 Winter Olympics, with novel touch-to-pay, eTicketing and cold-wallets (above-image). From a perspective of 30 years the difference has been staggering, from worrying about physical pick-pockets to fretting about cybersecurity (tinfoil around NFC cards). As tourism recovers post-COVID, expect to see retail innovation spreading from Asia. Oh … and don’t forget to pick up your own set of colorful “hell money” when in Chengdu.

👮♂️ Taxation

Wen Tax? Important Tax Considerations for Navigating the Crypto Metaverse

The taxation of cryptocurrency and other digital assets has received much attention from Congress and other U.S. regulators. While agencies clash over jurisdiction claims, U.S. lawmakers have proposed new laws that, if enacted, will almost certainly mark the beginning of an accelerated government focus on cryptocurrency as an attractive tax revenue generator. Increased reporting requirements for taxpayers and organizations are all but inevitable. This has become evident especially with the introduction of a new question on income tax returns in 2020 asking, “At any time during 2020, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency?” Despite the ever-changing landscape of U.S. tax regulations, two important principles should be kept in mind: first, the Internal Revenue Service made the critical distinction in 2014 that virtual currencies will be treated as property (not currency) for U.S. tax purposes, and second, decentralized platforms are not a shield from U.S. taxation.

U.S. residents involved in the crypto metaverse should have a general understanding of the basic crypto tax laws. This knowledge can help you make educated decisions that could save you from being ill-prepared or even paying more income taxes than you owe. One such example is the proposed legislation currently making its way through Congress. This legislation would restrict the application of certain cryptocurrency losses because these losses have been identified as tax “loopholes.”

Future issues of Decentralized Law will continue to keep you informed on U.S. tax regulatory changes and address a variety of tax topics. A few examples of topics to be discussed in future issues are:

What is or isn’t taxable? Purchasing virtual tokens using a fiat currency (for example, the U.S. dollar) through an exchange does not in and of itself subject the purchaser to U.S. income tax. Airdrops are never “free” when considering potential tax implications.

How do U.S. taxes on capital gains apply? U.S. tax is generally imposed to the extent of the net capital gain on disposition (for example, in a sale). The specific amount of U.S. tax imposed will primarily be based on the type of transaction involved and the length of time the cryptocurrency was held. What’s the difference between long-term and short-term capital gains? When and how are NFTs and token sales taxed differently?

What are the tax implications and your options when you choose to form a legal entity (such as an LLC)?

Unfortunately, there is no “one size fits all” answer for every situation. Specific facts and circumstances need to be carefully considered when determining how to apply U.S. tax rules to a particular transaction or position. Whether you buy cryptocurrency and HODL, design and sell NFTs, collect royalties when those NFTs are resold, receive cryptocurrencies in exchange for goods or services, mine and/or stake, navigating the U.S. tax regulations, and knowing which laws apply, can ensure compliance and avoid overpayments.

It’s essential to keep detailed records of all crypto-related transactions regardless of whether you’re new or have been involved in crypto since the beginning; note that all information needs to be easily accessible and safely stored for a minimum of seven years. Several companies specialize in gathering and tracking crypto transactions. There are also several tax preparation firms that help file returns and claim to help gather most of the information for you. Finding and relying on one may be an excellent solution. That said, keeping a personal record for yourself will only ensure that the right information is being reported at the right time.

This material has been prepared for informational purposes only and is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. You should consult your own tax, legal, and accounting advisors before engaging in any transaction.

🙏 Sponsor: UMA - Making financial markets universally accessible. DAO Better.

🌐 News and 📰 Selected Articles

The Rise of Decentralized Autonomous Organizations: Opportunities and Challenges

Author: Aaron Wright

🔑 Insights

The author explores the nature of DAOs and highlights several areas where states and regulators can adapt existing legal regimes to potentially accommodate DAOs.

Compared to existing legal entities, DAOs present certain operational efficiencies and are currently used by organizations managing over $500m in assets, suggesting that legal regimes should take steps to accommodate their growth and development.

The ideal design of DAOs is still being explored, exposing challenging governance questions which may ultimately stymie their growth and development. Undefined DAOs are not formally recognized and do not fit neatly into existing forms of business associations, making it difficult for DAOs to interact with traditional business entities and imposing personal risk on members.

When DAOs Get Real - Managing Real Property on a Blockchain

Author: James McCall

🔑 Insights

The author reflects on the concept of real estate management through DAOs. The concept is explored through the example of RealDAO, a series LLC formed from Ricardian, LLC. This DAO was founded to explore the possibility of managing real estate assets via DAOs on the blockchain, primarily tokenized as NFTs.

Legal Entity DAOs (LAOs) as an independent concept are discussed to ideate an additional layer of contracting and ownership assertion over the traditional indicators of transfer and ownership of real estate. LAOs can easily handle contracts, sales, or loans, estate transfers, and property management.

Further, it is ascertained that while NFTs are usually used to represent art, they can also consist of pictorial depictions of properties corresponding to the “four corners” of a legal document. Using examples of real world tools such as LexLocker Decentralized Escrow, etherize.io, LexDao Smart Contracts, and Farmapper.com, the author explains the use case of DAOs in managing farmland.

Indexed Finance Claims to Have Found Hacker Who Stole $16 Million

Author: Mathew Di Salvo

🔑 Insights

On 14 October 2021, a hacker stole crypto assets worth $16 million USD from Indexed Finance. Indexed Finance is a DeFi project built on Ethereum. The author reports that Indexed Finance has stated that the hacker has been identified. Unlike most hackers, the identified hacker turned out to be significantly younger than expected and the hacker did not adhere to the ultimatum which was given to return the assets.

The attack followed a pattern common to DeFi exploits: the hacker abused the flash loan mechanism by flooding the protocol with new assets. This resulted in a decrease in the price of Indexed tokens, allowing the attacker to mint new ones and cash them out.

The author states that two out of the six assets on the protocol lost most of their value due to the hack. He states that attacks on DeFi protocols have increased significantly in the past year. Further, it is reflected in the article that auditors are required in the DeFi space as most platforms are experimental.

When Online Dispute Resolution Meets Blockchain: The Birth of Decentralized Justice

Authors: Federico Ast and Bruno Deffains

🔑 Insights

The Online Dispute Resolution (ODR) industry was born in the 1990s. As the Internet became a part of people’s everyday lives, many also sought to leverage the web’s potential for the creation of virtual courts that would greatly increase the efficiency of dispute resolution procedures.

This vision, however, failed to fully materialize. To some extent, early ODR solutions only brought an incremental innovation that streamlined existing alternative dispute resolution procedures, but did not create any disruptive innovation with the potential of generating a more than 10x advantage over existing methods. In recent years, a number of technological innovations in computer networks, such as blockchains and the growing use of cryptocurrencies, enabled new types of mechanism designs for online dispute resolution.

This emerging approach, which may be called “decentralized justice” because of the decentralized nature of blockchain and of juror networks, enables the possibility of a radical increase in the efficiency of dispute resolution.

MakerDAO Ponders the Unthinkable as Members Debate Incorporation and Paying Taxes

Author: Brady Dale

🔑 Insights

A conversation underway in MakerDAO’s forum has thrown its past and future actions into sharp relief. After the dissolution of the Maker Foundation and the DAI Foundation, MakerDAO continues to have no formal legal structure registered and its members are concerned with the implications if it remains that way.

Like most DAOs, the potential classification as a “general partnership” under U.S. law could allow for tax obligations to be imposed upon individual members of a DAO, something that seems inescapable in the current regulatory climate. Consequently, members of MakerDAO are concerned about such a possibility and would urgently like an answer. Compounding this issue further is the threat of adverse tax obligations being levied in multiple jurisdictions, and, considering MakerDAO’s scale, fame, and history, this could pose a serious problem for its members.

One user suggests that MakerDAO should select a strategic jurisdiction and make appropriate tax payments in order to potentially lessen the likelihood of being targeted by multiple jurisdictions in connection with tax obligations. Extreme measures, such as an emergency shutdown by design, are also being considered to try to help protect MakerDAO’s members. How MakerDAO deals with these questions could well determine the way forward for other DAOs across the blockchain ecosystem.

Lawless in Austin

Author: SEC Commissioner Hester M. Peirce

🔑 Insights

Analogizing the cryptoverse to the “Wild West” is accurate, but not for the reasons cited by crypto skeptics. Like the frontier of the West, those on the frontier of crypto demonstrate that private regulation is effective when enforced by competitive parties with a stake in the outcome and accountability occurs in the public sphere. And like the code of conduct in the “Wild West,” code is the ultimate arbiter of conduct in the cryptoverse.

Lack of clarity around which rules apply to crypto assets punishes honest players who seek guidance. The tendency of the SEC to settle in private rather than litigate in public or otherwise undertake transparent enforcement of existing regulations is partly to blame for this lack of clarity. But clarity must come from Congress, not regulatory bodies. Ironically, thoughtless SEC action will lead to greater decentralization rather than compliance.

SEC spends too much time fighting turf wars, and not enough time understanding the needs of those it seeks to both regulate and protect. Don’t force actors into poorly thought-out regulatory regimes; instead, all parties are best served by being responsive to the needs of the crypto industry and crypto consumers while creating a transparent framework for enforcement.

🧱 DAO Legal Tools

The Model DAO Contributor Agreement

Author: Larry Florio

The model agreement is meant to clarify the relationship between a DAO and a contributor as something more like a typical freelancer/independent contractor rather than as an employee.

It is meant to be flexible and lightweight, and allows many of the DAO-specific terms to be managed through their standard process, whether by linking to a Notion page, discussion on Discord, Snapshot vote, etc. instead of including the specifics in the agreement itself.

Other terms that might be of interest are that the contributor keeps ownership of any developed IP but grants the DAO a free license and waives the ability to go after individual DAO members if there is a disagreement on the idea that the DAO is a general partnership. DAOs should of course discuss use of the agreement and any desired modifications with their own lawyers.

📚 Crypto-Legal Research

💰 The BANK Token - A Legal Assessment

Author: BanklessDAO Legal Guild

The members of the BanklessDAO’s Legal Guild have endeavored to present a research paper in order to provide an assessment of “BANK,” BanklessDAO’s native-governance token.

This assessment predominantly focuses on so-called “utility tokens,” which seem to be the closest to the BANK token’s intended functions. The paper is mainly focused on U.S. and European law, with some content devoted to other jurisdictions.

The present paper intends to offer legal narratives from the perspectives of multiple jurisdictions. The broad scope of the research in this paper is intended to acknowledge and reflect the global and decentralized nature of the BanklessDAO movement, which at this stage is global and cannot refer to one particular jurisdiction.

Get Involved:

👩⚖️ Join the BanklessDAO Legal Guild 🏴

The Legal Guild supports BanklessDAO and the Bankless community with up-to-date summaries of legal developments in crypto and DAO governance, and assists with strategic outbound communications with the broader crypto community and regulatory and legislative bodies.

At the BanklessDAO Legal Guild you could participate in research projects, stay up to date with crypto-legal news, as we present daily a collection of articles, as well as participate in good discussions on new developments in the crypto-legal field.

We encourage you to take part in the weekly Legal Guild meetings on Discord (Thursdays 8AM PDT).

⚔ Join LexDAO

LexDAO is a non-profit association of legal engineering professionals whose mission is to research, develop, and evangelize first-class legal methods and blockchain protocols that secure rules and promises with code rather than trust.

The aim is training LexDAO certified legal engineers and building LexDAO certified blockchain applications.

LexDAO strives to balance new deterministic tools with the equitable considerations of law to better serve clients, allies, and ultimately citizens.

🐵 Join the LeXpunK Army

The LeXpunK’s Builder Defense DAO is dedicated to legal advocacy for builder-centric DeFi communities. The LeXpunK_DAO is governed by builders from its founding contributing communities (Yearn, Curve & Lido) and practicing lawyers from the LeXpunK Army.

L3X, the non-transferable reputational token of the LeXpunK Army, is being airdropped to the founding communities, additional contributing DAOs, and a broader community of legal and developer advocates who are identified to date as active in the DeFi space and aligned with the LeXpunK mission, to enable direct sentiment polling on relevant legal issues from the DeFi community.

LeXpunK will provide additional airdrops from time to time, proportionally in line with the relative contributions of advocates, LeXpunK Army contributors and other builder communities, with the goal of forming a broad coalition to pool resources for funding shared advocacy goals.

🚨 Call to Action 🚨

⚠ Crypto Needs Your Help 💪

Those of us who closely follow U.S. regulatory action affecting the crypto ecosystem know the real solution to the opacity of current enforcement actions and the subject and scope of future actions lies not with the SEC or another regulatory body. The subject and scope of future U.S. regulatory action rests soundly within the discretion of Congress. Congress makes the laws; the SEC enforces the laws within its mandate.

It’s time for all of us, particularly those familiar with the language of the law and decentralization, to contact our representatives in Congress to assist those drafting laws impacting the crypto ecosystem. Congress must understand the importance, in the words of SEC Commissioner Hester M. Peirce, of taking a “methodical approach, one that provides answers to the key questions to which market participants need answers.” The only way Congress can arrive at well-thought out answers to the questions posed by blockchain technology is if those working for and within Congress know which questions to ask. Your questions and comments are vital to ensuring sensible regulation. We are running out of time to influence the future of crypto regulation - please take the next five minutes to contact your representatives:

🏛 United States House of Representatives

🙏 Thanks to our sponsor

UMA

UMA can help DAOs achieve their goals by incentivizing their community.

UMA’s KPI options align incentives and build loyalty through airdropping options tokens, which pay out a variable amount of the protocol’s token depending on the KPI metric being tracked, giving the community a powerful motivator and focussing their efforts to collaboratively achieve the protocol's aims. If the metric is not fully achieved, the residual amount is returned to the DAO treasury. The BanklessDAO Legal Guild has used KPI options to crowdsource international legal opinion on the regulatory space that surrounds DeFi.

Thanks legal guild. Great article and excited for more to come.