Bitcoin Learns Some New Tricks: Emerging Effects of Taproot

Defying Ossification; The UX Risks of Gasless Transactions

Dear Bankless Nation 🏴,

In this issue of the DeFi Download we take an exploration of the latest primitives to emerge from the Bitcoin blockchain, by Austin Foss, followed by a huge quality of life improvement for Ethereum, detailed by d0wnlore.

Has the magic in magic internet money returned to Bitcoin? For a blockchain that earned a reputation of stagnation in the last 5 years all of a sudden Bitcoin was in the news headlines much more than normal for the first half of this year, and we dive into the details of what exactly has drawn such a wave of interest back to the original blockchain.

On-boarding new users has always been a point of friction for any blockchain. To do anything on Ethereum costs gas, and gas costs ETH; say for instance a new user finally decides to take self custody of their stable coins off of their exchange of choice and withdraws their entire net-worth in DAI to mainnet, well now they’re stuck with no ETH to pay for anything further. Gasless transactions are now possible, but with them come potential new pitfalls for the new, and maybe even experienced, users.

Thank you very much for continuing to support our work and we look forward to bringing you more breakdowns from across the cryptocurrency ecosystem,

This is the DeFi Download ⚡️

Contributors: BanklessDAO Writers Guild (Austin Foss, d0wnlore)

This is the official newsletter of BanklessDAO. To unsubscribe, edit your settings.

Defying Ossification

Author: Austin Foss

Compared to other blockchains following in its wake, Bitcoin has earned a reputation as a technology which moves at a much slower pace in terms of improvements — that it’s ossifying. One of last major improvements split the Bitcoin community so severely it caused the Bitcoin Cash and Bitcoin SV hard forks in 2017; that was the SegWit activation.

What SegWit did, among other things, was help pave the way for further improvements to the Bitcoin protocol such as the Lightning Network and the more recent Taproot (aka SegWit version 1) upgrade, activated in 2021; but the year is 2023, why do these multi-year old upgrades matter now?

When both upgrades were activated neither had a significant impact on drawing in new users and increasing demand for Bitcoin block space. SegWit preceded the late 2017 bull run by a few months, and Taproot activation happened near the peak of the record setting 2021 all time highs; both provide efficiency and scaling improvements, but what actual new use cases did they open the door for?

Enter Ordinals and BRC-20 tokens, two new Bitcoin native primitives that have driven network fees (Bitcion’s security budget) to highs only equivalent during the 2017 and 2021 price all time highs.

Actual user facing functionality is driving Bitcoin adoption and renewed interest.

At the Root of it All

Taproot, “first proposed by Bitcoin core developer Gregory Maxwell in January 2018”, is a combination of three independent, but mutually beneficial, BIPs; 340, 341, and 342.

BIP340 – Schnorr Signatures

An improvement over Elliptic Curve Digital Signature Algorithm (ECDSA) used by Bitcoin exclusively since its genesis, Schnorr signatures are much more versatile. They allow for the things like more efficient multi-signature transactions and smart contracts (conditional transaction execution). Due to a feature called signature aggregation user privacy is also greatly improved on Bitcoin by obscuring your address among several others.

BIP341 – Taproot

Taproot brings something called Merklized Alternative Script Trees (MAST) to Bitcoin. A merkle tree is “a data structure used for data verification and synchronization”. This pattern of building a single root hash of the merkle tree further extends the scalability SegWit initially provided on its own; now able to compress much more information into the witness portion of a block.

BIP342 – Tapscript

A scripting language used to extend Bitcoin’s existing Script language by taking advantage of the new features BIPs 340 & 341 make available.`

Ordinals

A new BIP created on February 2 of this year, titled Ordinal Numbers, was drafted and defines “a scheme for assigning serial numbers to sats.” As an overlay system on top of the Bitcoin protocol there’s nothing in the protocol itself that numbers each individual satoshi, so exploring and utilizing this system must be done using the ord software. Under this system all sats are indexed automatically, retroactively, and until the last sat is mined.

As a result of this not every sat is/was created equal. Satoshi’s first and last sat, or really any sat that was mined by Satoshi may have intrinsically more value than an ordinary sat, or the first/last sat of a halvening for instance. Formerly fungible sats can now be made non-fungible. because the Bitcoin protocol itself doesn’t recognize the serialization system it can be very easy for someone to accidentally send one of their ordinals from an ordinary wallet. At the time of writing the only wallet that is recommended for use with Ordinals, outside the previously mentioned ord software, is Sparrow Wallet.

Taproot Wizards

Combining Ordinals and the now available features from Taproot, arbitrary data can be “inscribed” onto each sat. Dubbed Taproot Wizards the first inscription was made on February 1. Well, the first wizard inscription anyway, inscription #1 on ordiscan may not be appropriate for viewing here.

“We are the Wizards who wish to reignite the spark that made bitcoin Magical.” - The Wizard Manifesto

One of the side effects of these inscriptions was another split among the Bitcoin community that hadn’t happened since the block size wars around SegWit’s implementation. Emotions got so heated that there were calls for any blocks containing these inscriptions to be censored by miners because they are viewed by some as a waste of block space and were pricing out smaller value, ordinary, BTC transactions.

This split in the community ultimately culminated in a sort of rebellion at this year’s Bitcoin Miami where many attendees proudly donned their wizard hats and two prominent champions of the cause, Udi and Eric, celebrated on stage the resurrection of the magic in “magic internet money”.

BRC-20

Before Bitcoin Miami, just a month after the Ordinals BIP was drafted, a new type of inscription was made by a developer going by the pseudonym Domo; the BRC-20 inscription. If you’re familiar with programming you’ve likely seen JSON data objects at some point, and that’s all a BRC-20 is, just some JSON. Compared to an ERC-20 smart contract on Ethereum where all of the operations of the new fungible token are written in solidity, this is all that makes up a BRC-20 deployment:

{ "p": "brc-20", "op": "deploy", "tick": "ordi", "max": "21000000", "lim": "1000" } - ORDI BRC-20 Inscription

First of the BRC-20 tokens is the ORDI token, inscribed March 8.

Trading

Due to how new this standard is it’s recommended to proceed with extreme caution before attempting any transactions because the UX development is nascent and tooling for these features is very young.

Metrics of ordinal trading is being tracked on Domo’s Dune dashboards. Do not trust any Ordinal markets outside of these for the time being as this is the the prime time for scammers to strike on Twitter, Discord, etc., with false front ends.

“While BRC20 inscriptions are fully on-chain, the off-chain indexing crucial to BRC20 markets poses centralization risk.” - Twitter @AlexLabBTC

For now a fully decentralized DEX does not exist for exchanging BRC-20 tokens but in time, with further development and utilization of tools like Tapscript, we may yet see a proper Bitcoin Native DEX.

Taproot Assets

In his own documentation for BRC-20s Domo tips his hat in acknowledgement of another standard that has been in development for a while, lead by Lightning Labs, called Taproot Assets (formerly known as Taro) and acknowledges their’s as an “unequivocally a better solution.”

Just a Phase or the Next Stage?

It’s still very early days for these new primitives, a little more than year after Taproot’s activation Ordinals emerged, and just a couple months later BRC20s extended Ordinals even further. Perhaps we’ll see this level of acceleration continue as interest in buidling on Bitcion returns, attracting new and old developers.

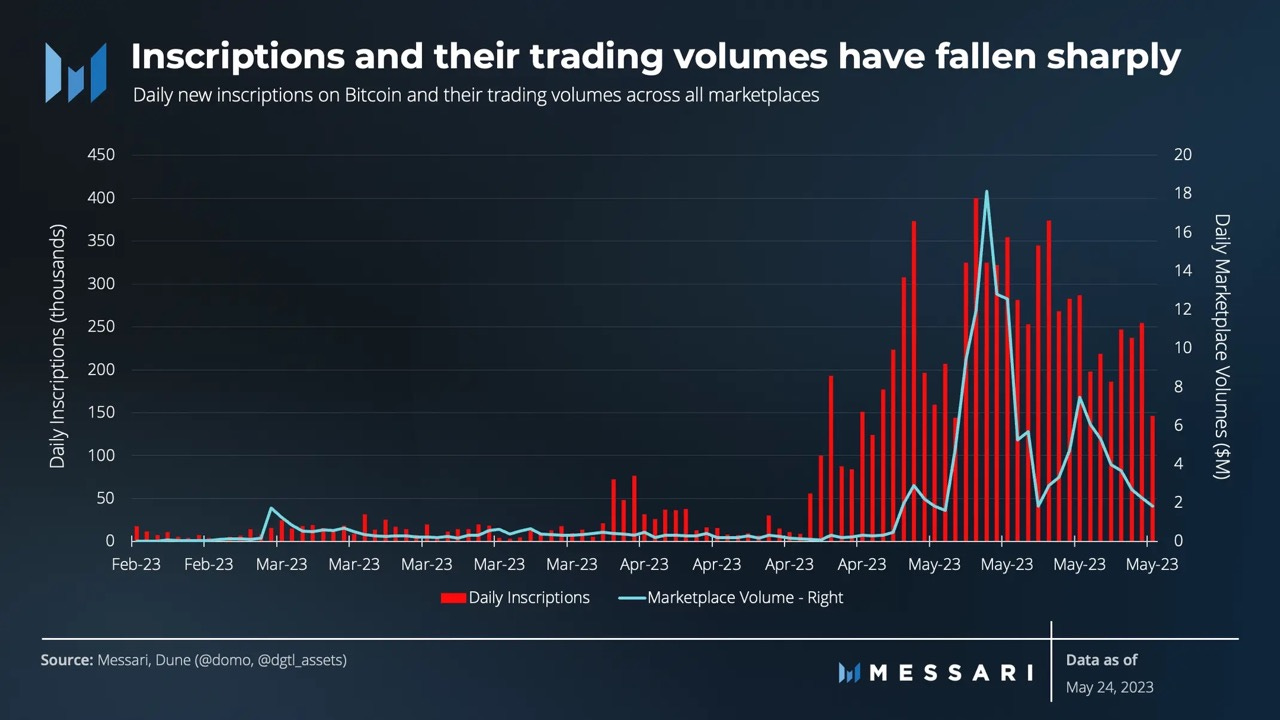

Messari Capital analysts have observed that Ordinal inscriptions have mimicked meme coin patterns with volume dropping sharply after just one month of high activity.

In comparison to a meme coin that began trading around the same time, PEPE, trading volume went through the same flash flood of interest and now appears to be reaching an equilibrium.

Does this mean Ordinals and BRC-20s are just a temporary fad taking advantage of meme magic? Potentially, but it’s also helpful to remember the history of things like Ethereum NFTs; Crypto Punks preceded the now ubiquitous ERC-721 & ERC-1155 token standards but still sparked inspiration for a wave of innovation for several years after.

We’re still early, and the magic has returned.

The UX Risks of Gasless Transactions

Author: d0wnlore

The bear season has been digging in it's claws deeply over the past few months. As this season lengthens so too do the austerity measures that protocols and users implement to reduce unnecessary expenses, particularly gas fees and potential losses due to Maximal Extractable Value (MEV).

However, constraints typically surface novel ideas, and one constraint that DeFi protocols have been employing over the past several months is "gasless transactions"invoked through signatures. Enabled by EIP-2612, this method of initiating transactions for ERC20 tokens that incorporate the new permit function introduces numerous quality-of-life enhancements for users and protocols:

Protocols can pay the gas fee for your final transaction, as well as handle failed transactions, which is where the term "gasless transaction" originates (the final transaction is not free or "gasless"; the entity that sends the transaction still must pay gas with a native token, but not the users themselves)

Token approvals expire after a certain period of time, rather than the natural default of allowing an unlimited amount of the token to be spent forever as is the case today

Making two transactions to approve the spending of a token and to make the actual trade can now be done with one transaction

Users can pay their gas fees using the ERC20 token they are selling, instead of always having to use the chain's native token, such as ETH or MATIC

As the DeFi protocol you are interacting with is responsible for sending the transaction, they may incorporate methods to mitigate MEV that users might not have themselves

But as with any new or upgraded technology, we usually lag behind getting the most out of these new paradigms. Signatures, in particular, have been poorly displayed in wallet clients for some time, even as the ecosystem has made heavier use of them to improve the Web3 user experience, such as using Sign-In with Ethereum.

As more protocols adopt gasless signatures, it's crucial that wallet clients display signatures and the messages they contain in a manner palatable to non-developers. Until this occurs, the user experience will always trail behind the amazing technology users actually have access to. These issues have also become vulnerabilities that are exploited by fraudsters, which we will address next.

Signature Concerns

Protocols that have incorporated gasless signatures have made efforts to help their users understand how these new forms of transactions operate. However, signatures are still poorly displayed in the wallet clients that users actually use to initiate trades. This raises numerous concerns that can be exploited by fraudsters:

Wallet clients still present signature contents in a purely textual form, which is a chore to read and verify, especially for non-developers (this is the primary issue leading to phishing attacks that successfully steal tokens via signed messages)

They do not record and display a history of signature activity; therefore, users lack a record of when they attempted to initiate gasless signatures or what signatures could potentially be used in subsequent transactions

As the protocol builds and sends the final transaction, wallet clients may not display these in the current user's transaction history (though block explorers like Etherscan will display these)

Transaction simulator extensions may not fully display what will transpire after a gasless transaction has ultimately executed, as it is another entity that constructs and sends the final transaction (will more of your approved tokens go to fees than you expected?)

These issues can lead to not only confusion and bewilderment from users but ultimately a loss of assets should they be tricked into signing a transaction that they cannot understand.

This also extends to protocols using a similar methodology for token transfers via signatures, such as OpenSea’s SeaPort protocol. This is what allegedly happened to Kevin Rose when he lost several high-value NFTs to a phishing scam earlier this year.

Conclusion

DeFi trades conducted through these new gasless signatures can offer more ways to onboard new, and enhance the experience for existing users. However, to fully capitalize on this new paradigm, signatures need to be treated as first-class citizens in wallet clients, not just as a large block of textual data that doesn’t require extra UX flourishes. Imagine if your typical transaction screen—the one that shows the contract you are interacting with, the token you are transferring, the gas fee, etc.—was presented as just one large wall of text.

Until there are improvements to the gasless signature UX, they will also be an opportunity for fraudsters to enhance the utility of their phishing toolbox. DeFi users like you should remain vigilant as long as gasless signatures become more popular, and wallet clients do not make them easier to understand.

Action Steps

📖 Read The Wizard Manifesto | Taproot Wizards

⛏️ Dig into The Ordinals Theory Handbook | Ordinals

🎧 Listen The Future of Bitcoin with Nic Carter, Eric Wall, & Udi Wertheimer | Bankless Shows

🎧 Listen BRC-20 Tokens Will Change Bitcoin FOREVER | Bankless Shows

Hand-picked updates to help you understand the current state of the DeFi ecosystem

Curve Finance Launches crvUSD Minting Using wstETH Collateral

crvUSD was audited by MixBytes and the report made public on June 6

June 8 minting crvUSD with wstETH was made available

Depegging of the crvUSD stable coin occurred briefly afterwards but recovered quickly

https://twitter.com/CoinDesk/status/1666778658529239040

Stage 1 of their three phase roll out of Eigen Layer’s restaking solution has taken a “guarded launch” approach on Ethereum’s mainnet

Stage 2 is planned for later this year to onboard operators who will carry out validation tasks

Liquid staking tokens currently accepted are Lido’s stETH, Rocket Pool’s rETH, and Coinbase’s cbETH

https://twitter.com/eigenlayer/status/1669065156427681792

Prometheum*

Although the Twitter account of the project was created in 2017, as far as the cryptocurrency community is concerned this project launched this week

Testifying before congress on June 13 the project “has become the Securities and Exchange Commission’s poster child for compliance“ - Decrypt

https://twitter.com/adamscochran/status/1669143092274888704

Chirping Birds

🔥 and 🧊 tweets from across the DeFi ecosystem

BANK utility (BanklessDAO token)

With over 5,000 holders, BANK is one of the most widely held social tokens in crypto. So it bears asking, where are the best places to put our BANK to use? The five protocols below will allow you to deposit BANK in a liquidity pool and earn rewards. To get going, just click on the name, connect to the app, filter by BANK, and start earning passive income.

⚖️ Balancer

Balancer has two 80/20 liquidity pools, meaning that you are required to deposit 80% BANK and 20% ETH in the pool. There is one pool on Ethereum and another on Polygon. Once you’ve provided liquidity, you’ll receive LP tokens. Keep an eye out for opportunities to stake these LP tokens. There is nearly 500,000 USD in the two Balancer liquidity pools.

🍣 SushiSwap

SushiSwap has a 50/50 BANK/ETH pool. As with Balancer, you will receive LP tokens, and while you can’t stake them on SushiSwap’s Onsen Farm yet, you may be able to in the future. Liquidity providers earn a .25% fee on all trades proportional to their pool share. The SushiSwap pool has a little over 100,000 USD in liquidity.

🦄 Uniswap

The Uniswap V3 liquidity pool is 50/50 BANK/ETH, and provides a price oracle for the Rari Fuse Pool. By depositing in the Uniswap pool, you can earn fees and help enable borrowing on Rari. This pool currently has over 500,000 USD in liquidity.

🪐 Arrakis

You can also provide liquidity to the Arrakis Uniswap V3 pool. The ratio is about 2/1 BANK/ETH. This pool is new, and only has a bit more than $6,000 in liquidity. In the future, you may be able to stake your BANK/ETH LP tokens within the protocol to earn additional rewards.