Bankless DAO Weekly Rollup | July 16

Season 1 Public Announcement, another NFT showcase, and a new merch store?!?

Dear Bankless Nation,

It's summertime in the DAO and its been a hot week!

We released a public Season 1 announcement, dropped the latest NFT Showcase, teased a new merch store and highlight some upcoming events. Plus an op-ed on “Is a Centralized Stablecoin our only option?”.

Dig into this week in Bankless DAO.

Authors: Bankless DAO Writers Guild (siddhearta, ffstrauf, FrankAmerica)

This is the official newsletter of the Bankless DAO. If you were a Premium Member of the Bankless Newsletter as of May 1, 2021 you have been subscribed to this newsletter at launch.

To unsubscribe edit your settings here.

BanklessDAO Weekly NFT Showcase 🔥

🧑🎨 Artist: Abstrucked

🏦 Auction Type: Open edition for 7 days

💰 Price: 0.02 ETH each. 1 ETH for limited edition BAE.

This weeks featured pieces are all enticing and beautiful abstract themes around Ethereum. If you collect all three ETH primary colour NFTs from the primary market sale, you will earn a FREE airdrop from the Bankless DAO containing a rare BAE (Bankless APE Evolution) NFT.

Community Highlights

🚀 Introducing Season 1: The community made a public announcement on Season 1, featuring our inaugural post on Mirror. It recaps the progress made in Season 0 along with clearly outlining the plan for Season 1.

🏆 BED Index Design Contest Winner: Congratulations to the winner of the BED Index Logo Contest, @Netsynq for being voted the best design out of hundreds of entries!

🔝 Top Signal: Watch the latest episode presenting DAO Dudes, featuring Cooper Turley, Lucas Campbell, Callum Gladstone, and James Waugh.

⚕️ Sovereign Health & Wealth Podcast: Watch episode six "Why are Fundamentals Key to Success?"

🏴 Bankless Nation Map Sales: DAO member and resident cartoonist Perchy has been absolutely crushing it this week on Rarible, selling over 9 ETH and placing BanklessDAO in the top 5 sellers on Rarible this week. It's not too late to get your own map of the Bankless Nation. 🔥🔥🔥

What’s New

🎙 Tuesday Talks with Tracheopteryx: This week the Crypto Sapiens podcast, hosted by Humpty Calderon, features Tracheopteryx, a contributor to Yearn and Coordinape. Join us in the Amphitheater on Tuesday, July 20 at 1pm EDT, where we will discuss governance, social graphs and more!

🏦 Grants Committee FAQ: The Grants Committee has put together a guide for applying for Guild grants and Program grants. Grants have to meet certain requirements and specifications before funds can be distributed each season. BANK will be distributed over the next few weeks to guilds and programs that are eligible.

🔥 Ultrasound Merch Store 🔥 (COMING SOON) : The NEW BanklessDAO merch store is the platform for high-quality, evergreen crypto merch and collaborations. Ultrasound Merch lives between fast fashion and luxury, in a place where quality and value both matter.

🤝 UMA Collab Talk: Join us next Friday, July 23 12:30pm EDT for Round 2 of our UMA collaboration strategy series with conversation around KPI tokens, range tokens, and more!

📊 Community Call POAPs claimed: Check out the latest POAP numbers through Season 1. The latest data shows that last weeks numbers were more than double the amount of claims in May.

📈 Analytics Dune Dashboard: The Analytics Guild has put together a new dashboard for DAO Treasury Holdings of all ERC-20 Tokens. This dashboard gives transparency to the DAOs treasury and as @paulapivat stated, "The revolution will not be reported quarterly."

🙏 Sponsor:UMA — Diversifying DAO Treasuries. DAO Better.

Is a Centralized Stablecoin our only option?

DeFi needs decentralized stablecoins.

DeFi, going Bankless, and crypto in general is all about decentralization, breaking down centralized institutions and distributing their power. Two parts of this ecosystem, however, are still heavily tied to central entities: exchanges and stablecoins. Stablecoins have recently received a lot of press coverage. This Forbes article cites Fed Chair Powell claiming a CBDC could replace all stablecoins. It also mentions that VISA has begun to settle payments in USDC. But what is a stablecoin?

A “stablecoin” is a type of cryptocurrency whose value is tied to an outside asset, such as the U.S. dollar or gold, to stabilize the price.

Stablecoins like Tether or USD Coin are attempts to be a virtual dollar. They are great for moving money around on a blockchain. It is much faster for investors to move in and out of assets, as they don’t need to send their money back to a bank account and wait for the weekend to pass, plus a potential government holiday for settlement. There is no doubt that stable coins have vastly improved the frictionless environment of decentralized finance.

The main use case of stablecoins is being a stable asset inside the cryptosphere. They are a digital substitute for the dollar, that in the traditional financial markets, is used as the primary trading currency. Coingecko’s stats show that 24h trading volume of stablecoins makes up more than 50% of the entire crypto trading volume. The chart below lists the top three coins per market cap and the 24h volume shows that Tether is traded more than Bitcoin and Ethereum combined.

Clearly, stablecoins play a critical role. Crypto needs stablecoins and yet their backing is disputedheavily.

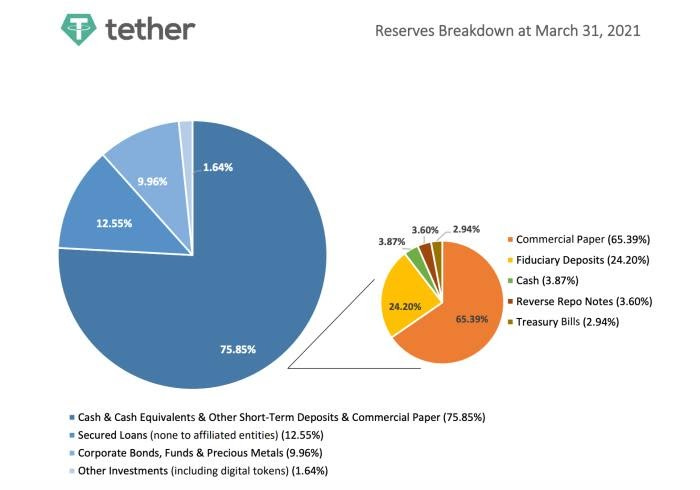

The largest and oldest stablecoin is Tether. But Tether is only backed by 75% cash and cash equivalents, of which less than 3% are actual cash reserves. A while back they misplaced 850 million dollars in USDT, and shelled out 18.5 Million to the New York Attorney Generalto to settle the matter. Tether Holdings has 15 employees.

Can we trust 15 people hanging around a water cooler with access to 850 Million in liquidity? Maybe, maybe not. After constant scrutiny, Tether finally revealed their backing rate. [See graph below]. But that graph is not stable, sneak a peek at Section 3 on Tether’s legalese page. Spoiler alert, “The composition of the Reserves used to back Tether Tokens is within the sole control and at the sole and absolute discretion of Tether.”

So perhaps we’re in need of more regulation? 👮♀️ Centralized control even? Along comes USDC, a 2018 collaboration between Coinbase and Circle; this is a reputedly regulated stable coin, with a 1:1 backing by one US dollar, held in a bank. But there’s an issue here. A primary driver for cryptocurrency is to navigate beyond the traditional financial world. Though it may be valuable and serve a place in DeFi, Coinbase is essentially a new centralized bank, and USDC is their dollar.

To fix this, why not just back a stablecoin with crypto? Overcollateralize even?! The Maker protocol created the DAI stable coin to do just that, backing it with crypto assets. This worked quite well until the whole market tanked on Black Thursday, and DAI was unable to hold its peg, an issue that persisted for much of DeFi Summer.

As a result, MakerDAO now backs a large percentage of DAI with centralized assets (reads:USDC). DAI is currently about 2/3 USDC and 1/3 Ether. For a deeper dive look here. Although DAI was and is a step in the right direction, it’s now mostly centralized.

Algorithmic stablecoins try to solve the collateralization problem, by not backing their coin with any collateral, instead having an algorithm regulate the peg. Iron Finance’s Titan token has shown that this is not an easy thing to do either. Most approaches have failed because of poor tokenomics design. In this case a recursive holding incentive ie. “hold our coin to farm more of our coins” led to a negative feedback loop.

The one area the Terra team deviates from their algorithmic stablecoin competitors, is that its coin (UST) is based on real world use of their own stablecoins. The US Dollar is not important because of the Fed, but because of its global utility. Terra taxes real transactions to reward staking, avoiding a feedback loop. To keep the peg, their reserve token Luna is either minted or burned, opening an arbitrage opportunity to swap Terra for Luna depending on demand. Being an algorithmic stablecoin, Terra is decentralized and with their unique approach of building an ecosystem of real world use they seem to have taken a step into the right direction. It might take some more market crashes and bear markets though to see if it can survive some rough weather.

Lastly, in February of 2021, a purely Ethereum backed fork of DAI called RAI arrived on the scene. Rai is not pegged to fiat currency. RAI only uses ETH as collateral. RAI remains relatively stable to Ether, but can fluctuate in its dollar value. Basically it’s a smart contract that runs a “cruise control buy-sell machine” which incentivizes interest rates on one or the other to maintain stability between the two over time. RAI is truly decentralized. RAI co-founder and CEO explains,

“It works kind of like a spring: the further the market price of RAI moves from the target price, the more powerful the interest rate, and the greater the incentive to return RAI to equilibrium.” -

The pure ETH backing means it is fully decentralized too and without pegging it to USD it acts like a sovereign currency. CEO Ammen Soleimani called it a, “Money God”. 🌅

Proposals in Discussion

⚔️ BanklessDAO Guild ENS: This proposal would create verified subdomains of the BanklessDAO treasury vault for each respective guild.

🧑🏫 Crypto Mentorship Program: This proposal would create a mentorship program to guide new crypto enthusiasts from simple to complex topics. We will aim to produce high quality recorded content which can be used long-term as well as to produce highly knowledgeable mentors that can then be presented to enterprise clients.

🎨 BanklessDAO Should Host this Art Show: This proposal would bring attention and people to the DAO and solidify our image as patrons of the arts by hosting Values, Layers, Communities: 2,809 Free Paintings in context. The exhibition would feature a fascinating art piece and exciting speakers.

👷 Dev Guild Organizer Program: The Dev Guild has put together a new program proposal framework and drafted a proposal for creating formal role for guild organizer.

✍️ Newsletter Team Proposal: The Writers Guild drafted a proposal based on the program proposal framework to receive ongoing funding and resources for our newsletter publications.

Action Items

🖋 Subscribe: Sign up for the official BanklessDAO newsletter.

➕ Add your Role: The Ops Guild is putting together Roles and Responsibilities, please add yours to the list. 🙏

🧑🚀 Apply for a JOB: Check out the best and ****hottest crypto gigs in the nation, members first access!

🏃♀️ Catch up: Review this week's community call notes or listen to the recording.

🙏Thanks to our sponsor

UMA

UMA helps DAOs build products to diversify their treasury. Most DAOs treasuries are imbalanced. By using UMA’s range tokens, KPI options, and call/put options, DAOs can prepare their treasury for any market.

👉 Join the #bankless Channel in the UMA Discord.

👉 Tell UMA What DAOs you belong to.

👉 Earn KPI Options. Go to the Discord to learn more.