Analyzing DAO Treasuries | State of the DAOs

You're reading State of the DAOs, the high-signal low-noise newsletter for understanding DAOs.

gm and welcome to State of the DAOs!

We are deep in bear market territory and many DAOs and contributors are starting to wonder if they can survive a long crypto winter.

This week, Jake and Stake provides a basic framework for understanding the health of DAOs. Whether you are an investor, contributor, or user, in an open financial world everyone has view-access to DAO treasury information using tools like Dune Analytics. By using dashboards to monitor and track the financial health of these organizations, Jake shows how you can determine which of them are built for long-term success and sustainability.

Next, Seneca52 shares the story behind GoodDollar, the world's largest crypto Universal Basic Income (UBI) platform. Featuring an interview with GoodDollar co-founder Anna Stone, they share how the road to economic impact leads to impacting human capital by opening doors, building social reputation, and recognizing contributors. When we incentivize for dignity, anything is possible.

Finally, we share the TL;DR on some of the best DAO ecosystem takes and thought pieces, making it easy for you to cut through the noise and learn everything you need to know to get started and stay up to date on your journey into Web3.

This is the current state of the DAOs.

Contributors: BanklessDAO Writers Guild (Jake and Stake, Seneca52, AustinFoss, Alvo von A, helloashpreet, Paulito, Dippudo, hirokennelly, siddhearta)

This is the official newsletter of BanklessDAO. To unsubscribe, edit your settings

Analyzing DAO Treasuries

Author: Jake and Stake

DAOs are organizations that utilize tokens to incentivize particular behaviors. People often work for DAOs in exchange for these assets (stablecoins, DAO governance tokens, or the blockchain’s native cryptocurrency, like MATIC or ETH), and all DAOs that offer any form of remuneration need a treasury. Without a treasury, DAOs won’t be able to pay contributors and they won’t be able to fund projects. Unless a DAO has missionary-like contributors, it will be hard to get initiatives off the ground.

This is why understanding a DAO’s treasury is important to determine their positioning in the larger crypto economic landscape:

Does the DAO have a sufficient number of stablecoins? If they don’t, they’ll be selling tokens and diluting holders in order to operate.

Does the DAO hold a small number of governance tokens? If so, they will have less power to vote for the initiatives crucial for growth.

Sometimes DAO treasuries can be hard to identify because the assets may be spread out across multiple contracts. Uniswap, for example, has five treasury addresses according to openorgs.info.

This article will give you some tools to use when digging into DAOs and their treasuries and highlight some details to pay attention to when analyzing the health of a DAO.

DAO treasuries matter—not just to investors, but to users and contributors too.

Identifying the Assets

DAO assets can be categorized into four components:

The DAO’s governance token

Stablecoins

The blockchain's native cryptocurrency

Tokens of other DAOs as a result of partnerships

DAO Governance Tokens

DAOs use their governance tokens in order to incentivize users to participate in the protocol, whether that means providing liquidity, voting, or investing. These are often “Governance” tokens, but we’ll refer to these as “DAO tokens”. Like equity in an early stage start-up, DAOs will have a lot of tokens but not a lot of other assets. Often this asset can be traded away for start-up capital or used to pay contributors.

Because of DEXs, these tokens are very liquid. If token emissions are very high, contributors will often sell them for stablecoins. Unless there is an equally powerful mechanism to increase demand, holders will sell them before prices fall further—due to increased supply.

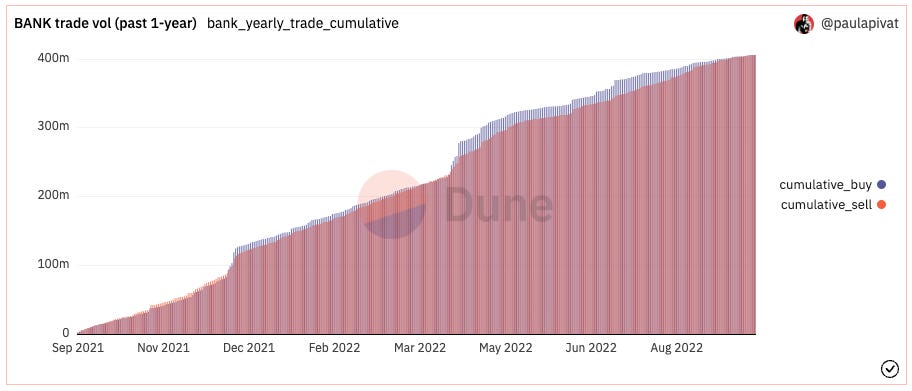

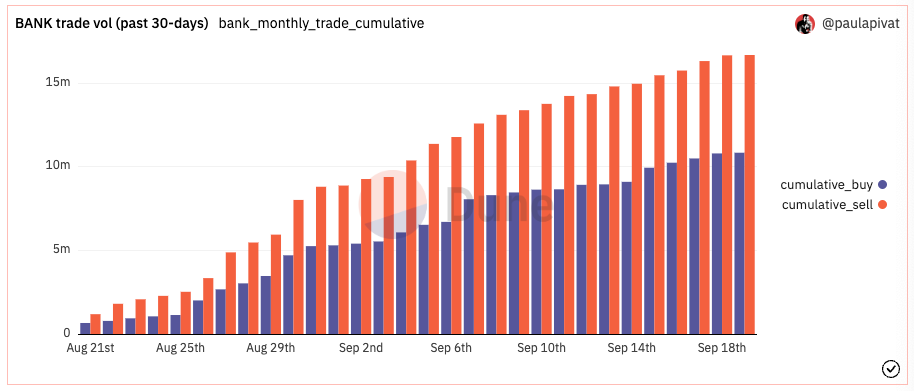

We’ve seen this behavior regarding BANK tokens. Here is BANK trading volume over the last year:

Zoom in on the last 30 days and you see more granular market dynamics:

DAO tokens should be considered the crypto-equivalent of stock, and should be discounted as a part of the DAO’s assets. DAOs can issue new tokens or change the contract. Businesses do not list stock as an asset on their balance sheets, neither should DAOs list governance tokens. Companies do not count unissued shares as assets because they could arbitrarily inflate their balance sheet by authorizing more shares without selling them, does this improve the financial position of the company?

Uniswap is a well-known example of a protocol with a large treasury but little token diversity. The vast majority of Uniswap’s $2 billion treasury holdings are UNI tokens.But discounting UNI tokens (~1.47 billion), and unvested UNI tokens ($790 million) shows a clear picture of their financial position:

The solid pink represents vested UNI tokens while the striped pink represents unvested tokens

If there’s a market downturn or some kind of hack that pushes the project to distribute funds, selling the DAO token will dilute existing holders and could create enormous downward price pressure. Most DEXs don’t have the liquidity to handle large token sales. Hasu notes in A New Mental Model for DeFi Treasuries:

“[...] imagine that Uniswap tried to sell as little as 2% of its treasury. When executing this trade via 1inch, which routes the order to many on- and off-chain markets, the price impact on UNI would be almost 80%.”

Treasuries would do well to hold more than just their DAO token.

Stablecoins

The second most common asset held in DAO treasuries is stablecoins. If you need a primer on stablecoins, the DeFi Download has your back. Stablecoins like DAI, FRAX, USDT, and USDC maintain a 1~1 ratio to the dollar. Most are backed by off-chain assets—at least in part.

Stablecoins serve to reduce treasury volatility. Crypto-native assets are very volatile and subject to large price movements. Even Bitcoin and Ether are subject to market movements, trading like risk-on assets.

DAOs should aim to keep at least some stablecoins in their treasury. These stablecoins can be used to pay contributors and hedge any market or DAO-specific events.

For example, Maker accumulated $7 million of net earnings from 2018-2020. Maker used these funds to buy and burn MKR tokens as a part of their protocol outline. But on Black Thursday (March 12, 2020), Maker failed to liquidate underwater positions due to network congestion and accrued bad debt totaling $6 million in losses.

Some of the debt was paid with DAI in the MakerDAO treasury while the rest was covered through the sale of MKR tokens at depressed prices. Maker eventually bought back and burnt these tokens, costing them 3 million DAI.

If they had instead held that 7 million DAI and used it repay the bad debt, Maker would have $1 million left over, an additional $3 million, and the MKR token supply would not have changed at all.

“Or put another way, Maker could have seen up to $4 million in additional value accrual by holding a larger treasury.” Hasu (A New Mental Model for DeFi Treasuries)

If a DAO hopes to survive for years to come, it must weather bear markets and black swan events. It cannot hope to do this using the DAO token alone. If they do, they’ll end up selling their tokens at the bottom (at worst) and buying those tokens back at the top (at best). Stablecoins often serve to de-risk the treasury.

Note: Be mindful of which stablecoins are in the treasury. If you were holding UST during its de-pegging event (May 7), the value of those tokens would’ve fallen 65% by May 9 and 95% at the time of writing.

Blockchain-Native Cryptocurrency

You can also find the blockchain’s native asset in DAO treasuries. These tokens are used to pay for transactions on the token contract’s network. Most tokens run on Ethereum and Polygon, so DAOs set up on these chains have ETH and MATIC respectively.

It makes sense to hold some of those assets in case fees get abnormally expensive, and DAOs are usually highly aligned with the protocol they’re deployed to. Although these assets are different from the DAO token, there’s often high correlation between these assets because they’re part of the same industry. If your goal is stability, buying the blockchain’s native asset should usually be done by dollar cost averaging, unless you expect your native asset to fall in price.

Strategic Token Swaps

Another item to look at is other DAO tokens in the treasury. These tokens represent partnerships between DAOs and grant voting rights in each others’ governance processes.

One of the most strategic partnerships was between Maker and Aave in their collaboration to implement the DAI Direct Deposit Module (D3M). The module works by allowing Maker to deposit liquidity directly into Aave’s DAI pool. Subsequently, Maker influences DAI’s supply to stabilize loan rates, making it more attractive to borrowers.

The efforts have been effective. Since its launch in November 2021, DAI variable borrow rates have stabilized to a range of 1.7% to 3.8% on Aave. The results are similar for the stable borrow rate.

In the process of doing so, Maker earns AAVE tokens as a part of Aave’s liquidity mining incentive program, giving Maker a voice in Aave’s governance process. DAOs can also choose to spend extra cash to buy votes in the governance processes of other DAOs and the implications can be far reaching, given enough stake.

With the growing number of DeFi projects in the wild, the overhead of learning about each project’s governance intricacies and second-order effects are large. Most DAOs will only vote if there are ecosystem-wide implications or if the proposal influences the voter in particular, so intervention is minimal.

Theoretically, they can serve as “Mutually Assured Destruction” (MAD): if you dump my tokens, I’ll dump yours, but I don’t foresee this happening in the near future. If anything, the trading of governance tokens increases overlap between contributors and can foster better collaboration in the spirit of open source development.

Financial Sustainability

In order to be financially sustainable, DAOs should generate more revenue than they expend. This means analyzing out-flows and in-flows, often discounting the DAO token.

Reporting

Looking through a DAO’s financial report is a good way to determine a DAO’s financial health. Yearn has quarterly reports that denote income, expenses, and operating margins:

From the statement you can see that Yearn has grown their gross profit following 2020, and compensation and administrative costs are also increasing. Many DAOs have put together financial statements, so contributors, users, and investors can understand the organization.

Often, these reports provide more insights than pure data. They include the categorizations of expenses that include the purpose of spending, token buybacks, and upcoming changes to the protocol/organization. Yearn noted in their most recent report that their largest cash expense was allocated to “Strategists”, developers that oversee and manage Yearn vaults, but they expect to move away from a salary for the Strategists and instead institute a profit sharing model for all DAO contributors. Yearn also notes their assets and liabilities.

However, these statements are subject to human intervention and error. An alternative is to create a dashboard of real-time blockchain data. Maker has a dashboard to display real-time P&L data.

Asset In-Flows

The equivalent of income for companies, DAOs should determine how much they’re earning from fees and other investments. Asset in-flows can materialize in a variety of forms:

Protocol Fees

Membership purchases

Yield farming rewards

Researchers can utilize the Maker Dashboard and identify how Maker categorizes income. The Dune SQL commands are publicly available, so users can run the commands themselves and double-check their accounting.

Dashboards can hold a variety of income data that’s specific to the protocol itself. For instance, Maker has a Surplus Buffer that accounts for revenue generated from Stability Fees.

And they break out monthly interest revenues by asset type:

Dashboards are a useful way to identify income from different products. Maker has several revenue streams that are broken down in the dashboard above. The Peg Stability Module, Real World Assets, and Liquidations are included. Dune is great for this sort of thing, and is essential for doing this kind of analysis yourself, but it does take some SQL knowledge.

Asset Out-Flows

Often, these details can be found in governance proposals and financial reports, not solely by looking at the DAO’s treasury. Expenses will include paying salaries, profit sharing, security audits, or grants.

A similar model to traditional finance can be used to look at these expenses. Some questions to ask:

What is the DAO’s burn rate?

How much is spent and where are those funds going?

How is spending increasing or decreasing?

Does this spend positively affect the DAO’s long-term roadmap?

DAO spending should line up with the mission statement of the DAO or otherwise fuel growth.

It can be difficult to identify and categorize DAO spending, so paying close attention to the DAO’s governance proposals, identifying transactions from the treasury, and going through financial statements is crucial.

Note: Some DAOs will spend funds on multiple projects at once and give those teams the freedom to use their grant as they like, making spending even more difficult to identify and collate.

Exploring DAO Treasuries

ENS

ENS has the majority of its holdings in the ENS token, but there’s a sizable amount of ETH. Users have to pay ETH to buy ENS domains.

Lido

The majority of Lido’s treasury is in their governance token: LDO. As a liquid staking derivative provider, they’ll earn quite a bit of ETH as well. Their treasury is more diverse with DAI being the 3rd largest asset holding.

MakerDAO

MakerDAO again has a large amount of governance tokens MKR, however what’s not noted here is its holdings in stablecoins, particularly USDC and DAI from the peg stability module (PSM). It’s important to understand how each product affects the protocol’s total holdings. This understanding will allow analysts to determine where tools fall short.

Bankless

Bankless has a more diverse treasury than some of the examples above, with BANK composing 80% of the DAO’s treasury. Still, notice the lack of stablecoins. In the event of a bear market, BanklessDAO doesn’t have the funds to purchase BANK tokens or otherwise maintain purchasing power for projects in the event of downturns.

Rook

One of the most stand out counterexamples, Rook has an incredibly diverse treasury with its top 5 holdings having a 30% share or less. This kind of runway will help Rook continue to operate into the future and survive downturns, bear markets, and black swan events.

Conclusion

DAO treasuries give investors, contributors, and users compelling insights into the health of the organization. They can signal a DAO’s strength and foresight, but this information should be taken with nuance. Some DAOs have various projects that earn revenue not noted in the DAO’s balance sheet, and spending is of great benefit for growth and long-term sustainability.

DAOs should keep treasury diversification in mind when planning into the future. If the DAO token is highly correlated with other assets in the treasury, it can still be negatively affected by market movements, and DAO tokens will not always hold their value, so diversifying into different assets can help DAOs maintain momentum. DAOs can hold LP tokens to generate revenue or index tokens to this effect.

If you’re looking to use a tool to help you manage and diversify your DAO’s treasury, there are a variety to choose from: Yearn, Balancer, and Llama just to name a few.

It’s crucial to understand DAO treasuries, whether you're a contributor, investor, or user because it affects long-term success. You can see how DAOs are spending, what income looks like, and how much runway they have. In an open financial world, everyone has view-access to the balance sheet, and it’s an important part of understanding where web3 is going.

Actions steps

📖 Read How DAOs should approach treasury management | Shreyas Hariharan

⛏️ Dig into How to Manage a DAO Treasury | Aragon

🎧 Listen Stateless #5 - Infinite Time Horizons and the Future of DAO Treasuries with Shreyas Hariharan

Impact DAO Study

Impact DAOs Research + Book project is a decentralized, collaborative and open source project. The goal of the project is to publish a book on Impact DAOs that provides information, wisdom, and insights for new web3 entrants. The project covered ten DAOs in total, conducting three in-depth conversations per DAO. To learn more about the project visit the Gitcoin grant page. If you’d like to follow their work they’ll be regularly sharing their learnings and DAO builder interviews on Crypto Good. You can also follow the hashtag @ImpactDAOMedia on Twitter.

The Buck Starts Here: Fixing Finance with DeFi

Author: Seneca52

GoodDollar is the world's largest crypto Universal Basic Income (UBI) platform.

The central concept is to use DeFi yields, earned from investor (Supporter) capital to provide income for recipients (Claimers), generating the native GoodDollar token as an additional yield in the process. But this description doesn’t do it justice.

In this series, as always we are interested in the story behind the DAO behind the protocol. CryptoGood initiator Deepa sat down with GoodDollar’s co-founder Anna Stone to find out more.

Origin story

Anna’s story is a fascinating one, and important in tracing the genetic lineage of the GoodDollar DAO’s vision, values and culture.

Originally majoring in philosophy and economics, Anna graduated a self-confessed ‘idealist’, with plans to devote her career to global development. Her experience working in traditional philanthropy focused on Africa taught her, among other things, that ‘money is at the root of everything.’

With this in mind, she returned to graduate school to find a way to provide financial services for those on a low income. The answer, she concluded, had to be through the novel use of “leapfrog” technology. At the time, smartphones were considered the most promising candidate.

After some years working for a tech startup in Israel and then New York, she came across the blockchain and realized she had found the leapfrog technology she was looking for. Looking beyond its potential as a mere currency, she saw in it a paradigm shift that would “reveal itself and unfold over the next 30 to 50 years”.

Her next move was to help build Bancor in its early days. For those new to crypto, this was one of the OG protocols, that along with the likes of Compound, Aave and dYdX established DeFi as a credible alternative to TradFi. With the help of what we now refer to as liquidity pools, Bancor eliminated the need for traditional order books, establishing the paradigm for UniSwap and its many imitators.

Founding GoodDollar

This combined experience - economics, philosophy, development, technology, marketing, and DeFi - turned out to be the ideal foundation on which to build a sustainable DAO-based UBI platform. Based on Yoni Assia’s vision to build a UBI, Anna was one of the core group of people to found the GoodDollar protocol as a possible solution for how to deliver it.

Aside from MakerDAO, there were very few examples of DAOs that had survived long enough to deliver on their own premise. The challenge was not how to start GoodDollar, but how to ensure that it would outlive its founding team. “The way to do that,” Anna recommends, “is not to decentralize and drop everything on the community at once.”

Instead, the first step is to map out the desired future state of the DAO, the skills required (e.g. software, smart contract, community etc.), and the implied responsibilities (e.g. country leads). Then it’s a question of finding the right people.

Skin in the Game

GoodDollar hires from its own community, as a primary filter for identifying those with skin in the game.

Skin in the game is important because unless everyone is invested (in every sense), a decentralized (=diffusion of responsibility) system won’t work. Just like in a democracy, says Anna, “Not everyone cares enough to show up to vote. So you're trying to create the right constituents.”

Like many DAOs, the structure is concentric. Anna visualizes these circles as successive waves of members getting integrated into the DAO, absorbing both its processes and its values. The idea is that as the organization grows, this year’s contributors will be next year’s moderators, and in time, grow to become leaders of specific functions.

Who GoodDollar is aimed at

While open to all, GoodDollar has a well-defined group it believes can benefit from what it offers. In short, people whose potential vastly outweighs their current level of opportunity. GoodDollar members tend to be:

Under-resourced (earning less than $5-10k per year)

Highly-educated, often with advanced degrees

Living in a country with:

Broad smartphone penetration

Strong crypto awareness

Rampant inflation

This target description applies to many who live in countries such as Brazil, Nigeria, Vietnam, and India.

The education level is important because it amplifies the effect of the UBI dollars they receive, as well as providing to the DAO contributors who are motivated, resourceful, and able to operate independently.

As Anna sums it up, “[The target group for GoodDollar] is really the people that crypto is designed for and that DeFi is designed to reach.” With such a talented group, all that is required of the DAO is to serve as a catalyst that unlocks their potential.

The Impact

Anna says that the impact is best seen through stories. She gives the example of a specific member - an ‘active node’ to use the GoodDollar parlance - who has contributed a great deal to the DAO and the members he has worked with. And in return? “[GoodDollar DAO has] given him a job. It's given him an income stream. It's given him a professional platform. It's given him a way into building his career in Web3.”

The aim of the DAO - the impact that it creates - Anna believes is best measured through the number of these stories it can produce.

“It’s not just economic impact,” she concludes, “There’s also human capital. There’s also recognition and social standing. There’s all sorts of things. So I think that for us, it's all really about learning.” As she discovered in Africa, financial problems can be fixed in the short-term with money, but in the long-term, only with education.

DAOs at a Glance

Hand-picked articles to understand the current state of the DAO ecosystem

🧵

Minimum Viable Permissionless-ness

Author: Rowan Yeoman

DAOs are self-managing organizations much like a fractal network of cells, where pods organize around emerging opportunities. In order to harness the power of decentralization, DAOs need to be “permissionless.” This term gets thrown around quite a bit in Web3, but it is an important design principle.

What needs to be permissionless is DAOs is access to its network. By building a DAO around three features, a permissionless structure and culture will dynamically start to emerge:

How online communities are revolutionising human coordination

Author: Donatus Schaumburg

Buildings that are now recognized as cultural heritage sites have served as a conduit for brilliant minds to come together throughout history. Instead of continuing to use such locations for the incubation reasons for which they were built, society, regrettably, seems to have reinvented them as landmarks to recall the past and to embody old authority.

For Donatus, the goal was to bring creation and life back to the heritage site's walls since the last world war, when they had served just as historical markers. He learned the following lessons as a new DAO member that the community could disagree with:

The liberal market theory, which is the foundation of the Web3 ethos, holds that organizations or people will inevitably change, turn, or converge in order to meet market demands or gaps.

One of the most impressive things about this event was how thoughtfully most, if not all, participants approached the subject of how they could help society and address the key environmental or social issues that are most prominent in today's society.

What some saw as a chance to completely replace existing structures is now coming in a variety of formats, some of which integrate with existing ones and build more flexible community representations.

Tokens of appreciating appreciation

Author: Joey DeBruin

Bear markets are for buildooors, but used properly, free tokens given to engagooors can spark new communities.

The idea is to overcome the cold start problem, initiating loops that start with tokens of appreciation, which lead to other forms of ownership. For teams looking to dabble in the ecosystem, these assets can act as placeholders, allowing projects to “be web3” while they negotiate a training ground for governance models and other token-based tools. However, there are challenges to this model, too. NFTs are still relatively complicated and can be expensive, which limits some audiences. Further, token reputation systems can have their own cold start problem if they’re not widely recognized.

Dark Matter, Water, and the Word "We": Describing power in DAOs

Author: Samantha Marin

In this article, Samantha dives into power dynamics in DAOs as she explores how we leave out other forms of power when we only focus on power as it relates to governance rights. Some of her key insights include:

“Power is when you see a direction and put things successfully in place to move toward executing it.”

“Power is the ability to be a decision-maker, to tell someone "yes" or "no" unilaterally, and to move confidently forward in one direction without significant blockers.”

“Power is dark matter because it causes other objects to move without asking permission: it just does. It is a force we cannot see that is always present, and is neither good nor bad. And, it's hard for outside observers to detect unless you see what is moving.”

“When someone in a DAO is powerful, their words and messages and forum posts are given more weight than those of others—more respect. This is true even if the system wasn't designed to give more power to this person.”

“Power is agency, problem-solving, and self-direction.”

Ecosystem Takes

🔥 and 🧊 insights from across the DAO ecosystem

Treasury Management: A Guide to Navigating Downturns

Author: Jeff Amico, Maggie Hsu, Ed Lynch and Emily Westerhold

🔑 Insights: Whether a project is being launched through a traditional corporate structure or a DAO, an essential function is the responsible management of the group’s treasury. The folks at a16z Crypto published a comprehensive guide and framework to help teams succeed:

A critical first step is to create a financial model which calculates the forecasted monthly cash burn. Assumptions around estimated expenses and revenues should be conservative. To assure completeness, line items should also be broken out by operating function or non-operating categories.

Once the sources and uses of cash have been established, the group can develop a treasury management plan, which should be underpinned by the following priorities: capital preservation, liquidity, and income. The primary requirement is to maintain 12–18 months of operating expenses in cash/stablecoins.

If the treasury is fortunate enough to have surplus capital, the team should then create a plan for investing those funds to earn some incremental yield. Keeping with the priorities above, any allocations here should be in high-quality cash-like instruments.

When putting the strategy into practice, it’s important to select capable partners for things like custody, governance, payroll, etc.

Because things rarely work out as forecasted, it’s essential to monitor cash balances and flows consistently. Adjustments should be made to spending and/or budgeting when necessary.

An Exploration of Internet-Native Organizations

Authors: Scott Moore & Maxwell Kanter

🔑 Insights: Great communities are built through a sense of belonging. This Forefront Journal presents a framework for designing around the community first before focusing on organizational design. These include:

Since the advent of the internet, there are a growing number of squads that are Internet-native. Squads have extremely stringent boundaries and a small number of members, and they are regulated by unwritten norms based on a feeling of community. However, because of networked evolution, they also run the risk of losing many of their unique characteristics.

In DAOs, stories serve as a vital reminder of our identities and the reasons we are here. Stories in DAOs are created by and for the community rather than top-down mission declarations. These scaling techniques frequently lack hierarchy.

DAOs as they currently exist are essentially human. We still need to rely on ideas that are essentially off-chain, such as giving, sharing, and cooperating to create better futures, even while smart-contracts may enable trustware on-chain. It is up to us to shape how DAOs develop.

Four Factors That Make a DAO Sticky

Author: Peter Jones

🔑 Insights: DAOs are revolutionizing the way we work together. DAOs need talented contributors and retention can be challenging when contributors are able to come and go as they please. If DAOs are going to retain talent, they need to find a way to make members stick around:

Factor #1: Easy Paths to Contribution - DAOS need to make a path for members to consistently make quality contributors.

Factor #2 - Earning and Value Exchange - Bounties and role-based work need to have clear parameters.

Factor #3 - Proposal Paths That Meet Community Needs - Governance design should encourage community engagement and facilitate the proposals being fully scoped before being voted on.

Factor #4 - DAO Impact, Sustainability, and Growth - What is the mission and values of the DAO? What impact are they trying to make? Is the DAO designed to relate to the Web3 world or to interact with traditional businesses or communities?

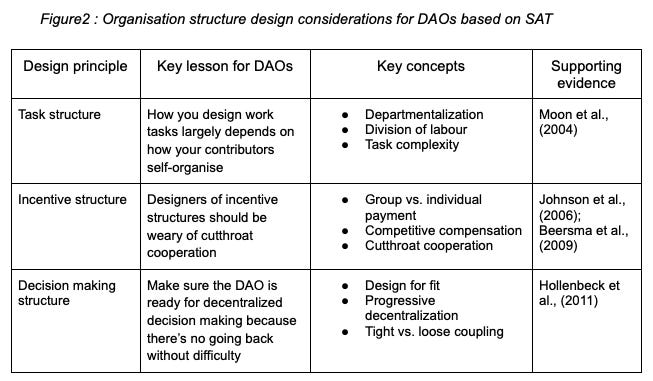

DAOs & Structural Adaptation Theory - Part 2

Author: Saulthorin

🔑 Insights: Structural Adaptation Theory (SAT) studies how change might be affecting your organization’s design process. As Part 2 of a three part series, TalentDAO shares three lessons DAOs can learn from SAT:

Lesson #1: How you design DAO structure largely depends on how contributors self-organize and work is divided.

Lesson #2: Designers of incentive structures should be weary of cutthroat cooperation.

Lesson #3: Make sure the DAO is ready for decentralized decision-making because there’s no going back without difficulty.

DAO Spotlight: MolochDAO

Since first being summoned at Eth Denver in 2019, MolochDAO has left a permanent mark on the Ethereum ecosystem. On its own MolochDAO has brought approximately 1.4 million USD worth of funding to public goods projects, as well as spawning hundreds of forks of the Moloch framework including MetaCartel DAO. Over MolochDAO’s now three year life span it hasn’t stayed static, continuing to evolve from its original form as a minimum viable DAO with the least possible lines of code.

Moloch’s origin, outside recently entering the Web3 world, dates back to Biblical times as a Canaanite deity. MolochDAO was not summoned to bring together new followers of a deity, especially one associated with child sacrifice. In modern times, Moloch was the subject of a poem that serves as the introduction to an essay titled Meditations on Moloch. In it the pseudonymous author and psychologist describes various examples of the prisoner’s dilemma. These are situations where the individuals in the moment are far more likely to act out of self-interest or self-preservation. In order to escape such lose-lose and win-lose circumstances a leap of faith is required to achieve a win-win. This essay was a primary inspiration for Ameen Soleimani when naming the DAO to be summoned; to slay Moloch and overcome our coordination problems.

Moloch whose mind is pure machinery! Moloch whose blood is running money! Moloch whose code is a coordination mechanism!

—First two lines Allen Ginsberg’s Howl, Part II. Last line added in the Moloch Summoning Guide

Initially the v1 Moloch contracts were quite limiting; with single token support, proposals could only be submitted or processed by a DAO member, and grants were awarded as shares that would later be redeemed for ETH. Evolving to Moloch v2 in September 2021 brought a wide range of new abilities. Using the upgraded contracts, any Moloch v2 styled DAO could now hold 200 different assets, grants would now be awarded as any of the DAO’s assets instead of redeemable shares, proposals could be submitted from outside the DAO, and more nuances were added.

In February of this year, MolochDAO published their annual report showing that in 2021 close to 750,000 USD were estimated to have been distributed, more than both 2019 and 2020 combined; although at a decreasing proposal approval rate from 31 in 2019 to just 15 in 2021. Noteworthy projects that were awarded funding included TrueBlocks, Rotki, Ethereum Cat Hearders (ECH), Umbra Protocol, and Flashbots.

Although MolochDAO is still accepting grant proposals it is important to consider their current how to guide where they state that the DAO is in a “phase out period.” Approvals are now oriented towards Ethereum infrastructure, public goods, research, and sometimes advocacy projects. For decentralized apps, or tokenized/VC funded projects MolochDAO now provides a link directly to MetaCart Ventures. Among the list of grants approved this year there are “In Defense of Privacy”, “SmartInnvoice”, and “Black Sky Nexus”, and several for DAO infrastructure.

On the third anniversary of Moloch’s summoning, the next evolution of the framework was announced at Eth Denver 2022. Named Baal, continuing the biblical theme and another among the Canaanite pantheon, v3 adds tremendous versatility. Between v2 and v3 an intermediary feature was implemented, called minions, allowing any Moloch DAO to execute other smart contract calls through proposals. Flexibility like this is built directly into Baal as well as the ability to manage a Gnosis safe.

Will this be MolochDAO’s final form?

Join their Discord, follow on Twitter, or support their Gitcoin grants.

Get Plugged In

Upcoming Events