A Tale of Two Markets | BanklessDAO Weekly Rollup

Catch Up With What Happened This Week in BanklessDAO

Dear Bankless Nation 🏴,

Last season started with the UST collapse followed by numerous exploits across the ecosystem. Amid this and a market downturn, bDAO endured and kept doing amazing things. Starting this season we can feel that there is positive sentiment in the air, that a wave of interest and adoption is coming — a wave bDAO is perfectly positioned to catch. Our mission is to help the world go bankless, and this mission is spreading around the world as we see momentum buidling on every continent.

Not only does the market seem to be holding steady, but the Ethereum proof-of-stake merge has an official date following the successful merge of the Goerli testnet this week. Arguably the most anticipated day in Ethereum history, this event unites our entire ecosystem. Mark your calendars, the Merge is scheduled for mid-September. That’s only 5 weeks away!

To be honest, it barely feels like a bear market anymore with this amount of anticipation and activity across the Web3 ecosystem. Through good times and bad, it’s the bDAO vibes that make it easy to carry each other through to whenever the bull returns. Our momentum is strong going into this season and it’s important not to lose it as we scale our influence across the globe.

This week’s Rollup is brought to you by a team that includes two of the Rollup’s original contributors. New Grants Committee member and OG Rollup writer Ap0ll0517 brings us a tale of two markets, set against the ebb and flow of bDAO’s history. And the steady hand of our Master of Shipping, siddhearta, has been guiding the newsletters since go. As Season 5 kicks off, we say thank you.

Contributors: HAshBrown27, Paulito, Ap0ll0517, AustinFoss, Trewkat, siddhearta, hirokennelly.eth, Chameleon

This is the official newsletter of BanklessDAO. To unsubscribe, edit your settings.

🙏 Sponsored by humanDAO

🗓 Weekly Recap

Community Highlights

🌐 Season 5 Kicked Off in Twitter Spaces

Closing out the first week of Season 5, we were joined by the Bankless Duo for this season’s kick-off call. While the event was a celebration for bDAO, the whole crypto community was shaken by the events surrounding Tornado Cash. For the first time in blockchain history, a smart contract was sanctioned. David summed up the incredulity at the U.S. Treasury’s decision in what almost felt like a eulogy for Tornado Cash:

“…now we have nation states going after an actual application. Not really knowing what to do with an application that is actually decentralized, and actually permissionless, and so what do they do? They just restrict their own citizens’ ability to touch that thing, and so we are now in the phase where this shit matters. This is no longer just toys, games, and DeFi fun times, this is now where it gets real. This whole idea of going bankless has to get a little bit more serious.” — David Hoffman

The alpha that Ryan and David shared at the end of the call tells us HQ was already thinking hard about strengthening the Bankless community’s resilience in the face of events such as the state-sanctioned demise of Tornado Cash:

A new website is in development and will host everything HQ-related on Web3 rails. This will address the centralization risk associated with email providers like Mailchimp, which has recently started banning crypto-related content producers. This will also allow HQ to integrate token-based features.

A PFP NFT project is in progress — a collaboration with Bankless Consulting.

During the call we also took a tour through the various guilds and projects and heard about how much they have grown. Just two examples are:

Bankless Consulting grew their social media reach by 323%, and increased referral fees paid out by 750%.

Bankless Academy has had 688 lessons completed, and shipped a total of three new lessons: Blockchain Basics, Academy Community, and Web3 Security.

For a full recap, listen to the recording.

What’s New

🌱 Bankless Consulting: Regenerative Finance for Normies and Degens

Last Friday, Bankless Consulting hosted a Twitter Spaces event — Regenerative Finance for Normies and Degens — to mark the launch of Season 2 of ReFi Podcast. Guests were from the regenerative finance (ReFi) and Web3 climate space, and included Climate DAO, Moonjelly, Flowcarbon, Toucan Protocol and Future Quest DAO. It was a lively discussion, moderated by Feems, about defining the ReFi movement, onboarding more people into ReFi, how the Web3 environment provides more opportunities for collaboration and shared knowledge, and what the teams are looking forward to in the next year. You can listen to a recording of this conversation by clicking on the tweet below:

🎙 BanklessDAO Podcasts

🧠 Crypto Sapiens Podcast

🌍 Bankless Africa

💰 Making Bank

🏹 Bounty Hunter

✍️ Bankless Publishing

🌏 Bankless Africa Newsletter

Get Involved

🌎 Metaversité Launches Creative Hackathon Ahead of ETHMexico

Lens, herhacks, The Gallery DAO, and H.E.R DAO have partnered with Metaversité to host a creative hackathon in Mexico City, August 17 - 19, ahead of the first edition of ETHMexico. This event will take place online and IRL. Both virtual and IRL participants will be able to access coaching and mentorship during the event, as well as qualify for chances to win up to $7K USDC in prizes. Applications are open until August 16, 2022. For more information visit www.themetaversite.io.

📃 Bankless Academy

Bankless Academy is proud to be kicking off a new learning series in Season 5: Liquidity & DEX Aggregators, with 1inch. You're invited to apply to attend this Level-Up Live learning series, a series which will feature a short presentation followed by 45 minutes of Q&A with the session teacher and a subject matter expert. Each session will be less than one hour. Please fill out this Tally form to apply to be a part of this series.

#️⃣ WeAreDAO

🙏 Sponsor: humanDAO - improving lives through crypto.

A Tale of Two Markets

Author: Ap0ll0517

“It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us, we were all going direct to Heaven, we were all going direct the other way…”

— A Tale of Two Cities

This celebrated text from Charles Dickens may have been written in 1859, but it accurately describes the two types of market cycles — bull markets and bear markets. Everyone loves the bull phase when the prices are steadily rising, and everyone fears the bear phase when the prices fall. Each market has a life of its own — with unique characteristics and different energies.

Amid the bull phase, there is much hype and excitement. This is a time when, in addition to rising prices, there is a great deal of innovation in the market. There is so much hope and confidence when new projects, protocols, and communities are introduced that there is an almost biased belief that each will succeed.

During the last bull market, we saw DeFi Summer, the rise of NFTs, and the emergence of DAOs. Each was a new paradigm that defied the traditional ways of operating. DeFi challenged the outdated finance models, NFTs brought crypto to art, and DAOs introduced a fresh model for governance and ownership.

In contrast, during a bear market, the euphoric period of rising prices is over. Typically prices decline by more than 20% and this downward trend continues for a sustained period of time. Negative sentiment starts to set in as some investors suffer losses. This is a time when investments are re-evaluated. Some positions may be liquidated and others may be reorganized.

The bear phase has also produced some of the most respected and recognized names in the Web3 space today. Blue-chip projects like MakerDAO, Uniswap, Compound, and Aave were all built during the last bear market and were huge catalysts for DeFi Summer. Historically, bear markets have been a time of fewer distractions and greater focus.

BanklessDAO Was Born During the Bull Market

BanklessDAO was no exception to the mania whirlwind experienced during the bull market. The post announcing BanklessDAO’s genesis detailed the goals and purpose of the DAO and notified BanklessHQ subscribers that they may be eligible for an airdrop of BANK, its governance token. As the Genesis Team explained in the announcement, “The Bankless DAO Discord is the foundational communication and coordination hub for the community.” Over 3,000 people received access to the Discord server with their airdrop of BANK. Many others purchased the required 35,000 BANK tokens to gain full access. The primary goal was “for the community to form in Discord and formulate the initial distribution campaigns and token functionality for future seasons.”

There was so much chaos in the early days of Season 0. Some BanklessHQ subscribers did not receive the airdrop, so this sparked a few different forum proposals to modify eligibility. There were discussions about lowering the membership threshold of 35K BANK. There was an initiative to allow us to retain membership even if we deposited to the BANK/ETH liquidity pool on Uniswap. Because there was so much happening, a few contributors decided to publish a central source of DAO-related info. Hence, the first Weekly Rollup newsletter was published just three days after the DAO was launched and it was done async!

We didn’t have an incentive or rewards mechanism in place. Contributors were just taking initiative with no promise of remuneration. We simply tipped each other BANK to show our appreciation. I remember my first tip was so empowering! I felt so accomplished and appreciated when I received that unexpected gift. It encouraged me to get more involved and keep contributing.

The DAO was unpredictable and people were not certain what to expect. But there was an excitement about not knowing. There were so many ideas and conversations. The chatter on Discord was overwhelming at times. Every day there were new channels added and navigating the DAO was always challenging. Soon the choppy waters settled and we began to sail more smoothly toward our north star — to spread crypto culture, media, and education to one billion people.

Season 1 and Beyond

By the time Season 1 kicked off, BANK’s price had seen a dramatic decline. I like to suggest that Season 1 was the beginning of BANK’s run during the bull market. At that time, we’d experienced BANK’s all-time low price and were starting to see a price reversal. This is also when we started to see some core contributors emerge.

I remember the days when the Writers Guild meetings consisted only of Frank America, frogmonkee, nonsensetwice.eth, siddhearta.eth, and myself. Every week, we showed up and put in the time, not only to work on the Weekly Rollup but to build the framework that would allow us to expand and scale. There was a lot of work to do and only a few contributors to share the responsibility. There was still hype and excitement within the DAO, but there wasn’t as much noise. People were busy working with their heads down.

Bull Phase for BanklessDAO

During Seasons 1 and 2, the number of BANK holders was always growing. However, as BANK’s price began to increase, the growth rate of BANK holders went exponential as people rushed to the DAO. Once again there was a distinct buzz of electricity flowing through the Discord server. The bull phase was in full effect.

Some people saw an opportunity to earn BANK and sell it for a quick profit. Others saw a chance to accumulate BANK and HODL. Everyone wanted to contribute and earn our coveted governance token. There were many examples of people contributing to multiple projects and guilds. It was almost impossible to say no to any new opportunity; it felt like FOMO not to jump for the newest project.

New projects were spawning and the BANK token was being used to entice contributors. The DAO was progressively spending more BANK to fund different initiatives. In his Annual Letter to BanklessDAO, frogmonkee eloquently pointed out that we only spent 1M BANK in Season 0. However, we spent 11M BANK in Season 1 and 20.5M BANK in Season 2!

All-Time High

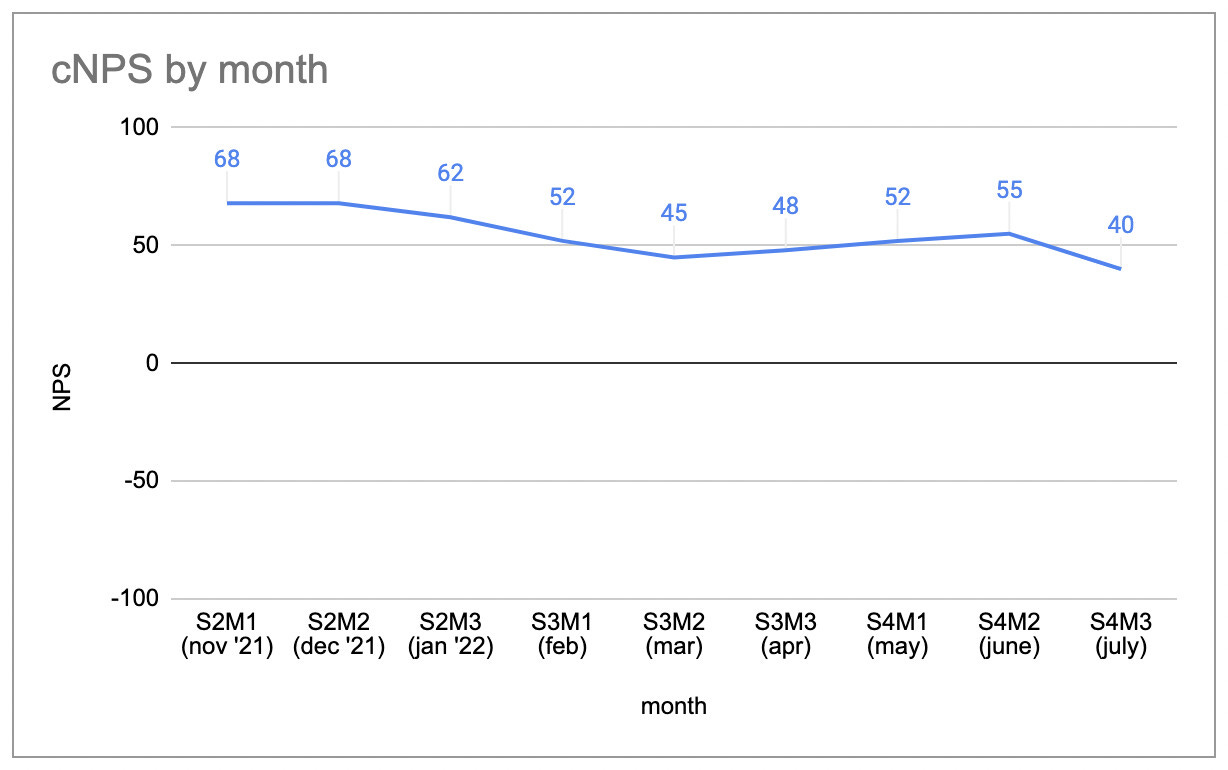

During Season 2, contributor sentiment was at an all-time high. According to the analytics provided by Bo Brustkern and Ella Dane, our Community Net Promoter Score (cNPS) was at its highest at 68 in November and December 2021. Coincidentally, that is also around the time BANK’s price averaged more than $0.10 (USD) per token, touching $0.12 and even $0.15 on occasion.

BanklessDAO Enters the Bear Phase

From the all-time high, we can see that our cNPS has gradually decreased. I think this is correlated to the price in BANK and the overall confidence in the market. A downward trend started in January 2022, after the price of BANK dropped more than 60%. In February and March, the price continued to fall another 40%. BANK lost almost 80% of its value from its price of $0.15 in December to its price of $0.03 in March. Consequently, our cNPS score suffered a 34% decline.

After a small correction in April thru June, the cNPS score experienced another rapid decline. This time it was a 27% reversal which occurred after BANK registered its all-time low price of $0.0081 on June 18, 2022. Is it a coincidence that our cNPS score was at an all-time low in July? I think not.

Although we’ve experienced blows to both BanklessDAO’s cNPS score and the price of BANK, the number of BANK holders continues to grow. There was a slight decline in the growth rate from February through April. But it appears the number of contributors isn’t directly correlated with the price of BANK during this bear phase we’re experiencing.

What Bear? This Is a BUIDL Market!

Not only has BanklessDAO continued to grow, but we’ve also continued to ship. Many projects are building amazing things during this bear market. UltraSound Merch launched this year and is already in Stage 4 of its roadmap. It has emerged as one of the hottest Web3 merchandise and apparel supply chains that also includes “the Bankless Checkout, our custom-built Layer-2 payment gateway.” Bankless Africa released two different podcasts and a newsletter and is possibly the fastest growing project in terms of size, reach, and audience. Bankless Academy launched this year with the mission to help guide over one billion explorers on their Web3 journey. There are already five different lessons for explorers with over 13,000 lesson completions to date.

There are so many more projects which are building right now within the DAO that I feel neglectful not mentioning the progress they’ve all made. Projects like Bankless Publishing, Bankless Consulting, International Media Nodes, and Fight Club are just a few.

I think my friend Above Average Joe accurately sums it up with this simple tweet:

Sustainability in a Bear Market

I’ve been a BanklessDAO member since day one. I’ve been here for both the bull and the bear markets. There is a different vibe in the DAO with each phase. During the bull market, it felt like blissful ignorance. We didn’t know where we were headed or how we would get there. All the hype and energy were contagious. It was so easy to get caught up in the mania. There was always a new project and we didn’t know how to say no.

“Can you fund this project?” “Sure!” “Can you contribute to this project?” “Of course!”

We did this without regard for sustainability. It honestly was not a recipe for success. From a contributor’s perspective, it was a great lesson. We overcame challenges experienced in the bull which prepared us for the bear. One such example is addressing sustainability, not only in terms of profitability or scalability but also in terms of mental health and combating burnout. During the bull, there were many contributors suffering from burnout. I can attest to this as I accepted too much responsibility across roles in projects and guilds. Part of this stemmed from the FOMO that comes with the bull phase, and part of it was we had more work than contributors.

Back in Seasons 0, 1, and 2, the work wasn’t as decentralized as we wanted it to be. We were still in the process of developing procedures, training, onboarding, and learning. I remember a lot of trial and error. We opened the Discord server to Guest Pass holders to increase the number of contributors. Although we had an increase in contributors, we didn’t have proper documentation outlining expectations or opportunities to contribute. There were a lot of people who wanted to chip in, but didn't know how or where to get started. So we implemented talent scouts and coordinators to welcome new members and help them get plugged in.

We tried remunerating contributors using only Coordinape. Then we introduced paid bounties and salaries in addition to Coordinape. Initially, anyone could claim salaried positions as long as they expressed interest. We quickly learned that wasn’t the most effective approach. Some guilds modified the process and mandated that another contributor has to nominate someone for a salaried position. We also initiated elections to select role holders if there were more than two nominations.

There is still trial and error, but not as much. Now our processes are more refined. We also have more contributors now, which allows us to distribute the workload and share more responsibility. The onus isn’t entirely on a few contributors. This allows people to focus on granular tasks instead of the whole project, preserving our time and mental health and also increasing our productivity.

Still Bullish on BanklessDAO

It doesn’t matter what market we’re in, I’m still bullish on BanklessDAO — maybe even more bullish now than in the bull market. Now we have a much better idea of where we are headed and the hype isn’t sourced from blind passion, it’s sourced from the community’s concerted effort. The excitement is still contagious. New members joining today feel our energy and embody our vibes. We know that many great projects are built during bear markets — we’re here and we can’t wait to show you what we create!

🏛 Governance

Snapshot Votes

⚡️Season 5 Guild and Project Seasonal Funding

Per the Season 5 specification, guild and project funding requests were reviewed by the Grants Committee and were endorsed for a total of 19,501,085 BANK. Of this amount, 50% of project funding (5,270,750 BANK) will be retained by the Grants Committee multisig to disburse mid-season, based on KPIs being reported. This proposal seeks to ratify the distribution of guild and project funding.

Proposals in Discussion

🏅 Leveling Up Proposal

This proposal aims to develop a tokenomics certification for DAO contributors who want to prove their tokenomic capabilities with an on-chain, verifiable credential and access to an expert community. The proposal seeks funding to develop a minimum viable product.

📣 DomainDAO x BanklessDAO — bankless.dao URL

DomainDAO is applying to become the TLD (top-level-domain) issuer for .dao URLs from ICANN. A successful application would empower community ownership and oversight of .dao domains, raise awareness of the Bankless mission, and give DAOs a clear way to express their identity as a DAO in the digital space. This proposal seeks support from BanklessDAO in raising awareness and possible funding.

💡 An Idea to Decentralize bDAO Project Selection

An early-stage proposal has been brought forward to formalize the way bDAO selects for and prioritizes projects by implementing a scoring system. How this would fit in with the Grants Committee and the Governance Solutions Engineers is yet to be decided, and everything is open for discussion. This conversation is to take a temperature check on what other bDAO members think about the best way to prioritize bDAO projects.

🚐 GM Bus and Green Pill Trailer — Season 1

The GM Bus is focused on collaboration, cross-ecosystem coordination, and engaging with IRL communities to spread adoption of DAOs. The GM Bus will cultivate awareness of the regenerative nature of decentralization and the power of open-source ecosystems, while boosting the visibility of our individual sponsors. By appearing IRL, the GM Bus creates the opportunity to directly connect with communities outside of the crypto echo chamber.

Four dates are planned across the U.S.: two in California, one in Colorado, and one in New York. While also having outside support, this proposal seeks 5,000 USD equivalent in BANK for contributor funding.

📈 dYdX Grants Bid

dYdX wants leading-edge research into how working groups are built, operated, and led in Web3. BanklessDAO is in a superb position to offer dynamic, leading-edge advice. This proposal seeks to introduce the idea to the DAO for comments.

✅ Action Items

📖 Action: Participate in any of the above forum proposals.

🗳 Vote: Make your voice heard and vote on Snapshot.

🏃♀️ Catch up: Review this week's Community Call notes or listen to the recording.

🙏 Thanks to Our Sponsor

humanDAO

Pocket Assistant NFTs are pioneering a new gig economy for Web3, with Web3 values. Our community of contributors are here to help you spend more time on high-value activities by easily delegating your simple but time consuming tasks. PA NFT holders get to delegate 20 tasks per week to Pocket Assistants. In doing so, you provide valuable, safe, flexible work and income to someone in an underserved community. This is a step-change in utility for NFTs, a jpeg with real-world utility, freeing up hours of time per week for holders and providing wages to those most in need across the world.

👉 Reserve a Pocket Assistant NFT before they're gone.

👉 Follow humanDAO on Twitter.

👉 Join humanDAO Discord.

🤣 Meme of the Week

Thanks Elemental!

In the latest edition of the HXLLYWXXDVICES monthly editorial, the publisher argues now is the time we “witness and allow.”

He does so via a couture model in Louboutins and a dead classical poet floats downs a river?

Link to the August edition:

https://hxllywxxdvices.substack.com/p/hxllywxxdvices?s=r&utm_campaign=post&utm_medium=web&utm_source=direct