4 Simple Ways to Stack Sats

Bitcoin is Booming, So What Can You Do About It?

Bitcoin Half-Mooning

With bitcoin half-mooning, and investors clamoring over a forthcoming bitcoin ETF, you may feel like you’re a little late to the game. But as of today, bitcoin is only sitting at half its all-time high (ATH). If it continues to appreciate in value following each halving, like it has done historically, this would mean you’re still early. Of course, bitcoin is a risk-on asset, and before making any financial decisions it is best to talk to a professional.

One way to get started in the market without putting too much skin in the game is to simply participate. Similar to the way the Ethereum ecosystem rewards onchain behavior with airdrops, NFTs, and POAPs, the Bitcoin network has some innovative ways for its community to gather rewards. Let’s look at a few simple ways you can stack satoshis.

Fun fact: One satoshi, or “sat”, is 1/100,000,000 of a bitcoin. Another way to say that is that every bitcoin has one hundred million satoshis.

4 Simple Ways to Stack Sats

TL;DR 👀

Stream it on Fountain

Post it on Nostr

Invoice it on Nodeless

Buy it on River

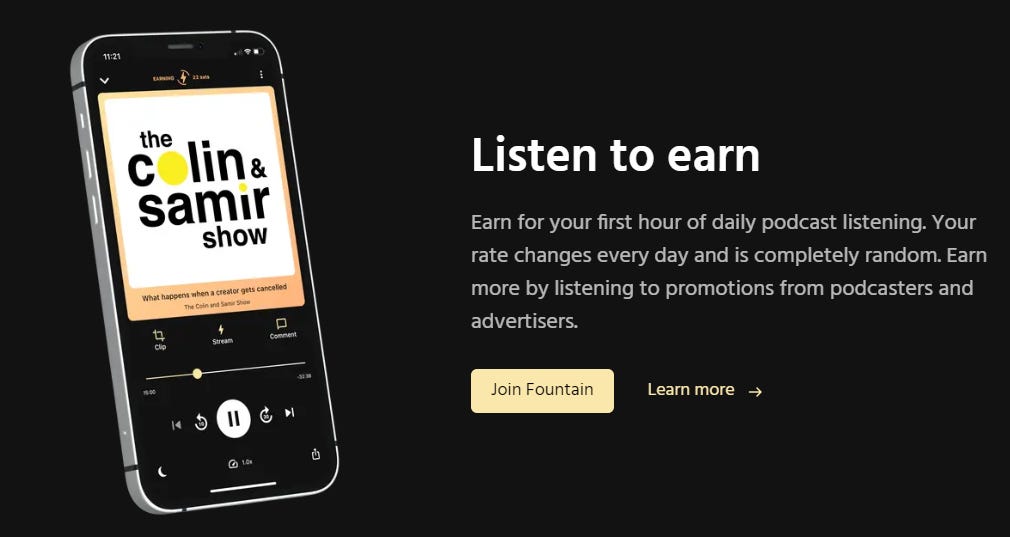

1. Fountain

Download the Fountain app, listen to podcasts, comment, and make clips.

Streaming Satoshi

Fountain utilizes the Bitcoin Lightning Network to pay people in sats for streaming. The Lightning Network is a layer-two functionality built on top of the Bitcoin protocol, just like Optimism and Arbitrum are built on top of the Ethereum protocol. Fountain pulls RSS feeds from traditional podcasting platforms and has an incentive structure on top of those feeds to send sats both to listeners for listening, and the podcasters for creating. If you have a podcast it is free for you to claim your RSS feed on Fountain, and start getting sats from anyone who listens to your show on the platform.

If you’re an avid consumer of podcasts, it’s really worth it to look up your favorite shows on the Fountain interface, and play them on there instead of another platform. It’s nothing crazy but listening to shows for the last year has brought in ~30K satoshis for me, most of which I’ve sent back to the podcasts that I appreciate as tips. This value-for-value component feels good and is probably the prototype for the web3 network of goods and services that will be ushered in this decade.

Just Clip It

Perhaps the most innovative component to Fountain is the capability to make clips. Some users find 90-120 minutes of a podcast is too much, so they listen to clips that other users create. If you do the hard work and clip the juiciest parts of meaningful and popular podcasts, users like your clips and then you get sats. The network effect on this is still nascent. Hot tip: nobody has done this effectively for the Bankless Podcasts as yet.

On the downside, much like most new tech, it can simply glitch out. Don’t get too frustrated; just switch over to another podcast platform for a show or two and then circle back. Fountain is always improving the tech so keep updating it via your app store.

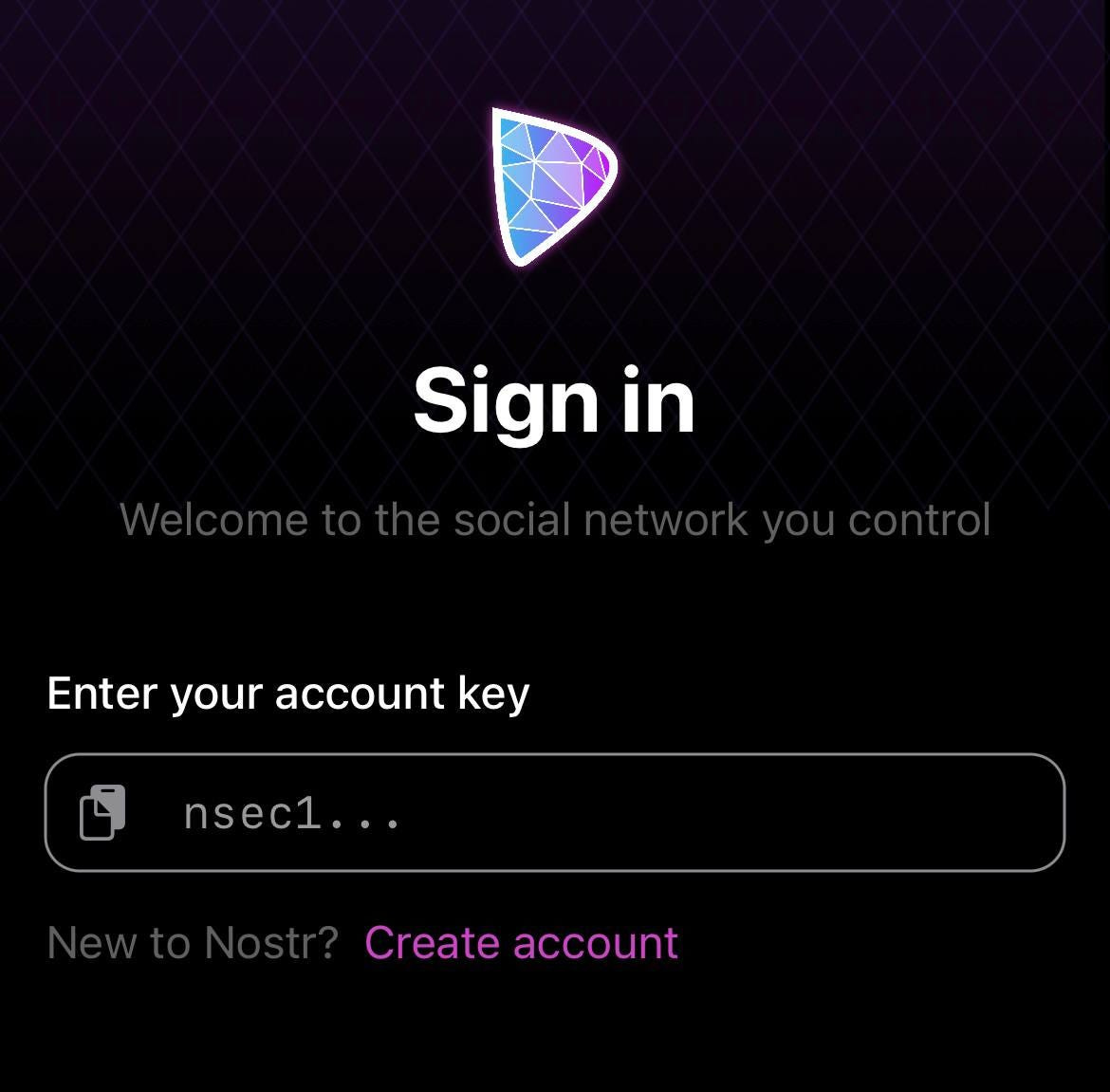

2. Nostr

Set up a Nostr account and engage via social media clients like Damus (you’ll get Zaps, they’re dope).

X, But You Own The Data

Nostr, which stands for ‘Notes and Other Stuff Transmitted by Relay’, is an open social-networking protocol. Once you create a Nostr account you will use it to access the Nostr protocol via any of the clients that are built on top of it. Clients such as Iris, Damus, or Plebstr will set you up with access to Nostr and then you’re good to go.

With Nostr you create one private key via any client you choose and then use it with all the clients. Clients are just an interface; all will pull the same data from the Nostr protocol. So if I make a post on Damus on my iPhone, it’s visible to a desktop user using a different client like Iris. This is true to the web3 ethos. Take your data with you, all of it — your followers and your posts. Once I understood that, I realized how brilliant this is. This is occurring on Ethereum too, via protocols like Farcaster, and its popular client (interface) Warpcast.

Many of the Nostr clients use the Lightning Network to deliver micro payments. When someone likes one of your posts, they can send you zaps, and they feel amazing. Zaps are micro payments in sats that go directly to whatever wallet you link to. For example, you may have a Wallet of Satoshi Lightning address (custodial), or a Muun wallet Lightning address (non-custodial), or you can use the one you made on Fountain (custodial).

With Nostr, you have a public key which begins with npub1 (this is the one you share around), and a private key which begins with nsec1 (do not share this, as it’s what controls access to the data). When you login into a client, you provide your private key once (check the Nostr advice about this first), and that’s how it pulls all your data from the base layer. It’s pretty friggin’ sweet actually.

Personally, I’m stoked for a multi-account feature to be rolled out, so I can hop between brand entities and a personal entity on a single app via a toggle function. Sound interesting? Then set up a Nostr public/private key pair, start posting, and get some zaps.

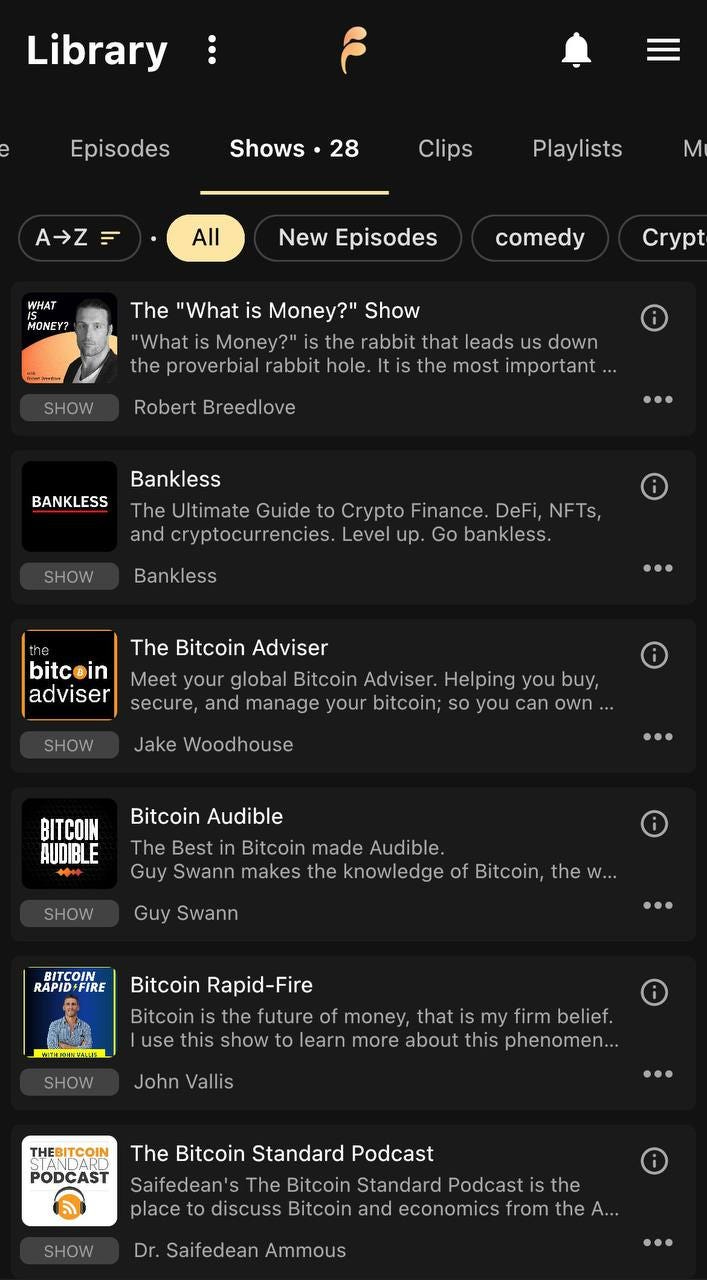

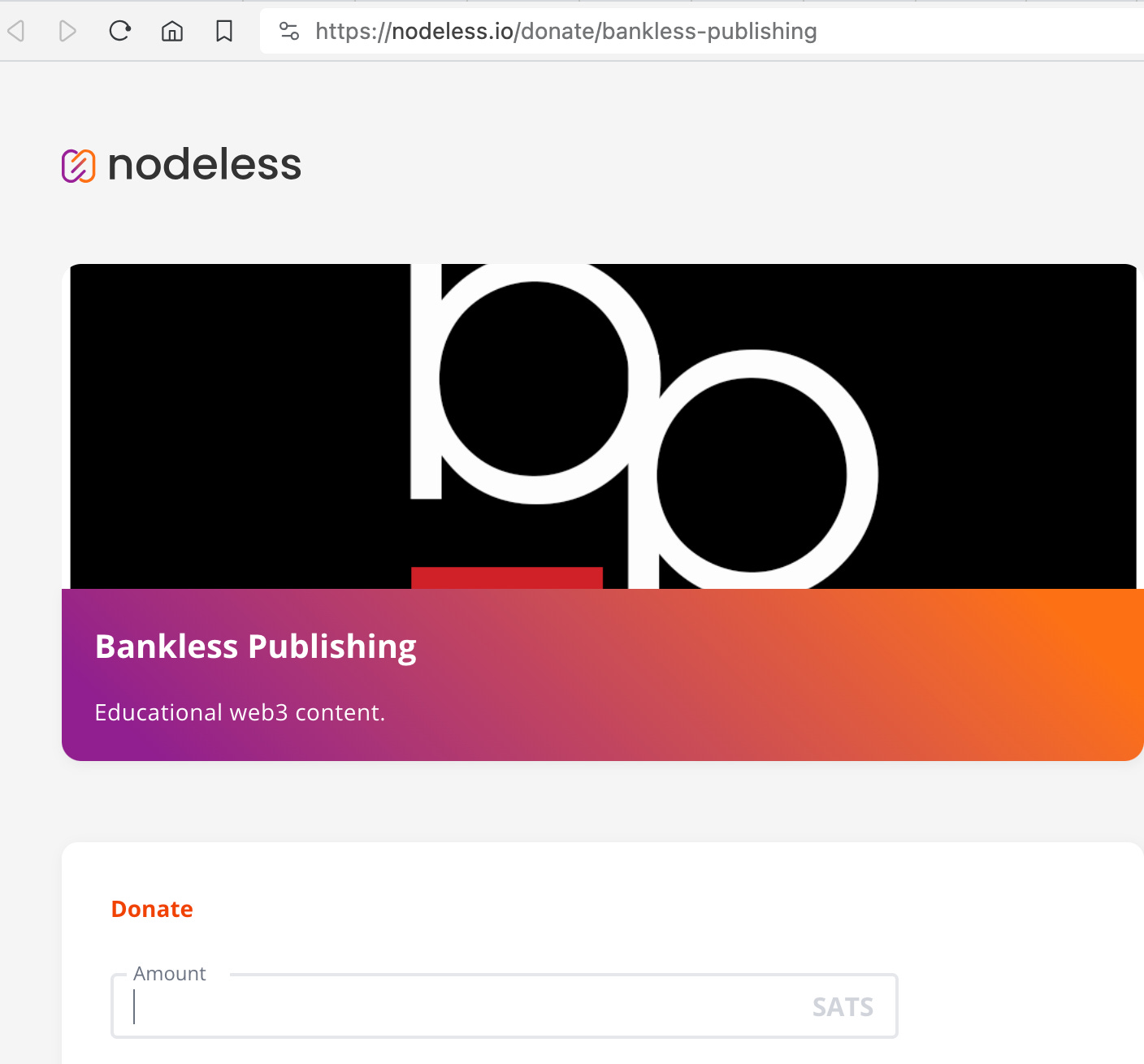

3. nodeless

Head over to nodeless, and spin up a donation button or invoices for your website, product, or service.

Non-Profit Sats

If you’re providing any sort of service or selling any sort of goods, think about integrating bitcoin donations via nodeless — a semi-trust-based platform that makes it super easy to spin up a donation page and link to it from your website. From there, nodeless will direct any sats received to your designated Bitcoin or Lightning address.

You can spin up a donation page in under five minutes and add that link to your site and socials. If you’re more technical and want to develop a trustless way to receive payment, switching from nodeless to btcpayserver is interoperable.

For-Profit Sats

On the for-profit side, if you run a business and are looking to accept payments in bitcoin, or send out invoices in satoshis, nodeless has that completely baked in. It’s also got a plugin to integrate with woocommerce.

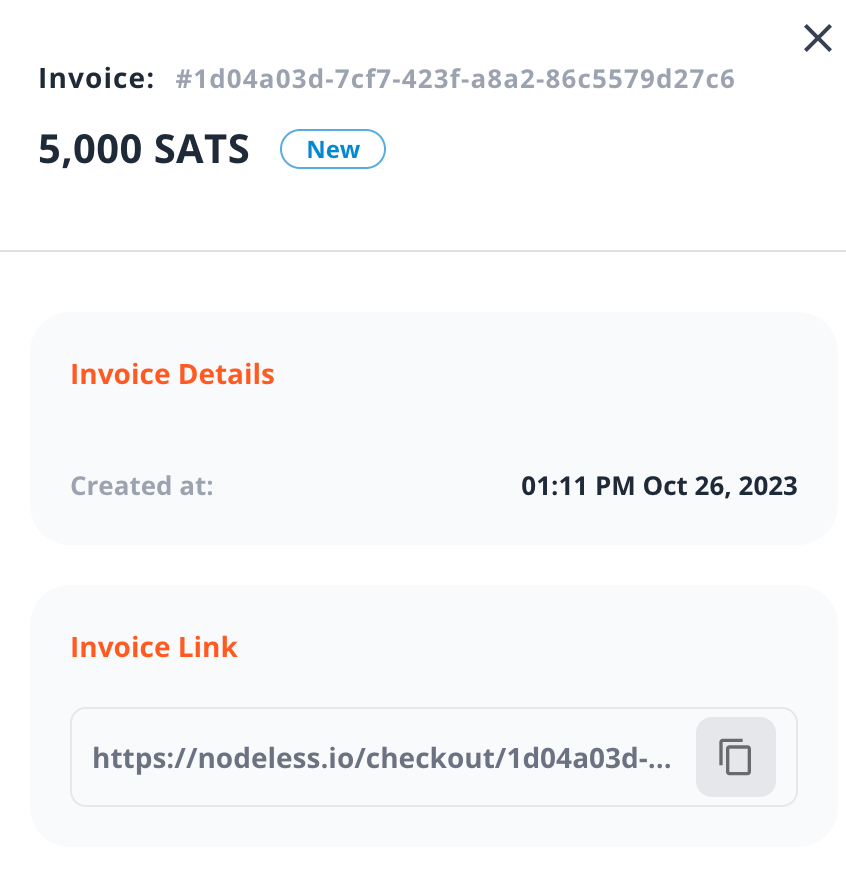

You can spin up a sat invoice, drop the email of who it goes to, and get a custom link to send them. Take a look at this example invoice I just made up for Bankless Publishing. It’s killer smooth, and allows for settlement on L1 or L2, complete with QR codes for a quick payment from your client. That’s dope.

Products like nodeless are redesigning the way companies can work with the bitcoin protocol. If you provide goods or services online this may be a good option for you. To be clear: this capability isn’t about saying, “we only accept bitcoin” — it’s about expanding the options for your clients.

4. River

DCA into bitcoin with zero fees using River.

Just Buy It

The simplest way to stack sats is to buy bitcoin. If you’re like me, you probably started with a Coinbase or Binance account and have used those large entities ever since. There is nothing wrong with the liquidity they carry and their ability to cash out instantly. However, this typically comes with larger margins, and/or a higher quote on fees for the end user. Companies like River are trying to put a stop to all that.

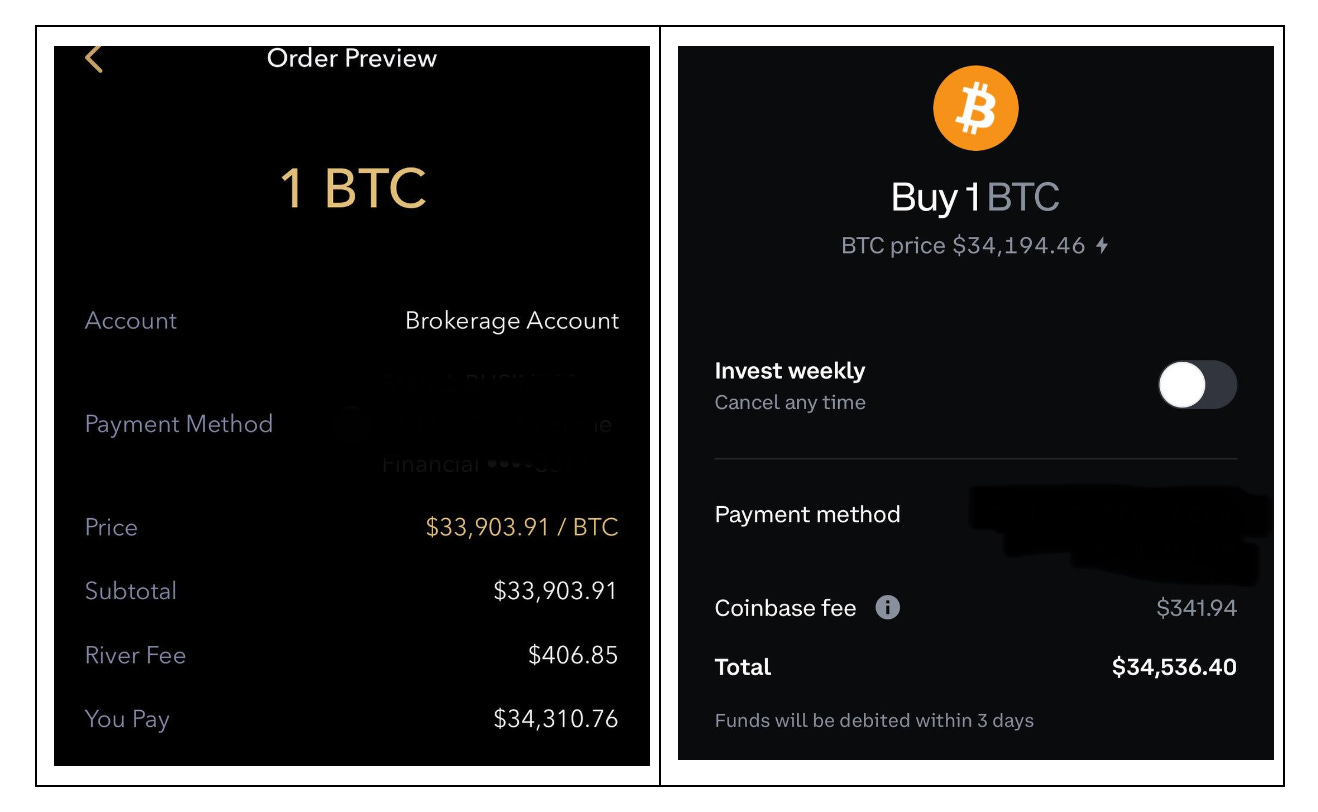

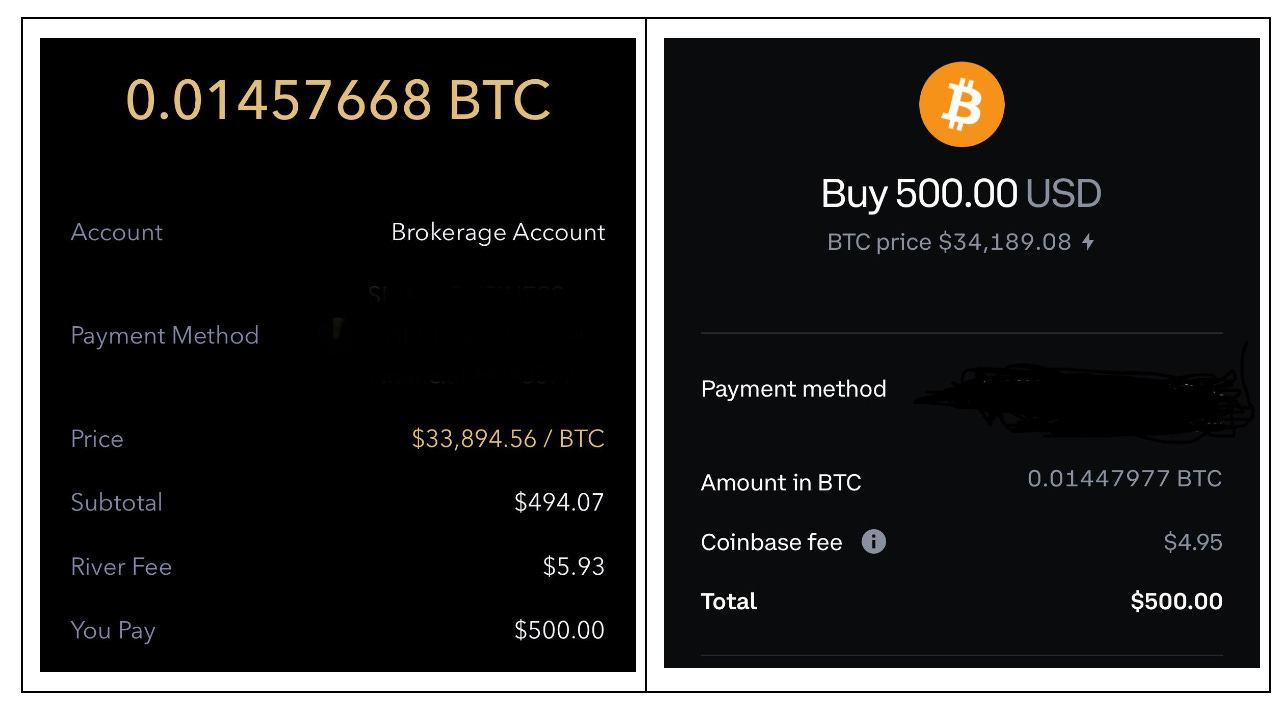

River is a U.S.-based company that only sells bitcoin. Their margins are typically lower than Coinbase’s — meaning their quote price of bitcoin is better. For example, at the time of writing this, I created buy orders on both River and Coinbase within about fifteen seconds of each other. Coinbase quoted one bitcoin at $34,194.46 with a $341.94 fee, for a total of $34,536.40; and River quoted one bitcoin at $33,903.91 with a fee of $406.85, for a total of $34,310.76. River’s fee was bigger, but the total cost (quote + fee ) was $225.64 cheaper.

Don’t Stress, DCA

The main point here isn’t to use a particular client, but that many people stress about the right time to buy bitcoin and this can lead to indecision, and the lack of action. The remedy is dollar cost averaging (DCA) a modest and affordable amount of fiat — that doesn’t make you lose sleep at night — into bitcoin.

Now, about that bigger fee… River offers an incentive to DCA bitcoin, and if you set up recurring purchases from your bank account, they stop charging you fees after the first buy.

If you’re purchasing bitcoin on Coinbase you’re losing out on sats, every single time. If time is an issue though, note that River takes 5–8 business days to clear a bitcoin transaction, whereas Coinbase will let you withdraw immediately. Since I think in the long term (low time preference) and see that River encourages self-custody, I don’t mind letting my sats build up there for a couple weeks before being able to draw them down.

The best part here is that you can set up a satoshi threshold you’re comfortable with, and enable auto-withdrawals to your cold storage wallet whenever you’ve bought enough bitcoin to hit that threshold. As long as you keep enough cash in your bank account, you can automatically buy and transfer bitcoin to cold storage without even opening the app. Pretty cool.

You can transfer sats to and from River via Mainnet or a Lightning address. You can also purchase bitcoin mining equipment through them (set up personally or via a business) that they run for you, and stream sats that way.

Is Bitcoin Like Gold?

From ‘rat poison squared’ to ‘digital gold’, bitcoin has been called many names. One thing that is certain so far is that, regardless of what people think, it keeps producing a new block every ten minutes. What if bitcoin — with its absolute scarcity of 21 million — is a sort of digital gold? How much would one bitcoin be worth if it captured the market space that gold does?

The market cap of bitcoin is about 650 billion dollars. The market cap of gold is estimated to be about 13 trillion dollars — about 20x larger than bitcoin.

If bitcoin’s market cap were ever to rival gold then one bitcoin would be worth about $400,000. That’s more than 10X from today. Similarly, the Ark Invest CEO, Cathie Wood, says that if institutional investors put about 5% of their portfolios into bitcoin it would go to half a million per coin by 2026. It seems like the forthcoming bitcoin ETF will help with that… So why not stack a few sats now? It’s fun.

Author Bio

Frank America is an author, musician, and comedian. He is Editor-in-Chief of The Rug News, and a Content Manager/Staff Writer at Bankless Publishing.

Editor Bios

trewkat is a writer, editor, and designer at BanklessDAO. She’s interested in learning about web3, with a particular focus on how best to communicate this knowledge to others.

Designer Bio

Tonytad is a graphic designer who has worked locally and internationally with organisations and firms on over 200 projects, which includes branding, logos, flyers, cards, and covers.

BanklessDAO is an education and media engine dedicated to helping individuals achieve financial independence.

This post does not contain financial advice, only educational information. By reading this article, you agree and affirm the above, as well as that you are not being solicited to make a financial decision, and that you in no way are receiving any fiduciary projection, promise, or tacit inference of your ability to achieve financial gains. Affiliate links were used in this communication.

Bankless Publishing is always open to submissions for publication. We’d love to read your work, so please submit your article here!

More Like This

Luke Broyles, Making The Case for Bitcoin by Frank America

The Crazy World of Bitcoin by Tigi76

BlackRock Bitcoin ETF, A Generational Endorsement by Frank America

You left out one of the best ways to gain sats, Stacker News (https://stacker.news)!